Posted on 08/17/2014 1:35:32 PM PDT by expat_panama

Alternate Title: UPTREND SPECIAL EDITION!

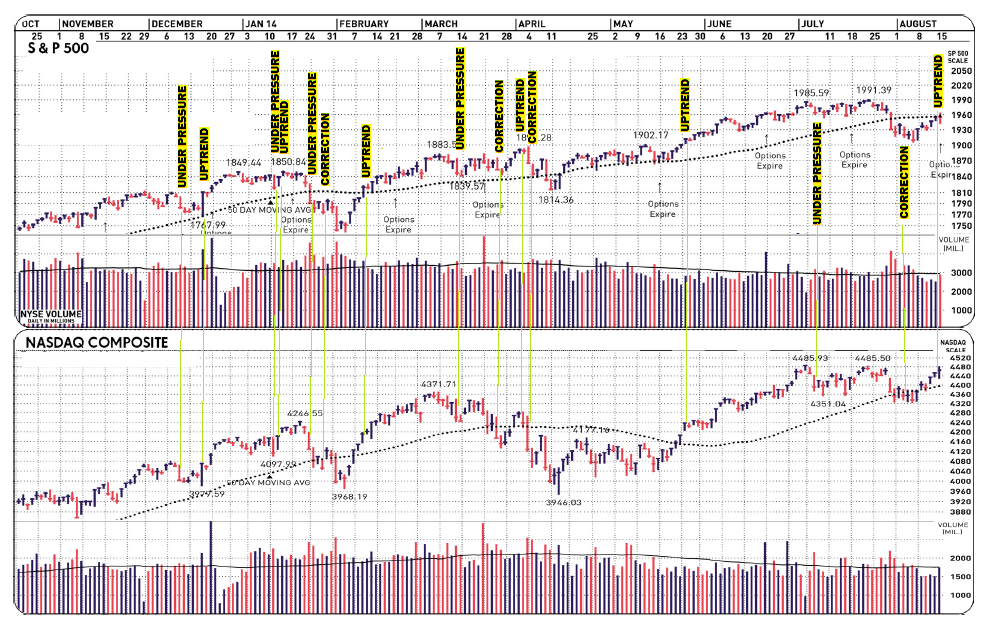

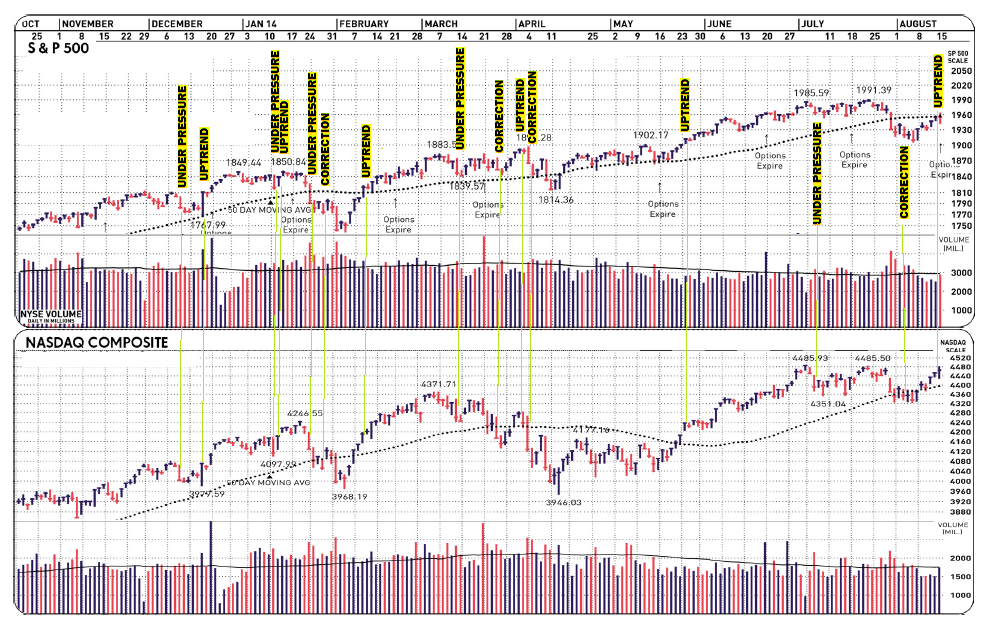

That's right, last Thursday IBD announced that NASDAQ had its "follow-through-day" so investors in the driver's seat just saw the light turn green. That said, we also know that nobody walks across a one-way street without looking both ways, and even though the signs say 'buy' here's what they've been saying so far this year--

