' border='0' alt='IMG-8659'> >

If you would like to be on the Gold & Silver PING LIST, please pm me.

The Gold & Silver Ping List covers the following:Everything Gold & Silver

Stock market investments in mining companies,

etc.

PING!

Posted on 01/01/2026 7:12:59 PM PST by delta7

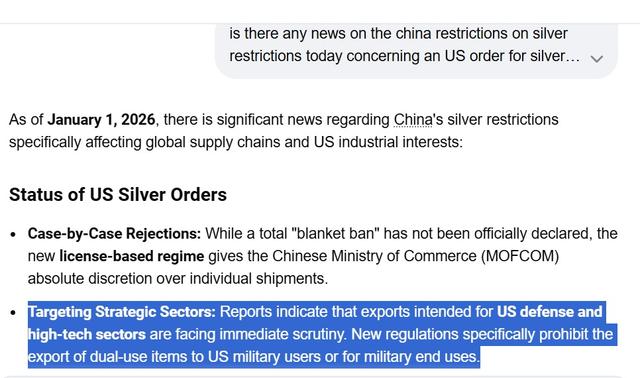

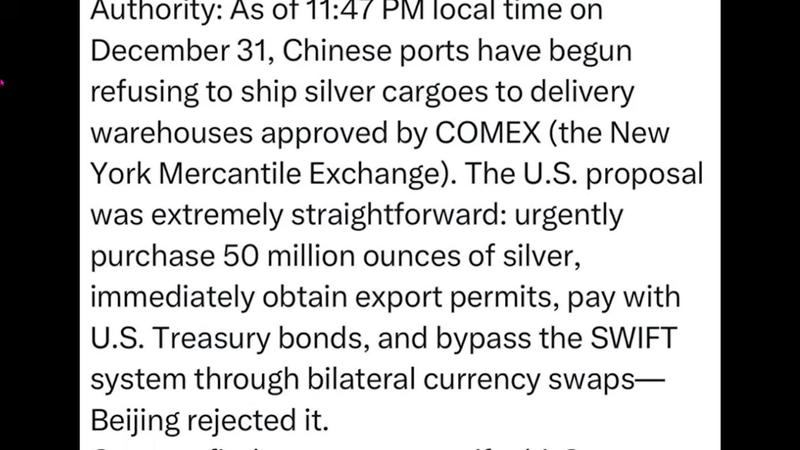

Once Shanghai opens up again on Sunday night Jan 4 2026, More Fireworks

I used to sell brick pavers in El Paso for American Eagle Brick Company, back when the heat could cook a man twice in one afternoon. We sold for .60 a unit.......

....Same story today. Silver’s $71 on paper, $130 in Japan. Numbers without metal. Just another ACME special—free bricks from an empty yard. The game hasn’t changed, only the commodity. The old brick hustle is now traded in ounces and clicks instead of pallets and handshakes. But the moral holds: when supply runs dry and promises keep multiplying, price becomes a rumor—and truth costs whatever someone’s willing to pay.

SILVER’S DOUBLE LIFE EXPOSED

Silver at $130 in Japan, $106 in Kuwait, $97 in Korea, and “$71” on Western screens is not a market; it is a confession. The numbers read like a crime scene diagram: in the real world where bars change hands and coins disappear into safes, silver has quietly migrated into triple‑digit pricing, while the supposed “global benchmark” in New York and London is still stuck in a fantasyland of leveraged promises.

TOKYO PRICE, WALL STREET LIE

In Tokyo shops and Japanese bullion counters, you are not buying silver in the 70s; you are paying the equivalent of $120–130 an ounce because that is what it costs to replace inventory once you factor in tight wholesale supply, shipping, insurance, currency chaos, and the growing sense that the next shipment might not show up on time, or at all. Kuwait tells the same story in a different language: retail bars priced around $100+ an ounce are not a fat merchant’s greed; they are the market’s answer to a simple question—what will it really take to pry physical metal out of the pipeline in a world where everyone suddenly wants the same scarce asset at the same time.

THE PHILHARMONIC THAT BLEW UP “SPOT”

Then there is the Korean angle, where a single silver Philharmonic trading near $100 on a local precious metals exchange brutally exposes the “$71” Western spot quote for what it is: an accounting fiction maintained for the comfort of derivatives desks and headline writers. You do not get a 30–40% gap between futures and coins because of some quirky “collector premium”; you get it because one market is settling contracts and the other is settling reality.

THE DERIVATIVES CIRCUS MASQUERADING AS PRICE DISCOVERY

Behind the polite charts and breathless TV segments about “volatility,” the Western price is still being set in a sandbox where almost nobody actually wants delivery. High‑frequency traders, bank desks, and hedge funds ping contracts back and forth in microseconds, congratulating themselves on “discovering” a price for a commodity that, in their own venues, rarely has to be delivered in size. The result is a “spot” number that tells you more about how comfortable the banking system is with its own paper exposure than it does about the true cost of securing a 1,000‑ounce bar.

WHEN THE WORLD STOPS BELIEVING THE TAPE

Meanwhile, the places that actually need silver—Asia’s refiners, Middle Eastern bullion houses, industrial buyers staring at supply chains—are quietly ignoring the Western fantasy and paying what they must. When multiple regions are routinely clearing real ounces at $90, $100, $130 while COMEX prints a number in the low 70s, the joke writes itself: the West no longer sets the price of silver, it just sets the official lie.

DEATH OF A “BENCHMARK”

In the end, this is how over‑financialized benchmarks die. First, insiders smirk at the spread and call it an “arb opportunity.” Then, month after month, the arb fails to close because there simply is not enough loose metal to make it work. Finally, foreign markets and retail investors stop pretending the Western quote is “the” price at all, and the so‑called global benchmark decays into a provincial settlement price for a shrinking club of leveraged players while the real world quietly re‑prices silver higher in the only place that matters: where someone has to hand over an actual bar.

Dear FRiends,

We need your continuing support to keep FR funded. Your donations are our sole source of funding. No sugar daddies, no advertisers, no paid memberships, no commercial sales, no gimmicks, no tax subsidies. No spam, no pop-ups, no ad trackers.

If you enjoy using FR and agree it's a worthwhile endeavor, please consider making a contribution today:

Click here: to donate by Credit Card

Or here: to donate by PayPal

Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794

Thank you very much and God bless you,

Jim

Stay tuned!

PS, the train has left the station, the US big boxes ( Apmex, JM Bullion, Moneymetals, SD, etc) experiencing huge shortages....$85.60 for ONE US Silver Eagle.....spot is about $73.

Otherwise a roll of film would be a day's wages.

PS, the train has left the station, the US big boxes ( Apmex, JM Bullion, Moneymetals, SD, etc) experiencing huge shortages....$85.60 for ONE US Silver Eagle.....spot is about $73.

Can you explain that for the ignorant (me).

Not enough supply to meet the immediate demand, which, when shorting, is always a risk.

Look up what happened around GameStop.

Gives me goosebumps.

I had a gut feeling that the artificial manipulation of the physical silver price would come crashing down eventually.

Holy crap. This could go parabolic in a short time.

Great for us stackers, bad for the banks that have been raping the little guy for decades. No tears from me.

Any thoughts about timeline and prices???

Thank you.

' border='0' alt='IMG-8659'> >

If you would like to be on the Gold & Silver PING LIST, please pm me.

The Gold & Silver Ping List covers the following:Everything Gold & Silver

Stock market investments in mining companies,

etc.

PING!

Timelines are a fools game. Technicals the best. Fib numbers, Lucas numbers all point to 88 next test, after that 123 then 333., then who knows?

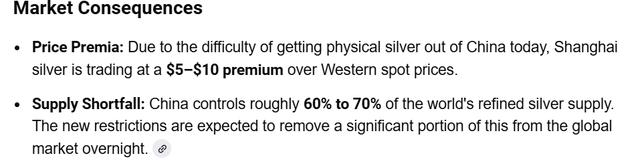

The only known is Silver’s historic demand is industrial user driven, four years of supply deficits, underperforming mining operations, and as of today China announced tight controls on ALL Silver exports, especially to the West. The crooked western Comex and LBMA good delivery supply is now at historic lows. IF they default on delivery, the $300 mark will be easily surpassed, quickly.

The most powerful indicator of pricing is that sovereign nation’s Central Banks are now buying Silver. They are the largest money on the planet....if they are buying, they know something Joe 6 pack doesn’t.

Silver Price Performance USD

Change Amount %

Today +2.08 +2.91%

30 Days +14.24 +24.96%

6 Months +34.40 +93.24%

1 Year +41.68 +140.74%

5 Year +44.03 +161.50%

19 Years +62.25 +688.60%

silverprice.org - 22:56 NY Time

.

So if you own physical silver you should sit tight?

Thank you.

Query: what do you think I should do with my silver when the price goes parabolic? Convert to cash (probably not a good idea in my opinion, but I’m not an expert)? TRADE silver for gold??? It would keep the IRS out of the loop, I think…

Any insight or opinion is very welcome.

Crazy days ahead in 2026.

On a footnote: A close Chinese national sent me a New Years card. Guess what the graphics depicted?

A huge Silver horse with Gold bridle,saddle.....they enter the Year of the Horse in February. I found it very fitting and telling. She has no idea about the historic precious metals Bull we entered....when I replied Silver has increased 150 percent this year, she said who would buy Silver?

Any insight or opinion is very welcome.

Take some profits, pay off debt, trade some Silver off for Gold ( maybe at the 40:1 GSR), but never sell it all. If selling, sell for tangible assets.

Keep in mind, ALL the world’s paper currencies are tanking when measured in PM’s....I snicker when I hear people complain about Inflation, things have never ever been cheaper when priced in Silver or Gold.

I got diagnosed with a severe case of FOMO. Maybe a case of double FOMO.

,,, not enough silver is being mined as industrial users need more and more of it. The up in this cycle is more than difficult to estimate an end to on that basis. If cashing out, I won't get into financial alternatives... I'll buy things I can draw a picture of, like a boat, larger sized generators I can lease out or...

US governments ( Federal, state and local) have over $45 trillion of debt on the books and it increases daily. Add to that about another $10-25 trillion unfunded liabilities and commitments. The EU, Africa and South America are also in huge debt. How long can the paper currency and all the financial gimmickry continue? It is no mystery why the middle classes in India, China and elsewhere are converting as much of their surplus wealth into gold and silver as possible. IMHO the price of copper will soon reach record levels weekly.

The actual market (eBay) for silver eagles is running about $75-$80 right now (plus shipping) on auctions. So yeah, really high compared to where it’s been, but not yet $130 like this article claims.

That’s the thing, it’s not an artificial inflation. Silver is a much needed metal in building data centers, EVs, batteries, and word is that the new solid state battery that Japan will start production soon will also need silver for it’s conductivity.

The demand for silver is going through the roof, that why the people who shorted it thinking it was just price manipulation are losing their shorts.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.