Skip to comments.

Opinion: This is the most dangerous stock market since 2008

marketwatch.com ^

| October 13, 2014

| Michael Sincere

Posted on 10/13/2014 3:22:48 AM PDT by John W

Volatility has returned to the market. To be specific, the market has rallied, sold off, rallied, and sold off, all in one week. This is ideal for day traders but unnerving for individual investors. It is also a big red warning sign.

To refresh your memory, last week every rally failed, so the market ended the week on its lows. Even the October 8th rally of 274 points reversed direction the next day. It was a monster rally based on the FOMC minutes, which revealed member’s concern for global growth. Got that? The market rallied on bad news. In the mixed-up world of Wall Street, that meant interest rates would remain low. Unfortunately for the bulls, the next day the market fell by 334 points. That’s volatility!

In nontechnical terms, the October 8th manic rally was a head fake. It might have cheered amateur investors, but in reality, this has become one of the most dangerous markets since 2008.

Facts are hard to dispute but easy to spin. Already, the Russell 2000 RUT, -1.37% is in a 10% correction. Judging by history, the Dow Jones Industrial Average DJIA, -0.69% and S&P 500 SPX, -1.15% shouldn’t be far behind. A major correction or crash would be definitive proof this market is wearing no clothes.

(Excerpt) Read more at marketwatch.com ...

TOPICS: Business/Economy; News/Current Events

KEYWORDS: stockmarket

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

To: John W

Sooner or later continued monetizing of the debt has effects... trading stocks in a atmosphere of worthless money propping up the government which props up the debt which props up the worthless money - works great until the props fall out...

To: RayChuang88

Interesting perspective. Heading off to work, but I’ll be back later to check on updates on this thread (just so nobody thinks I’m rude, LOL).

To: John W

I guess the folks controlling the printing presses know exactly when to buy and sell stocks.

Must be nice to be among the exempt!

23

posted on

10/13/2014 4:43:30 AM PDT

by

The Duke

To: Alberta's Child

Think back to the late ‘80s and early ‘90s when “movement conservatives” were in ascendency. The Christian Coalition had a big say in the GOP, and so on.

So what happened?

A few of our folks got to DC and caught Potomac Fever. Others had other things to do - watch Dancing With the Stars, or NFL football, or whatever.

We quit working within the system and stayed home. The RINOs took over. They’ll stay in charge as long as we sit on our collective assess and do nothing about it.

24

posted on

10/13/2014 4:49:18 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Alberta's Child; abb; ryan71

Are any of these companies we see every day worth more than twice what they were 6 years ago? No.are they making more or less money than they were six years ago

are profitable on their own, or if they are only profitable because they operate in an environment marked by “crony capitalism”

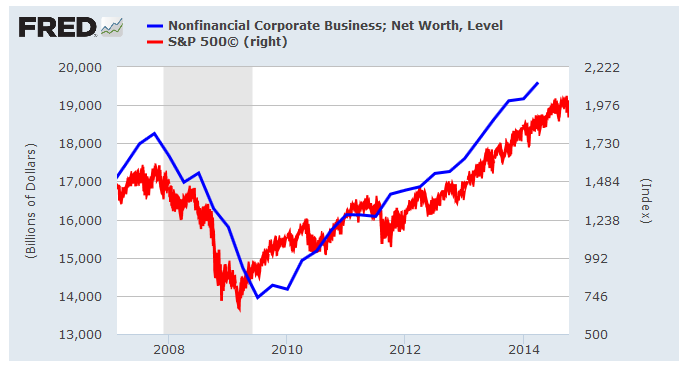

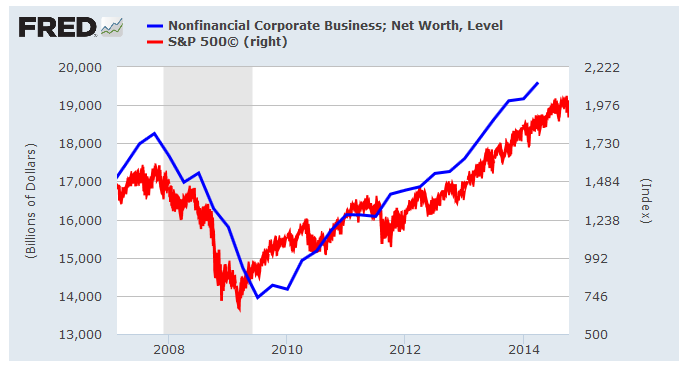

Don't know which "these companies" y'all are talking about but here's the total net worth of all non-bank U.S. corps along w/ the S&P 500:

U.S. companies are worth just over seven percent what they were seven years ago --that's a one percent annual growth rate. The S&P500 index is part company value and investor profit, and it's had an average yearly growth at 3%. That's fair, especially considering we got corp values plus the 2% dividend yield. Then again, if everyone wants to talk about the 40% gains since the '09 inauguration then we need to decide whether that drop made sense.

To: John W

OBAMA-NOMICS,

Bringing unemployment to the masses!

OBAMA-CARE,

Bringing denial of service to the masses.

OBAMA BORDER SECURITY,

Bringing disease and DEATH to the masses.

OBAMA'S RULES OF ENGAGEMENT,

Destroying our military on all fronts.