--and this is the problem we got driving down the road while only being able to look out the back window.

Remember these market designations are not arbitrary, they're signals proven with decades of research. That said, we're still looking at a market where price trends have not yet proven themselves. We've gotten so many false signals this year that a person would've done better by buying on the 'corrections' and selling when uptrends begain.

Of course, if we're concluding that past patterns don't mean anything for seeing the future, then to be honest we'd also have to admit that simply being contrary promises nothing.

OK, so imho 'honesty' is highly over-rated.

Maybe our bottom line here is that it's IBD's job to show what usually has happened before when stuff looking like today's headlines popped up --and truth betold they do it superbly. When it comes to guarding our family's wealth and keeping the kids fed, well that's our job. It means we can still learn from folks like NEWSMAX/FINANCE, IBD, WSJ, but we also need to kick those guys around on this thread too...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Time to shave and get dressed yet?

Weird! This morning's futures traders see soaring prices for both stocks and metals (w/ say, oil tanking) and we got a rally w/ legs on steroids, there are no major reports to speak of (there are a few but I'm not speaking about 'em) but all that folks care about is Soros and his put options.

So. Forget the news 'cause here's were everyone will be today:

Soros Bets $2 Billion on Stock Market Collapse

Does George Soros Know Something We Don’t About The S&P 500?

Man who broke Bank of England increases bet against US stock market

Tomorrow I think we really need to get back to work though...

From Business Insider:

Good morning! Here’s what you need to know:

It’s A Global Market Rally. Stocks are up everywhere. In Europe, Britain’s FTSE is up 0.6%, France’s CAC 40 is up 1.1%, and Germany’s DAX is up 1.4%. In Asia, Japan’s Nikkei and Hong Kong’s Hang Seng closed just a hair above breakeven. U.S. futures are up with Dow futures up 78 points and S&P 500 futures up 9 points.

Dollar Store Out Bids Dollar Store For Dollar Store. “Discount retailer Dollar General Corp offered to buy Family Dollar Stores Inc for $78.50 per share in cash, trumping an offer by Dollar Tree Inc,” reported Reuters’ Sruthi Ramakrishnan. “The deal, at an enterprise value of $9.7 billion, was proposed in a letter to Family Dollar’s board. Last month, Dollar Tree offered to pay $74.50 per share in cash and stock for Family Dollar, at an enterprise value of about $9.2 billion.”

Chinese Home Prices Fall. “China’s new-home prices fell in July in almost all cities that the government tracks as tight mortgage lending deterred buyers even as local governments eased property curbs,” reported Bloomberg News. “Prices fell in 64 of the 70 cities last month from June, the National Bureau of Statistics said today, the most since January 2011 when the government changed the way it compiles the data. Beijing prices fell 1 percent from June, posting the first monthly decline since April 2012.”

UK Home Prices Plunge. According to new data from Rightmove, London home prices fell by 5.9% in August from a month ago. “[T]his is the largest decrease ever recorded by Rightmove at this time of year, and a lead indicator of a slower market in the second half of 2014,” wrote Rightmove analysts.

Bank Of England’s Mark Carney On The Sunday Times. “Bank of England Governor Mark Carney said officials may raise the key interest rate before workers’ pay increases, according to a Sunday Times interview,” wrote Bloomberg’s Jennifer Ryan. “’We have to have the confidence that prospective real wages are going to be growing sustainably’” before raising borrowing costs, he said. “’We don’t have to wait for the fact of that turn to raise them.’” The BoE is expected to be the first of the world’s big central banks to hike interest rates following the financial crisis.

