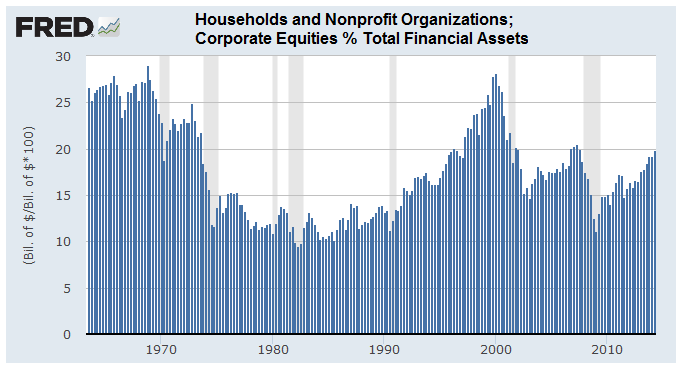

--and now that I look at it I think that's what's really happened here. PBS won't say where J. Lyons Fund Mgmt. got their numbers for their graph, but when the world looks at the Fed's data on privately held stocks % private financial assets they get this:

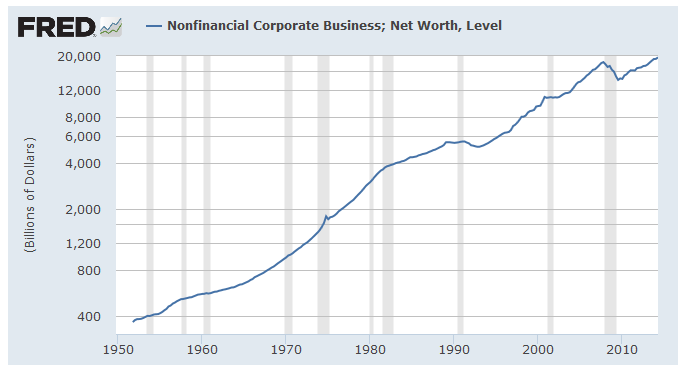

Not only do we see no big deal any more, but now we remember that most stocks are owned by institutions, not individuals. If we're concerned about stock prices and money available to buy then we want to think about how total corp net worth (total market cap) is doing:

The numbers are irrefutable. Before the recession growth going back to 1950 averaged 7% yearly. The past seven years stock investments have grown yearly at just one percent.