IF you voted for this ILLEGAL ALIEN IN CHIEF, this MUSLIM TERRORIST IN CHIEF,

26

posted on

10/13/2014 4:58:43 AM PDT

by

Yosemitest

(It's Simple ! Fight, ... or Die !)

To: abb

“

We quit working within the system and stayed home. The RINOs took over. They’ll stay in charge as long as we sit on our collective assess and do nothing about it.

“

Easy... Republicans took over, became complacent and more interested in retaining power than in change, continued crony capitalism... And began to run status quo RINOS a, designed and picked not to offend the electorate... But surely alienated their base.

Meanwhile. demon rats - the other wing of the central party - took over and also never had to change because Obola was so appealing. They were swept back into power, became totally focused on retaining power with crony capitalism, crony government ism, and bread and circuses.

Here we are... Drowning in debt, our economic base destroyed, our dollar destroyed and a nation of growing dependency on government.

If your money is in stocks, reduce exposure. The CAPE ratio passed 20 long ago. By valuation, this is one of the most expensive markets ever. If your money is all in U.S. banks, move some to a better jurisdiction. Prepare to survive a number of years of depression, deflation and later inflation.

27

posted on

10/13/2014 5:02:52 AM PDT

by

aMorePerfectUnion

( "I didn't leave the Central Oligarchy Party. It left me." - Ronaldus Maximus)

To: proxy_user

It could be a buying opportunity. But how to tell when the carnage is over is anyone’s guess.

I’ll wait until the election is over.

28

posted on

10/13/2014 5:49:03 AM PDT

by

unixfox

(Abolish Slavery, Repeal the 16th Amendment)

To: ryan71

Look around. Are any of these companies we see every day worth more than twice what they were 6 years ago? No. Absolutely correct. These businesses know the economy is screwed, that's why they've been buying back shares at rapid rate. Gotta keep that EPS number looking good for the shareholder and analyst reports.

Of course, when they float those shares in the future. They'll end up driving the EPS down, at a time that when the company will likely be worse off (lower stock price to begin with).

We are now watching a very large ponzi scheme going on, with only one possible option for resolution. It isn't IF, but WHEN.

29

posted on

10/13/2014 6:06:47 AM PDT

by

voicereason

(The RNC is like the "One-night stand" you wish you could forget.)

To: RayChuang88

I am with you Ray. I sold EVERYTHING the last week in August. I did not like the candlestick chart formations the DOW and S&P made(double top, then sell off). I think we were overdue for a correction. Plus there had been some articles that were published that major players like Soros were placing bets that the market was going down.

I even sold my Matthews India fund even though it was up 32% in the last year. The world economy is slowing.

To: woodbutcher1963

The Black Swan issues of the Russia-Ukraine conflict, the political instability caused by ISIS and the Ebola outbreak could send the stock market on a semi-slow motion crash--a bottom around DJIA 12,000 to 12,500 may not be so far-fetched.

31

posted on

10/13/2014 7:02:10 AM PDT

by

RayChuang88

(FairTax: America's economic cure)

To: ryan71

Look around. Are any of these companies we see every day worth more than twice what they were 6 years ago? No.You are correct, but many have put their heads down and are running into this Obama headwinds so to speak. I see many companies that still have to innovate and offer value added products to customers at the consumer level as well as to industrial customers. I hesitate to name names ( the usual this is not investment advice warning ) but I will give an example. I stumbled upon a firm who is making a Diamond Like Coating ( DLC ) for the inside of piping via their patented applied process that utilizes a vapor and laser. Think less friction drag and no corrosion. The uses would be for fluids through said pipe in an industrial plant or ( I am not sure they are using it here ) for the tubing used in getting the oil and gas up from fracking.

Game changer? I am not sure, Advance? Yes. Their are so many more, Disney on the Potomac can't stop these innovations.

The question begs, when will a change in leadership occur to allow these folks to feel unencumbered and for us to feel the waters fine and invest without a plethora of exogenous instabilities and return to a more Reaganesque investment environment.

32

posted on

10/13/2014 7:17:31 AM PDT

by

taildragger

(Not my Circus, Not my Monkey ( Boy does that apply to DC...))

To: raybbr

The time for talking and thinking is over. Better to move your money right away. I’ve moved mine two times in my life ahead of major sells offs in the market and was criticized by my broker and friends for panicking too early. Well, I never lost a dime but my friends and the broker did big-time because they waited too long trying to squeeze every last penny out of the stock market rise.

When everybody realizes the market is diving, it’s too late. Seek safe harbor for your IRA in cash money market accounts or metals as soon as possible or you will kick yourself for waiting too long to act. I can smell a major downturn coming soon. When the stock market reaches new highs and then the engine starts to sputter with volatility like it has this last week, it is getting ready to blow a gasket or break a piston and drop in its tracks. You can always move it back into the equities market when, and if, it recovers. I’m retired now and can’t earn enough money to start over again, so I’ve kept my money out of the market since the summer of 2008 and have never gone back. But my principle is safe for now. I got out that summer before the September crash when several of my friends lost over half their retirement nest eggs before they knew what hit them. Unfortunately for them, they had to keep working and will into their 70’s to make up their losses, while I was able retire to my cattle ranch in Florida.

Smart you say? No, just cautious with my hard-earned money.

33

posted on

10/13/2014 8:24:14 AM PDT

by

HotHunt

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson