Posted on 12/14/2014 7:43:31 AM PST by expat_panama

So while nobody knows the future we still need to know what to expect from the week's two big headlines, even though our view can easily (and will probably) be muddied w/ other factors. So we deal with an unknown future by checking the historical record for clues on at what the news means to our future investment returns.

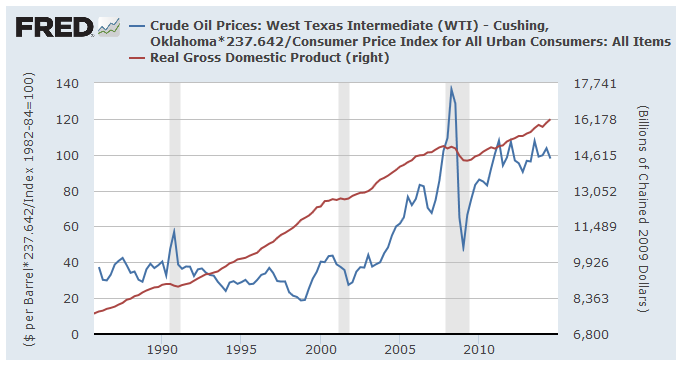

What oil bargains do: namely, what's it doing to the economy and to investments; here's what tanking oil's done in the past (ya gotta LOVE the fed's data site) and how real oil prices (2014$ per barrel) track real GDP--

[click to enlarge]

--and what we got is that it's the oil price surge that precedes a recession while crashing oil is what comes to the rescue afterword. True, there's more to econ growth than oil (wars and stuff) and sometimes econ growth can launch oil prices right back into orbit. Just the same, cyclical economic patterns come and go. We deal with it.

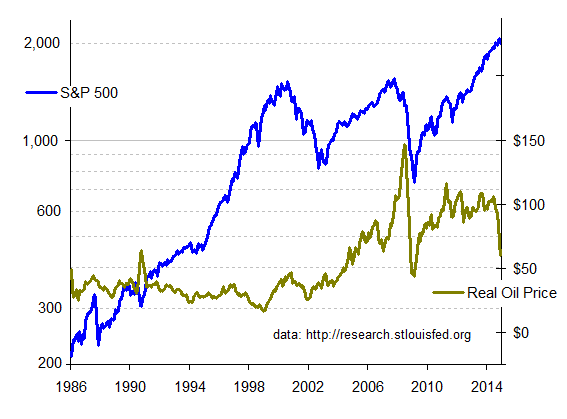

I n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

Someone please tell me if they're seeing something that I'm missing, but I believe I'm getting the same thing for stocks as w/ GDP. Namely, that a price surge is what tanks stocks and an oil price plunge (or prolonged era of low prices) does quite well thank you.

My first glance made me sing the old "...but this time is different..." tune because of how "this time" we've just been having several years of rising stock prices. My problem is that I'd been looking at this graph --with the S&P on a linear plot. In stocks we care about our gains --what percent we're doing now. A log plot shows percent increases better, so using the log plot at the right we can ask what a few years of $40 oil will do, and look at the long term oil price decline from Reagan thru Clinton. It made great gains even better.

Until the '99 oil rally that is, and then we had a dot.com bust. Still, I personally wouldn't mind another five years of super gains, even w/ another dot.com at the end.

More tax'n'spending: --and the other big headline being the fact that the House caved and gave the budget busters everything they wanted and the big question is what has this done in the past.

Answer: nothing.

OK, so why nothing? The answer is that (w/ few rare exceptions) the extreme left has controlled taxes & spending pretty much continuously for decades and that there's no way of seeing how a few years of budget restraint could have affected GDP and stocks. Sure, we know that big tax cuts (for those that remember that far back) did wonders for our personal lives and our ability to save and invest. We also know how increased investment w/ lower costs affect business activity. It might happen in the future and we can simply agree it would be great. It's not happening now, it hasn't happened before, and we're still here. We need to remember the enormous economic power of the American people and how we can build and prosper even during loooong stretches of abysmal government leadership.

In the meantime right now stocks are crashing ("market under pressure") and metals are continuing a month of solid gains. That can change.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

h/t to Lurkina.n.Learnin for asking us this question (here).

Say what you want, but if -0.3% ain’t deflation, it’ll sure do fine until a real deflation comes along...

Ruble Strengthens After Central Bank Acts

Russian Central Bank Moves to Shore Up Banking System

By Andrey Ostroukh, Alexander Kolyandr and Chiara Albanese

Updated Dec. 17, 2014 12:36 p.m. ET

MOSCOW—Russia’s battered ruble recovered some of its recent losses against the dollar on Wednesday as the market welcomed measures by the Bank of Russia to shore up the country’s banks, and the Finance Ministry said it would start selling its excess foreign currency holdings.

