Posted on 08/17/2014 1:35:32 PM PDT by expat_panama

Alternate Title: UPTREND SPECIAL EDITION!

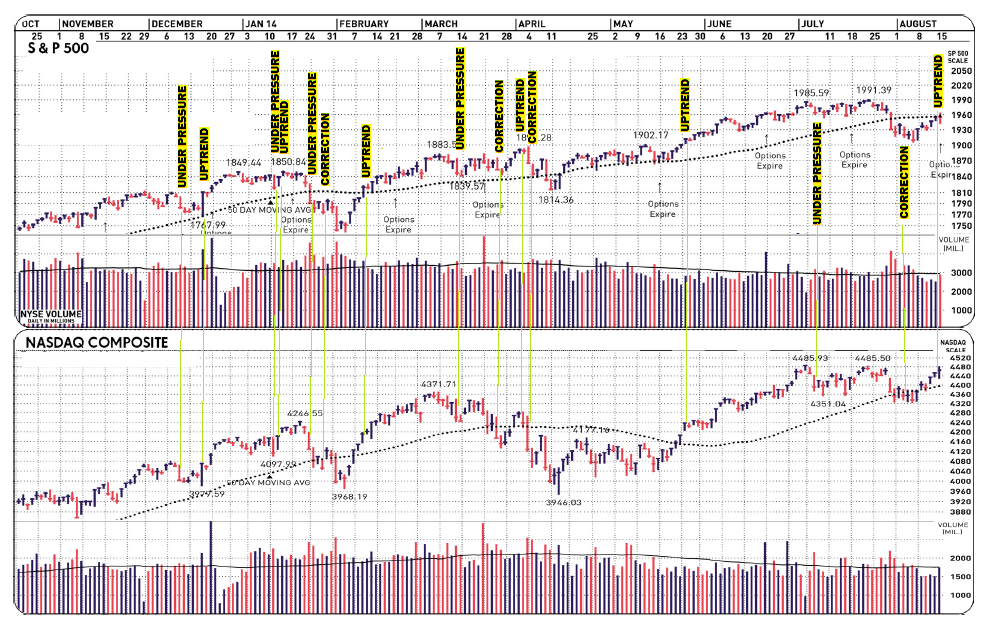

That's right, last Thursday IBD announced that NASDAQ had its "follow-through-day" so investors in the driver's seat just saw the light turn green. That said, we also know that nobody walks across a one-way street without looking both ways, and even though the signs say 'buy' here's what they've been saying so far this year--

--and this is the problem we got driving down the road while only being able to look out the back window.

Remember these market designations are not arbitrary, they're signals proven with decades of research. That said, we're still looking at a market where price trends have not yet proven themselves. We've gotten so many false signals this year that a person would've done better by buying on the 'corrections' and selling when uptrends begain.

Of course, if we're concluding that past patterns don't mean anything for seeing the future, then to be honest we'd also have to admit that simply being contrary promises nothing.

OK, so imho 'honesty' is highly over-rated.

Maybe our bottom line here is that it's IBD's job to show what usually has happened before when stuff looking like today's headlines popped up --and truth betold they do it superbly. When it comes to guarding our family's wealth and keeping the kids fed, well that's our job. It means we can still learn from folks like NEWSMAX/FINANCE, IBD, WSJ, but we also need to kick those guys around on this thread too...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Some would ask that, and others would point out that to be honest and consistent we'd have to also consider whether--

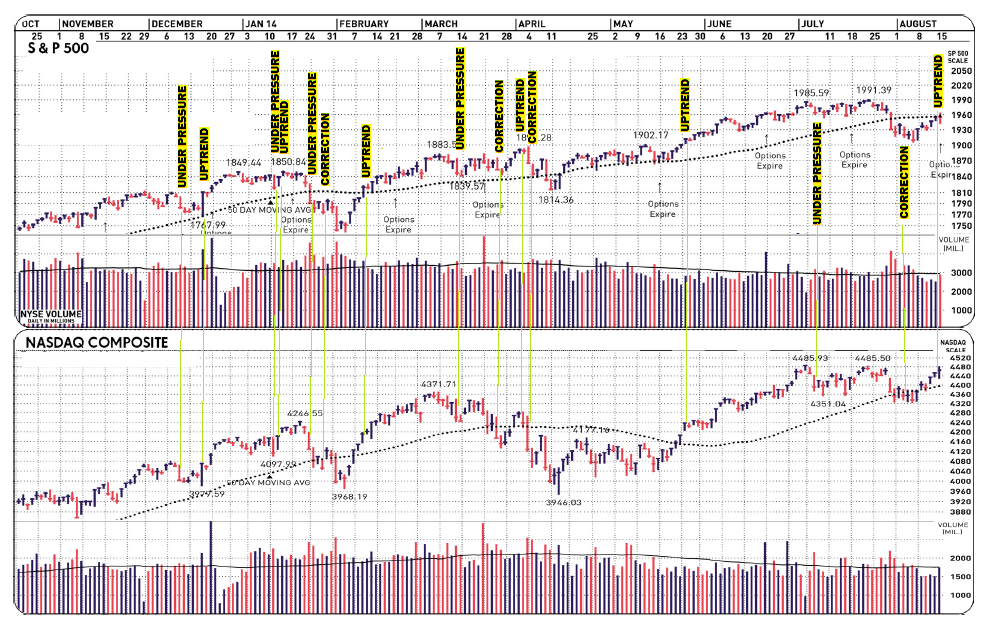

--the plunges in '03 and '09 were appropriate, and that's why I've come to the conclusion that honesty and consistency are highly overrated. In the meantime, I'm seeing how over the past century or so stock prices usually double every decade, and this past decade and a half they haven't.

By definition, the market’s are ALWAYS “appropriately priced.” There is no other mechanism yet devised by man that can assign value any better than a willing seller and a willing buyer, with as much information as possible mixed into the transaction.

Of course, those factors (sellers, buyers, information) change continually, and that what makes a market.

From Business Insider:

Good morning! Here’s what you need to know:

Remember The Sell-Off? The global markets are extending their big comeback from their lows of the month. In Europe, Britain’s FTSE 100 is up 0.5%, France’s CAC 40 is up 0.3%, Germany’s DAX is up 0.9%, and Spain’s IBEX is up 0.4%. Asia closed higher with Japan’s Nikkei up 0.8% and Hong Kong’s Hang Seng up 0.6%. U.S. futures are pointing to another up day. Dow futures are up 31 points and S&P 500 futures are up 3 points. “The S&P 500 has recovered all of the 65 point fall from July 31 to August 7,” wrote Societe Generale’s Kit Juckes. “‘Risk’ is ‘on’ again by that measure, and if you include press reports of large fund managers buying US junk debt, or look at falling volatility, tighter spreads more generally.”

Investors Are Tired Of Worrying. That’s how stock market guru Ed Yardeni explains the series of modest market dips as opposed to big 10% corrections. “Often in the past, I’ve noted that the current bull market has been marked by a series of “endgame” corrections followed by relief rallies to new cyclical highs, and then new record highs since March 28, 2013,” he wrote. “I also noted that at the start of 2013, when the widely dreaded fiscal cliff was averted, our accounts showed symptoms of anxiety fatigue. They were tired of worrying about endgame scenarios. That might explain why there have been dips rather than corrections since early 2013.”

Good News Out Of Home Depot. The home improvement chain reported Q2 comparable store sales jumped 5.8%, which was stronger than the 4.4% growth expected. Earnings of $1.52 per share beat expectations for $1.44. “In the second quarter, our spring seasonal business rebounded, and we saw strong performance in the core of the store and across all of our geographies,” said CEO Frank Blake. Management’s full-year earnings outlook was also ahead of analysts’ expectations.

Good News Out Of Maersk. Danish shipping behemoth Maersk announced Q2 revenue and earnings beat expectations, driven by a 6.6% increase in volume. Management sees global container demand up 4-5% year-over-year. Shipping activity tends to be a reliable bellwether of global economic activity.

