Posted on 11/30/2014 1:24:35 PM PST by expat_panama

Once again we can say we're looking at a great time for investing! OK, so it means we wince over last Friday's metals prices, but like who does metals anyway dude, like it's soooo 2013 even. That and the general feeling we get reading stuff like Gold mining industry mostly ‘under water’ – Gold Fields CEO (h/t Chgogal).

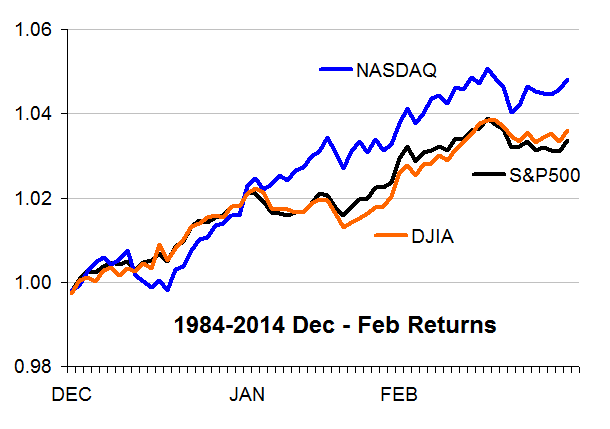

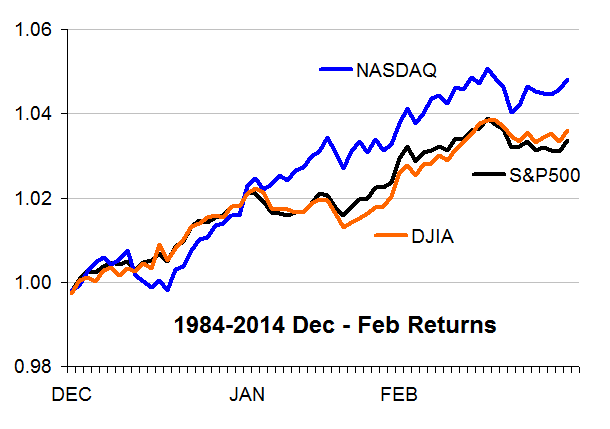

Hey, I'm talking stock market year end "window dressing"† January effect --check out the averages over the past 30 years for the Dow, S&P500, and the NASDAQ, they typically go up 3.4%, 3.6% and 4.8% respectively. On top of that these are for just 3 months and it translates to annualized returns of 15%, 14% and 21%!

Only thing we could hope for is that we're looking at an average year --problem is that the reason this time it's different is becuase it's always different. The plots on the right (click to enlarge) show how the stellar year-end trends look compared to what the 30-year extremes have been. Sure, the past 3 decades includes the 2009 Inaugaration Grand Market Crash that was in all the papers, but still we all know that we can't just buy and expect any guarantees here.

That said yours truly is cautiously moving back in w/ one hand while the other hand's holding on to the ejection seat lever. Stay calm. Remember that the new congress takes office in the latter part of Jan. and they won't be able to have any actual impact until weeks later. At the same time we know the President has already gotten middleeast-defeat, amnesty, Ferguson, and obabacare-defiance completely out of his system so that there's nothing down the pike that he might toss out that can possibly be any worse....

† "window dressing" is when institutional traders clean up their portfolios at year's end w/ pop darlings bought w/ cash from dumping the bow-wows --the idea being they want the annual report to look better.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

There're probably "good" ETF's and "bad" ones that are easier & harder to manipulate, but while fudging an individual stock is hard enough, the fear of someone fudging an entire stock sector block kind of makes me want to reach for the tin-foil. I use index funds (SPY - S&P500, QQQ - NASDAQ, and IWM for the Russell 2K) and am always checking.

Like you said, sell rules are key, though many of us have been disappointed w/ automatic stop-loss limit orders in favor of simply watching for sell-times.

Sorry for your loss; getting busy is a good idea.

Sideways markets so I’m watching a live feed of the NASA @ http://www.space.com/17933-nasa-television-webcasts-live-space-tv.html ‘cause my daughter’s there in person watching & texting...

There are folks that do just fine thankyou w/ commodities but sadly I ain’t one of ‘em. Oil stocks however sometimes come up on my radar but atm none are in my top-15...

I’m waiting and watching that also.

;)

“There’re probably “good” ETF’s and “bad” ones that are easier & harder to manipulate, but while fudging an individual stock is hard enough, the fear of someone fudging an entire stock sector block kind of makes me want to reach for the tin-foil. I use index funds (SPY - S&P500, QQQ - NASDAQ, and IWM for the Russell 2K) and am always checking.”

The bigger and long in the tooth ETF’s like the ones you mentioned are hard to manipulate.

The smaller ones could be manipulated by a big hedge fund or $ore$$ or Buffett.

“Like you said, sell rules are key, though many of us have been disappointed w/ automatic stop-loss limit orders in favor of simply watching for sell-times.”

I’m a fairly lucky guy until it comes to picking sell-times or what checkout line to get into. I never pick the right time to sell or the best checkout line. When I used to buy ETF as investments instead of safer investments with regular dividends, I would set up an auto sell order when the ETF went over a certain % gain from 10% to 15%. That worked well during the Clintoon years until the bottom fell out. Then, our stop loss sale orders saved our butts when the dot.com fantasy/wet dream world collapsed. That event drove me to the lower risk and dividend paying ETF’s.

W/ all the pundit buzz about which stock to buy and which way the market’s going, everyone seems to forget the most important part: good sell rules. I’m much more pleased by how great my sales go than how my buys are went.

LOL - ONLY Grampa Dave... you’re choosing favorites... Anyhow, thanks for the ping expat.

Lower fuel prices are the equivalent of a tax cut. Seems to be upsetting some of the big government types. I have been hearing more talk of this recently

Raising gas tax overdue: Barney Frank

http://www.freerepublic.com/focus/f-news/3233852/posts

The gas tax has been fixed at 18 cents for two decades. Now would be a great time to raise it

http://www.freerepublic.com/focus/f-news/3233660/posts

Statists are troubled when mobility of the masses is enhanced.

Cheaper gas lets us proles spew more evil carbon...

Cheaper gas also puts more money in your pocket...so you can pay for Obamacare.

Happy Friday gang! Futures traders see stock indexes up +0.14% and metals down -0.22% after yesterday's sagging stocks in light trade and hovering metals. The fun begins an hour before opening--

Nonfarm Payrolls

Nonfarm Private Payrolls

Unemployment Rate

Hourly Earnings

Average Workweek

Trade Balance

Factory Orders

Consumer Credit

--and imho these related threads are far ahead of the news services:

+321K

Ka. Boom.

US Department of Labor

A to Z Index | FAQs | About BLS | Contact Us

U.S. Bureau of Labor Statistics

Follow Us Follow BLS on Twitter | What’s New | Release Calendar | Site Map

Home

Subjects

Data Tools

Publications

Economic Releases

Students

Beta

Economic News Release

FONT SIZE:Minus Font SizePlus Font Size PRINT: Print

CPS CPS Program Links

CES CES Program Links

SHARE ON: share on facebook share on twitter share on linkedin

Employment Situation Summary

Transmission of material in this release is embargoed until USDL-14-2184

8:30 a.m. (EST) Friday, December 5, 2014

Technical information:

Household data: (202) 691-6378 • cpsinfo@bls.gov • www.bls.gov/cps

Establishment data: (202) 691-6555 • cesinfo@bls.gov • www.bls.gov/ces

Media contact: (202) 691-5902 • PressOffice@bls.gov

THE EMPLOYMENT SITUATION — NOVEMBER 2014

Total nonfarm payroll employment increased by 321,000 in November, and the unemployment

rate was unchanged at 5.8 percent, the U.S. Bureau of Labor Statistics reported today.

Job gains were widespread, led by growth in professional and business services, retail

trade, health care, and manufacturing.

Household Survey Data

In November, the unemployment rate held at 5.8 percent, and the number of unemployed

persons was little changed at 9.1 million. Over the year, the unemployment rate and

the number of unemployed persons were down by 1.2 percentage points and 1.7 million,

respectively. (See table A-1.)

Among the major worker groups, the unemployment rate for adult men rose to 5.4 percent

in November. The rates for adult women (5.3 percent), teenagers (17.7 percent), whites

(4.9 percent), blacks (11.1 percent), and Hispanics (6.6 percent) showed little change

over the month. The jobless rate for Asians was 4.8 percent (not seasonally adjusted),

little changed from a year earlier. (See tables A-1, A-2, and A-3.)

The number of long-term unemployed (those jobless for 27 weeks or more) was little

changed at 2.8 million in November. These individuals accounted for 30.7 percent of

the unemployed. Over the past 12 months, the number of long-term unemployed declined

by 1.2 million. (See table A-12.)

The civilian labor force participation rate held at 62.8 percent in November and has

been essentially unchanged since April. The employment-population ratio, at 59.2

percent, was unchanged in November but is up by 0.6 percentage point over the year.

(See table A-1.)

The number of persons employed part time for economic reasons (sometimes referred to

as involuntary part-time workers), at 6.9 million, changed little in November. These

individuals, who would have preferred full-time employment, were working part time

because their hours had been cut back or because they were unable to find a full-time

job. (See table A-8.)

In November, 2.1 million persons were marginally attached to the labor force,

essentially unchanged from a year earlier. (The data are not seasonally adjusted.)

These individuals were not in the labor force, wanted and were available for work,

and had looked for a job sometime in the prior 12 months. They were not counted as

unemployed because they had not searched for work in the 4 weeks preceding the

survey. (See table A-16.)

Among the marginally attached, there were 698,000 discouraged workers in November,

little different from a year earlier. (The data are not seasonally adjusted.)

Discouraged workers are persons not currently looking for work because they believe

no jobs are available for them. The remaining 1.4 million persons marginally attached

to the labor force in November had not searched for work for reasons such as school

attendance or family responsibilities. (See table A-16.)

Establishment Survey Data

Total nonfarm payroll employment rose by 321,000 in November, compared with an

average monthly gain of 224,000 over the prior 12 months. In November, job growth

was widespread, led by gains in professional and business services, retail trade,

health care, and manufacturing. (See table B-1.)

Employment in professional and business services increased by 86,000 in November,

compared with an average gain of 57,000 per month over the prior 12 months. Within

the industry, accounting and bookkeeping services added 16,000 jobs in November.

Employment continued to trend up in temporary help services (+23,000), management

and technical consulting services (+7,000), computer systems design and related

services (+7,000), and architectural and engineering services (+5,000).

Employment in retail trade rose by 50,000 in November, compared with an average

gain of 22,000 per month over the prior 12 months. In November, job gains occurred

in motor vehicle and parts dealers (+11,000); clothing and accessories stores

(+11,000); sporting goods, hobby, book, and music stores (+9,000); and nonstore

retailers (+6,000).

Health care added 29,000 jobs over the month. Employment continued to trend up in

offices of physicians (+7,000), home health care services (+5,000), outpatient care

centers (+4,000), and hospitals (+4,000). Over the past 12 months, employment in

health care has increased by 261,000.

In November, manufacturing added 28,000 jobs. Durable goods manufacturers accounted

for 17,000 of the increase, with small gains in most of the component industries.

Employment in nondurable goods increased by 11,000, with plastics and rubber products

(+7,000) accounting for most of the gain. Over the year, manufacturing has added

171,000 jobs, largely in durable goods.

