Posted on 11/30/2014 1:24:35 PM PST by expat_panama

Once again we can say we're looking at a great time for investing! OK, so it means we wince over last Friday's metals prices, but like who does metals anyway dude, like it's soooo 2013 even. That and the general feeling we get reading stuff like Gold mining industry mostly ‘under water’ – Gold Fields CEO (h/t Chgogal).

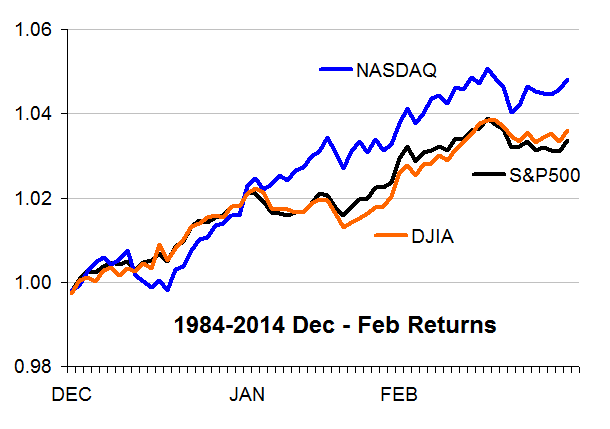

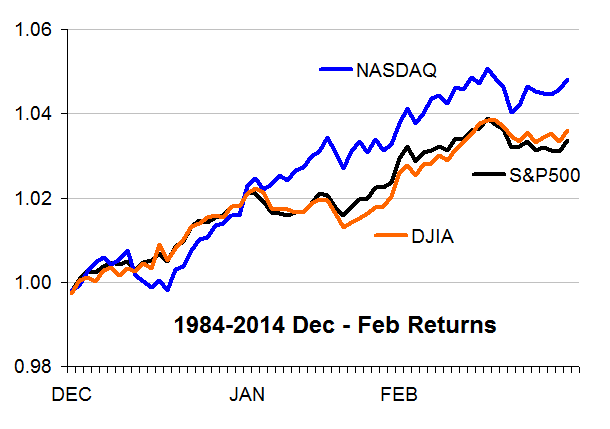

Hey, I'm talking stock market year end "window dressing"† January effect --check out the averages over the past 30 years for the Dow, S&P500, and the NASDAQ, they typically go up 3.4%, 3.6% and 4.8% respectively. On top of that these are for just 3 months and it translates to annualized returns of 15%, 14% and 21%!

Only thing we could hope for is that we're looking at an average year --problem is that the reason this time it's different is becuase it's always different. The plots on the right (click to enlarge) show how the stellar year-end trends look compared to what the 30-year extremes have been. Sure, the past 3 decades includes the 2009 Inaugaration Grand Market Crash that was in all the papers, but still we all know that we can't just buy and expect any guarantees here.

That said yours truly is cautiously moving back in w/ one hand while the other hand's holding on to the ejection seat lever. Stay calm. Remember that the new congress takes office in the latter part of Jan. and they won't be able to have any actual impact until weeks later. At the same time we know the President has already gotten middleeast-defeat, amnesty, Ferguson, and obabacare-defiance completely out of his system so that there's nothing down the pike that he might toss out that can possibly be any worse....

† "window dressing" is when institutional traders clean up their portfolios at year's end w/ pop darlings bought w/ cash from dumping the bow-wows --the idea being they want the annual report to look better.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

If CVX dips below $95.64 I am in big for a long haul. Long term energy is not going to get cheaper.

I’m looking hard at BP. Almost pulled the trigger Friday.

http://www.cnbc.com/id/102223036#.

Christmas comes early for Asian economies

Guess What Happened The Last Time The Price Of Oil Crashed Like This?

“At the same time we know the President has already gotten middleeast-defeat, amnesty, Ferguson, and obabacare-defiance completely out of his system so that there’s nothing down the pike that he might toss out that can possibly be any worse....”

Might not be worse but he can certainly try

EPA Smog Rules: The Most Expensive and Pointless Regulation Ever

http://www.freerepublic.com/focus/f-news/3231724/posts

AT&T chief: Net neutrality uncertainty puts a pause in investing

http://www.freerepublic.com/focus/f-news/3226169/posts

Who knows what else he has up his sleave?

Coin value calculations use the 3:17 PM PST gold price for November 30, 2014:

Gold $1153.70/oz -21.50

This is 6:17 pm EST.

from coinflation.com

A dual calendar spread on NFLX. Now, I'll skip the academic crapola, but if you want to know (some of it, anyway), just ask.

