Posted on 06/08/2021 8:49:47 AM PDT by blam

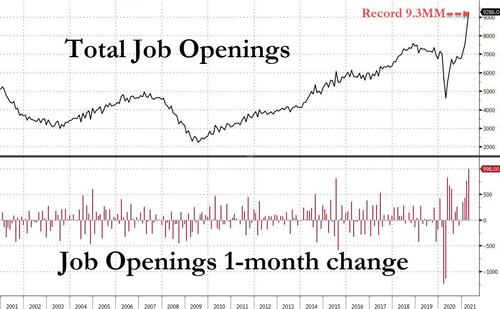

In case we needed more proof that the US labor market is in a historic supply-demand mismatch crisis sparked by Biden’s generous unemployment benefits, a few hours after the latest NFIB showed that it has never been more difficult for small business to fill job openings, moments ago the BLS confirmed what we expected: that the number of job openings in March (recall JOLTS is one month delayed) soared by a record 998K to 9.286MM in April from an upward revised 8.288MM in march, and the highest in the history of US jobs data!

The record number was also a record beat to the already lofty expectations of a 8.2 million print.

Looking at the details, the increase in job openings was driven by a number of industries with the largest increases in accommodation and food services (+349,000), other services (+115,000), and durable goods manufacturing (+78,000). The number of job openings decreased in educational services (-23,000) and in mining and logging (-8,000). The number of job openings increased in all four regions

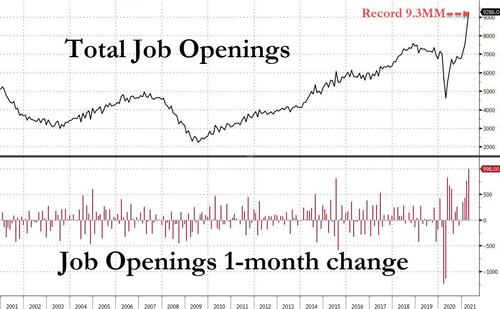

Separately, in yet another indication of the record surge in demand for labor since the collapse last April when there were 18.1 million more unemployed workers than there are job openings – the biggest gap on record – the gap has since shrunk dramatically to just 526K in April, down from 1.4 million in March. Yes: despite the covid shock, there are just half a million more unemployed people than there are job openings!

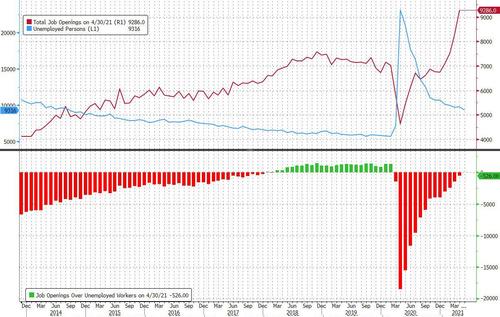

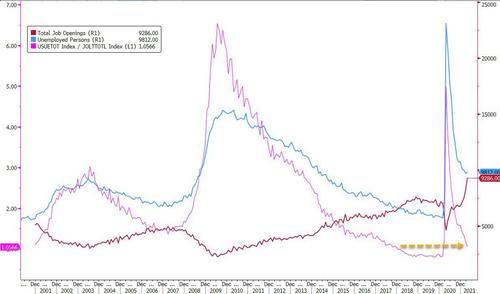

As a result, there has been even more continued improvement in the job availability series, and in April there were jus 1.06 unemployed workers for every job opening, down from 1.19 in March, down from 1.35 in February and from 4.6 at the peak crisis moment last April.

Meanwhile, confirming the accelerating in the hiring picture as covid lockdowns were lifted, in April hiring surged for a 4th consecutive month to 6.075MM, up from 6.009MM in March.

P>

P>

According to the BLS, hires increased in accommodation and food services (+232,000) and in federal government (+10,000). Hires decreased in construction (-107,000), durable goods manufacturing (-37,000), and educational services (-32,000).

Curiously, as hires soared, total separations also increased to 5.8 million (+324,000). The total separations rate was little changed at 4.0 percent. The total separations level increased in retail trade (+116,000) and in transportation, warehousing, and utilities (+60,000).

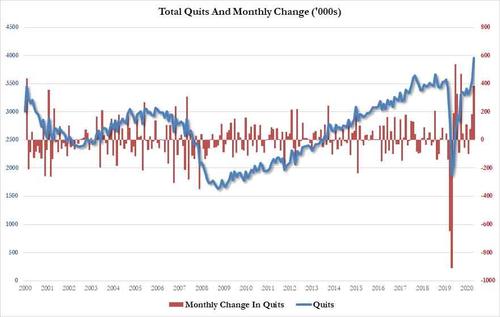

Finally, confirming the overheating in the labor market sparked by “Biden’s trillions” and the tsunami of unemployment benefits which has prompted a wave of revulsion toward work in general, in April the level of quits – or people leaving their job voluntarily due to better prospects elsewhere – soared by a whopping 384K to a record 3.985 million, after rising by 185K and 77K in the previous two months. The number of quits increased in a number of industries with the largest increases in retail trade (+106,000), professional and business services (+94,000), and transportation, warehousing, and utilities (+49,000).

I don't have problem with marginally higher prices if the workers can make enough to live off of. Prices would only go up a few pennies on the dollar anyway.

Would Walmart’s Prices Spike if They Paid Their Employees More?