Nobel-Prize Winner Warns Of Mood Swings. “The United States stock market looks very expensive right now,” said Robert Shiller in The New York Times. “The CAPE ratio, a stock-price measure I helped develop — is hovering at a worrisome level...nothing I’ve come up with is a slam-dunk explanation for the continuing high level of valuations. I suspect that the real answers lie largely in the realm of sociology and social psychology — in phenomena like irrational exuberance, which, eventually, has always faded before. If the mood changes again, stock market investments may disappoint us.”

$50 Billion Man Is Bullish. In a new interview with Barron’s, Federated Investors’ Stephen Auth says the S&P 500 could hit 2,500 in the next 18 months to two years. “Market valuations depend on growth, bond rates and perceptions of risk, and all three of those are going in the direction that actually expands the price/earnings multiple,” Auth said. “At the same time, earnings are expanding, and that’s a recipe for another leg up in the market.”

US Housing Market Check. The NAHB’s Housing Market Index will be published at 10:00 a.m. ET. Economists estimate this index of homebuilder confidence was unchanged at 53 in August. “While momentum has been positive, we only expect a modest increase due to a yet-to-be seen rebound in new home sales,” said Bank of America Merrill Lynch economists who are expecting a print of 54.

Swiss Bank Had A Hand In Portugese Bank Downfall. “Credit Suisse Group AG helped sell billions of dollars of securities that ultimately played a role in toppling Portugal’s second-largest bank,” reported the WSJ’s Patricia Kowsmann, Margot Patrick and David Enrich. “The Swiss bank was responsible for putting together securities that were issued by offshore investment vehicles and then sold to retail customers of Portugal’s Banco Espírito Santo SA. Many customers didn’t realize that these vehicles were loaded with debt issued by various Espírito Santo companies and apparently served as a mechanism to finance the family-controlled empire, according to corporate filings and people familiar with Portugal’s investigation into the Espírito Santo affair. It is unclear what, if any, direct role Credit Suisse had in selling the securities to bank customers. “

Inversion Are Just Hype. “Establishing a tax domicile abroad to avoid U.S. taxes is a hot strategy in corporate America, but many companies that have done such “inversion” deals have failed to produce above-average returns for investors, a Reuters analysis has found,” writes Reuters’ Kevin Drawbaugh. “Looking back three decades at 52 completed transactions, the review showed 19 of the companies have subsequently outperformed the Standard & Poor’s 500 index, while 19 have underperformed. Another 10 have been bought by rivals, three have gone out of business and one has reincorporated back in the United States.”

Seem like, almost every morning I turn on the TV, the Dow Futures are up ~ $40. Eery how consistent it is.

oh well... I’m ready for another leg up.

Homebuilder confidence beats

That's the new "taxes-are-good-for-you" meme going around, saw it the other day here: Tax Inversions Are Bad for Shareholders - Chuck Jaffe, MarketWatch. Apparently there's big money for journalists who urge investors to pour their money into companies that are being fleeced by high taxes. In the mean time this anti business frenzy kicked up against Walgreens got so bad that when they finally caved (under who-knows what kind of duress from the exec. dept.)--

--stockholders got robbed of $ten billion in one day. Controls to prevent people fleeing with their possessions don't work. Despots can either allow capital flight or they end up destroying capital altogether.

Me too. The saying that seems to come to mind is "hold your nose and buy".

Woulda, coulda and shoulda.

I own TSLA but not SCTY

LOL as one of our sales guys said, “I have a pretty good handle on what happened. It’s the future that’s a bit fuzzy.”

:-)

Market definitely in a reverse crash...

NASDAQ at 14-year high

bit fuzzy indeed.

Translation: NASDAQ has been stuck for 14 years and has yet to resume normal growth.

That assumes that the NASDAQ was appropriately priced 14 years ago :-)

GOOD MORNING!!! Another up day for everyone just like yesterday. Reports today are CPI, Housing Starts, and Building Permits.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.