Posted on 04/13/2009 8:44:20 AM PDT by djf

Jim Willie Ph.D. is a well-placed statistical analyst in market research and retail forecasting. Since I first started reading his articles in early 2007, which was before our current economic crisis was a blip on the radar screen, he accurately predicted the severity of our current financial crisis many months in advance and how the events would unfold. In his latest article, he speaks about what one of his trusted colleagues:

This message was just received by a trusted colleague. This summer could be very bloody, in terms of global retribution against the United States, its debt peddlers. The gloves could finally come off. The person has global connections, decades of gold and banker experience, connections with the Euro Central Bank, numerous commercial contacts in Russia, China, and Arab world, and lives with several feet in several ponds, fluent in a few key languages. He is involved in many meetings of international importance, and lately has had the advantage of being involved with both bilateral barter arrangements created by Russia (with China, with Germany). He has a strong reliability record, with advanced notice often provided in a valuable manner. Here is a quote from this morning, which was in response to some queries about continued US Treasury Bond support, recently difficulty with UK Gilt bond auctions, and general monetary debauchery by major nations like US, UK, and Switzerland.

He wrote: “However, come the end of May/June/July 2009, the United States will be put through the meat grinder once and for all. You have no idea how pissed off the creditor nations are with the unmitigated arrogance and delusional bulxxhit coming out of Washington DC / Wall Street. I have never heard people be so furious and vocal on how the US needs to be dealt with from here on forward, as demonstrated during an early morning conference call we had with Europeans, including Russians and Asians. (The emphasis is all his) All on the call are heavy-duty decision makers.” A time of reckoning comes for the US, and my opinion is that what lies directly ahead is a dark place with more economic hardship and far less liberty. Be prepared with ownership of gold & silver bullion, bars, and coins. If not, a likely outcome is more destruction of personal finances, savings, and pension holdings, along with job cuts.

We're now monetizing debt, which is something only "banana republics" do - - right??? The Treasury's auction of 5-year bonds ran into problems Wednesday for the first time causing the market to drop several hundred points before the PPT jumped in and bumped it back up. This should be a warning to all that the US dollar has serious problems. If a new international currency comes into play; e.g., the "drawing rights" as set up by the IMF, the billions of US dollars circulated in other nations will be repatriated to the US. There is no effective mechanism to take all of this money out of circulation once in. We will likely have to monetize a couple trillion dollars more of debt just in 2009 as we attempt to roll over our past deficits and the new proposed spending.

Jim Willie's article follows the lead of several European "think tanks" like LEAP/E2020 who reported a major US dollar devaluation will take place no later than September 2009. They predict a 90% devaluation, which if true, would create hardships and suffering in the US at levels we have experienced in our history, maybe excepting major wars.

Though there will be rumblings, any devaluation would be very swift where one goes to the bank the morning and finds them on holiday (i.e., a banker's term for "closed until further notice"). When they do open up, your money is devalued.

As the US is primarily an import nation, we will find goods imported from other counties soar in price after a major devaluation. Using the 90% devaluation number byLEAP/E2020 and others; it would mean the lawnmower you want to buy now for $150 would cost $1,500 then, or that $40 dinner with your wife might cost $400, or a gallon of gas would cost $30.

Hopefully it won't be that bad, but even with a 50% devaluation, the hardships would be immense. Also, the US is a net importer of food, so food shortages would take place. With $10+ for a gallon gasoline, fertilizers and shipping would raise the costs for food grown domestically. In a major devaluation, incomes will rise some, but no where to the extent of the devaluation. The value of pension plans and savings would decline or be wiped out.

Everybody should have at least 20% of their net worth in gold and silver bullion and 20% in foreign currencies (I like the Yen and the Swiss Franc). The popular GLD and SLV stock ETF that trade in gold and silver are good for stock speculation, but will go belly up in any real crisis. There's been several reports of impropriety related to where their gold/silver holdings are actually located. They are owned by JP Morgan and HSBC who themselves are insolvent.

