Skip to comments.

If Republicans Want to Cut Socialists Off at the Knees, Homes Need to Be Affordable Again

Hotair ^

| 11/05/2025

| Beege Welborn

Posted on 11/05/2025 9:04:44 PM PST by SeekAndFind

This is my two cents, and the information arrived after some interesting texts with my little brother, Crusader.

Some of it, now that last night's results are in, needs to be attended to immediately, as he said.

Trump really needs to focus on what can be done for the economy... He needs to light a fire under congresscritters to ratchet down on outsourcing and h1bs; the job market is not getting better and grocery prices aren’t getting better either

Some grocery prices are better, sure - those damn eggs, for one thing. But the hamburger you feed a family with is still through the roof, and that's the kind of thing people feel. Not that it's gone up, as it did constantly with the much reviled #Bidenomics. But the prices haven't gone down appreciably. Folks find that irksome, and Trump will catch that blame even though he had little to do with it.

And the anger that younger generations are feeling about being stuck in place is a tangible thing, which translates into the appeal of figures like Ocasio-Cortez and the once-amiable Mamdani. Sure, their mountains of student debt were stupidly obtained for worthless degrees from universities with no skin in the game, and their fantasy expectations of enormous salaries for entry-level positions were pipe dreams of the first order, as most had never had any contact with real life to begin with.

But it still breeds contempt for everyone who has attained those American dreams through hard work, saving, sacrifice, and sometimes a bit of luck. Particularly when that one thing - home ownership - seems so far out of reach as to never be attainable, no matter what one does.

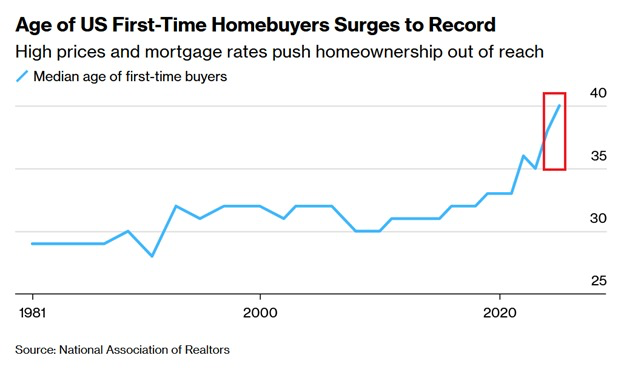

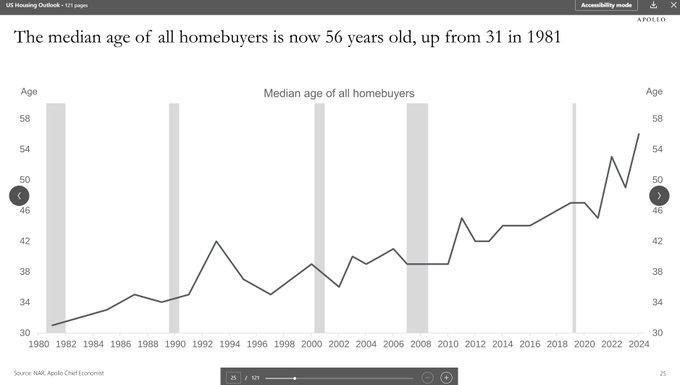

And that dream has just hit a new level of out there.

...Over the last year, first-time buyers made up just 21% of purchases, the lowest on record.

Meanwhile, the typical age of repeat buyers hit an all-time high of 62, with their median down payments reaching 23%, the highest since 2003.

Record home prices and high mortgage rates have created the worst buying conditions on record, locking younger Americans out of homeownership.

The US housing affordability crisis is worsening.

Wowsahs.

Home buyers are getting older and older. An 'all-time high' of cash buyers and an 'all-time low' of folks getting that first set of keys.

...The median buyer age increased to a peak of 59 years, up from 56 the previous year. The median age of first-time buyers increased to 40 this year from 38 the previous year, while the typical age of repeat buyers also rose to 62 from 61. First-time homebuyers decreased to 21% of the market share, down from 24% last year. That marks the lowest share since NAR began collecting the data in 1981. Before the Great Recession, the historical norm was 40%. The report noted the division in the housing market.

“In the 1980s, the typical first-time home buyer was in their late 20s,” according to NAR’s 2025 Profile of Home Buyers and Sellers. “The housing market remains divided between an all-time high of all-cash home buyers and an all-time low of first-time buyers.”

Jessica Lautz, NAR deputy chief economist and vice president of research, said the implications are “staggering.”

“The historically low share of first-time buyers underscores the real-world consequences of a housing market starved for affordable inventory,” she said.

“The share of first-time buyers in the market has contracted by 50% since 2007 – right before the Great Recession. The implications for the housing market are staggering. Today’s first-time buyers are building less housing wealth and will likely have fewer moves over a lifetime as a result.”

Twenty-four percent of all buyers had children under the age of 18 living at home, a historically low percentage. That’s down from 27% last year and from 58% in 1985. This year, 11% of home buyers had one child, 9% had two children, and 5% had three or more children. Thirty-two percent of first-time buyers and 22% of repeat buyers had children under the age of 18.

Seventy-six percent of all buyers had no children under the age of 18 living at home, up from 73% last year.

There are no 'starter' homes anymore, and what's available isn't affordable until someone is in their forties.

One fellow calls what's happening right now a 'full-on housing freeze,' and I can see the points he's making. The average 30-year fixed rate dropped to 6.17% this week. But you have to have good credit and a whopping down payment saved up to put down 20% on a $400K house (Q2 2025: 410,800). That's, like, eighty grand down, with a $24-2600 a month payment before taxes, etc. added in.

There don't seem to be many $159,000 fixer-upper boxes anymore.

How we break out of it, I have no idea. I'm not an economist and don't even attempt to play one here at HotAir. I've always been lousy at math.

But I do know we lucked into one of those low rates, just like he's talking about, and are part of the freeze. There's no way we're moving and paying out the wazoo, even though I'd dearly like more room.

...Nobody wants to sell because they’re locked into 3–4% mortgages they’ll never see again, and nobody wants to buy because prices are still sky high on top of 6% rates. It’s not a lack of demand or supply in the usual sense, it’s paralysis. Everyone’s waiting for someone else to move first, but nobody can afford to.

What’s made it worse is that the mechanics of the market are broken. Mortgage spreads are still wide, so even when bond yields ease, mortgage rates barely fall. That means affordability doesn’t really improve, and the few who could move decide it’s not worth the risk. The real fear is buying right before prices finally crack. People know this is the most unaffordable market in modern history, and the danger is getting stuck underwater on your home, unable to refinance when rates drop. So the market sits in a kind of quiet standoff, everyone knows something has to give, but nobody wants to be the first to find out what.

In the meantime, everyone sits, stews, stares, and gets angry, frustrated, and dejected, feeling they'll never have those keys, no matter how hard they work at it.

And they begin to feel like that shiny face telling them there's a better way has the answer.

I do remember those days when the credit union car loan we got at 11% was considered a bargain, and a mortgage, had we gotten one, would have been close to double digits.

But this is a different world right now, and while these rates are historically still low, the housing prices are insane. Back then, folks were pleased to come away with a nice little appreciation of their property when they sold it, not the wholesale doubling or tripling in value we've seen around here, which is now expected.

'I only made fifty grand on it.' After three years.

Inconceivable in times past.

As I said, I don't know. I do hope there's a pivot to economics soon. Not tariffs - kitchen table issues.

Letting Americans see what's going on with household budgets needs to be just as important to the Trump team as, say, Venezuela or the Nobel Peace Prize.

Cuz, really - there's no place like home.

Your own home.

TOPICS: Business/Economy; Culture/Society; News/Current Events; Politics/Elections

KEYWORDS: affordability; gop; housing; nlz; socialism

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-66 next last

RINOs are socialists, so they would not want to cut themselves off at the knees. More nonsequitur talk.

2

posted on

11/05/2025 9:06:38 PM PST

by

Olog-hai

("No Republican, no matter how liberal, is goings to woo a Democratic vote." -- Ronald Reagan, 1960)

To: SeekAndFind

home prices have dropped this year in many of the top markets.

3

posted on

11/05/2025 9:08:57 PM PST

by

pissant

((Deport 'em all))

To: SeekAndFind

Local, State and Federal Governments have done a lot to make building new homes and apartments more expensive. Regulations, permits, laws, requirements, etc have had a large impact on this cost. On top of that, if your business is renting apartments, again Government had struck regarding areas which increase the cost of offering rental property. Yet the politicians run on “rent too damn high” platforms.

4

posted on

11/05/2025 9:13:30 PM PST

by

Lockbox

(politicians, they all seemed like game show host to me.... Sting)

To: SeekAndFind

The problem is that the demand exceeds the supply in a multitude of locations. Blue cities add to this problem by charging exorbitant fees for permits, inspections, environmental assessments, and so forth. In other words, there is really no simple solution to the problem.

5

posted on

11/05/2025 9:15:18 PM PST

by

DennisR

(Look around - God gives countless clues that He does, indeed, exist.)

To: SeekAndFind

6

posted on

11/05/2025 9:25:45 PM PST

by

chris haney

(Apache)

To: SeekAndFind

2.2 million illegals deported in 10 months under Trump.

Another 2 million illegals in the second year will start sending home prices down.

That's the best and earliest way.

To: chris haney

RE: Again ?

Does that question mean that you think homes were never affordable before?

To: DennisR

Blue cities add to this problem by charging exorbitant fees for permits, inspections, environmental assessments, and so forth. Everyone wants to live in Los Angeles and NYC not Des Moines.

$220K in Des Moines or nearly one million in Los Angeles.

To: SmokingJoe

Agreed. I would also like to see companies like black rock who just buy up houses, site unseen, to turn them into rentals addressed somehow.

10

posted on

11/05/2025 9:40:46 PM PST

by

matt04

( )

To: SeekAndFind

Here’s a crazy idea that crossed my mind back when the real estate market was in chaos after 2008-09:

Allow first-time home buyers with sufficient income to convert some of their student loan debt to mortgage credits.

Basically, this would allow someone to take a portion of their debt up to a certain cap (say $50,000) and convert it to a “down payment credit” on a qualified home. The $50,000 would remain on the books as an unpaid student loan debt, but it would carry an interest rate of 0% and would only be repaid upon the sale or refinancing of the home.

This would let these (mostly young) home buyers overcome the two biggest hurdles they face when buying a home: (1) saving up enough money for a down payment, and (2) having a sufficient positive cash flow to qualify for a mortgage while paying off student loan debt.

11

posted on

11/05/2025 9:49:02 PM PST

by

Alberta's Child

("There's somebody new and he sure ain't no rodeo man.")

To: matt04

I was thinking the same thing.

12

posted on

11/05/2025 9:50:15 PM PST

by

lastchance

(Cognovit Dominus qui sunt eius.)

To: SeekAndFind

The average size of a new single-family home built in the U.S. in 1981 was approximately 1,700 square feet. In 2017 it was 2,631. By the end of 2014 it was 2,384.

The average home mortgage rate in 1981 was 16.63%, which is the highest recorded figure by Freddie Mac. In 2025 they are around 5.375% to 6.500%. [I think I saw some in the 4 range recently].

The average home price in 1981 was $304k, adjusted to 2025 dollars. The average house price in the United States as of the fourth quarter of 2023 was $417,700.

To: pissant

It’s not the price, it’s the interest rate, that’s killing the housing market. Trump better get housing going and hamburger prices down or midterms will be a blood bath.

14

posted on

11/05/2025 10:01:14 PM PST

by

factmart

( )

To: DennisR

There is a simple solution shoot all the Democrats.

That of course is not going to happen, but that

is where all our problems come from.

I live in a Home on 5 acres and my only physical connections to the outside world is a private company power cable and a road.

No water, sewer, cable, telephone, or any other utility they can use to enslave me at a whim.

I happen to live where this is very do-able

due to natural resources. If I were allowed

to burn trash, I would never go to the dump.

I would then be able to recycle everything.

Drives Democrats NUTS! I can live

free of their “Control”.

Housing is too expensive because of

Earth worshipers regulations, designed

to force people into crowded “slums”.

There is plenty of land for all in America,

if we had roads, and freedoms.

Prices would drop. But NO! we can’t have more private transportation, private water supplies,

private sewer systems, and Acreage to spread out.

We’d be free and not oppressed by Democrat tyrants.

Luckily my Hawaii big island tyrants

are too busy trying to build empires

to mess with me.

And most the worker “bees” have the same attitude

I have, Big Island, few people, and we don’t need

enemies.

Aloha

15

posted on

11/05/2025 10:02:45 PM PST

by

rellic

(No such thing as a moderate Moslem or Democrat )

To: SeekAndFind

How you going to undo the inflation caused by 50 years of post-gold standard fiat money and the petrodollar scheme...?

16

posted on

11/05/2025 10:03:31 PM PST

by

citizen

(A transgender male competing against women may be male, but he's no man.)

To: rellic

You want affordable housing, then you have to have a balanced budget and pay down and off the National Debt to start with, then we have to move to a currency backed by something like a basket of hard commodities.

To: factmart

Good lord, they are going to blame Trump for Bidens interest rates and beef prices? He’s practically ripped the heads off of the Fed reserve browbeating them to lower rates, which they just started doing, finally.

If he gets dinged for inherited high beef prices, does he also get credit for the actual lower pork, egg, fish, cheese and gas prices?

FFS, snap out of it.

18

posted on

11/05/2025 10:07:22 PM PST

by

pissant

((Deport 'em all))

To: SeekAndFind

I was watching a YouTube video tonight on how the Germans in the 1930’s managed to make their economy look like it had recovered and was paying for their re-militrazation.

It was a Giant Ponzi Scheme that was certainly creative. Will the U.S. take their plan and update it for today and try to pull that sleight of hand off? Nothing would surprise me. Probably trying to do this Bitcoin, etc..

To: Captain Peter Blood

You make good points for a strong economy!

I was trying to say free up more land since the

government owns so much of it they can do that.

Put in roads and things will develop.

People can spread out and they will.

20

posted on

11/05/2025 10:14:10 PM PST

by

rellic

(No such thing as a moderate Moslem or Democrat )

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-66 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson