Posted on 12/14/2014 7:43:31 AM PST by expat_panama

So while nobody knows the future we still need to know what to expect from the week's two big headlines, even though our view can easily (and will probably) be muddied w/ other factors. So we deal with an unknown future by checking the historical record for clues on at what the news means to our future investment returns.

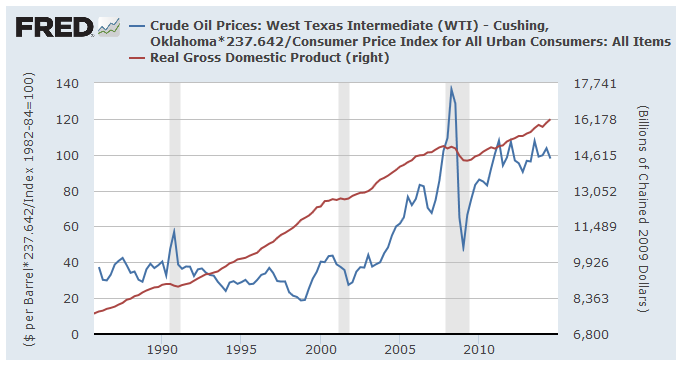

What oil bargains do: namely, what's it doing to the economy and to investments; here's what tanking oil's done in the past (ya gotta LOVE the fed's data site) and how real oil prices (2014$ per barrel) track real GDP--

[click to enlarge]

--and what we got is that it's the oil price surge that precedes a recession while crashing oil is what comes to the rescue afterword. True, there's more to econ growth than oil (wars and stuff) and sometimes econ growth can launch oil prices right back into orbit. Just the same, cyclical economic patterns come and go. We deal with it.

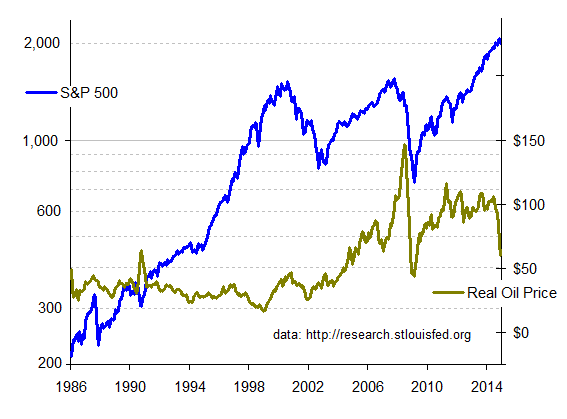

I n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

n the mean time right now we got $60 oil and we're wondering about what that means for our 2015 investment returns. That track record's next on the right:

Someone please tell me if they're seeing something that I'm missing, but I believe I'm getting the same thing for stocks as w/ GDP. Namely, that a price surge is what tanks stocks and an oil price plunge (or prolonged era of low prices) does quite well thank you.

My first glance made me sing the old "...but this time is different..." tune because of how "this time" we've just been having several years of rising stock prices. My problem is that I'd been looking at this graph --with the S&P on a linear plot. In stocks we care about our gains --what percent we're doing now. A log plot shows percent increases better, so using the log plot at the right we can ask what a few years of $40 oil will do, and look at the long term oil price decline from Reagan thru Clinton. It made great gains even better.

Until the '99 oil rally that is, and then we had a dot.com bust. Still, I personally wouldn't mind another five years of super gains, even w/ another dot.com at the end.

More tax'n'spending: --and the other big headline being the fact that the House caved and gave the budget busters everything they wanted and the big question is what has this done in the past.

Answer: nothing.

OK, so why nothing? The answer is that (w/ few rare exceptions) the extreme left has controlled taxes & spending pretty much continuously for decades and that there's no way of seeing how a few years of budget restraint could have affected GDP and stocks. Sure, we know that big tax cuts (for those that remember that far back) did wonders for our personal lives and our ability to save and invest. We also know how increased investment w/ lower costs affect business activity. It might happen in the future and we can simply agree it would be great. It's not happening now, it hasn't happened before, and we're still here. We need to remember the enormous economic power of the American people and how we can build and prosper even during loooong stretches of abysmal government leadership.

In the meantime right now stocks are crashing ("market under pressure") and metals are continuing a month of solid gains. That can change.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

h/t to Lurkina.n.Learnin for asking us this question (here).

Enjoyed the video. happy trading.

Bottom? Or dead cat bounce?

After analyzing my portfolio, I discovered I had more than 20% of my investment holdings in major oil companies. So I can’t really buy BP at 35, tempting as it is.

I did put 100 shares of BP in a small Roth IRA.

You may have called the bottom. Yesterday, it got to 34.88, and at this moment is at 36.06.

In the stock market, there are no bottoms or tops....the road goes on forever. You don’t want to try to predict the short-term future. If you see value, buy it.

Suppose I had no oil stocks and bought BP at $35. If it goes down to 30 after I buy it, would I be upset or panic? That is the test of whether you are qualified to be a value investor or not.

I’ve been buying BP from $39 to $35. I’m prepared to buy more. I had been accumulating cash for a year or two just for this occasion. Not necessarily energy, but whichever opportunity arose.

Oil has always been boom/bust, and I see nothing to change that in my lifetime. The busts are huge buying opportunities.

Looks like the cat went splat.

LOL, that question was answered!

Is this the inflation we've been looking for?

Leading to the Fed tapping the brakes?

What I suspect is the FED is working hard to keep the dollar strong and hopefully spark some action out of Europe and Japan. What Europe and Japan need to do is deregulate, but I don’t see that happening any time soon.

The entire goal is to reinflate RE so as not to cause a slew of municipal bankruptcies, exactly the opposite of what FReepers want. If we never pay the piper then why change?

Gonna be hard to reinflate with $50-$75 oil. It is a component of so many manufactured items, transportation, etc.

There is an enormous transfer of wealth to the Middle East that has taken place over the past 10-12 years that won’t be happening now. We can keep that money at home and reinvest it.

I just don’t see any inflation really happening. Just government which is actually counterproductive as it represents higher bond payments and taxes in the future.

An exiting new day campers! Not only do we see both the S&P and the NASDAQ crash their 50-day moving averages in soaring volume, but gold'n'silver have fallen to $1,198.10 and $15.94 respectively. OK, this morning's futures see a bit of a respite with metals back up +0.18 and stock indexes up +0.47% but we've been hearing lots of wonderful promises in the morning but we have to wonder if she'll still respect us at afterwards. Adding to the soap-opera drama today we're getting these announcements:

MBA Mortgage Index

CPI

Core CPI

Current Account Balance

Crude Inventories

FOMC Rate Decision

Related threads:

Gekko: “She’s at night beside your bed watching you, with one eye open. Money is a bitch that never sleeps. She is jealous, and if you do not pay attention, you’ll wake up and she’s gone”.

International russian roulette? Thanks for the ping; posts. I’ll be watching closely.

Or even sometimes when you do pay attention!

That subway-soliloquy is exactly what I was thinking about. Something else that occored to me just now is about this difference between wealth and money. It's the way that individuals create wealth and the community creates money when that wealth is mortgaged. The money is vapor --it disappears when the loan's repaid, but the wealth remains.

Maybe too early for economic philosophy, I need another coffee....

Personally I'm still betting on a dip to $20/leveling off just under $40 --but the point is we've had real oil prices there before w/ lots of inflation. Hard to predict, but I'm wondering what kind of pyrotechnics we'll be seeing today w/ the Fed rate announcement right after the CPI.

Seatbelts everyone!

FDX missed top and bottom line. Reiterated guidance though.

CPI -0.3% (exp -0.1%)

Core (ex food and energy +0.1% met expectations)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.