Posted on 12/14/2014 7:43:31 AM PST by expat_panama

So while nobody knows the future we still need to know what to expect from the week's two big headlines, even though our view can easily (and will probably) be muddied w/ other factors. So we deal with an unknown future by checking the historical record for clues on at what the news means to our future investment returns.

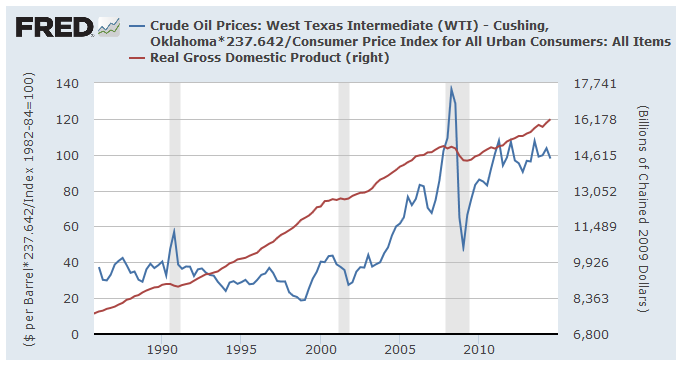

What oil bargains do: namely, what's it doing to the economy and to investments; here's what tanking oil's done in the past (ya gotta LOVE the fed's data site) and how real oil prices (2014$ per barrel) track real GDP--

[click to enlarge]

--and what we got is that it's the oil price surge that precedes a recession while crashing oil is what comes to the rescue afterword. True, there's more to econ growth than oil (wars and stuff) and sometimes econ growth can launch oil prices right back into orbit. Just the same, cyclical economic patterns come and go. We deal with it.

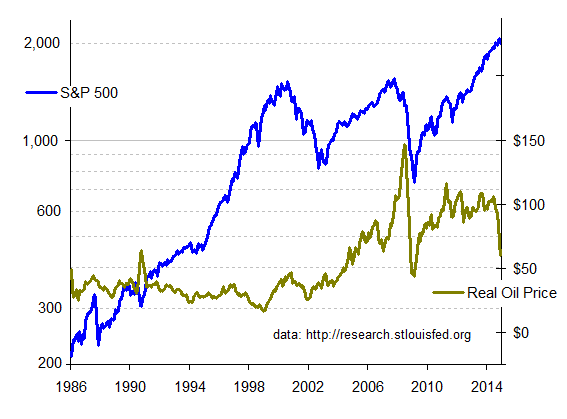

I n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

Someone please tell me if they're seeing something that I'm missing, but I believe I'm getting the same thing for stocks as w/ GDP. Namely, that a price surge is what tanks stocks and an oil price plunge (or prolonged era of low prices) does quite well thank you.

My first glance made me sing the old "...but this time is different..." tune because of how "this time" we've just been having several years of rising stock prices. My problem is that I'd been looking at this graph --with the S&P on a linear plot. In stocks we care about our gains --what percent we're doing now. A log plot shows percent increases better, so using the log plot at the right we can ask what a few years of $40 oil will do, and look at the long term oil price decline from Reagan thru Clinton. It made great gains even better.

Until the '99 oil rally that is, and then we had a dot.com bust. Still, I personally wouldn't mind another five years of super gains, even w/ another dot.com at the end.

More tax'n'spending: --and the other big headline being the fact that the House caved and gave the budget busters everything they wanted and the big question is what has this done in the past.

Answer: nothing.

OK, so why nothing? The answer is that (w/ few rare exceptions) the extreme left has controlled taxes & spending pretty much continuously for decades and that there's no way of seeing how a few years of budget restraint could have affected GDP and stocks. Sure, we know that big tax cuts (for those that remember that far back) did wonders for our personal lives and our ability to save and invest. We also know how increased investment w/ lower costs affect business activity. It might happen in the future and we can simply agree it would be great. It's not happening now, it hasn't happened before, and we're still here. We need to remember the enormous economic power of the American people and how we can build and prosper even during loooong stretches of abysmal government leadership.

