Skip to comments.

Learning to Love Market Chaos --Investment & Finance Thread Jan. 18

Weekly investment & finance thread ^

| Jan. 18, 2015

| Freeper Investors

Posted on 01/18/2015 10:51:35 AM PST by expat_panama

|

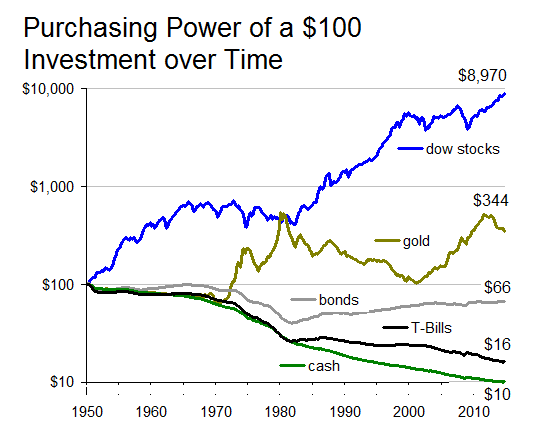

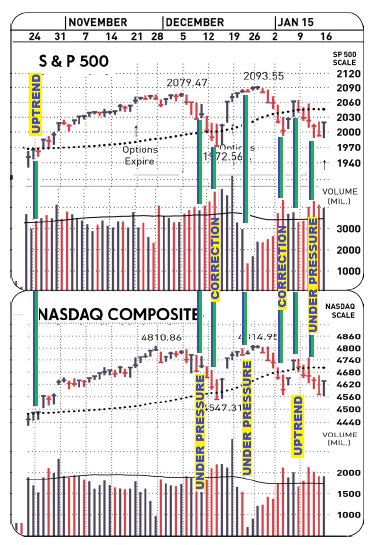

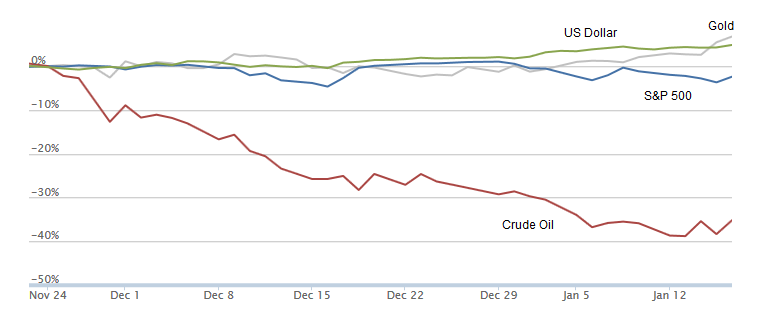

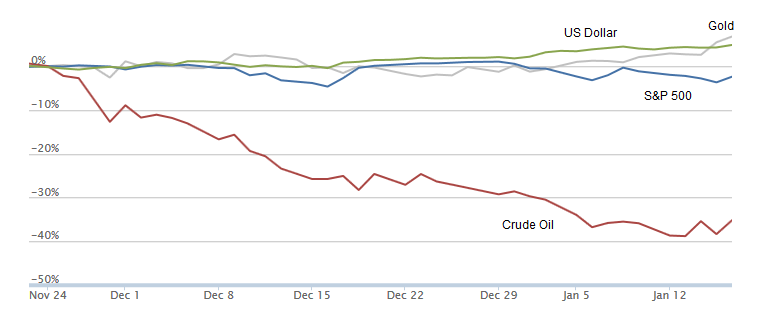

The main reason we try to predict markets is so afterward we can gloat saying we knew it all along. Easy-peasy -- all we do is predict doom'n'gloom and eventually asset prices will sag. Sure, most of the time prices go up, things grow and wealth is created, but the only time folks cry WHY!!?? is during the rough times. Then again, the other reason we figure out expected market trends is so we can make money. That's not that hard either because over time most investments do better than say, cramming bux in a mattress (first graph left). Then we get to the fact that not all types of investments are created equal, and various types of investments' eventual purchasing powers behave differently. My favorite's stocks, though there have been time periods when some of us have done even better w/ precious metals. Note that real estate, collectables, etc., are not being mentioned here because of the constraints of I don't want to. Long term over-the-decades is all well and good, but hey we also would like to see some good happening say, day by day or at least month by month. There's the rub; the past couple months have been crazy (graph right) what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls. what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls. Please. Years of research enabled them to correctly call the nifty run-up we all enjoyed last November (second graph left). That was then and for the past month all those formally dependable signals have suddenly gone into mid-life crisis. Rule Number One though is to accept things as they are, and if we got chaos then we got chaos. Everyone's got their own favorite way of muddling through times like these; my personal favorite calls back to the old oriental counsel going something like if you're going to be savagely attacked and beaten and there's nothing you can do about it you may as well just relax and enjoy it. iow, there's a lot to be said for the "don't just do something, stand there" approach --AKA wait and see and be good w/ it.

|

|

Top 10 reasons that us FR investors want to participate in the 2015 Q1 FReepathon:

10. Gold, silver, stock indexes, and bond values are all cr@pping out these days anyway...

9. The FReerepublic is a proven and solid force for (among other things) sound national fiscal policy; we need that force stronger now more than ever.

8 We benefit from these threads personally. Equity as a legal doctrine thus requires our compensatory donations.

7. Economic realism: there's no free lunch.

6. Market realism: you get what you pay for.

5. Donations are necessary for continued maintenance/loss reduction of desired FR services.

4. Donations are a guaranteed adjunct to an individual investor's game plan. These threads will either pay for themselves through info leading to profits or reduced setbacks (in which case a monthly donation is reasonable overhead) or if by chance what you pick up here is dumb then having donated enables you to request a cheerful refund. [Note: "request" ≠ "receive"]

3. Hey, this place is fun!

2. This thread's been going on a year now. Those of us that found this thread useful for money making will be entitled to imagine saying that the donations were earnings expenses when they itemize next April.

--and here's my favorite: 1. On the internet, when you're getting something you're not paying for, then you're not a customer. You're a product.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--  Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

|

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-71 next last

To: palmer

they quote Frum as a "conservative".There are many on the extreme left who call him that for various reasons, but imho that label just doesn't fit w/ someone who was an editor for Newsweek and a CNN contributor while supporting Obamacare.

To: expat_panama

http://www.wsj.com/articles/worlds-largest-traders-use-offshore-supertankers-to-store-oil-1421689744?mod=WSJ_hp_RightTopStories

World’s Largest Traders Use Offshore Supertankers to Store Oil

By Sarah Kent and Georgi Kantchev

Jan. 19, 2015 12:49 p.m. ET

The supertanker TI Oceania was built to ferry vast quantities of oil across oceans but for the next year it is expected to remain firmly anchored off the coast of Singapore, storing millions of barrels of oil for giant trading house Vitol SA.

According to shipbrokers and analysts, the 3-million-barrel megaship—one of the largest in the world—is just one example of a growing trend that sees traders seeking ways to turn a profit in the slumping global oil market. The strategy is simple: buy and store oil at cheap prices now and sell futures contracts to lock in the higher oil prices expected later.

According to data gathered from ship brokers and analysts, major traders including Vitol SA, Gunvor SA, Trafigura Beheer BV and Koch Supply & Trading Co. Ltd have chartered supertankers capable of storing a combined total of more than 30 million barrels of oil—many of them in the past few weeks. Vitol, Gunvor and Trafigura declined to comment. Koch didn’t respond to requests for comment.

The opportunity to stockpile oil in such large quantities has come from the dramatic shift in the commodity’s market in recent months. Since June, prices have collapsed, tumbling by more than 50% amid soaring production from the U.S. and unwavering output from the Organization of the Petroleum Exporting Countries, at a time when global economic growth and weak demand is slowing.

The oversupply has given rise to contango—when the current price of a commodity is lower than prices for delivery in the future. That makes it attractive for buyers to purchase oil now at the cheaper rates, store it and strike sales agreements at a higher price in the future, locking in profits.

22

posted on

01/19/2015 10:48:16 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

How does that graph look with a linear y axis?

