Posted on 02/24/2010 11:35:21 PM PST by bruinbirdman

Freddie Mac said on Wednesday it would probably have to take more taxpayer cash this year to offset continued losses in a fragile housing market.

The warning by the government-run mortgage financier came as it revealed it lost $7.8bn in the last three months of 2009, compared with a loss of $23.9bn a year earlier. The deficit in the fourth quarter of last year was inflated by a $1.3bn dividend payment to the US Treasury but is still up on the loss of $5.4bn in the previous quarter.

Tim Geithner, Treasury secretary, on Wednesday put off until next year a final resolution of Freddie Mac and Fannie Mae, the other main mortgage financier, which back most US home loans and are in a suspended state between full nationalisation or privatisation.

Amid Republican criticism, Mr Geithner told a congressional hearing that it was only an “abundance of caution” that led the Treasury to remove in December a $400bn cap on its assistance to the so-called government-sponsored enterprises. At a separate hearing, Ben Bernanke, Federal Reserve chairman, agreed with Republican suggestions that a blueprint for the GSEs should be outlined in the next few months.

A rebound in the price of mortgage-backed securities in the second half of last year meant Freddie Mac did not have to tap the Treasury for more money in the fourth quarter, the third consecutive three-month period in which it avoided taxpayer financing.

But that streak is expected to be broken in the first quarter of 2010, when Freddie takes an $11.7bn charge related to an accounting change that requires companies to record securitised assets on their balance sheets.

Charles Haldeman, Freddie Mac chief executive, said that in spite of some signs of stabilisation “the housing recovery remains fragile, with significant downside risk posed by high unemployment and a potential large wave of foreclosures”.

Freddie Mac’s fourth quarter loss included $7.1bn in credit-related expenses and a $3.4bn write-down on a low-income tax credit. Provisions for loan losses fell to $7.1bn from $8bn the previous quarter. Full-year provisions nearly doubled to $29.5bn.

Delinquency rates on single family homes rose quarter-on-quarter to 3.87 per cent at the end of December, compared with 3.33 per cent the previous quarter. At the end of 2008, the rate was 1.72 per cent.

In another sign the housing market remains weak, new home sales fell 11.2 per cent in January from the month earlier to a seasonally adjusted annual rate of 309,000, a record low, the Commerce Department said on Wednesday.

....laughs.

Yeah you and the teachers and GM and the guys working on the roads and the welfare people and the environmentalists and “starving” artists and college professors and...and...and...

Sorry though: we’re out of money.....

They’re like little kids playing with monoploy money. It’s a continuous nightmare.

I’m shocked ! Shocked I say !!

The Socialist parasites have a big problem. They have killed the host.

If the Greeks' new bonds are guaranteed, their interest rates will still exceed other EUrotopia bond rates. If Germany is guaranteeing them, why lend to Germany when you can make more from Greece?

yitbos

yitbos

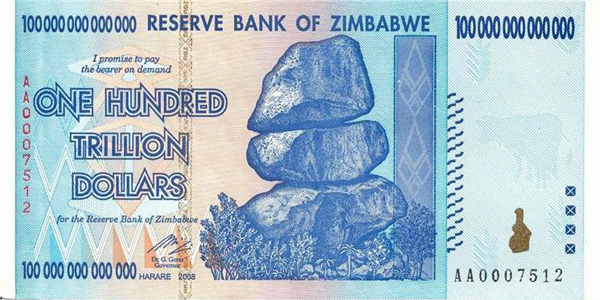

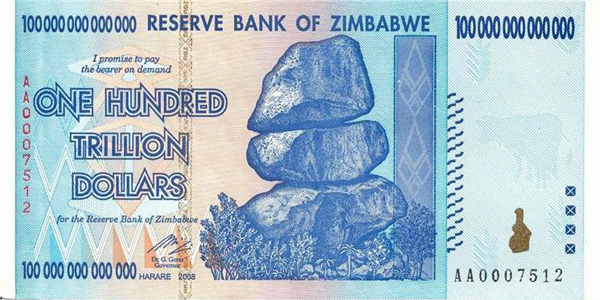

No problem! Here's a gajillion quintillion billion trillion dollars! LOLOLOL! Want more? Sure! Heres a zing zillion bazillion dollars! Just ask Pelosi for it! Obama will sign it! Sure! take it! Take all of it, foverever and ever! LOLOLOL!

Sorry. My money tree died.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.