British Inflation Cools. UK consumer prices fell by 0.3%month-over-month in July, which was worse than the -0.2% expected. On a year-over-year basis, CPI climbed by just 1.6% year-over-year, missing expectations for 1.8% growth. All of this gives the Bank of England room to keep monetary policy loose for longer.

We’ll Soon Hear About U.S. Inflation. At 8:30 a.m., we’ll get the July U.S. consumer price index report. Economists estimate CPI climbed by 0.1% month-over-month or 2.0% year-over-year. Excluding food and energy, core CPI is estimated to have climbed by 0.2% or 1.9%, respectively. Here’s Morgan Stanley’s Ted Wieseman: “Lower retail gasoline prices and lower utility rates as natural gas prices extended a sharp reversal of winter elevation point to lower energy prices. Food prices were flat in June after surges averaging 0.4% from March to May, but farm prices and PPI pointed to renewed upside concentrated in meats. Core inflation, meanwhile, should continue to be boosted by a gradual acceleration in shelter costs. Taken together, rent and owners’ equivalent rent, accounting for 40% of core CPI, were at a six-year high of 2.8% year/year in June, up from 2.6% in December and 2.4% in June 2013, and a plunge in the national rental vacancy rate to a twenty- year low in Q2 points to further upside going forward. Otherwise, a decline new car prices restrained core CPI in June, but industry sources estimated lower sales incentives in July. Industry figures also pointed to more stable hotel rates after a 1.9% pullback in June reversed a 2.0% rise in May, and airlines have seen continued strength in domestic revenues.”

Aeropostale CEO Is Out. The casual apparel retailer announced that Thomas Johnson would be stepping down as CEO after three and a half years, and former CEO Julian Geiger would return. During Johnson’s tenure, the company’s stock price has fallen by around 85% and profit margins have fallen by half.

Standard Chartered Nearing Deal Over Compliance Failure. “Standard Chartered Plc is close to a deal to pay between $200 million and $300 million to resolve allegations by New York’s banking regulator that it failed to review high-risk transactions, two years after agreeing to reform its practices, a person familiar with the matter said on Monday,” reported Reuters’ Karen Freifeld. “The announcement of the settlement could come this week, possibly as soon as Tuesday, according to the person, who was not authorized to speak about the talks and declined to be identified.”

Sprint Cuts Prices And Doubles Data Offerings. “Sprint Corp on Monday unveiled a new pricing plan that offers customers 20 gigabytes of data and up to 10 lines for $100, doubling its data offerings, the latest in a string of price cuts and promotions sweeping the wireless industry,” reported Reuters’ Marina Lopes and Carey Gillam. “Sprint’s chairman, business tycoon Masayoshi Son, is betting new prices will revive a carrier hampered by an expensive network overhaul and rising competition.”

BofA’s Tom Montag Becomes Sole COO. “Bank of America Corp.’s Thomas K. Montag, the lender’s top-paid senior manager, will become sole chief operating officer as co-COO David Darnell takes a new title so he can move to Florida,” reported Bloomberg’s Hugh Son. “Darnell, 61, will be vice chairman and continue overseeing global wealth and investment management, as well as business banking, Chief Executive Officer Brian T. Moynihan wrote in a memo to employees. Montag, who has split the COO job with Darnell since 2011, will still run the investment banking and capital markets businesses.”

CPI +2.0% in line

Core CPI +0.01% MOM - Exp +0.2%

Housng Starts 1.093MM, Exp. 969K, Last 893K

Starts beat mainly on MF, SF +10% YOY

Permits also up but mainly MF

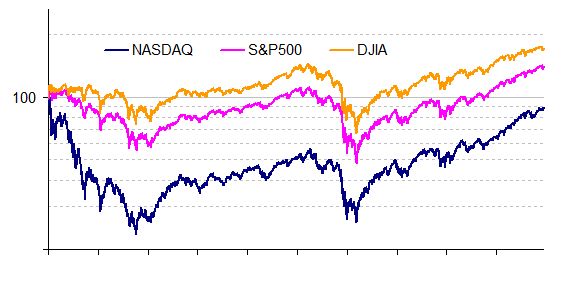

Let's not underestimate the power of the bloated ego; I don't know how many times I've heard "aw, stocks are way overpriced", or "housing market's dead 'cause nobody's willing to pay me what my house is worth!". Let's face it, it's not love makes the world go 'round, it's bloated egos. Any given moment w/ virtually any asset we got a spread; here's what's happening (even as we speak) w/ the AAPL I bot yesterday:

