Skip to comments.

The Senate Tax Proposal Delivers Benefits Directly to the Middle Class

U.S. Senate ^

| November 21,2017

| Katie Niederee & Julia Lawless

Posted on 11/21/2017 1:28:06 PM PST by Brown Deer

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-103 next last

To: petercooper

This SHOULD be Unconstitutional.

Removing a deduction for State And Local Taxes (SALT) is fundamentally DOUBLE TAXATION.

Politically, the tax code is being reinterpreted from fundamental accounting principles to becoming a temporary popular taxation scheme at the federal level.

Now there isn’t any principle disallowing the federal tax code from exponentially taxing the individual on their other deductions.

For example, if you have somebody prepare your taxes and their calculation of your tax rate is 25%, now the govt might claim you owe them an additional 25% on that 25% because the the amount of tax you paid is now taxable itself.

61

posted on

11/23/2017 12:36:53 AM PST

by

Cvengr

( Adversity in life & death is inevitable; Stress is optional through faith in Christ.)

To: rbmillerjr; Rome2000

There is a pent up economic expansion coming and it is percolating now based on expectations of a growth environment. Fine. Then pass a corporate rate cut of 10%, and give everyone (including consumers and individuals) a rate cut across the board.

But they are not doing that.

In order to abide by the "Byrd Rule" (gee, I didn't know that was in the U.S. Constitution), they have to pass something that is "revenue neutral" - which is also a fluid definition. They don't want to explode the deficit, so they have to "pay for" the massive tax breaks to corporations by soaking everyone else. They are capping or outright making illegal almost every deduction individuals and families have.

This bill is not the 1986 Reagan Tax Cut. It is the opposite. The GOPe, the Goldman Sachs maniacs, and the K Street Lobbyists decided that corporations would be "winners" and the middle class (and especially certain states and certain individuals) would have to be "losers."

Freeper Rome2000 pointed this out:

In 2016, corporations paid about 300 billion in corporate taxes , individual tax payers paid 1.6 TRILLION in income tax and 1.1 TRILLION in FICA and Medicaid. The Government made about 900 billion in excise taxes, total tax receipts about 3.3 trillion. Anybody who doesn't understand that corporate taxes are the SMALLEST portion of Federal Tax Revenues doesn't really have the facts necessary to weigh in on what these degenerate scumbags are up to.

And to your logic, if lowering taxes stimulates growth for businesses, how does a massive tax raise for millions of Americans affect their growth?

You need to face reality. Both the House and the Senate bills stink to high heaven. They are NOT Conservative bills - they are class warfare bills where Peter robs Paul. The are "deduction cut" bills for hard working and patriotic families, millions of whom voted for Trump and have been Republican voters their entire lives.

The Tax Bills, for all their complexity, are now polling at 25% approval rating in the polls. If the GOPe passes this mess, we will most likely lose the House in 2018 (and who knows how many state legislatures, governors, and other races).

Businesses will reinvest, grow and hire. That’s not based on an anecdotal show of hands, it’s based on data.

For every set of "data" you want to show me, there are other sources that claim your data is overstated. Again, this is not 1986. We have incredibly inflated markets, globalism, automation, and massive fiat money manufacturing. Are corporations going to "re-invest", or buy their own stock?

I think some will re-invest, and there will be growth. Sure. But there will also be more stock pumping.

You know that.

Is all of that worth giving a huge FU to millions of middle class Americans through the "Rob Peter To Pay Facebook Act"?

62

posted on

11/23/2017 3:54:57 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: Cvengr

This SHOULD be Unconstitutional. Removing a deduction for State And Local Taxes (SALT) is fundamentally DOUBLE TAXATION. Politically, the tax code is being reinterpreted from fundamental accounting principles to becoming a temporary popular taxation scheme at the federal level. Now there isn’t any principle disallowing the federal tax code from exponentially taxing the individual on their other deductions. For example, if you have somebody prepare your taxes and their calculation of your tax rate is 25%, now the govt might claim you owe them an additional 25% on that 25% because the the amount of tax you paid is now taxable itself. Yup.

63

posted on

11/23/2017 3:55:50 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

“If the GOPe passes this mess, we will most likely lose the House in 2018 (and who knows how many state legislatures, governors, and other races).”

It is the exact opposite. If the GOPe does NOT pass the tax cuts, the Democrats will run everything again and will have the WH in 2020.

Then we can review the opportunity cost of not having the lower tax bills vs. the higher taxes, lost jobs, lost wages, and oh yeah, the drastically reduced 401K, retirement and discretionary accounts in our portfolios.

I believe, the SALT stuff will get fixed in Committee, we’ll see.

64

posted on

11/23/2017 7:44:45 AM PST

by

rbmillerjr

(Reagan conservative: All 3 Pillars)

To: rbmillerjr

It is the exact opposite. If the GOPe does NOT pass the tax cuts, the Democrats will run everything again and will have the WH in 2020. That’s what the GOP is telling themselves. Because that’s what the money donors are telling them (threatening them actually). But to pass a bill that screws over millions of loyal Republican voters with a huge tax increase, not to mention the fact that these bills are polling in very low numbers because they are extremely unpopular as people find out what’s in them, will lead to disaster. They want to pass very bad bills quickly before people realize how bad they are.

65

posted on

11/23/2017 8:34:31 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

It’s not going to be a tax increase for most.

It will be a substantial tad CUT - FOR MOST.

...AND when the joint committee fixes the state and local tax situation, it will be tax cuts for everybody.

66

posted on

11/23/2017 10:02:52 AM PST

by

rbmillerjr

(Reagan conservative: All 3 Pillars)

To: SkyPilot

The people writing this tax bill are lying Goldman Sachs oligarchs Banksters, the same scumbags that were “too big to fail” and got the taxpayers to bail them out back in 2008 that now want a huge tax cut for corporations and want the upper middle class to pay for it.

CUT SPENDING

DO NOT RAISE TAXES ON THE MIDDLE CLASS

This bill raises taxes on a family of four in ANY State, whether they have a State Income tax or not.

Banksters Mnuchin and Gary Cohn from Goldman Sachs are writing the tax bill.

This is an attempt at the biggest heist in history.

“Mnuchin is a member of the “Big Six”, a group of politicians convened to write a tax reform proposal that incorporated input from members of the House of Representatives, Senate, and White House. In addition to Mnuchin, the group consists of Senators Orrin Hatch (R-UT) and Mitch McConnell (R-KY); Representatives Kevin Brady (R-TX) and Paul Ryan (R-WI); and National Economic Council Director Gary Cohn”.

Do you trust these 2 creepy scumbags or believe a goddamned word they say?

67

posted on

11/23/2017 8:43:55 PM PST

by

Rome2000

(SMASH THE CPUSA-SIC SEMPER TYRANNIS-CLOSE ALL MOSQUES)

To: Rome2000

68

posted on

11/23/2017 8:47:23 PM PST

by

Rome2000

(SMASH THE CPUSA-SIC SEMPER TYRANNIS-CLOSE ALL MOSQUES)

To: rbmillerjr

LOL

You enjoying your savings from Obamacare?

69

posted on

11/23/2017 8:48:39 PM PST

by

Rome2000

(SMASH THE CPUSA-SIC SEMPER TYRANNIS-CLOSE ALL MOSQUES)

To: rbmillerjr

..AND when the joint committee fixes the state and local tax situation, it will be tax cuts for everybody. The only way they can “fix“ the state, local, and property tax issue is to take it completely out of their sham tax bills. They have had many, many opportunities to do so, and have flat out refused every - single - time. The reason? They need middle and upper middle class taxpayer’s money - to the tune of $1.3 to $1.5 Trillion that the elimination of SALT money to be confiscated by the Feds. That money is used to “pay for” the generous tax cuts for the GOPe donors and the corporations.

70

posted on

11/24/2017 4:27:52 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: Brown Deer; factoryrat; Mariner; Sirloin; BookmanTheJanitor; shotgun; DoodleDawg; IWONDR

71

posted on

11/26/2017 2:15:03 PM PST

by

remember

To: remember

...flawed and carefully cherry-picked?

From your link, it shows a tax cut all the way across...

72

posted on

11/26/2017 3:25:01 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

> ...flawed and carefully cherry-picked?

>

> From your link, it shows a tax cut all the way across...