Financial activities added 20,000 jobs in November, with half of the gain in insurance

carriers and related activities. Over the past year, insurance has contributed 70,000

jobs to the overall employment gain of 114,000 in financial activities.

Transportation and warehousing employment increased by 17,000 in November, with a

gain in couriers and messengers (+5,000). Over the past 12 months, transportation

and warehousing has added 143,000 jobs.

Employment in food services and drinking places continued to trend up in November

(+27,000) and has increased by 321,000 over the year.

Construction employment also continued to trend up in November (+20,000). Employment in

specialty trade contractors rose by 21,000, mostly in the residential component. Over

the past 12 months, construction has added 213,000 jobs, with just over half the gain

among specialty trade contractors.

In November, the average workweek for all employees on private nonfarm payrolls rose

by 0.1 hour to 34.6 hours. The manufacturing workweek rose by 0.2 hour to 41.1 hours,

and factory overtime edged up by 0.1 hour to 3.5 hours. The average workweek for

production and nonsupervisory employees on private nonfarm payrolls was unchanged at

33.8 hours. (See tables B-2 and B-7.)

Average hourly earnings for all employees on private nonfarm payrolls rose by 9 cents

to $24.66 in November. Over the year, average hourly earnings have risen by 2.1 percent.

In November, average hourly earnings of private-sector production and nonsupervisory

employees increased by 4 cents to $20.74. (See tables B-3 and B-8.)

The change in total nonfarm payroll employment for September was revised from +256,000

to +271,000, and the change for October was revised from +214,000 to +243,000. With

these revisions, employment gains in September and October combined were 44,000 more

than previously reported.

_____________

The Employment Situation for December is scheduled to be released on Friday,

January 9, 2015, at 8:30 a.m. (EST).

__________________________________________________________________________________

| |

| Upcoming Changes to the Employment Situation News Release |

| |

|Effective with the release of January 2015 data on February 6, 2015, the U.S. |

|Bureau of Labor Statistics will introduce several changes to The Employment |

|Situation news release tables. |

| |

|Household survey table A-2 will introduce seasonally adjusted series on the labor |

|force characteristics of Asians. These series will appear in addition to the not |

|seasonally adjusted data for Asians currently displayed in the table. Also, in |

|summary table A, the seasonally adjusted unemployment rate for Asians will replace|

|the not seasonally adjusted series that is currently displayed for the group. |

| |

|Household survey table A-3 will introduce seasonally adjusted series on the labor |

|force characteristics of Hispanic men age 20 and over, Hispanic women age 20 and |

|over, and Hispanic teenagers age 16 to 19. The not seasonally adjusted series for |

|these groups will continue to be displayed in the table. |

| |

|The establishment survey will introduce two data series: (1) total nonfarm |

|employment, 3-month average change and (2) total private employment, 3-month |

|average change. These new series will be added to establishment survey summary |

|table B. Additionally, in the employment section of summary table B, the list |

|of industries will be expanded to include utilities (currently published in |

|table B-1). Also, hours and earnings of production and nonsupervisory employees |

|will be removed from summary table B, although these series will continue to be |

|published in establishment survey tables B-7 and B-8. A sample of the new summary |

|table B is available on the BLS website at www.bls.gov/ces/cesnewsumb.pdf. |

|__________________________________________________________________________________|

__________________________________________________________________________________

| |

| Revision of Seasonally Adjusted Household Survey Data |

| |

|In accordance with usual practice, The Employment Situation news release for |

|December 2014, scheduled for January 9, 2015, will incorporate annual revisions in|

|seasonally adjusted household survey data. Seasonally adjusted data for the most |

|recent 5 years are subject to revision. |

|__________________________________________________________________________________|

Employment Situation Summary Table A. Household data, seasonally adjusted

Employment Situation Summary Table B. Establishment data, seasonally adjusted

Employment Situation Frequently Asked Questions

Employment Situation Technical Note

Table A-1. Employment status of the civilian population by sex and age

Table A-2. Employment status of the civilian population by race, sex, and age

Table A-3. Employment status of the Hispanic or Latino population by sex and age

Table A-4. Employment status of the civilian population 25 years and over by educational attainment

Table A-5. Employment status of the civilian population 18 years and over by veteran status, period of service, and sex, not seasonally adjusted

Table A-6. Employment status of the civilian population by sex, age, and disability status, not seasonally adjusted

Table A-7. Employment status of the civilian population by nativity and sex, not seasonally adjusted

Table A-8. Employed persons by class of worker and part-time status

Table A-9. Selected employment indicators

Table A-10. Selected unemployment indicators, seasonally adjusted

Table A-11. Unemployed persons by reason for unemployment

Table A-12. Unemployed persons by duration of unemployment

Table A-13. Employed and unemployed persons by occupation, not seasonally adjusted

Table A-14. Unemployed persons by industry and class of worker, not seasonally adjusted

Table A-15. Alternative measures of labor underutilization

Table A-16. Persons not in the labor force and multiple jobholders by sex, not seasonally adjusted

Table B-1. Employees on nonfarm payrolls by industry sector and selected industry detail

Table B-2. Average weekly hours and overtime of all employees on private nonfarm payrolls by industry sector, seasonally adjusted

Table B-3. Average hourly and weekly earnings of all employees on private nonfarm payrolls by industry sector, seasonally adjusted

Table B-4. Indexes of aggregate weekly hours and payrolls for all employees on private nonfarm payrolls by industry sector, seasonally adjusted

Table B-5. Employment of women on nonfarm payrolls by industry sector, seasonally adjusted

Table B-6. Employment of production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

Table B-7. Average weekly hours and overtime of production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

Table B-8. Average hourly and weekly earnings of production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

Table B-9. Indexes of aggregate weekly hours and payrolls for production and nonsupervisory employees on private nonfarm payrolls by industry sector, seasonally adjusted(1)

Access to historical data for the “A” tables of the Employment Situation Release

Access to historical data for the “B” tables of the Employment Situation Release

HTML version of the entire news release

The PDF version of the news release

Table of Contents

Last Modified Date: December 05, 2014

Recommend this page using:

share on facebookFacebook

share on twitterTwitter

share on linkedinLinkedIn

tools

Areas at a Glance

Industries at a Glance

Economic Releases

Databases & Tables

Maps

calculators

Inflation

Location Quotient

Injury And Illness

help

Help & Tutorials

FAQs

Glossary

About BLS

Contact Us

info

What’s New

Careers @ BLS

Find It! DOL

Join our Mailing Lists

Linking & Copyright Info

resources

Inspector General (OIG)

Budget and Performance

No Fear Act

USA.gov

Benefits.gov

Disability.gov

Freedom of Information Act | Privacy & Security Statement | Disclaimers | Customer Survey | Important Web Site Notices

U.S. Bureau of Labor Statistics | Division of Labor Force Statistics, PSB Suite 4675, 2 Massachusetts Avenue, NE Washington, DC 20212-0001

www.bls.gov/CPS | Telephone: 1-202-691-6378 | Contact CPS

U.S. Bureau of Labor Statistics | Division of Current Employment Statistics, PSB Suite 4860, 2 Massachusetts Avenue, NE Washington, DC 20212-0001

www.bls.gov/CES | Telephone: 1-202-691-6555 | Contact CES

Even better news hourly earnings surge +0.4%. there’s the wage inflation everyone has been waiting on.

Headlines:

Payrolls +321k.

September revised up +15k; October revised up +29k.

Unemployment 5.8%

Hourly earnings up 2.1% over the year.

Using my usual 80/20 rule: 80%*321k (payrolls) + 20%*4k (household) suggests underlying growth of 257k per month, in line with 3-month ave.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.