Huh. Just noticed that there's a bid at $99.57 and offers at only $99.54. Anyone for arbitrage? Where are the HFT's when we need them?

Seems to be pleasing the index futures traders...

Yet another morning when, I wake up to see the Dow Futures at +38, S&P at +3.

It’s ALMOST as if, someone is gaming the futures...

But, that couldn’t happen... right?

Whoa neat --if there's a swindle going on then I want in! Just need to know how it works; here's the DJIA futures this past year and here's the actual DJIA at the same time. Someone tell me how the scam part works.

LOL

I don't know how likely it is, but.... I have read articles suggesting that the Fed and/or the Treasury were buying up stocks, in after hours trading in order to move the futures ahead of the open. Takes much less leverage to move futures as compared to the overall market.

Just seems odd to me. So many times, during these run-ups, the Dow futures seem to be right at, or around $40. Maybe, there is some natural reason for it to settle around there?? Doesn't seem totally random to me.

I put more money into the market today. (Shoulda done it last week...drat!) I want to see my money grow! Come on market, go higher!

AAPL all time high. There’s a scam I’m sure though...

BTW sell the day before the event on the 9th and buy the inevitable dip the day after :-)

What we got is that price waves are not random like dice or white noise, they're chaotic like waves of the sea or gusts of wind. That means while they're still unpredictable, we can just the same dependably sail a boat or catch a good wave on a surf board. Half the art (imho) seems to hinge on deciding how fast to go in and out because while jumping in/out fast can make for bigger returns it also increases risk exposure.

We chose our level of risk v return.

The other half is seeing whether we're in a stable enough market where signals that say one thing one day can mean the same thing the next. The lesson for me from my review of IBD market designations was that from Dec. '13 to Apr. '14 conditions were too schizoid for decent market trend reading, but that since then (again imho) I'm seeing a bit or sanity returning.

btw, I bot in more today also --after rechecking I'm seeing that I'm right now about up to all-out full speed today. Looks like I'll be in 'sit-up-pay-attention' mode for a while 8-/

Last Fri. IBD was putting it on the radar--

--and their comment about 'weak bounce' seems to be addressed by the heavy volume it's showed powering into the recommended $97.2 - $102.06 buying range.

Their stock checkup was stellar too:

APPLE INC RANK WITHIN THE COMPUTER-HARDWARE/PERIP GROUP (17 STOCKS)

Composite Rating 99 Rank within Group:1st 100% Best in Group

EPS Rating 93 Rank within Group: 2nd 94%

Relative Strength Rating 91 Rank within Group: 5th 76%

SMR Rating A Rank within Group: 2nd

94%

Acc/Dist. Rating B Rank within Group: 4th

Someone tell me how the scam part works.

I don't know how likely it is, but.... I have read articles

Ah; we're just thinking out loud. For actual money things we really need to know what's going on but for merely accusing others of criminal activity behind their backs --all that knowing-the-facts stuff is completely unnecessary. My mama always used to tell me that before criticizing someone we must first walk a mile in their shoes and she was absolutely right. It's that when we do criticize them they'll not only be a mile away, but we'll also have their shoes!

Was Soros involved? Had to be Soros.

Happy Wednesday everyone! Good econ news yesterday w/ housing and inflation, today we only got a mortgage index, crude inventories, and some Fed minutes. Market reaction was flat for metals and up for stocks in tepid volume (warning sign). Futures today point to more flat metals and early profit taking in stocks; we'll see by today's volume how the greater consensus views this rally's lifespan. Eye-catching headlines:

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.