Every Monday, at least 1/2 hr after the mkt has been open (and 3 hrs is better), wait for NFLX to bounce around close to, say, w/in 1/2 pt, of a striking price of that Friday's expiration of options. If the 2nd-expiration options (i.e. the following week's) has the same striking price (almost always), we're in.

Then, buy the weekly calendar spread of calls exactly 12.5 pts above NFLX' current price AND buy the weekly calendar spread of puts exactly 12.5 pts below NFLX' current price. Typically, this pair of trades will cost you between $300-400 for each pair. Again, check BOTH weeks' expiries to make sure that the striking prices you want exist. If not, do NOT enter the trade, but rather wait to see if NFLX bounces around to a price where all the options you want DO exist.

You should sit in this trade (ideally) until late Thursday, and the reason for this is the nature of calendar spreads. Summarising this nature, calendar spreads profit if one of two conditions (or better, both) occur: A) the price of the stock moves rather smartly toward the striking price of the calendar spread, or, B) the IV of the options in the spread goes up.

By definition, since we have two striking prices in this trade, the price of NFLX **WILL** move toward one of them, right? The good news here is that the spread that will be gaining (the other will be losing, clearly) gains faster than the one that is losing loses.

The IVs of the oppies we're trading in, of course, is something we cannot control, but this feature tends to apply over longer periods of time than 3 days, true? In any case, we have another advantage...and it is theta, the rate of decay of option premium. Not surprisingly, the rate of decay of the short near-expiration (this week's) options starts off faster, on Monday when we enter the trade, than the rate of decay of our long 2nd-expiration (next week's) options.

And (what a shame), this differential rate of decay INCREASES on Tuesday and Wednesday as the nearby options approach very near expiration. You can persuade yourself of this easily: simply compute the successive (Tuesday, Wednesday, ...) ratios of the number of days of life left in our short side near options to the number of days of life left in our long side 2nd-week options.

Come midday Thursday, NFLX will almost invariably have moved between 4 and 15 pts...and our pair of spreads will now be worth between $20 and $90 more than on Monday (each pair, of course), and we PREFER to simply exit the trade at this point. Note carefully that we simply don't care which direction NFLX has moved -- and that's because we have deliberately played both sides of the market. That's the "secret", if you like, of the trade.

Now, should NFLX **not** have moved at least 3-4 points (and you can look for yourself how unlikely that little possibility is!), we will probably show a small loss at midday Thursday. We can accept the loss, or we can go for a bit of gusto. Friday, historically over the past year, has been the 2nd most active day for NFLX' price, and a tidy little 6-10 pt move will put us nicely back in the profit column. Keep in mind, we do not intend to sit through until expiration; when a nice Friday move, either direction, occurs by half-session, we should take profits on the gaining side and accept losses on the losing side (which has increasingly less chance of gaining any significant amount in the remaining 2-3 hours of Friday trading).

And, there's one more bonus here. Should, by some fluke, NFLX' price end up w/in a couple of pts either side of one of our striking prices on Thursday (which it does about 3-4 times a year), we will have a very tasty profit, perhaps a much as $2.00 per pair.

2 caveats: 1) if NFLX' price at any time during the trade before Thursday midday moves more than 1 pt above the striking price of our calls or 1 pt below the striking price of our puts, we exit the trade, period. No exceptions. Sometimes this action can result in a small loss. TAKE THE SMALL LOSS; do not try to defend the trade.

2. We do NOT EVER enter the trade when earnings will be reported during the current week or the next week. It is also not advisable to enter the trade when the current week is the week after earnings have been reported, because the IVs of the oppies will, in all likelihood, be inflated (having been so due to the recently posted earning and subsequent price movement.)

Real world: observed, 11 out of 11. Actual trades, 7 out of 7. Up about $3800, give or take, as I write this.

Any questions, give me a call: 6777-6222. Mornings are best, but early evening usually works, too. If you miss me, e-mail and tell me when you plan to call next and I shall be right there and waiting.

Best to the lovely Ann, and Happy Christmas!

