Click here: to donate by Credit Card

Or here: to donate by PayPal

Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794

Thank you very much and God bless you.

Posted on 02/19/2026 8:06:36 PM PST by SeekAndFind

America’s top 1% enjoy a fifth of the economy’s income and pay nearly a third of its federal taxes. Many politicians think they should cough up much more. Zohran Mamdani, New York’s mayor, wants a new 2% city levy on incomes over $1m. Virginia, Rhode Island and Washington state are weighing up similar measures; Californians are likely this year to vote on a “one time” 5% levy on billionaires’ wealth.

In Europe, too, there is a similar clamour to target the wealthy. France has seen a popular campaign for a wealth tax. And with Sir Keir Starmer weakened or doomed as prime minister, the left wing of Britain’s Labour Party may implement one of its own.

The “Robin Hood” state, which takes from the rich to give to the poor, has obvious appeal. Governments across the developed world are strapped for cash. Budgets are burdened by legacy debts, ageing populations and the need to spend more on defence. But few politicians will countenance raising broad-based taxes at a time when voters, scarred by the high inflation of the early 2020s, are worried about affordability. Booming stockmarkets, meanwhile, have reinforced the idea that inequality is too high. And it always sounds good to say someone else will foot the bill.

Yet plans to fill budgetary gaps by raising levies on the rich are flawed. Taxes are one way governments can redistribute income from the rich to the poor. But that is not their only function: they must also raise revenue without distorting the economy. The system today is failing on all counts. Arguments that high earners do not pay their fair share are mostly empty. And squeezing the rich further will raise trifling sums of money, while causing real economic damage.

Consider revenues first. There are simply not enough fat cats to fund welfare states by themselves. The proposed wealth tax in California would raise about 2% of the state’s annual output—not much for a swingeing one-time levy in the place with one of the world’s greatest concentrations of billionaires. The figure for Mr Mamdani’s proposal is around 0.25% of output annually.

The limited revenue-raising power of the rich is why European governments have to fund their big spending with broad-based levies, such as taxes on consumption. By contrast, America, with its low overall tax burden, can get by with one of the world’s most progressive tax systems.

Loopholes benefiting the very wealthy should certainly be closed. The biggest problem in the American tax system is at the very top. The resetting of the basis for capital-gains tax upon death allows billionaires who hold on to assets, borrowing against them to fund spending, to avoid the levy entirely. The dodge is outrageous. Yet ending it would yield only a tiny amount of money, probably less than 0.1% of GDP annually. The same goes for raising inheritance tax, a good tax that has never generated much money.

Another problem with increasing taxes on the rich is that it damages the economy. True, it would take a lot to stop bankers and lawyers turning up for work. Yet in New York they already face a combined federal, state and local top tax rate of 52%. And the cumulative impact of such levies on risk-taking, enterprise and innovation—the lifeblood of economic growth—may cause real harm.

Recent research finds that facing a one-percentage-point higher income-tax rate reduces the likelihood that someone will file a patent in the following three years by 0.6 percentage points. This loss of entrepreneurial effort hurts society more than it hurts innovators, who by one estimate capture just 2% of the value they generate.

You might think that the one unassailable argument for taxing the rich would be fairness. But even that idea is dubious. The presumption that governments have failed to ensure taxes on the rich keep up with their income is mostly wrong. The rich world does more redistribution than ever. In Britain, France and Japan income inequality has fallen after taxes and spending. Since 1990, America has offset much of the rise in pre-tax inequality with more redistribution. Taxes on the top 1% are higher, and spending on the poor, such as on health care, has grown. Besides, fairness is not just about making incomes equal.

A fair system would also respect property rights, be reasonably predictable and allow people to reap the rewards of their efforts and risk-taking.

Of all the proposals, California’s most dramatically fails these tests. It looks more like the arbitrary seizure of property than progressive taxation. No one should expect the promise that it is a one-off levy to be honoured. It is a safe bet that the left will raid the same billionaires again the next time they have a programme to fund.

Broad-based taxes do not only raise much more money. They are also politically healthier. A society where the many pay tax and benefit from spending is stronger than one where the few have to pay for the many. If progress on artificial intelligence concentrates incomes at the top, as almost everyone in Silicon Valley expects, then the tax system will require fresh thinking. But that world, if it comes at all, is some way off.

Today, polls and experiments show that voters pay woefully little attention to the nasty side-effects taxes have on the economy. Without a personal stake in keeping taxes low, they are less likely to keep hare-brained public schemes in check. Only by exposing voters to both sides of the ledger can you expect them to pay heed to the benefits and costs of government spending, rather than always favouring more handouts.

Taxing the rich will wreak economic and political damage in the long term, however—and will fail even to bring in the revenue that governments need. Emulating Robin Hood and his merry men might look tempting. But it is a trap. ■

|

Click here: to donate by Credit Card Or here: to donate by PayPal Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794 Thank you very much and God bless you. |

The inheritance tax isn’t “good”.

In fact it’s downright evil.

L

Supposedly the wealth tax in California would be a one time only tax .

Anyone believe it would only be levied the one time?

The wealthy are the ones who spend the big bucks on consumer items (including the financial markets) which in turn helps the economy. The narrow-minded really don’t understand the economics involved. When the uber-wealthy quit spending, the economy slows. Taxing only the uber-wealthy is not the answer to the economy problems.

I have always considered it unconstitutional to treat people differently. Everyone is supposed to be equal under the law.

And that should include everyone paying the same tax rate.

You can’t get the rich because they can and will move. That’s why the definition is so important. It is also why the middle class is disappearing, because although you can label them rich, they are not and they also can’t move.

Bkmk

That would be an interesting court case. With our income tax system, people pay varying tax rates, based on income levels, and based on various exemptions and tax credits in the tax laws.

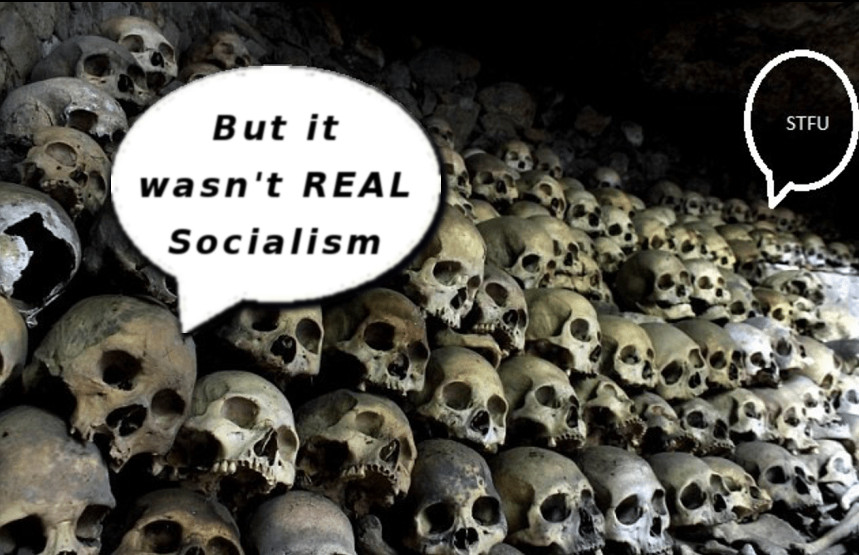

It does not matter how many times Socialism fails. The people who want it are immune to reason and history.

They problem is the governments are spending more in their yearly budget than they can reasonably extort from the average person. It’s a sheer numbers game. The potential victims? anyone who has a large enough chuck of cash the feed multi trillions dollar budgets.

I’m trying to figure out what the difference is between the CCP in China and the end stage capitalist elites that are running the show in the US?

The world appears to revolve in 80 yr cycles and so I’m placing my bets on GenZ. I watched the boomers on the left taking part in the ‘No Kings Protests’, and sadly there are equally the same clueless on the right.

GenZ rightly despises boomers and ‘some’ of us have been listening...

A good percentage of NYC’s tax revenue comes from the taxes collected on the salaries and bonuses given to financial executives and investment bankers who heretofore had been located in Manhattan. Now those firms and those executives are moving to frendlier states. Those taxes end up eroding the tax base itself and long term result in lower tax revenues. Also given not only the high taxes but the endless regulations and hostility to capitalism in Mamdani’s socialist paradise, fewer investors are willing to commit private capital into new ventures. Without the influx of capital, a locale declines and rots.

The type of rich who embrace woke ideas are fools who deserve what they get. (”But Mamdani smiled so much and seemed so nice.”)

The rest of the very wealthy may be soon like the ones in Executive Action who will fight back if poked with a Marxist stick by punks. Different party as the target this time for the Will Geer character who gave the word to kill the president (JFK) when his patience finally ran out. Targets will be the leftists from now on. News media. Judges who thwart our side. Dirty politicians who tried to destroy and imprison Trump in 2024.

“The rich are different from you and me”— F. Scott Fitzgerald.

Hemingway: “Yes, they have more money.”

The rich can afford the private armies poor patriots can’t.

They KNOW it won’t work. They want the tax money from whomever they can get it from. Rich, middle class, poor, they don’t care. But they can’t SAY that. So, they have to say that they’re going after the rich, and then when they all leave, or pay CPAs to find enough loopholes for them to not have to pay, the gubmint can go after the middle class, and eventually the poor.

Yes. The wealthy single handedly created the disaster bunker industry. Fat cats like Zuckerberg are building luxurious underground retreats to wait out natural or man made disasters. What would we do without them?

The Socialist > Communist have to tax the rich. The poor don’t have any money. The goal is for everybody to have equal amounts of nothing, except the Ruling Elite who will have everything.

They do NOT want it to work in the sense of helping America & Americans.

Their agenda/goal is the destruction of America & our Constitutional Republic.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.