In a volatile day of trading, the currency gained more than 10% on the Moscow Exchange after the central bank announced a raft of measures to ease banking regulations and aimed at convincing Russians to keep their money in the national currency. The ruble was trading around 60 to the dollar by late Wednesday evening. The dollar-denominated RTS Index also spiked 17.6%, its largest gain in five years.

The strengthening of the ruble was likely helped by a recovery in oil prices, with Brent crude, the global benchmark edging back above the psychologically significant $60-a-barrel level to reach $62.44 a barrel in late afternoon European trading on Wednesday.

snip

http://www.wsj.com/articles/oil-prices-skid-on-russia-output-plan-1418784516

U.S. Oil Prices Rise Off Multiyear Lows

Rebound Attributed to Traders Betting on Lower Prices to Close Out Positions

By Nicole Friedman

Updated Dec. 17, 2014 12:24 p.m. ET

NEW YORK—Oil prices rallied Wednesday as traders closed out positions following a dramatic plunge in prices in recent months.

Light, sweet crude for January delivery recently rose $2.12, or 3.8%, to $58.05 a barrel on the New York Mercantile Exchange, after trading as low as $54.21 a barrel in early trading.

Brent, the global benchmark, recently rose $2.43, or 4.1%, to $62.44 a barrel on ICE Futures Europe.

Market watchers attributed the rebound to traders who had bet on lower prices closing out positions. Oil prices have plunged nearly 50% since June to the lowest level in more than five years.

snip

http://www.wsj.com/articles/fed-sticks-to-patient-tack-on-rates-1418843005?

Fed Sticks to Patient Tack on Rates

Central Bank Holds to Dovish Approach on Monetary Policy

ByJon Hilsenrath

Dec. 17, 2014 2:03 p.m. ET

The Federal Reserve said it would be patient about raising short-term interest rates in the coming year as it weighs a mix of conflicting signals about the U.S. economy, and retained an assurance that a “considerable time” would pass before rates start going up.

With the new interest rate guidance the U.S. central bank is effectively sticking to a plan to start raising short-term interest rates in 2015, but it sought to soften the blow to the public by keeping a long-dabated reference to the considerable time language.

snip

Dow +288; Nasdaq +96; S&P +40.

Now what?

“Considerable Time” algos blew up.

“Patient” algos coming tomorrow

They should have Snoop Dog deliver it. That would blow up their algo’s, fer shizzle.

Not sure how the algos would respond to “Con$idera3le Tym3”

See what tomorrow brings.

Let the good times roll!

I think I’m gonna stick a Gordon Gekko movie in the DVD player tonight, lol!

I missed the IHS call this week so thanks for posting. Considering consumer spending is 70% of GDP this makes sense. Way more than offsets the decline from energy sector. What this doesn’t contemplate is if what is driving the oil price decline is declining economic activity and is a leading indicator to a recession. Hopefully that’s not the case.

Europe and Japan have done everything wrong on shrinking working populations and growing welfare populations. I think globally, we’re the only ones left standing. It’s almost a post WW2 situation, only we don’t have Ike. Instead we’ve got Alger Hiss running the country.

I think we’re going to putz along for a couple more years until the One is done.

|

Markets | Yesterday | Futures (3 hrs. before) | ||

| metals | Rebound w/ gold $1,201.55 & silver $16.13 | 1.20% | |||

| stocks | ...rebounded furiously Wednesday. Investors treated news from the Federal Reserve's final meeting in 2014 on interest rates like it was a Christmas gift from a cherished relative. The Nasdaq composite rallied 2.1%, ending a three-day slide and recouping well more than half of those losses. The S&P 500 wasn't far behind, up 2%. Volume grew on both exchanges... (more at IBD) | 1.25% |

--plus:

Initial Claims

Continuing Claims

Philadelphia Fed

Leading Indicators

Natural Gas Inventories

--and:

Whenever Barron’s says sell, buy. Just about every time.

That’s funny because I’d been coming to the conclusion that a great buy time was whenever IBD posts the ‘correction-red-light’.

Maybe the truth is that we’ve all got to do our own thinking...

--while we all hide under the bed! Truly a weird situation where we got so many reasons to prove the economy's in great shape and at the same time we got an equally long list of bad econ stats. Definitely not for the feint of heart....

Yeah right now we are the “tallest midget” economy... Ringing endorsement...

S&P is RIPPING - +25 2038 +1.3%

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.