NYMEX crude drops in early Asia as market awaits China PMIs

http://www.thetowntalk.com/story/news/local/2014/11/30/oil-prices-plunge-panic-acadiana/19714671/

Oil prices plunge, but no panic in Acadiana

http://www.bloomberg.com/news/2014-11-30/aussie-slips-with-kiwi-amid-oil-rout-gold-extends-drop.html

U.S. Futures Drop as Oil Extends Slump; Gold, Aussie Sink

http://www.bloomberg.com/news/2014-11-30/miners-covering-their-eyes-on-china-s-commodity-cliff.html

Miners ‘Covering Their Eyes’ on China’s Commodity Cliff

Now is the time to buy physical gold. If the mines shut down, demand will overcome supply and prices will soar. He who has the gold, rules.

http://www.cnbc.com/id/102225843

Asia stocks mixed as oil extends rout; Nikkei at new 7-year peak

https://en-maktoob.news.yahoo.com/u-crude-hits-five-low-market-rout-002455296—business.html

U.S. crude hits five-year low on market rout

Yergin weighs in. He wrote the book.

http://online.wsj.com/articles/daniel-yergin-the-global-shakeout-from-plunging-oil-1417386897

By Daniel Yergin

Nov. 30, 2014 5:34 p.m. ET

The decision by members of the Organization of the Petroleum Exporting Countrieson Thursday not to cut production reflects a profound shift in the world oil market. The demand for oil—by China and other emerging economies—is no longer the dominant factor. Instead, the surge in U.S. oil production, bolstered by additional new supply from Canada, is decisive. This surge is on a scale that most oil exporters had not anticipated. The turmoil in prices, with spasmodic plunges over the past few days, will likely continue.

Since 2008—when fear of “peak oil,” after which global output would supposedly decline, was the dominant motif—U.S. oil production has risen 80%, to nine million barrels daily. The U.S. increase alone is greater than the output of every OPEC country except Saudi Arabia.

The world has experienced sudden supply gushers before. In the early 1930s, a flood of oil from East Texas drove prices down to 10 cents a barrel—and desperate gas station owners offered chickens as premiums to bring in customers. In the late 1950s, the rapidly swelling flow of Mideast oil led to price cuts that triggered the formation of OPEC.

And in the first half of the 1980s, a surge in oil from the North Sea, Alaska’s North Slope and Mexico caused prices to plunge to $10 a barrel. That posed a much greater crisis for OPEC than today: Over those same years, global demand fell by more than two million barrels a day owing to a deep recession, greater conservation and the switch to coal from oil for electricity generation. This time world oil demand is still growing, but weakly.

snip

hmmm . . . .

Related thread GOLD IS GETTING SMOKED ($1150 Oz).

I honestly can't see why it's not going down around to another $400 bottom like it's done so many times before.

“desperate gas station owners offered chickens as premiums to bring in customers.”

I hope they give beef this time. It’s getting spendy.

To anyone interested in the energy biz, Yergin’s book is an absolute must read.

Which one should I go for

The Quest: Energy, Security, and the Remaking of the Modern World Paperback

http://www.amazon.com/Quest-Energy-Security-Remaking-Modern/dp/0143121944/ref=sr_1_1?s=books&ie=UTF8&qid=1417402968&sr=1-1&keywords=daniel+yergin

The Prize: The Epic Quest for Oil, Money & Power Paperback

http://www.amazon.com/Prize-Epic-Quest-Money-Power/dp/1439110123/ref=sr_1_3?s=books&ie=UTF8&qid=1417402968&sr=1-3&keywords=daniel+yergin

The Prize first, then the other one.

It's a beautiful new day campers! We're seeing early morning futures beginning to recover from earlier lows and metals are even in positive territory. Falling stock indexes may be no fun but before we cancel the Santa Claus rally we can note (see graph record above) that dips/profit-taking are also typical --especially at the beginning of Dec. The 10:00AM ISM Index is all we got reported today and the headlines are a bit edgy:

US holiday weekend store sales fall on early discounts, online growth

Moody's downgrades Japan on debt worries

Oil hits five year low, emerging stocks hammered Oil prices fell to their lowest in five years on Monday, hit by slowing factory activity in China and Europe and hammering emerging market stocks and commodity-linked currencies. Plunging prices for oil ...

Fed rattled by elusive inflation, but loath to sound alarm yet

So interest rates are NOT going up anytime soon? That can’t be. We’ve been told for four years now that 6% one year CDs are just around the corner!

From Fed rattled by elusive inflation, but loath to sound alarm yet: "the central bank's failure to nudge price growth up to its 2 percent target " That's amazing --2% used to be some kind of ideal maximum but these day's it's become the unreachable star that we're now striving for.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.