Skip to comments.

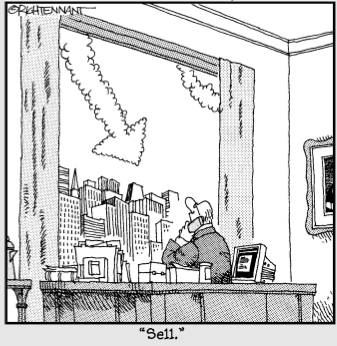

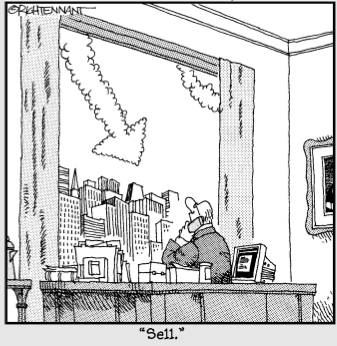

Bear Sinks Claws Into Russell 2000 As Stocks Fall Hard

Investors Business Daily ^

| 01/13/2016

| DAVID SAITO-CHUNG

Posted on 01/14/2016 3:23:51 AM PST by expat_panama

Nasdaq Closes Down 3.4% Major averages sell off after Brent oil undercut $30 a barrel intraday

Small-cap stocks officially entered a bear market amid a wide-ranging sell-off Wednesday, fueled by the lowest oil prices in a dozen years. Brent crude futures touched below $30...

[snip]

The Russell 2000, a key market gauge of smaller, publicly traded companies, dove 3.3% to end at 1010.19. That level is 22.1% below its 52-week peak of 1295.99, set on June 23.

In stock parlance, a decline is officially labeled a bear market when the price correction exceeds 20% from a 52-week or all-time high.

Russell Rout

The Russell 2000 is down 11.1% year to date. It slumped 5.7% in 2015.

The S&P 500 fell 2.5% on Wednesday, and the Dow...

[snip]

Each of these sell-offs caused a spike in the put-call volume ratio...

[snip]

The way to deal with uncertainty is to watch the daily interplay between price and volume in the major indexes and confirm that true demand has returned. This occurs when the market jumps more than 1.25% in heavier volume than the day before, usually four days or more into an attempted rally.

This type of action, called a follow-through, gives the best indication that a new market uptrend is underway. And that is the silver lining of the market's current destruction. The deeper the drop, the more likely a strong new uptrend will be born. More than a few market observers have been waiting for such a moment ever since the stock market galloped off its early 2009 lows. Back then, the S&P 500 hit bottom at 666. On Wednesday, the S&P 500 ended at 1890.

IBD research shows that not all follow-through days work out. However, every major market bottom since 1900 featured a follow-through rally.

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; stocks

This post is a tad different than what's on the web link as it's based on the print edition, but they're both great w/ lots 'o good stuff.

Bear market talk aside, we're still not quite down to where we were w/ the last big dip five months ago. My personal preference is to not talk about a 'bear market' until we first find ourselves in new major lows.

iow, it may not be time yet for us all to be running around in our shorts...

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Ah, but it's certainly a blustery morning today isn't it? Yesterday's stock action's all covered at the top of this thread, but fwiw today's stock index futures are bonkers --the heat map's got 'em at -2.43%! Metals seem fine, futures calling them at +1.67% and gold/silver are right now at $1,093.20/$14.22.

Reports:

8:30 AM Continuing Claims

8:30 AM Export Prices ex-ag.

8:30 AM Import Prices ex-oil

10:30 AM Natural Gas Inventories

Elsewhere:

Asian shares skid as Brent crude plumbs 12-year lows Reuters - 11:41am TOKYO Asian shares fell on Thursday in the wake of steep losses on Wall Street, as Brent crude oil skidded to 12-year lows amid a commodities rout that heightened fears about the global economy.

To: expat_panama

Ive been in cash for some time. Feel bad for a buddy that went heavy into energy. He’s losing his shirt now, but it will come back especially if there is war coming. And I think there is.

3

posted on

01/14/2016 4:01:50 AM PST

by

refermech

To: refermech

4

posted on

01/14/2016 4:26:28 AM PST

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: expat_panama

Catch a falling knife alert: I decided since one of my ultraconservative portfolios is only down 2% YTD, I would switch some money into international funds from reading the articles above. I don’t think those will do better in the long run and may go down some more in the short run, but in between those two there might be a little room for another developing markets bubble.

5

posted on

01/14/2016 4:59:43 AM PST

by

palmer

(Net "neutrality" = Obama turning the internet over to foreign enemies)

To: refermech

there will always be war and rumors of war.

6

posted on

01/14/2016 5:03:00 AM PST

by

RC one

(race baiting and demagoguery-if you're a Democrat it's what you do.)

To: expat_panama

7

posted on

01/14/2016 5:16:38 AM PST

by

Jack Hydrazine

(Pubbies = national collectivists; Dems = international collectivists; We need a second party!)

To: expat_panama

Completely off topic, but when I first saw the headline I saw “bear claw” and now I am craving a doughnut.

8

posted on

01/14/2016 5:24:01 AM PST

by

drop 50 and fire for effect

("Work relentlessly, accomplish much, remain in the background, and be more then you seem.")

To: expat_panama

On a more substantive note, while we may not meet the technical definition of a bear market, or more broadly, a recession, the global economy will have little to celebrate.

China is uncertain, either economically or politically. The US regulatory regime continues to strangle entrepneurship and the global trade outlook is dismal.

If we can get new administration to take off our self imposed straight jacket, we might get a jump start on improving things.

9

posted on

01/14/2016 5:31:40 AM PST

by

drop 50 and fire for effect

("Work relentlessly, accomplish much, remain in the background, and be more then you seem.")

To: drop 50 and fire for effect; All

Question. I wonder how much net worth has been lost in the US with this decline since January 1. I’d think it has to have a serious long-term impact on the economy.

10

posted on

01/14/2016 5:42:52 AM PST

by

grania

To: grania

11

posted on

01/14/2016 5:51:06 AM PST

by

Lurkina.n.Learnin

(It's a shame enobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin; All

Thanks for that. I tend to think in broad, logical strokes, so here goes: I'd think this is the real deal. People were happy about Saudi pulling the plug on gas prices (oh boy!! The consumer gets more money to spend on lottery tickets and candy bars and a trip to the amusement park). But that's money that was going to developing countries and to middle class lives and into communities. So now the Saudis are going to sink the world economy into chaos and pick up the pieces? How can it be stopped in a global environment.

I'd think the countries that will survive, the economic meltdown, global chaos with "migrants" and the effects of terrorism will be those countries that can isolate themselves. The US? Perhaps the only way to do it is for a collapse of federal control, and some states will be able to take matters into their own hands.

How quickly could it descend into chaos, anywhere? Look at Crimea, Germany, Syria, Libya etc to answer that question.

Are we closer to "the sky is falling" than ever before? Are there too many things on the table? I wonder.

12

posted on

01/14/2016 6:26:25 AM PST

by

grania

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson