Posted on 03/18/2011 7:16:35 AM PDT by SeekAndFind

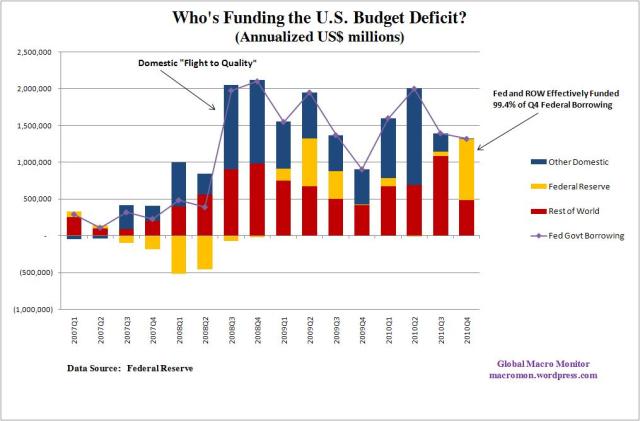

A couple of revealing charts from the Fed’s Flow of Funds data. Both show net flows into Treasuries by creditor type and the Federal Government’s borrowing during each quarter. Note, the quarterly data is annualized.

The first chart illustrates how QE2 flushed domestics out of Treasuries and effectively funded 63 percent of the budget deficit in Q4. The Treasury is prohibited from directly selling bonds to the central bank, but effectively finances the government through POMO.

Given that a large portion of the Rest of World category are central banks recycling BOP surpluses, it’s likely that 90 percent of the U.S. budget deficit in Q4 was funded by central banks. You think this may have anything to do with what’s happening in the commodity markets? That is, the central banks’ printing presses providing the fuel for speculators?

Furthermore, we ask: who is going to finance the U.S. budget deficit when QE2 ends, especially at a sub 3.50 percent 10-year Treasury rate? Bill Gross knows!

As for the Rest of the World, well, they aren't too bright.

If the Fed is buying 70% of the Treasuries issued during QE2, and QE2 is set to end of June 30, 2011, who’s going to buy them after that?

Gross says that bond yields have to go up 100 to 150 basis points to make Treasuries more attractive to private investors, and other countries.

That would mean higher interest payments for the US to cover, and that won’t be good.

Why don’t these bums just KILL Obamacare? That would go a long way toward repairing this problem.

-Rex

Furthermore, we ask: who is going to finance the U.S. budget deficit when QE2 ends, especially at a sub 3.50 percent 10-year Treasury rate? Bill Gross knows!

#################################################

Let me guess: The Fed and the Rest Of the World (foreign Central Banks). QE3 here we come.

Wazza matter....Obama/Bernanke’s “QE” is a historically proven successful technique. Just look at the old Weimar Republic of pre-Nazi Germany and at Mugabe’s Zimbabwee. Worked just fine there.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.