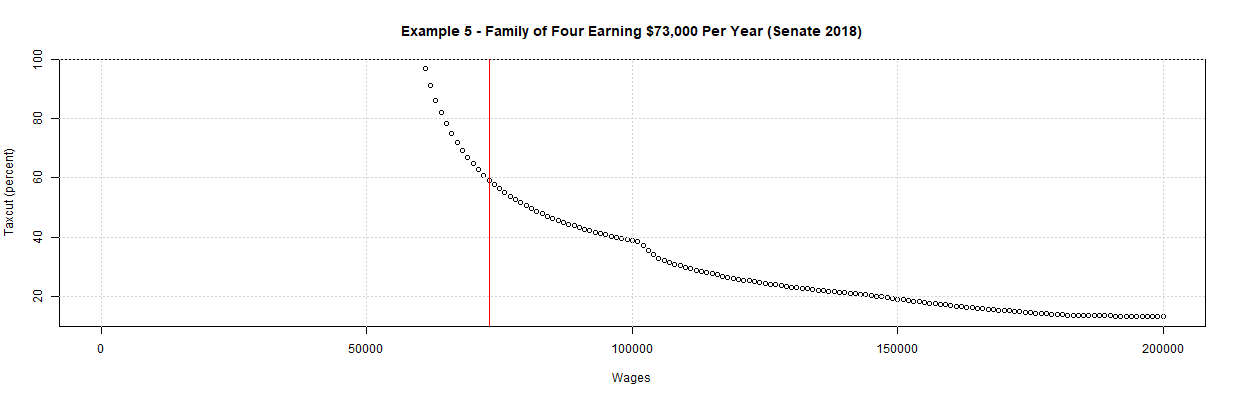

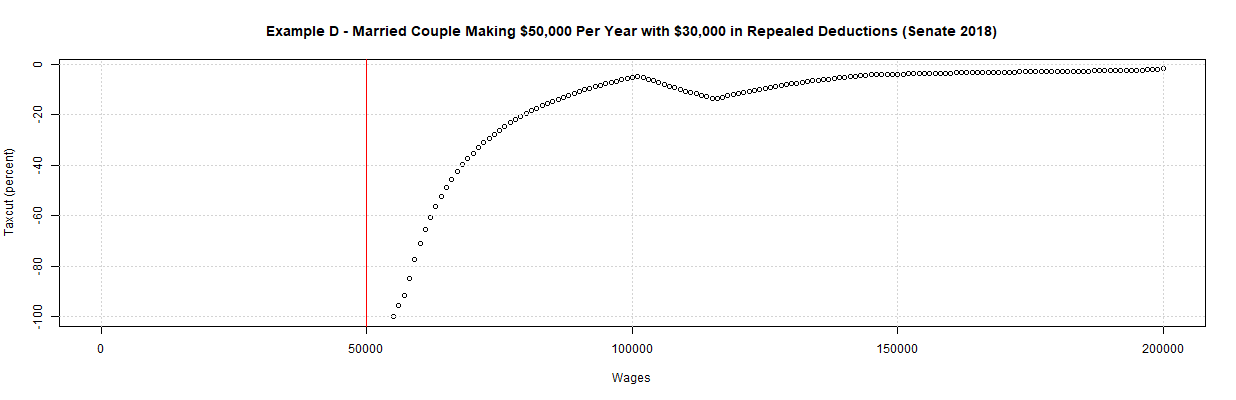

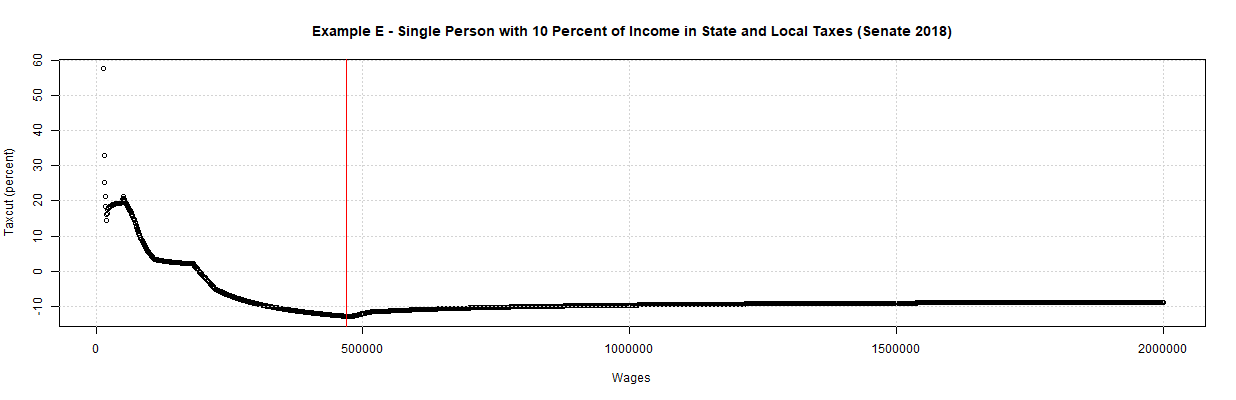

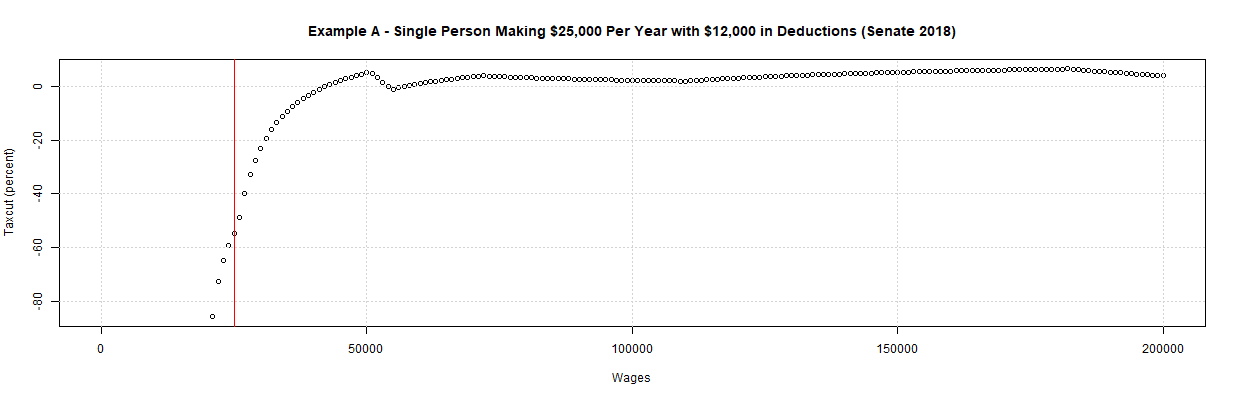

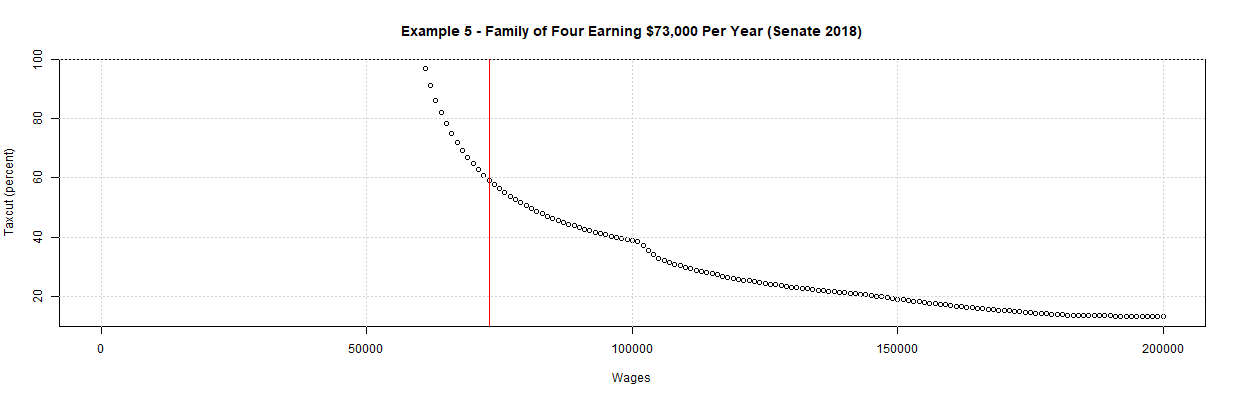

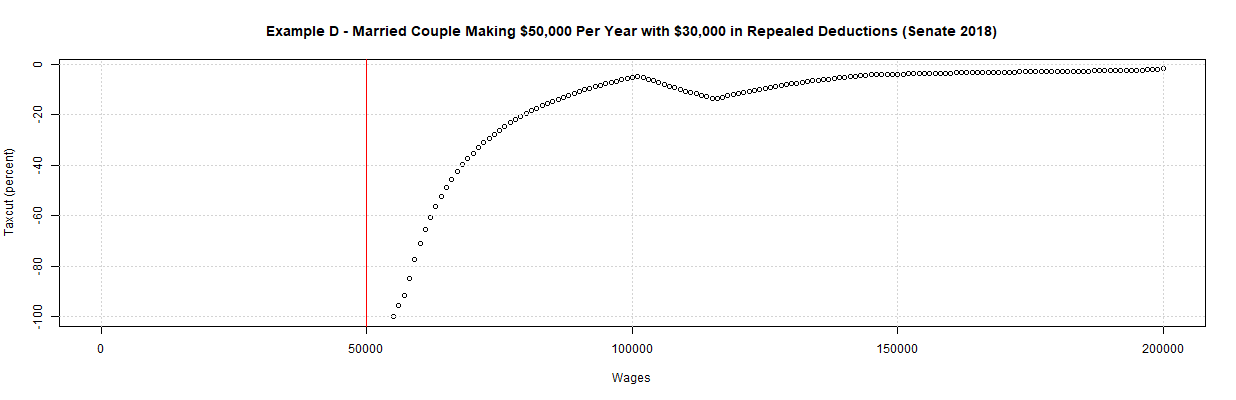

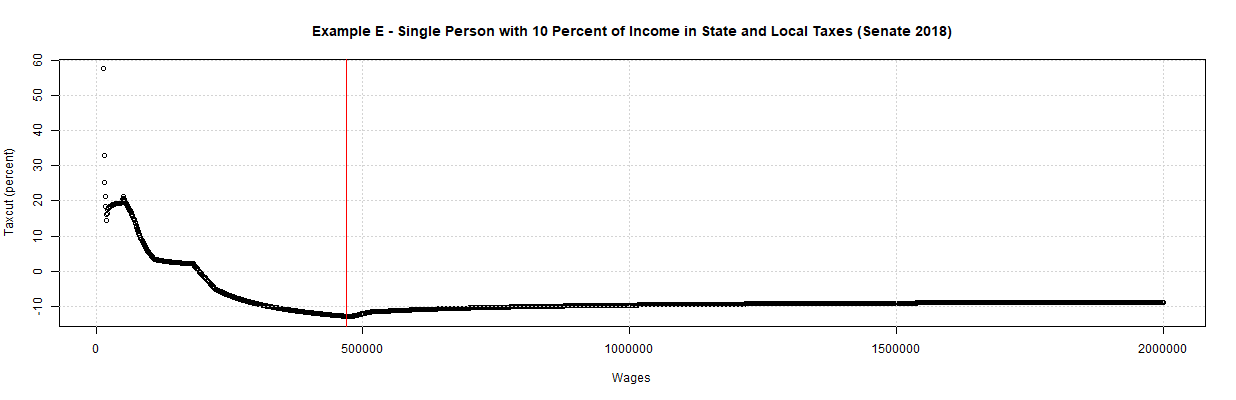

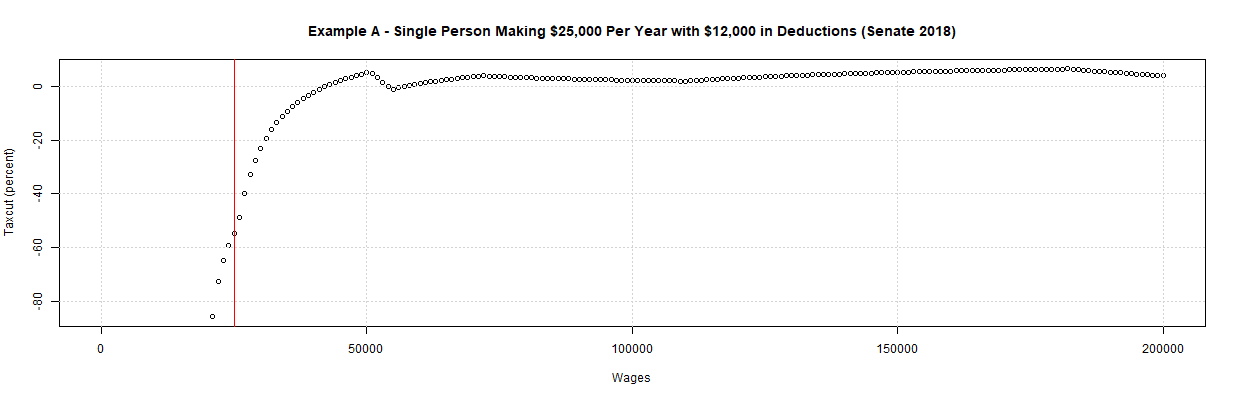

The two examples I cite are cherry-picked in that they carefully include taxpayers with eligible children and who use the standard deduction to take advantage of the fact that both of those have doubled (or nearly so). Following are a couple of plots from http://usbudget.blogspot.com/2017/11/who-will-see-their-taxes-go-up-under.html which include taxpayers who itemize and do not have eligible children:

The first plot shows higher taxes, especially for lower incomes, and the second plot shows higher taxes for higher incomes. In addition, there is the problem that the tax cut bill will increase the debt. That will make cuts to programs like Medicaid more