A good alternative is the Central Fund of Canada (CEF), which have audited and insured gold/silver bullion on hand. The value of their stock rises with the value of their precious metal holdings plus a premium typically ranging from 6% to 10%. My Roth account is entirely vested in CEF.

This post is not meant to spook anybody, but the writings on the wall. You can choose to believe our leaders when they say monetizing debt is a good thing to keep interest rates down, or spending trillions to bail out the banks is a good thing, or spending a trillion for stimu-less will make us better off'; or you can take positive actions to get your financial house into order. There's nobody looking out for you except yourself. When the next big shoe drops - - and it will, you don't want to be under it.

They need to print money to fund the already passed ‘stimulus’.

Now, that's some superfine blow this guy's doing.

They’re trying to do it without printing money - as that would result in hyperinflation.

But the Fed announcement that if the T-bill sales fail, then they would themselves buy the bonds or whatever means exactly that - that they have to actually print it.

While there will be some devaluation, I don’t see it in the extreme case that he is pointing out for one reason- value is the subjective rate of exchange. In other words, the value of the dollar in relation to xx- generally measured against other currencies. In the case of this ratio, other countries are going through a similar spending spree and debt increase like we are so the relationship has a similar movement.

They have to print more money. If they find exotic angles that sound better it doesn’t change the resulting necessary action.

Don’t worry. BO and our esteemed Treasury Secretary will save us.

The relation is key.

It is going to get ugly

http://www.businessinsider.com/henry-blodget-the-social-security-bomb-2009-4

http://www.businessinsider.com/aig-bucks-the-big-bang-2009-4

http://www.businessinsider.com/can-we-loot-social-security-to-pay-for-the-stimulus-2009-2

http://www.businessinsider.com/henry-blodget-is-obama-in-wall-streets-pocket-2009-4

Thing is, though, that I keep hearing stories, you know, “somebody knows a fellow who talked to suchnsuch bank and they say...”

And at least some of these guys really are deep financial professional with their fingers on the various pulses.

We’re gonna see some kind of MAJOR change. What it is, nobody knows yet. Or if they do know, they ain’t tellin.

His last advice to me was "buy coffee & lots-o-ammo". It is his belief something major is going to happen in Aug/Sept, concerning devaluation of the greenback.

This was such a howler, and so easily sourced and discredited, it very much casts suspicion on the rest of the article:

“Also, the US is a net importer of food, so food shortages would take place.”

see:

http://www.ers.usda.gov/AmberWaves/February08/DataFeature/

ping for later

Yeah....probably during the hottest part of the summer, when the power grid goes down, and people are in the streets of major "hot" cities rioting.....THAT'S when it'll happen....whadya bet? Hmmmm....guess I'll keep stocking up. My husband thinks I'm over-reacting....we shall see.

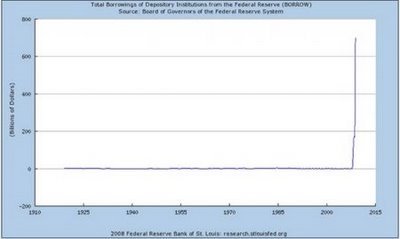

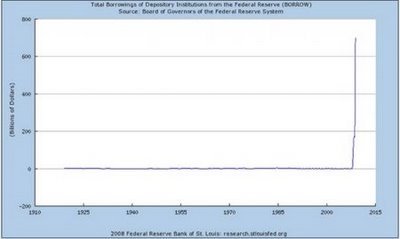

It seems to me that every chart of anything I’ve seen lately looks like a hockey stick. I guess you could say the amount of charts looking like hockey sticks is growing exponentially.

one can never have to much ammunition

Japan’s been monetizing their debt every year for 20 years.

Anyone care to comment on how far the Yen has been devalued?

Now there's a man who's never had to swim to shore...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.