Title: "The Fed and the Affordability Crisis"

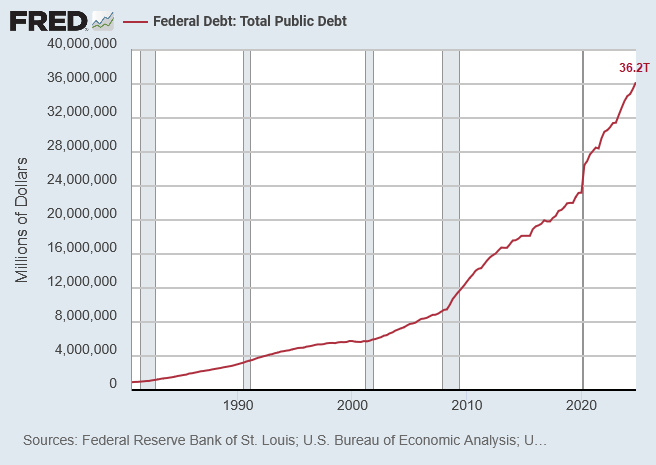

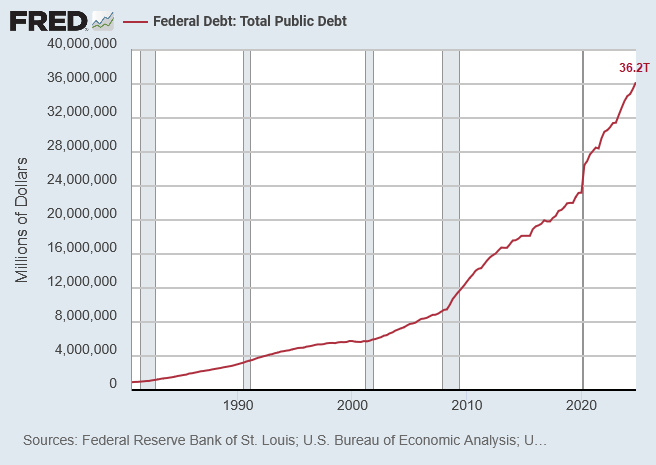

Reality: The federal government has gone into massive debt over these last 25 years.

Cut spending. "Degrow" government.

Posted on 11/07/2025 11:32:34 AM PST by E. Pluribus Unum

Rate cuts are too small, and the central bank is making things worse by shrinking its balance sheet.

This week’s election outcome showed that affordability and the economy are likely to be major political flashpoints in the 2026 midterm elections no matter how well the economy is doing. Meanwhile the Federal Reserve last week took three steps that will harm the economy and could weigh on President Trump’s growth program.

It cut the interest rate by only 0.25 percentage point, falling further behind in the rate-cutting cycle. It warned that any further rate cuts would depend on economic weakness, since the Fed’s demand-side model treats economic and job growth as inflation risks and prescribes higher interest rates. Most harmful, the Fed announced it would increase its bank-financed bond purchases and stop shrinking its balance sheet, hurting small businesses and median incomes.

Rate cuts should have started in June. The Fed’s base rate is now 3.9%, while Europe’s is only 2% and Japan’s 0.5%, even though they are less creditworthy in revenue growth, corporate profits, innovation and demographics. By lowering rates late and signaling a pause, the Fed is causing higher mortgage rates and unaffordable costs for small businesses that borrow at floating interest rates. This will counteract some of the strong gains from the permanent tax cut Mr. Trump signed on July 4, recent energy reforms, and technology advances.

The delay in rate cuts is also a direct cost to taxpayers since the government is financing $38 trillion of debt, heading rapidly toward the debt ceiling of $41.1 trillion. Since June alone, the Fed’s higher-than-necessary interest rate has added tens of billions in excess interest expense to the national debt.

Even more costly was last week’s decision by the 12-vote Federal Open Market Committee to stop shrinking the Fed’s balance sheet next...

(Excerpt) Read more at wsj.com ...

This is not a mistake from their perspective; this is part of the plan. The Fed has to do everything it can to tank the economy enough to flip the House in 2026, thereby effectively ending the Trump Presidency, without making it obvious that it wants to de facto end the Trump Presidency.

So retarded. The rest of the world is at lower rates because they suck, and have weak economies. Lower rates will further increase housing costs. Nothing drives housing prices higher than free money. But, nothing is free and we suffer from the doom loop of government spending and artificial low rates.

If anything, the Federal Reserve shouldn't be cutting rates at all ... as published U.S. inflation rates -- while declining -- are still above the Fed's 2% benchmark.

Title: "The Fed and the Affordability Crisis"

Reality: The federal government has gone into massive debt over these last 25 years.

Cut spending. "Degrow" government.

Lumber for a 30x30 two-story house

outside walls

~240’ of 2x6 studs 16” o.c. ~= 180 studs ~= $900

~360’ of 2x6 plates ~= 45 studs ~= $225

inside walls

~120’ of 2x4 studs 16” o.c. ~= 90 studs ~= $350

~120’ of 2x4 plates ~= 15 studs ~= $60

platform framing

24x2 of 2 16’x2”x12” joists [96 16’x2”x12” joists][Note: I-beams would usually be used]

+

4 16’x2”x12” platform ends ~= $3000

subtotal ~$4500

plywood

roof x 30’x30’ ~= 1000 sq. ft. ~= $1,100

floors ~1800 sq. ft. $42 4’x8’x3/4” sheet ~= $2,400

sheathing ~1920 sq. ft. ~= $2,000 [Note: Oriented Strand Board would normally be used]

truss wood

16(1+30/2 24” o.c.) x 70’ ~= 140 2x4 studs ~= $560

wood for house ~= $11,000 total

Just because there are stock-rich yuppies willing to overpay for housing is no reason to impoverish retirees need bank CD interest.

Upper West Side

20 blocks of brown stone about 900 feet long and 30 feet high with 60% coverage.

20*2*900*30*.6

20*900*36

648,000 square feet of brown stone

Park Slope, Brooklyn Heights, Fort Greene, Upper East Side, Upper West Side

~3,240,000 square feet of brown stone

~$25 million, total

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.