In the meantime right now stocks are crashing ("market under pressure") and metals are continuing a month of solid gains. That can change.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

h/t to Lurkina.n.Learnin for asking us this question (here).

Jacob: What’s your number?

Bretton Woods: Excuse me?

Jacob: The amount of money you would need to be able to walk away from it all and just live happily-ever-after. See, I find that everyone has a number and it’s usually an exact number, so what is yours?

Bretton: … … More.

Yeah, that's my number too.

Again!

OK, so even though we're in a 'correction', this is definitely where all the signs are saying I need to take a few measured steps back in...

Extra-fat dead cat bounce?

Scratch that. Full-fledged rally.

Scratch that. Buying panic. Seen only rarely.

LOL, That’s as clear as mud.

http://www.investinganswers.com/financial-dictionary/stock-market/panic-buying-613

Panic buying refers to the purchase of a stock immediately after a sudden, substantial price increase.

How it works/Example:

Investors watching the market may jump to buy a stock immediately after a major move in the stock’s price, hoping to take advantage of the surge in the price.

Why it Matters:

Investors may buy stock for a number of reasons. Fear of being left out of the next big thing, however, is not the best reason. Panic buying usually is the result of the herd instinct among some investors. While there may be some gains on the residual increase in the price spike, it is often too little, too late.

Or, what we saw today could be a classic short squeeze.

http://www.investopedia.com/terms/s/shortsqueeze.asp

DEFINITION of ‘Short Squeeze’

A situation in which a heavily shorted stock or commodity moves sharply higher, forcing more short sellers to close out their short positions and adding to the upward pressure on the stock. A short squeeze implies that short sellers are being squeezed out of their short positions, usually at a loss. A short squeeze is generally triggered by a positive development that suggests the stock may be embarking on a turnaround. Although the turnaround in the stock’s fortunes may only prove to be temporary, few short sellers can afford to risk runaway losses on their short positions and may prefer to close them out even if it means taking a substantial loss.

Was thinking that was the case yesterday but we're punching up into increasing highs: (from here) ...stock market opened strong and closed stronger... ...Stocks finished at their session highs. Volume was lower... ...major indexes closed up more than 2%

Stock futures flat right now, oil stronger.

Friday will be a quadruple witching day, which could lead to volatility and heavy trading.

From your link @ .investinganswers.com

“Witching hours are usually accompanied by considerable volatility in trading volume and stock and derivative prices. As a result, investors can anticipate and plan for the potential effects of these relatively turbulent trading days.

Although index futures and options generally share simultaneous expirations on the third Friday of every month, quadruple witching days only occur on the third Friday of every March, June, September, and December. The last hour of these trading days, from 3 to 4 p.m. EST, is referred to as the quadruple witching hour.

Quadruple witching is similar to triple witching, which only includes the expirations of index futures, index options, and stock options.”

Differing opinions on QE and oil prices

Oil drop sends major central banks in different directions

http://www.freerepublic.com/focus/f-news/3238542/posts

|

Markets | Yesterday | Futures (2 hrs. before the bell) | ||

| metals | Hanging on w/ gold $1,198.75 & silver $16.00 | +0.25% | |||

| stocks | ...(from here) ...stock market opened strong and closed stronger... ...Stocks finished at their session highs. Volume was lower... ...major indexes closed up more than 2% | +0.26% |

--on that 'volume was lower' bit, remember that what they mean is 'lower than yesterday' which happened to be astronomical. Bottom line is volume was above average. Morning news:

--and threads:

WTI $54.95

S&P 2066.6 +03%

DJIA 17780 +0.3%

Chevron, Statoil Announce First Oil Strike In New Gulf Of Mexico Field

http://www.freerepublic.com/focus/f-news/3239020/posts

“The two fields are among the largest in the Gulf and are expected to yield 94,000 barrels of oil equivalent and 21 million cubic feet of gas per day for an estimated 30 years, Chevron said in a statement on Dec 2. “

Is that what the collapse of the Ruble is? High inflation?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.