Posted on 01/13/2015 10:39:27 AM PST by thackney

I've been in the oil patch for close to 30 years. During that time, I have seen oil price go down to about $10 per barrel, and I have seen the price rise to over $100 per barrel. I have seen the price swing for no reason at all. I have heard different bogeymen being blamed for changes in the oil price. Supply and demand are certainly part of the oil price equation, but speculation has been a major price driver for at least the last couple of years, beyond the S&D factors.

Right now, the Saudis are being blamed for, or accused of, intentionally dropping the price of oil to its present position.

Did no one listen to what the Saudi spokesman said? He said that Saudi Arabia is going to let the market set the price, and they will not unilaterally lower their production to stop the apparent free-fall of oil prices. In fact, he went further to say that Saudi Arabia won't cut production as part of a multilateral effort to stabilize oil prices.

I believe they are merely facing a grim reality. In the past, in order to moderate oil price swings, Saudi Arabia - as the world's largest producer - would drop oil production with promises from their OPEC partners to do likewise. The partners, time and again, were caught selling their product through clandestine channels, or even blatantly raising production publicly to increase their income before prices dropped further. The phrase "get while the gettin's good" comes to mind.

I believe that Saudi Arabia is just weary of being the only country/producer to attempt to moderate the swings, and that they are doing exactly what they said: They are letting the market set the price. After all, the Saudi Arabian oil production infrastructure is in place, and they can still make a profit even at half the price that oil is trading for today. The Saudi Arabian national economy may need higher prices, but the oil patch is still in the black, while other producers with higher production costs are going to feel the pinch long before the Saudis do.

One other item of note: US oil production is up about 1 million barrels per day, and the apparent world wide surplus is reported to be 2 million barrels per day. Why is no one suggesting that the US cut production to 2010 levels? Because the US is still a net oil importer is certainly one of the factors; however, if there is a world-wide oil glut, the increased US production must certainly take part of the blame for it.

Do you have a link?

They are drilling off shore now at ever increasing depths. They are trying to eliminate competition now while they still have cheap oil. Eventually though those big Saudi Fields will run dry and then they will just be a bunch of yahoos living in the desert.

No the point was that if the Saudi’s cut production, someone else would pick up the slack and the Saudi’s would get hit both on the lower price and the lower market share.

Stocks grow, for a time at least...

Record Oil Tankers Sailing to China Amid Stockpiling Signs

http://www.bloomberg.com/news/2014-12-12/record-oil-tankers-seen-sailing-to-china-amid-stockpiling-signs.html

Factual error in the article.

US oil production isn’t up one million barrels. It’s up MILLIONS of barrels a day, to the point where we’re now out producing Saudi Arabia, based in what I read.

Yes, the free market works every time it’s tried, and it’s largely thanks to the good ol USA that oil prices are falling. Don’t believe that? Take Americas oil production offline for six months and watch oil prices skyrocket back up.

If you can’t trust brutal dictatorships, socialist thugs, and Muslim tyrants, who can you trust???

True, they also have the benefit of tens or hundreds of billions of dollars of financial reserves that the rest of the Middle East and Russia do not have.

I have a question. Just going by the means of production shouldn’t the natural price of diesel be cheaper than gasoline? Isn’t diesel an easier fraction to get out of your average barrel of oil? Thanks!

Please note I am not factoring in distribution, speculation and other bottlenecks.

Thanks for the link.

The catch is, even if that is accurate for their average cost of production (some of theirs is now offshore). It does not mean they can replace the amount of oil growth the US has had for the past 5~7 years at that price.

Commodities tend to level out at the price to produce the next unit.

I can sell a barrel of oil at $2 a barrel. But if I don’t have enough supply to meet the market demand, I won’t drive down the price with too small amount.

The Manifa project shows Saudi doesn’t have surplus cheap oil either.

Not any more in the US. The EPA Ultra Low Sulfur Diesel requirements added more expensive processing like hydro-treaters to get below 15 ppm sulfur.

It depends upon the time frame you are looking at.

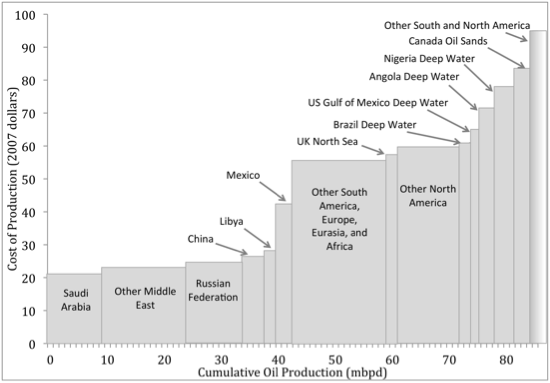

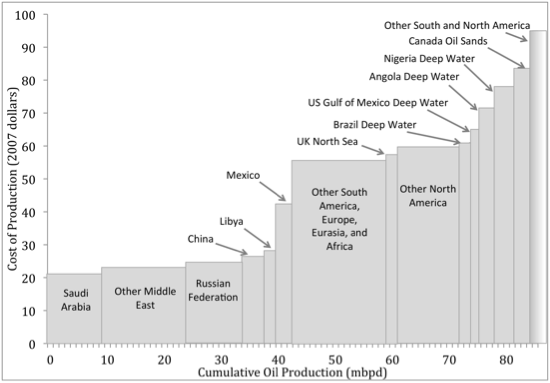

There’s another chart that someone posted that shows the same, but by “Cash Costs” of production. I think that chart, if correct, is more meaningful.

Here’s the link to the Rystad Energy chart: http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases/global-liquids-cost-curve

So now in America diesel is more expensive to produce than gasoline.

How about in Europe? I keep reading about super advanced diesel automobiles by Honda, Volkswagen, Toyota that the European love. These cars are not sold here

- VW Features - TDI Clean Diesel | Volkswagen

www.vw.com/content/vwcom/en/features/clean-diesel.htmlFind out how VW TDI Clean Diesel technology makes every mile a better one.

That is only in total liquids, counting natural gas liquids, ethanol, bio-diesel, etc, as well as crude.

In only crude oil (and condensate), we produce ~9 MMBPD and the Saudis produce ~9.7 MMBPD.

Europe has a slightly higher requirement of 10 ppm, so similar or greater expenses.

I don’t know if they have applied that restriction to Gasoline yet. The US EPA is about to put it into effect, so the gasoline price will rise up like the diesel did years ago.

http://www.epa.gov/otaq/tier3.htm

Here in the US, oil has to keep the oil company profitable.

In Saudi Arabia oil has to keep the state profitable. Government agencies are funded by oil. Government welfare programs are funded by oil. The royal family is funded by oil.

Being a kingdom, the royal family in essence owns the state. The state owns Saudi Aramco. Thus, 80% of all government money comes from oil.

Actual production costs might be low, but government expense requirements are high .

Reports I have read, place Saudi Arabias actual need for oil cost around $86-$88/bbl, to keep the government solvent.

SA produces about 9.7 million bbl per day. That's about 3.54 billion bbl a year. At $40 a bbl below whats needed, that's about $141.62 BILLION a year deficit.

$141 billion might seem small in comparison to our deficits, but Saudi Arabia has a population of 28 million vs the US of 316 million.

Seems like the US Govt should be adding to the strategic reserve at this time. Don’t know if they are or not, haven’t heard.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.