I have a 2.85% interest rate on my mortgage. So I'll probably never pay extra on that. Other than that we're debt free. And my investment strategy is 75% stock mutual funds / 25% bond mutual funds spread out across dozens of asset classes. I know the common ratios are more like 60/40 or 50/50, but I have to be concerned with inflation like you said. Plus over half of that is in Roth accounts (Roth IRA's and a Roth 401K, with the rest in traditional 401K). So I have some tax diversification as well. (I can do withdrawals from the tax deferred accounts and do Roth conversions during low tax administrations, while withdrawing from Roth accounts during high tax administrations.)

Plus, I manage my elder mother's finances for her. So I'm hip to how some costs go up as the years go by, while other costs are down (i.e. no more gas to commute to work).

Not a problem if you have a family in the targeted groups. Starting in July they can get up to $3600 a month through the end of the year.

New $3,600 stimulus payments will be here soon - here’s when and who will get the money

https://www.ktul.com/newsletter-daily/new-3600-stimulus-payments-will-be-here-soon-heres-when-and-who-will-get-the-money?fbclid=IwAR2UBl9fIsldhOGTY19X3TicRC6PeOmP88gNVlC5ESZAvAkT-_q3fNs7TDo

Yes, wages are rising.

You’re well balanced. You don’t need any more advice from me! :)

I focus on dividend growth stocks/funds and also have some REITS and BDCs to try and stay ahead of inflation. As you probably know, qualified dividends get favorable tax treatment (typically 15%). What a lot of people don’t know is that, while most REIT distributions are ordinary dividends, 20% of them are deductible. There’s some benefit to owning REITs in that they have generous yields and have escalation clauses in their leases to ensure rising revenues. That said, REITs have been bid up in price so its hard to find any at reasonable valuations now.

Best of luck in your retirement. It sounds like you’re on a good path.

I've said it before and I'll say it again. A lot of these people are ruined for life. They won't ever take the masks off. They avoid going outside and stay away from public places and they want to stay working at home forever.

They are perpetually terrified. You were already seeing some of that pre-covid. Just speak to a young person and watch the terrified deer look they get on their faces when they realize they have to look up from their phones and speak to an adult.

Nonsense. There are plenty of college graduates seeking employment in the energy industry. It’s the hamburger flippers that are in high demand and can afford to stay home.

>> Give a man free stuff and he will quit working.<<

Plenty of honorable men for whom a job represents pride and meaning to life. A job is more than just money

Seems like just a few years ago we nasty horrible baby boomers were refusing to retire and make way for the younger workers. Basically blocking employment opportunities for the young.

Now that there’re all the places reducing the hours they are open due to lack of employees - it seems like maybe all those claims were BS. Like 90% of the opinions offered by ‘experts.’

Also, the money in Roth accounts won't be taxed at all regardless of the type of investment (assuming I adhere to the 5 year start rule, the 5 year per rollover rule, and the 59.5 age rule). So I do a little in a REIT fund and a little in a municipal bond fund, but I do them solely for diversification in investments and with no regard to tax treatment of the funds.

The idea behind the broad diversification is it allows me to be 75% in growth instead of 50% or 60%. If we have a large downturn like 2020, 2008, 2000, or 1987 then a withdrawal rate of 4% per year will last me 6 years even if I pull from just the 25% in safe funds. And that's assuming the safe funds don't rise during the stock downturn (my LT treasury fund always rises during major downturns). If they do I have more than 6 years to last me until my stock funds recover.

Having my 75% of equities spread out across 30+ asset classes gives me comfort that even during a broad stock market downturn, at least a few of those classes will be up (i.e. last year tech and health skyrocketed while much everything else collapsed, even though most of everything else was down fairly briefly). So that gives me even more years of ability to handle a major stock downturn.

With all of that, it might be safe to say I can handle 8 or more years of a stock downturn without resorting to withdrawing from a fund that's gone down some (selling low) to live off of. That's plenty. Any more of a safeguard beyond that might be overkill and remove my ability to keep up with inflation.

What kind of parents exist in this country?

When we were growing up, even if the government were handing out thousands of dollars, Dad still would have us working two jobs. And we’d damn well be there on time, and never miss a day. (And we’d probably refuse Uncle Sam’s money, too.)

I'm in that bucket myself. I'm nearing 60 and finally have all my ducks in a row with enough savings to last me 30 years at 80% my current income (not including Social Security which should plug that gap nicely along with any part-time work I might want to do for fun).

I'm not worried about running out of money at 90. I figure if I make it to 90, I'll be sitting in a rocking chair on the porch all day reading books from the library so I won't need much then anyhow.

But I'm willing to go another 10 years. If I make it, I'll have 40 years of full income whether or not Social Security is even around. But no way will I live to be 110 so in that scenario, I'll be leaving a bunch of money for the kids.

So my kids at least are rooting for me to work 10 more years!

Way ta go!!

If I may make a suggestion (as someone else posted on this thread), be sure to account for inflation. Income that's good enough now won't be good enough in 5 or 10 years. So I hope that what you called "savings" is really investments that grow fairly well, even if a portion of the investments are in relatively safe funds to handle market downturns.

Well my retirement model accounts for 3.5% inflation so I might be a little screwed if I retire now and we get the inflation being talked about. But that’s based on 100-year average of about 3.10%. For now though, I continue to work and hope to ride this particular situation out.

I retired at the end of 1994 at the age of 51. My experience is that it's a lot cheaper/easier to live at this age than they said it would be. I'm in good health for 77 too.

Not being picked up by the Labor Department. Anecdotal evidence is just that.

Read a FR article a few days ago that said the UNION covered life guards in (I think) LA County CA sometimes made over $300,000 per year.

“Thanks for the tax advice on REIT’s and BDC’s.”

************

It wasn’t really “advice”, just pointing out the potential advantage of the relatively unknown deductibility feature of REIT income. FYI, this only applies to REITs, not BDC’s.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.