23

posted on

01/19/2015 11:30:16 AM PST

by

seowulf

(Cogito cogito, ergo cogito sum. Cogito.---Ambrose Bierce)

To: expat_panama

About like any other exponential growth pattern. It’d be like plotting the U.S. population, or the amount of written knowledge. Anything that doubles every fixed unit of time will always look like an explosion on a linear plot.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good morning! Hope you all had a great 3-day weekend --the futures markets are pointing to a great beginning for our short-week with Metals +0.42 and Stock Indexes +0.13%. Only major report is NAHB Housing Market Index at a half hour past opening bell. Sooo much has been happening related threads:

To: expat_panama

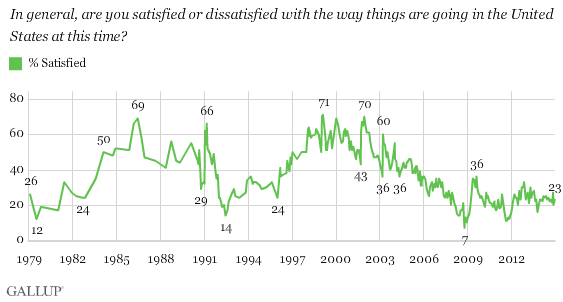

Uh oh... FReepers are going to claim this is made up as well because, well, the economy sucks and we are all going to die.

To: Wyatt's Torch

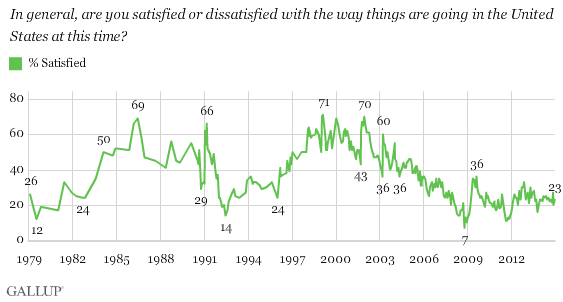

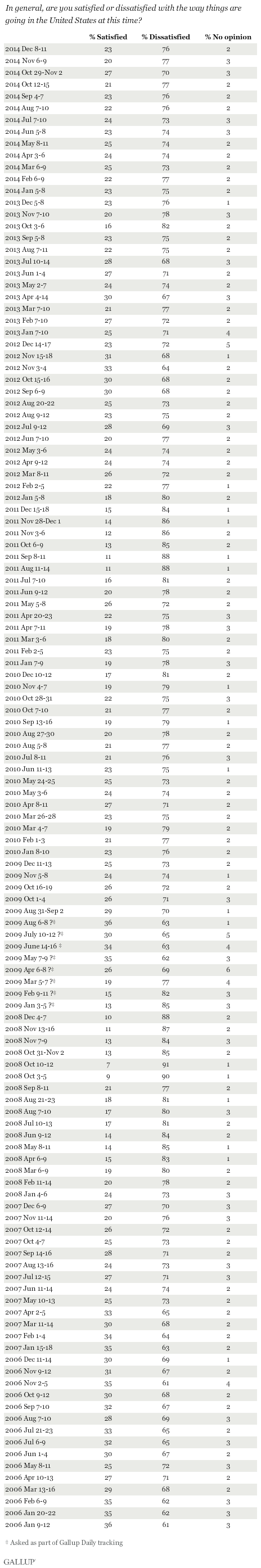

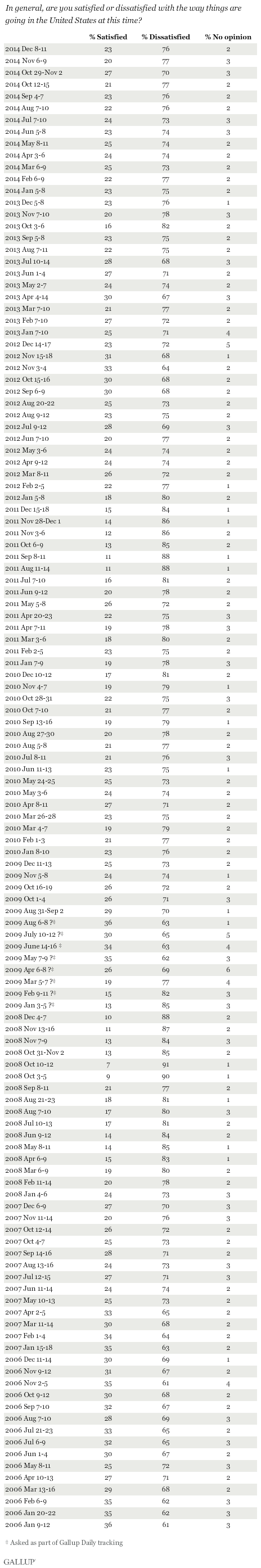

...FReepers are going to claim this is made up...Huh. I was trying to find out where that came from but all I could find was this from gallup.com:

Rather than getting into a fuss about who's not telling the 'truth', we can at least agree that there are discrepancies between those gathering data.

To: expat_panama

To: abb

29

posted on

01/20/2015 5:55:40 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wyatt's Torch

To: Wyatt's Torch

Tx! A big part of the difference was I mistakenly posted polling on politics, here's the

gallup econ sentiment:

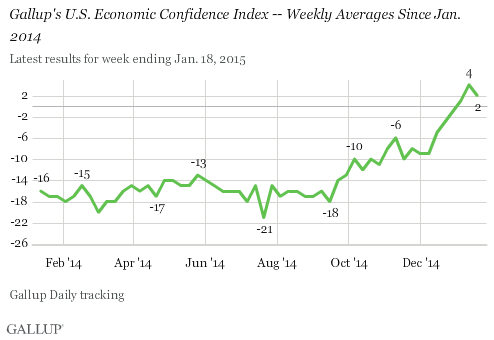

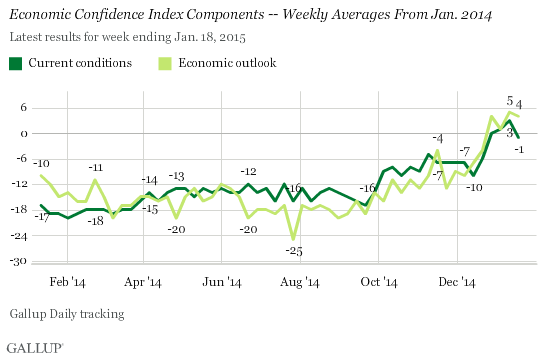

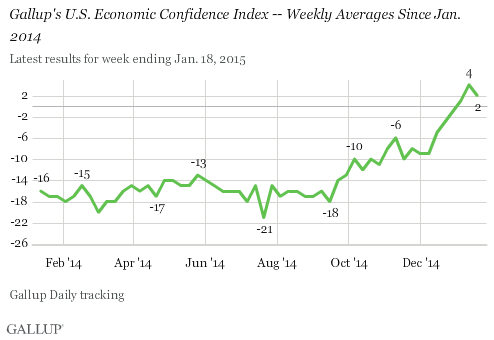

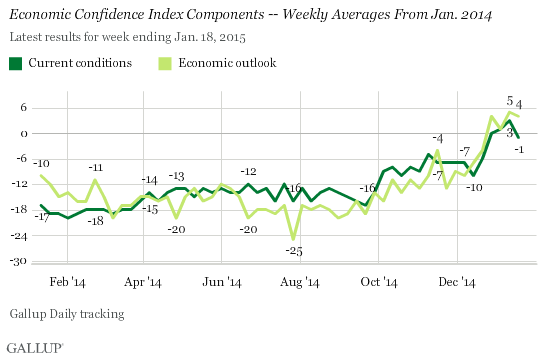

Americans' confidence in the economy only turned positive recently, when it reached +2 at the end of 2014. Since then, it has reached as high as +4. Although the recent positive figures are good news after seven years of sustained economic negativity, they are mere points away from reverting back below zero.

The fragility of Americans' overall positive economic outlook is underscored by the volatility in Gallup's three-day rolling averages throughout the past week. Although the weekly average ended in positive territory, the index fell back into negative territory during the middle of the week -- perhaps related to news reports of disappointing retail sales in December -- before recovering later in the week.

Gallup's Economic Confidence Index is based on Americans' assessments of current U.S. economic conditions and their perceptions of whether the economy is getting better or worse. It has a theoretical minimum of -100, if all Americans thought the economy was poor and getting worse, and a theoretical maximum of +100, if all Americans thought the economy was excellent or good and getting better.

For the week ending Jan. 18, 26% of Americans said the economy was "excellent" or "good," while 27% said it was "poor," resulting in a current conditions index score of -1 -- a four-point dip from the previous week. Meanwhile, 50% of Americans said the economy was "getting better" while 46% said it was "getting worse," resulting in an economic outlook score of +4. This is down one point from the week prior. Americans' assessments of current economic conditions changed more last week than their views of the economy's future course.

Bottom LineFrom a larger perspective, the three weekly Economic Confidence Index scores in 2015 so far have been good when compared with previous years of seriously low confidence Americans had in their national economy. However, three-day rolling averages are more revealing of how close the index is to dropping below zero again.

Despite promising news for Americans' overall outlook -- improved assessments of Americans' personal finances, new highs in standard of living -- the index is still vulnerable to seeing its recent progress wither if the stock market declines, or if economic forecasts do not consistently paint a picture of an improving economy.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted Jan. 12-18, 2014, on the Gallup U.S. Daily survey, with a random sample of 3,545 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±2 percentage points at the 95% confidence level...

The WSJ/NBS poll "was based on nationwide telephone interviews of 800 adults, including 280 respondents who use only a cellphone."

To: expat_panama

To: Rusty0604

...now, Wall Street in New York has seen nearly 50,000 jobs slashed...Wow, considering the fact that Wall Street is about couple thousand feet long this means for every foot of street there are a couple dozen unemployed rich guys. Or not. Sophie --the sweet young thing that wrote the article-- was long on poetic prose but short on reality. She came up w/ her story by reading this article from last week's NY Post where they said "reductions for 2014 were about 20,000 at Brian Moynihan’s Bank of America; 10,000 at Citigroup led by Michael Corbat; and 10,000 at Jaime Dimon’s JP Morgan. Morgan Stanley reports on Tuesday." That's different, it's not Wall street now it's the entire financial services industry for all of 2014.

Just the same, the the NY Post is giving us the impression that the financial community reduced its workforce in 2014. No, they got that wrong too. BLS records for that sector show a 121,000 employee net gain for 2014 --that's a 2% increase. We got 3 banks laying off but the rest of the industry more than made up for the loss.

To: expat_panama

Good news, I was worried that De Blasio would have less money to redistribute, LOL.

To: Rusty0604

lol! tx, I needed the exercise. Also, I remembered hearing the chatter on the story last week but hadn’t had time or interest to check it out. I’m thinking now that the idea spread because the right wanted more news about widespread layoffs and the left wanted the rich guys out of work. That meant a lot of folks wanted to believe the headline true or not.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Good morning all, while you were sleeping gold punched back over the $1,300 level not seen since last August and silver's tagging along w/ new highs of it's own at $18.24! Commentators have already made up reasons for oil and stocks but they haven't noticed metals yet. We can make up causes now and say we knew it all along (me first --metals are all up because of er, China!).

Yesterday's stocks were flat in lower volume yesterday and futures now see 'em off a fraction; oil's now just over $46. fwiw, reports today: MBA Mortgage Index, Housing Starts, and Building Permits

To: expat_panama

http://www.freerepublic.com/focus/news/3248974/posts?page=16

>> The cause of the glut is the same as the cause of the 1973 gas crunch, that is, inelasticity of demand <<

I’m basically with you, but I’d emphasize that the inelasticity of demand is only half of the explanation.

Remember Alfred Marshall’s famous question, which was something like, “Which blade of the scissors does the cutting?”

That is, price is always SIMULTANEOUSLY determined by demand-and-supply. Always, always, always.

Moreover, when there’s a relatively small shift of the supply curve, either up or down, and whether instigated by the Saudi King or by some other actors, the inelasticity of demand dictates a disproportionate swing in the price. Call it an “iron law” of prices.

No mystery. End of story.

16 posted on 1/21/2015, 3:43:28 AM by Hawthorn

37

posted on

01/21/2015 3:02:34 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

I no longer try to figure out anything. I just take my ups and downs as they come. :)

Diversify! Diversify! Diversify!

38

posted on

01/21/2015 4:06:44 AM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Diana in Wisconsin

...no longer try to figure out anything. I just take my ups and downs...Ah but that you're only dealing with reality while the rest of us are strutting and saying we know why everything's happening the way it is. Sure, we know it's goofy, but the fact is there are some of us that get paid big money.

To: abb

good link. The article had a great point about nobody saw this coming.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-71 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls.

what w/ tanking oil and sideways roller-coasters for everything else. I mean, usually when we spend a bit of time going over index charts we get patterns we can work with. Take IBD's market calls.