likely and/or will leave that much more debt for our children. Tax cuts cannot be treated as being manna from heaven. The costs need to be considered as well.

73

posted on

11/26/2017 4:01:04 PM PST

by

remember

To: remember

So now you are cherry picking? That is not the original link the you posted!

The first plot shows higher taxes, especially for lower incomes...

Over $50,000/per year is considered a lower income? Just exactly how many people in this country making $50,000 per year have been getting away with itemized deductions of over $30,000 per year on their income tax?

Talk about cherry picking!

The first example, from the Finance Committee was "A family of four with income of around $73,000 (median family income)" - a typical American family with two children with a middle claass family income. Nothing whatsoever, "cherry picked".

74

posted on

11/27/2017 8:16:13 AM PST

by

Brown Deer

(America First!)

To: Brown Deer

> So now you are cherry picking? That is not the original link the you posted!

Yes, my original link was http://usbudget.blogspot.com/2017/11/the-problems-with-taxpayer-examples_26.html but that post links to a prior post in it's discussion of examples A through J. In fact, you can't sum up all single and married taxpayers with just two examples, whether it be those from the Senate Finance Committee or those that I posted. My plots do give a broader view in that they look at a large range of incomes but they still don't represent ALL taxpayers. You need to look at as wide a variety of taxpayers as possible. As explained at the first link above, it helps if you analyze where the changes in taxes are coming from.

>> The first plot shows higher taxes, especially for lower incomes...

> Over $50,000/per year is considered a lower income? Just exactly how many people in this country making $50,000 per year have been getting away with itemized deductions of over $30,000 per year on their income tax? Talk about cherry picking!

Don't get excited! I meant "lower incomes" as the lower incomes of those displayed. Also, the tax increases below $50,000 are not shown in the plot because they are likely increases of more than 100 percent! Still, we can look at Example A which is only a $12,000 deduction for a single taxpayer making only $25,000:

> The first example, from the Finance Committee was "A family of four with income of around $73,000 (median family income)" - a typical American family with two children with a middle claass family income. Nothing whatsoever, "cherry picked".

It's cherry picked if you take it to be anything more than representing a family of four with an income of $73,000 which has less than $12,000 in deductions. By the way, the House claimed that the median income is $59,000 for a family of four in their Example 1. Hopefully, they can work that disagreement out in reconciliation! Selecting any one or two examples as representing all taxpayers is cherry-picking, whether is be those from the Senate Finance Committee or two of Examples A through J that I posted. You need to look at as wide a range as possible.

75

posted on

11/27/2017 11:04:50 AM PST

by

remember

To: remember

The fact is, most families in this country will get a tax cut. You have to “cherry pick” to show otherwise.

76

posted on

11/27/2017 11:38:32 AM PST

by

Brown Deer

(America First!)

To: remember

and btw, your calculations are flawed.

Under current law for 2017, a single taxpayer, with total income of $25,000 gets a $6350 deduction and a $4350 exemption for a $14,600 taxable income, giving him a $1728 tax bill.

Under the Senate plan, he would get a $12,000 deduction and no exemption leaving $13,000 taxable income and only a $1300 tax bill - a $428 savings.

77

posted on

11/27/2017 12:11:49 PM PST

by

Brown Deer

(America First!)

To: Brown Deer

> and btw, your calculations are flawed.

> Under current law for 2017, a single taxpayer, with total income of $25,000 gets a $6350 deduction and a $4350 exemption for a $14,600 taxable income, giving him a $1728 tax bill.

> Under the Senate plan, he would get a $12,000 deduction and no exemption leaving $13,000 taxable income and only a $1300 tax bill - a $428 savings.

You're forgetting that the Example A is of a single taxpayer who has $12,000 of deductions. If you go to the app, set "Tax Examples" to "Example A - Single Taxpayer", set "Tax Plan 1 to "Current 2017", and click on the "Calculation of Taxes" tab, you'll see "Home mortgage interest" of -6000 and "Charity" of -6000, and "Amount owed" of $895 for Current 2017. You can distribute the $12,000 among the itemized deductions however you want and you'll still get $895. You'll get a tax for the "Senate 2018" plan of $1,369.5". Your $1,300 number appears to assume a 10 percent rate but the the current Senate plan has the 10 percent bracket ending at $9,525 and income above that (up to $38,700) being taxed at 12 percent. That gives a tax of (9525 * 0.10) + (13000 - 9525) * 0.12 which equals $1,369.5.

To get your tax bill of $1728 for current law in 2017, set one or both of the 6000 deductions to zero so that the total deductions is now under the standard deduction of $6350. You'll then get a tax bill of $1723.75 for current 2017 law. The reason for the $4.25 difference is likely that you're using the tax table whereas I am calculating the tax using the 2017 formula. Following is the output on the "Calculations of Taxes" tab for Example A (for Current 2017 law) and for your example with itemized deductions below $6350:

Example A - Single Person Making $25,000 Per Year with $12,000 in Deductions

Tax Plan 2017 Senate 2018 Change Tax Plan 2017 Senate 2018 Change

1 --------------------------- -------- -------- -------- 1 --------------------------- -------- -------- --------

2 Wages, salaries, tips, etc. 25000 25000 0 2 Wages, salaries, tips, etc. 25000 25000 0

3 Exemptions -4050 0 4050 3 Exemptions -4050 0 4050

4 Standard deductions 0 -12000 -12000 4 Standard deductions -6350 -12000 -5650

5 Itemized deductions -12000 0 12000 5 Itemized deductions 0 0 0

6 --------------------------- -------- -------- -------- 6 --------------------------- -------- -------- --------

7 Medical 0 0 0 7 Medical 0 0 0

8 State and local taxes 0 0 0 8 State and local taxes 0 0 0

9 Real estate taxes 0 0 0 9 Real estate taxes 0 0 0

10 Home mortgage interest -6000 -6000 0 10 Home mortgage interest -6000 -6000 0

11 Charity -6000 -6000 0 11 Charity 0 0 0

12 Misc. repealed deductions 0 0 0 12 Misc. repealed deductions 0 0 0

13 --------------------------- -------- -------- -------- 13 --------------------------- -------- -------- --------

14 Taxable income 8950 13000 4050 14 Taxable income 14600 13000 -1600

15 --------------------------- -------- -------- -------- 15 --------------------------- -------- -------- --------

16 Tax on taxable income 895 1369.5 474.5 16 Tax on taxable income 1723.75 1369.5 -354.25

17 Child credit 0 0 0 17 Child credit 0 0 0

18 Other dependent credit 0 0 0 18 Other dependent credit 0 0 0

19 Parent credit 0 0 0 19 Parent credit 0 0 0

20 Earned income tax credit 0 0 0 20 Earned income tax credit 0 0 0

21 --------------------------- -------- -------- -------- 21 --------------------------- -------- -------- --------

22 Amount owed 895 1369.5 474.5 22 Amount owed 1723.75 1369.5 -354.25

78

posted on

11/27/2017 7:00:28 PM PST

by

remember

To: Brown Deer

> The fact is, most families in this country will get a tax cut. You have to “cherry pick” to show otherwise.

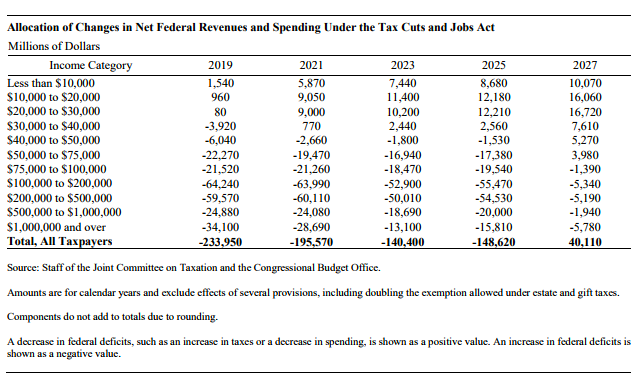

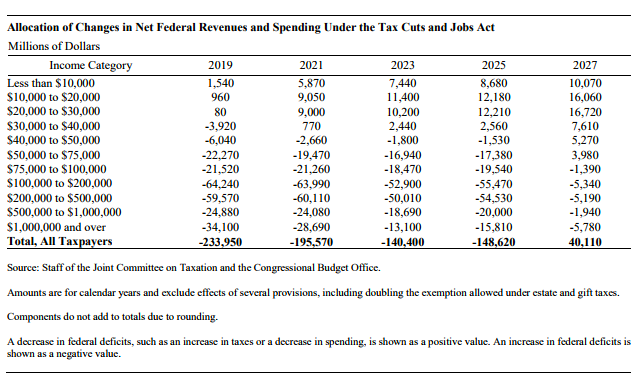

That may be but that doesn't make up for those many taxpayers who will pay more. A just-released report from the CBO (Congressional Budget Office) finds "that the combined effect of the change in net federal revenues and spending is to decrease deficits (primarily stemming from reductions in spending) allocated to lower-income tax filing units and to increase deficits (primarily stemming from reductions in taxes) allocated to higher-income tax filing units." Following is the main chart:

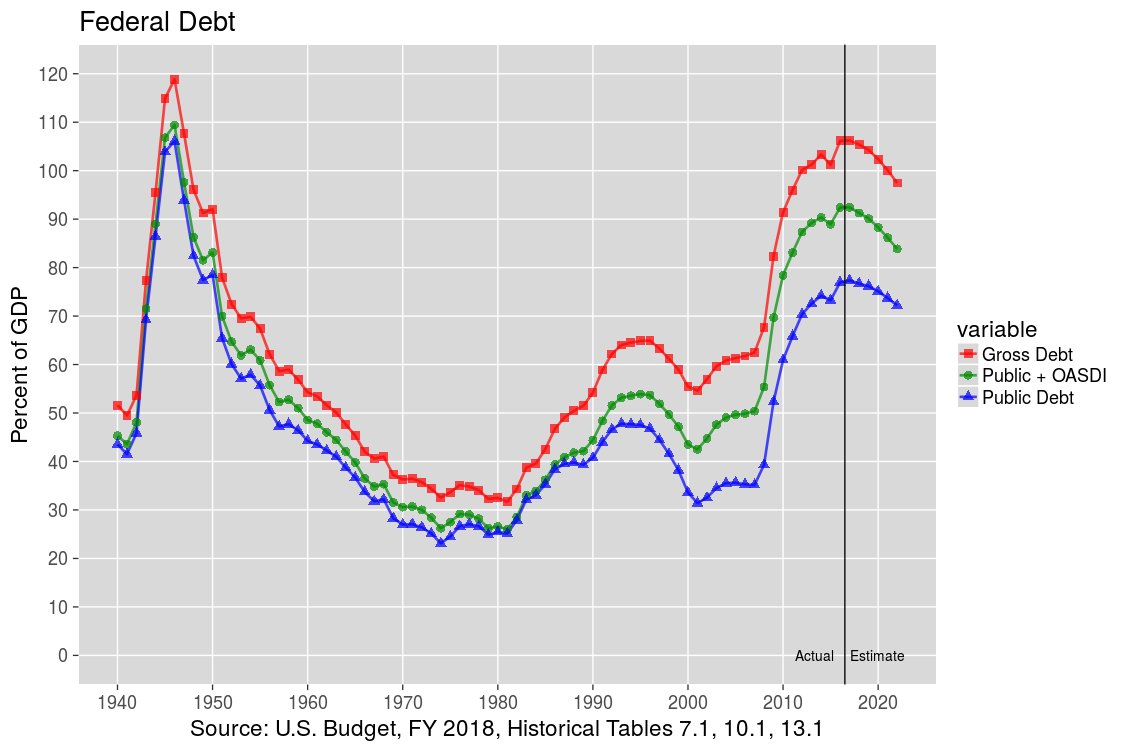

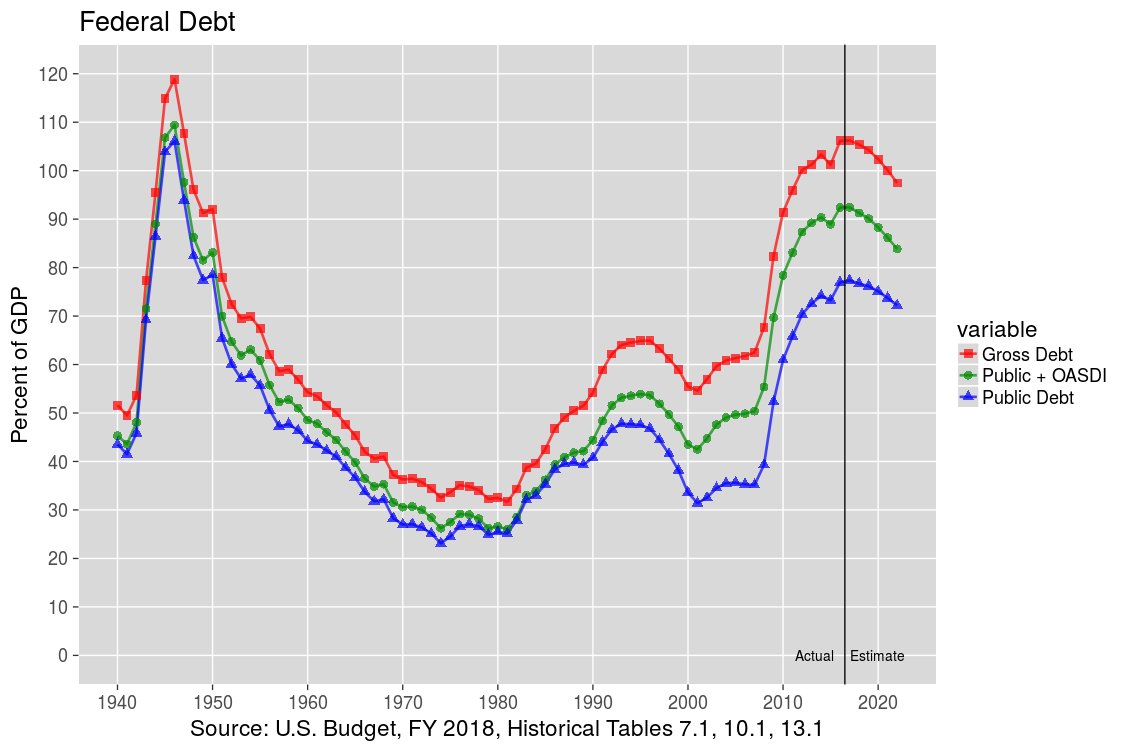

In addition, I would contend that we cannot afford another tax cut. Following is the debt according to the most recently released federal budget:

You can find the numbers at this link. As you can see, at 106 percent of GDP, the gross debt is much higher than it was during Reagan's 1986 tax reform (46.7% of GDP) or even Bush's 2001 tax cut (54.6% of GDP). It may well be that a revenue-neutral reform of the business tax would be good. But to be revenue-neutral, it could likely go no lower than 28 percent and it still could be very difficult to get business to go along with the necessary cuts in deductions. But with our debt level, we cannot afford to "reward ourselves" with yet another individual tax cut.

79

posted on

11/27/2017 10:58:46 PM PST

by

remember

To: remember

You're forgetting that the Example A is of a single taxpayer who has $12,000 of deductions.

So, it's very conveniently "cherry picked"? In fact, it's a very unlikely occurrence.

The fact is, only about 30% of all taxpayers itemize. Additionally, you and I both know that it is much more unlikely that someone with an income of only $25,000 will itemize because in most cases, for them, the standard deduction is higher.

In fact according to the IRS, for someone with under $15,000 AGI who has itemized, the average state and local tax deduction is $937, mortgage interest deduction is $6374 and for charity it is $1533.

Indeed, in your example, there is an automatic red flag being triggered at the IRS, when someone with an AGI of only $11K claims that they are donating $6000 per year to charity!

80

posted on

11/28/2017 3:21:03 AM PST

by

Brown Deer

(America First!)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-103 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson