Debt is a consequence of over spending.

Posted on 07/30/2011 12:15:23 PM PDT by lbryce

Yes, that is the mistake that many a spendaholic makes with their credit cards. Credit cards and loans with teaser rates will eventually go up and strangle the financial illiterates.

That is what is going to happen to us with the national debt.

No, but we are drowning in government, which is much more difficult to pay off. History has shown it is possible to make the debt smaller. We've yet to see the government shrink, at least in the last 80 years.

Thanks for posting.

What a ding-a-ling. Interest rates are historically very low right now and only because the Fed is buying our debt. Once that stops, interest rates will go up.

Let’s assume that the establishment Republicans win and privately held debt goes up to 100% of GDP. Let’s also assume that we decide not to inflate our way out of it (not a big assumption because much of our debt is short term, must be rolled over and can’t be inflated away). In constant dollars....

At 2.5%, interest payments are $357Billion every year.

At 5.0%, interest payments are $715Billion every year.

At 10%, interest payments are $1,430Billion every year.

As the debt grows and interest rates climb, the cost of just paying the interest becomes so high that all growth ends as taxes to pay just for the debt can climb higher than $715B and near and may pass $1,430B per year.

When interest payments don’t compete for investor dollars the cost of unpaid debt increases geometrically. When interest payments DO compete for investor dollars the cost of unpaid debt becomes infinite (the limit as available dollars goes to zero). That is why countries MUST fail when the Debt to GDP ratio becomes greater than 120%.

A 124 page paper available for download, This Time is Different: http://www.nber.org/~wbuiter/cr1.pdf

You can’t cure stupid.

But what is the problem, even if he where correct, is that we would end up with an untenable debt if there was a catastrophic emergency.

This guy does not know anything about the bond market. And he has not watched Greece. Their rates were lower and as their debt grew the rates moved up. Then the rollover interest started to snowball and here we are. Disaster.

“We have hearing aids in order to fix our ears. We have lasik surgery in order to fix our eyes. People ... you can’t fix stupid!”

— Ron White

You can't drown if you're already dead.

http://www.freerepublic.com/focus/f-bloggers/2755900/posts?page=4#4

the author should

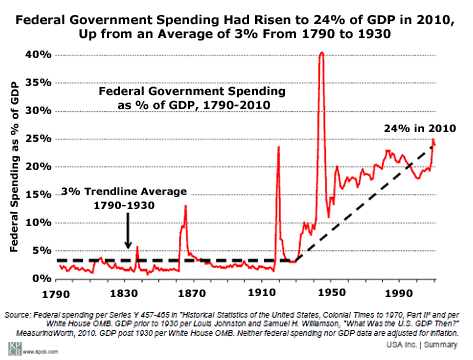

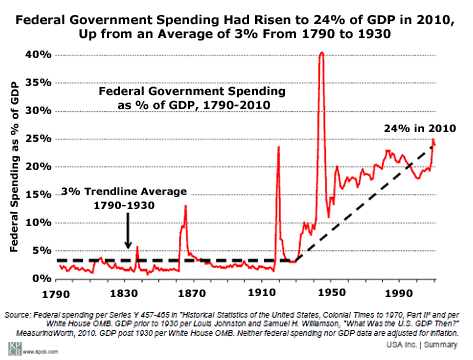

compare low flat tax Russian graph,

with the USA once the marxist took power.

charts with 10,000 words...

Debt is a consequence of over spending.

I love Ron White - his humor is based in what used to be known as “common sense” - back before our country was overrun by Harvard assholes and third-rate affirmative action socialists; or, in the case of our current President: both.

When the deficit is bigger than the budget will it qualify as drowning then??

I loathe professional politicians.

It tells me that governments should NEVER have “cash in the bank” or debt requiring service.

Government should only have the tax dollars required to fund essential services and no more... also, it should never spend more than it brings in.

Another idiot living in la-la land.

Congress has no intention of ever cutting real spending.

And here he is looking at the interest rates which are ultra low do to government and Fed intervention into the market not to mention there are no other markets for others to turn to in the event of a crisis like what we see in the EU. But how long can this last. Out of no where yields could skyrocket and of course add hundreds of billions of dollars in extra interest payments per year just on 2 to 3% point rise. That should be a telling sign of what things will look like. And what would that mean for private sector debt as well? Now if the rates do not rise do to suppression and other market factors, then you can bet that we will see massive inflation of goods especially raw materials and this would most likely be a global event not just here in the US. This guy has his blinders on and refuses to see the next set of possible future events, non of which is any good for anyone.

during = turning

charts with 10,000 words...

===============================================================================

Wow! Says it better than anything I've seen on the economic armageddon about to engulf us all.

Thanks for posting.

Yes. I think there are a lot of us who get it. That's why there are so many of us who are saying, "Stop It!"

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.