Skip to comments.

G.O.P. Joins Democrats Urging Glass-Steagall’s Revival. (Don’t Hold Your Breath.)

New York Times ^

| JULY 19, 2016

| JEFF SOMMER

Posted on 07/20/2016 4:20:02 AM PDT by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-54 last

To: ckilmer

RISK for bad loans was shifted from the investment banks to—ultimately— the tax payersTax payers have always been at risk for bad loans.

If Goldman borrowed $10 billion from Bank of America and went out of business because of derivatives, Bank of America is on the hook, even if they never held a single derivative themselves.

41

posted on

07/20/2016 10:57:14 AM PDT

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: 9YearLurker; ClearCase_guy; Georgia Girl 2; ckilmer; Mase; Pelham

9YearLurker separation of investment and commercial banks, that should not have been repealed... ...Glass-Steagall. ClearCase_guy Taleb supports Glass-Steagall and that’s good enough

Georgia Girl 2 Glass-Steagall got repealed.

ckilmer repealing the provision of Glass Stegal 1999 that separated commercial and investment banks

Mase repeal of Glass-Steagall

Pelham Glass-Steagall had been whittled down

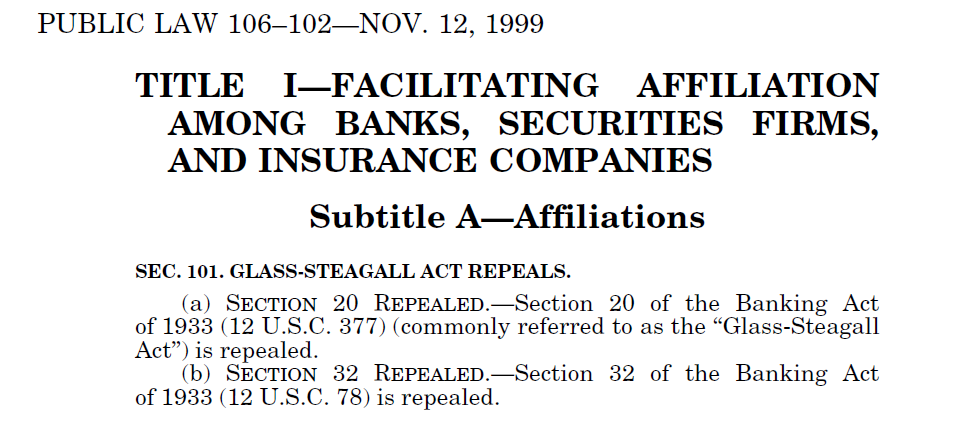

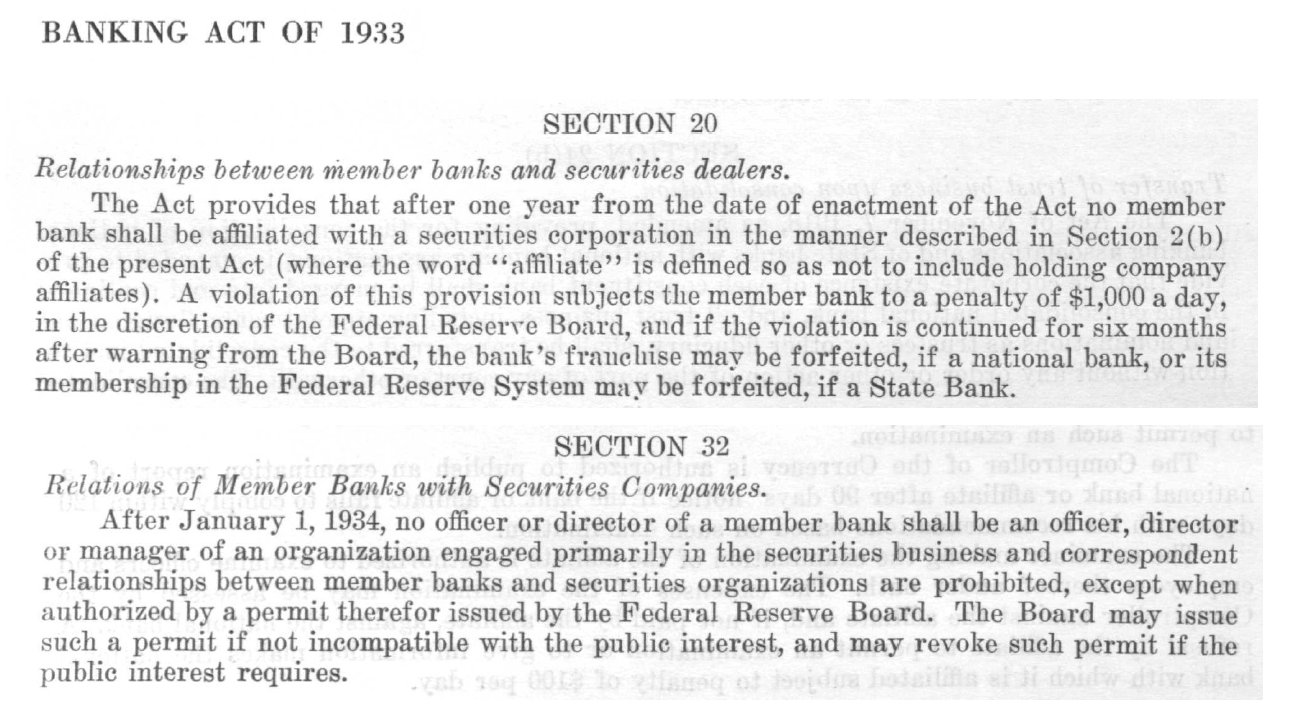

Let's all get together on what the heck we're talking about. Here are all 32 Sections of the original 1933 Glass-Steagall Act, and this is the 1999 Act that included this section:

--that removed Sections 20 and 32 or the 1933 act--

and still left in all the other 30 sections with that stuff about separation of "commercial and investment banks". Can we all agree that deleting two irrelevant sections out of 32 sections is not what we want to call a "repeal"?

Yeah, I know the left-wingnut press keeps saying that the 1999 'deregulation' caused the 2008 crash, but thats so we don't blame the real culprit for all those forced minority loans.

To: 9YearLurker

43

posted on

07/20/2016 2:54:45 PM PDT

by

Jimmy Valentine

(DemocRATS - when they speak, they lie; when they are silent, they are stealing the American Dream)

To: expat_panama; 9YearLurker; ClearCase_guy; Georgia Girl 2; ckilmer; Mase; Toddsterpatriot

I suspect that “repeal of Glass Steagall” is being used as an umbrella term covering a variety of changes in banking that occurred over the years, when the reality is that few involved actual changes in Glass Steagall itself.

I know that Section 11 of Glass Steagall, Regulation Q putting a cap on interest on demand deposits, was repealed by Dodd-Frank in 2011 although work-arounds had existed as early as the 1970s in the form of NOW accounts and money markets.

A more valid issue IMO is looking at the role, if any, of the Commodities Futures Modernization Act 2000 or Gramm-Leach-Bliley in the 2008 crisis. I don’t think either was a repeal of G-S, they instead were innovations that may have needed regulation to prevent a dangerous level of risk taking, especially CFMA 2000. Credit Default Swaps were another sector that seemed to have turned into a casino from what I’ve seen.

44

posted on

07/20/2016 4:40:38 PM PDT

by

Pelham

(Barack Obama, representing Islam since 2008)

To: expat_panama

“Yeah, I know the left-wingnut press keeps saying that the 1999 ‘deregulation’ caused the 2008 crash, but thats so we don’t blame the real culprit for all those forced minority loans. “

Forced minority loans may be exaggerated. They certainly didn’t help and added to the problem, but the Community Reinvestment Act applied only to deposit-taking financial firms, and the majority of subprime loans during the bubble were made by lenders that were entirely exempt from the CRA. The non-CRA lenders were making risky subprime loans in order to create high-yield CDOs. By the end of the bubble the demand for high-yield paper was driving the lending process.

45

posted on

07/20/2016 4:48:10 PM PDT

by

Pelham

(Barack Obama, representing Islam since 2008)

To: Pelham

I recently read that Fannie and Freddie, at the end, were forced to make 55% of their purchases Alt-A mortgages.

46

posted on

07/20/2016 4:51:54 PM PDT

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: Toddsterpatriot

“I recently read that Fannie and Freddie, at the end, were forced to make 55% of their purchases Alt-A mortgages.”

Well that certainly wouldn’t be good.

It was my understanding that F&F continued to deal only in conforming paper even when it was not prime, and that it performed as expected with a much lower default rate than non-conforming paper. There was a post-bubble report on this that Lazard issued IIRC, but I’m never sure how accurate the information I’m seeing is. I’m quite sure that you are in the financial industry from reading your posts over the years and know this field much better than I do, whereas I’m just an interested amateur trying to make sense of it all.

47

posted on

07/20/2016 5:05:13 PM PDT

by

Pelham

(Barack Obama, representing Islam since 2008)

To: Pelham

The GSE’s purchases of all mortgages slowed in 2004, as they worked to overcome their accounting scandals, but in late 2004 they returned to the market with a vengeance. Late that year, their chairmen were telling meetings of mortgage originators that the GSEs were eager to purchase subprime and other nonprime loans.

This set off a frenzy of subprime and Alt-A mortgage origination, in which–as incredible as it seems–Fannie and Freddie were competing with Wall Street and one another for low-quality loans. Even when they were not the purchasers, the GSEs were Wall Street’s biggest customers, often buying the AAA tranches of subprime and Alt-A pools that Wall Street put together. By 2007 they held $227 billion (one in six loans) in these nonprime pools, and approximately $1.6 trillion in low-quality loans altogether.

From 2005 through 2007, the GSEs purchased over $1 trillion in subprime and Alt-A loans, driving up the housing bubble and driving down mortgage quality. During these years, HUD’s regulations required that 55% of all GSE purchases be affordable, including 25% made to low- and very low-income borrowers. Housing bubbles are nothing new. We and other countries have had them before. The reason that the most recent bubble created a worldwide financial crisis is that it was inflated with low-quality loans required by government mandate. The fact that the same government must now come to the rescue is no reason for gratitude.

http://www.forbes.com/2009/02/13/housing-bubble-subprime-opinions-contributors_0216_peter_wallison_edward_pinto.html

48

posted on

07/20/2016 5:27:07 PM PDT

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: Pelham

...“repeal of Glass Steagall” is being used as an umbrella term... --because simply speaking clearly by saying "2009 crisis caused by not enough regulation" sounds hollow. I'd prefer they'd eschew obfuscation, but I won't hold my breath...

To: Pelham

...the majority of subprime loans during the bubble were made by lenders that were entirely exempt from the CRA...I can believe that. To be honest pointing to the one single cause of the '09 crisis is like pointing to the one single cause of the Great Depression. imho there're always many causes to big things.

To: Pelham; expat_panama

The non-CRA lenders were making risky subprime loans in order to create high-yield CDOs. By the end of the bubble the demand for high-yield paper was driving the lending process.Exactly. It wasn't poor minority borrowers who ate up all that money, it was house flippers, second home buyers and HELOC profligates, all fueled by the "players" with money to lend.

51

posted on

07/20/2016 6:38:32 PM PDT

by

semimojo

To: semimojo

And it was,” my secretary pays more in taxes,” Warren Buffet who rated these bundles to fabricate the largest transfer of wealth in world history. Through his machinations, he now runs one of the largest real estate holding companies in the country and rents the properties he stole back to their original owners. Crony capitalism doesn’t come close to defining the reality of the Washington/Wall Street collusion.

If Trump actually tries to wrest the country back to the people, he may be better served hiring his own body guards rather than relying on any government employees. Paranoia is justified in many circumstances.

52

posted on

07/20/2016 6:55:52 PM PDT

by

antidisestablishment

(If those who defend our freedom do not know liberty, none of us will have either.)

To: Toddsterpatriot

Thanks, I wasn’t aware of those details.

53

posted on

07/20/2016 8:21:49 PM PDT

by

Pelham

(Barack Obama, representing Islam since 2008)

To: expat_panama

“because simply speaking clearly by saying “2009 crisis caused by not enough regulation” sounds hollow. I’d prefer they’d eschew obfuscation, but I won’t hold my breath..”

I’m sure that the vast majority of people following all this aren’t doing what you have done, which is to chase down the facts regarding actual changes to Glass Steagall.

So you may well end up being the lone knowledgeable voice in the wilderness trying to straighten us out as we sloppily blame everything on ‘the repeal of Glass Steagall’ when the facts are otherwise. It may take a lot of repetition to beat it out of us.

54

posted on

07/20/2016 8:37:04 PM PDT

by

Pelham

(Barack Obama, representing Islam since 2008)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-54 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson