Skip to comments.

Obamacare for Your IRA

National Review ^

| 4/27/15

| John Berlau

Posted on 04/27/2015 3:06:57 AM PDT by markomalley

Is Jonathan Gruber — the MIT economist who seemingly dropped out of public view after he was caught on camera bragging about how he and other Obamacare architects misled the American public — now advising the Department of Labor?

No evidence indicates that he is, but the authors of DOL’s sweeping new seven-part group of regulations that would sharply curtail choices of assets and investment strategies in 401(k)s, IRAs, and other savings plans appear to share Gruber’s mindset on the “stupidity of the American voter” (a revelation that Rich Lowry aptly described as “an unvarnished look into the progressive mind, which . . . favors indirect taxes and impositions on the American public so their costs can be hidden, and has a dim view of the average American”).

Now President Obama and Secretary of Labor Tom Perez are advancing a new regulatory and hidden-tax scheme while claiming to protect average Americans’ retirement savings from unscrupulous financial professionals. The proposed “fiduciary rule” would restrict the investment choices of holders of 401(k)s, IRAs, health savings accounts, and Coverdell education accounts.

In a speech to AARP, Obama proclaimed:

If you are working hard, if you’re putting away money, if you’re sacrificing that new car or that vacation so that you can build a nest egg for later, you should have the peace of mind of knowing that the advice you’re getting for investing those dollars is sound, that your investments are protected.

Similarly, a DOL “fact sheet” describes the rule as “protecting investors from backdoor payments and hidden fees in retirement investment advice.” The sinister-sounding “backdoor payments” actually refers to a longstanding practice of compensation to brokers from many mutual funds and annuities. This practice is disclosed to investors and enables brokers to charge them less because of the additional compensation that brokers receive.

Yet upon further reading, the DOL rule seems premised on the Gruberite notion that American investors need protection from their own stupidity. According to page 4 of the rule:

[I]ndividual retirement investors have much greater responsibility for directing their own investments, but they seldom have the training or specialized expertise necessary to prudently manage retirement assets on their own.

Therefore, they “need guidance on how to manage their savings to achieve a secure retirement.”

Can’t savers who feel they need this guidance seek it out from a variety of investment professionals under a system with strong disclosure and anti-fraud rules? Absolutely not, says the Obama administration.

“Disclosure alone has proven ineffective,” states the rule. “Most consumers generally cannot distinguish good advice, or even good investment results, from bad” (page 36). In fact, proclaims the DOL, “recent research suggests that even if disclosure about conflicts could be made simple and clear, it would be ineffective — or even harmful.”

Besides being unnecessary and intrusive, the rule is legally dubious and a major case of executive-branch overreach.

So, in the administration’s view, the only solution is to tax these dim-witted investors — for their own good, of course — and expose financial professionals to a flurry of lawsuits and penalties if administration officials deem their advice not to be in savers’ “best interests.”

Besides being unnecessary and intrusive, the rule is legally dubious and a major case of executive-branch overreach. At Obama’s direction, the DOL is massively stretching its limited authority over pensions under the Employee Retirement Income Security Act (ERISA) of 1974 to bypass the Securities and Exchange Commission, which has primary jurisdiction over investments, and reshape the retirement-savings industry.

The DOL claims authority by reclassifying a broad swath of investment professionals as “fiduciaries” with a government-imposed “best interest” standard, which subjects them to heavy penalties and lawsuits if the DOL or a court determines that they deviated from this standard. This is true even for financial professionals whose clients manage their own 401(k) portfolios or hold self-directed IRAs.

In the 40 years since ERISA was first enacted, DOL regulations have for the most part strictly applied the term “fiduciary” to managers of defined-benefit plans and those who provided individualized investment advice on a regular basis, such as registered investment advisers. Under the new rule, financial professionals who provide even one-time guidance or appraisal of investments could find themselves classified as “fiduciaries.” Because most of the exemptions in the new rule are vaguely written, the rule could enable cronyism for certain types of financial-service providers and companies offering investments.

This means investment professionals dealing with 401(k)s, IRAs, HSAs, and Coverdell accounts (the DOL rule claims jurisdiction over the last two under the rationale that they are subsets of IRAs and pensions) will have to either look to the government for permission to offer certain types of investments or get out of the business altogether. A study by the consulting firm Oliver Wyman and the Securities Industry and Financial Markets Association concluded that 12 million to 17 million investors could lose access to their current service providers under a similar “fiduciary” mandate.

“This sea change in the law would force all brokers to move to the more expensive ‘Registered Investment Adviser’ role or charge their clients more money,” conclude American Action Forum analysts Sam Batkins and Andy Winkler.

Noting that the DOL itself estimates that the regulation could cost $5.7 billion over 10 years, Batkins and Winkler write that “the proposal easily qualifies as both ‘economically significant’ and major,” and therefore should be subject to heightened scrutiny. Instead, the Obama administration is truncating the comment period from the normal 90 days — and longer for a rule having this large an economic impact — to just 75 from the issuing of the rule. The deadline for public comments for this liberty-stealing rule is, ironically, the first business day after July 4.

The new rule is essentially a rehash of a previous proposed regulation that proved highly unpopular. That measure was withdrawn in 2011 after massive bipartisan opposition — including from Vermont’s self-proclaimed socialist senator Bernie Sanders, who protested that it was too restrictive on his state’s businesses that offered employee-sponsored ownership plans (ESOPs). ESOPs are exempt from the new version, but pretty much every other mandate is intact, and some new ones have been added.

As with the 2011 rule, the new regulation would also make it extremely difficult for owners of IRAs to hold specific nontraditional investments. Many self-directed IRAs contain, by the individual investor’s design, everything from precious metals such as gold and silver to peer-to-peer loans from platforms such as Prosper and Lending Club. Whether inclusion of these alternative assets is a good investment strategy is a matter of opinion, but it should be a choice for the investor to make.

Wealth redistribution may be a hidden motive for this rule. As the Obama administration showed earlier this year when it tried to sneak through a tax on 529 college savings plans, it doesn’t necessarily think the middle class isn’t “rich” enough to be taxed a bit more.

The Retirement Industry Trust Association, a trade group for custodians of self-directed IRAs, warned in 2011 that imposing a fiduciary standard on IRA service providers “would result in higher costs and potentially fewer service providers to self-directed IRAs,” which “in turn, could result in fewer investment choices.” And the new rule is full of phrases such as “generally accepted investment strategies” that could cause heightened liability for those who assist investors in buying nontraditional assets for their IRAs.

Even if an investor could find such a service provider willing to take this heightened risk, that investor could face a tax on investments deemed to be not in his or her “best interest.” The DOL fact sheet, under a section entitled “Strengthening Enforcement of Consumer Protections,” explains that to protect consumers, “the IRS can impose an excise tax on transactions based on conflicted advice” and “can require correction of such transactions involving plan sponsors, plan participants and beneficiaries, and IRA owners.”

And wealth redistribution may be a hidden motive for this rule. As the Obama administration showed earlier this year when it tried to sneak through a tax on 529 college savings plans, it doesn’t necessarily think the middle class isn’t “rich” enough to be taxed a bit more.

We should learn from Gruber’s other admonition that “lack of transparency is a huge political advantage.” Sunshine, conversely, is the best political disinfectant. Public dissection of the 529 tax by Ryan Ellis of Americans for Tax Reform helped build bipartisan opposition that defeated it.

Those who do not wish to be subject to the financial equivalent of Obamacare for their 401(k)s, IRAs, and other savings plans must do everything they can to expose the true paternalistic and redistributive agendas behind the DOL’s “fiduciary rule.”

TOPICS: Business/Economy; Editorial; Government

KEYWORDS: 401k; retirement; theft

Navigation: use the links below to view more comments.

first 1-20, 21-37 next last

To: markomalley

This is the actualization of that which was proposed by Clinton Administration Ghoul Teresa Ghilarducci in the early 90s before Republicans took over the House of Representatives. She maintained that all retirement and investment accounts should be “assessed” a fee so that government could do its good work (I’m guessing she was also on the HillaryCare secret panels, too).

These people will call it “protecting your retirement” but what it will be is an assessed penalty (likely a percentage of the total package) when it (your retirement plan) doesn’t meet their (ObamaCare-like) standards.

It’s a twofold strike: 1) assess massive penalties to fund government largesse for the leeches, and 2) eventually force you to put your retirements into socially responsible, government approved instruments. Think about that. You’d be forced to invest in Tesla, or wind power, solar power, “Green” technology companies and every other AGW or eco-nut fringe mania out there (many I’ll be who will become massive Democrat campaign contributors if not already).

There is, of course, a final option. If they could gain or consolidate enough legislative and judicial power, they would rather just take your retirement altogether and give you a chit that is good for a few bucks more per month on Social Security. They want, and will have that money by hook or crook. Count on it.

2

posted on

04/27/2015 3:33:37 AM PDT

by

Gaffer

To: markomalley

This is why I quit contributing to my 401K when obutthead was elected. Some call me stupid for not taking advantage of the “booming” market. I see it as not putting any more of my money where the government may very well declare it not mine very soon. I just wish I were old enough to get out what I already have in there.

To: markomalley

Quantitative easing is a huge tax nobody is talking about and its in force now. Every month the government clicks a mouse and adds $87 billion dollars. What is the effect? I went to Lowes to buy a pair of channel locks (hand tool). When I last bought a pair several years ago they cost about $5. Today they are $29.99.

If you adjust for inflation (adding money into the economy) gas is probably as cheap at $2.80 today as it was in 1970 at $.38. I saw an article yesterday saying that the Fed saw no way to end QE and that it would become a permanent feature of the economy. Now that will affect your 401k as no company (other than possibly Apple) is growing faster than inflation.

To: markomalley

Mattresses as saving depositories are looking better and better

5

posted on

04/27/2015 3:43:22 AM PDT

by

silverleaf

(Age takes a toll: Please have exact change)

To: markomalley

6

posted on

04/27/2015 3:47:28 AM PDT

by

gattaca

(Republicans believe every day is July 4, democrats believe every day is April 15. Ronald Reagan)

To: markomalley

sharply curtail choices of assets and investment strategies in 401(k)s

Aren’t they limited enough?

7

posted on

04/27/2015 3:54:00 AM PDT

by

logic101.net

(If libs believe in Darwin and natural selection why do they get hacked off when it happens?)

To: silverleaf

I’ve been joking for years about withdrawing my paltry savings and putting it under the mattress. Now it’s no joke.

Actually, as the dollar becomes declines, all that paper under the mattress will become worthless anyway.

I had thought about putting it in gold, but even that has lost value. There just is no safe investment vehicle anymore.

Thank you Republicans and Democrats.

To: fatnotlazy

Gold prices may go up and down but precious metals “values” for investors are subject to manipulation. Cost averaging is the way I look to go

Don’t think of gold as an investment, but as a way to preserve wealth for the long term. The ultimate buy and hold. That is why govts try to seize it from private citizens when financial markets crash and cash (aka givt promissory notes) means nothing

9

posted on

04/27/2015 4:12:57 AM PDT

by

silverleaf

(Age takes a toll: Please have exact change)

To: kevslisababy

This is why I quit contributing to my 401K when obutthead was elected. Some call me stupid for not taking advantage of the “booming” market. I see it as not putting any more of my money where the government may very well declare it not mine very soon. I just wish I were old enough to get out what I already have in there. I believe when the next financial crash happens (and it will), the sheer magnitude of the collapse will dwarf any previous financial calamity in world history.

The entire world has more debt (both corporate and government) than at any time in human history. The Stock Market "gains" are a joke and a mirage - propped up by fictitious "money" that the Fed "pumped." Now they are screwed - they cannot raise interest rates and they cannot stop "pumping."

http://www.wnd.com/2014/01/obama-step-closer-to-seizing-retirement-accounts/

Congress and Obama has been making stealth plans to seize IRAs, 401Ks, and all the rest should everything collapse. Obama is his supporters have all the machinery in place to do so today.

Government Lays Groundwork To Confiscate Your 401k and IRA: “This Is Happening”

The "groundwork" is already complete. Further, the government know EXACTLY how much is in every retirement account (that is why they dictate that you must disclose it to them).

When there are EBT food riots, and the Amish are burning down the cities, what priority for "emergency" spending do you think Obama will choose? The preservation of a middle or upper middle class white couple's retirement account?

The Treasury already "borrows" from retired civil servants Thrift Savings Plans accounts, and has taken that money twice in 3 years (citing "emergency measures"), and said they "paid it back." It is all smoke and mirrors. When the stuff hits the fan, the only reserves of cash they can hope to draw upon are the IRAs and 401Ks, and they will take them. They will issue you a worthless bond in return. Mark my words.

10

posted on

04/27/2015 4:29:13 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

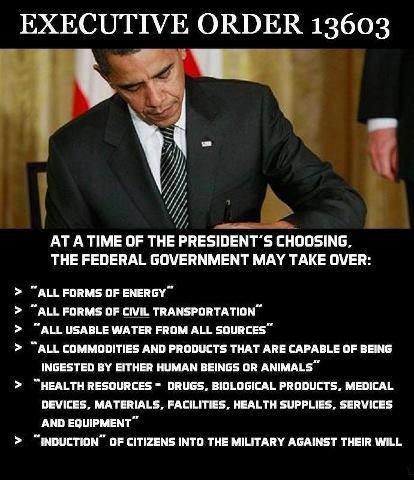

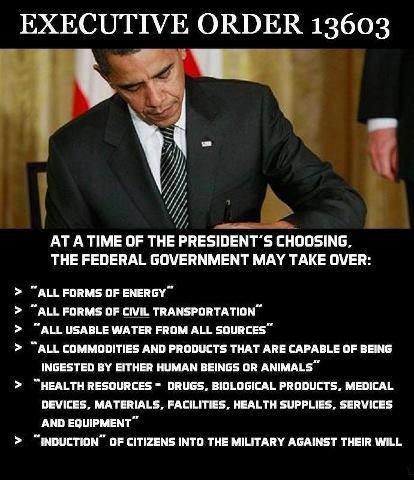

To: silverleaf

Don’t think of gold as an investment, but as a way to preserve wealth for the long term. The ultimate buy and hold. That is why govts try to seize it from private citizens when financial markets crash and cash (aka givt promissory notes) means nothing In 1933, FDR (via Executive Order, not even law) had the Federal Government seize all private gold holdings.

The Feds raided safe deposit boxes, and US citizens who had gold were arrested and their assets taken.

We all know Obama is ruling by "Executive Order", and that Congress will never stop him.

What makes anyone believe that when the next crash happens, Obama and his private alphabet soup agency private armies won't take all gold and silver?

All he has to do is say that private holdings of gold and silver are illegal, and cannot be stored, transferred, or used in any transaction for barter or commerce.

Stroke of the pen.

11

posted on

04/27/2015 4:33:50 AM PDT

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: silverleaf

There is too much money, in the eyes of the thieves in DC, in tax avoidance or tax delay plans out there. Start with that premise and move to any thought of how they are going to get their hands directly or indirectly onto it. Directly means seize it. That may come later. The second is the incidious way: direct how it can be invested in ideas they like i.e. low income housing projects, solar, wind power et al; put a yearly “custody fee” on it; and/or perhaps scare enough people who are in 401’s to pull their assets out and pay a high income tax rate plus an “early withdrawal” penalty. So, either they drip you to death or just lop off you assets in one fell swoop.

The time has come for the government to go before we all become part of it.

12

posted on

04/27/2015 4:35:26 AM PDT

by

Mouton

(The insurrection laws perpetuate what we have for a government now.)

To: markomalley

Unfortunately these waters have been tested for years. Wherever there’s money, the imperial government is looking for ways to get its hands on it.

To: SkyPilot

I agree 100%. There are those who tell me that they will NEVER appropriate our retirement accounts, because people of both political (or maybe I should say all) parties have them and the thieves wouldn’t want to make everyone angry and risk a great up rising/backlash. I don’t think they care, and that could very well be why all our government agencies are arming themselves so heavily.

To: kevslisababy

This is why I quit contributing to my 401K when obutthead was elected. Some call me stupid for not taking advantage of the “booming” market. I see it as not putting any more of my money where the government may very well declare it not mine very soon. Good grief. No one is trying to take it away from you. There was one instance where an obscure professor testified to a committee, proposing it. No one took her seriously, except for the conspiracy theorists.

This is simply a misguided attempt to prevent financially-illiterate people from making poor investments. They have a point, but this is a sledgehammer approach to a problem that could easily be solved with one small change: ban company stock funds from 401(k)'s.

I've personally been burned by a bad investment advisor, and am still involved in a class action lawsuit as a result. But, I don't think more regulation is needed.

There are actually better choices than ever for the passive retirement investor: the lifecycle funds. There are fees that you could avoid if you do it yourself, but for many investors, the fees are worthwhile.

15

posted on

04/27/2015 5:08:59 AM PDT

by

justlurking

(tagline removed, as demanded by Admin Moderator)

To: markomalley

“regulations that would sharply curtail choices of assets and investment strategies in 401(k)s, IRAs, and other savings plans...”

Looks to me like a strategy to herd livestock into pens for slaughter.

To: fatnotlazy

I call the currency monopoly money since it isn’t too far from it in terms of value.

Another lesson in economics is found in the Hitchhiker’s guide to the galaxy. The golgafrinchams (sp?) made leaves their currency and got a full on experience in inflation.

The shoe store event horizon is another funny one.

17

posted on

04/27/2015 5:26:05 AM PDT

by

wally_bert

(There are no winners in a game of losers. I'm Tommy Joyce, welcome to the Oriental Lounge.)

To: silverleaf

Put all my savings into forever stamps.

18

posted on

04/27/2015 5:29:26 AM PDT

by

Bucky14

(And I would have gotten away with it too, if not for you meddling kids!)

To: wally_bert

Luckily, they smartened up and burned down all the trees.

19

posted on

04/27/2015 5:31:02 AM PDT

by

Bucky14

(And I would have gotten away with it too, if not for you meddling kids!)

To: Bucky14

I’m afraid the fire that might be started for us will pale in comparison assuming it comes.

Douglas Adams wrote some great stuff.

20

posted on

04/27/2015 5:34:32 AM PDT

by

wally_bert

(There are no winners in a game of losers. I'm Tommy Joyce, welcome to the Oriental Lounge.)

Navigation: use the links below to view more comments.

first 1-20, 21-37 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson