Skip to comments.

Investment & Finance Thread (week July 20 - July 26 edition)

Weekly investment & finance thread ^

| July 20, 2014

| Freeper Investors

Posted on 07/20/2014 4:02:51 PM PDT by expat_panama

Year-to-date wrap-up time.

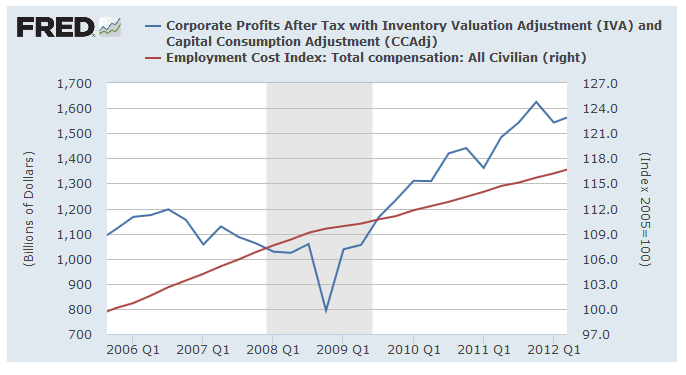

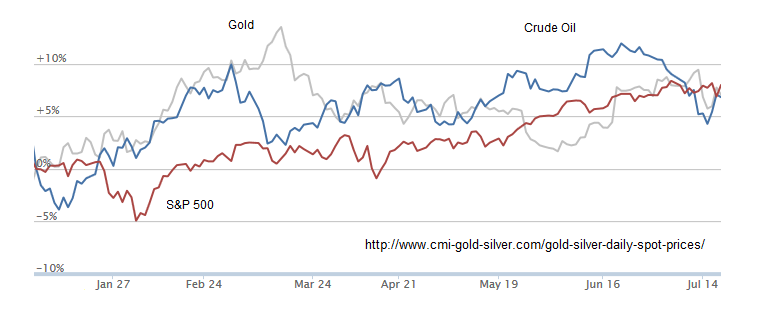

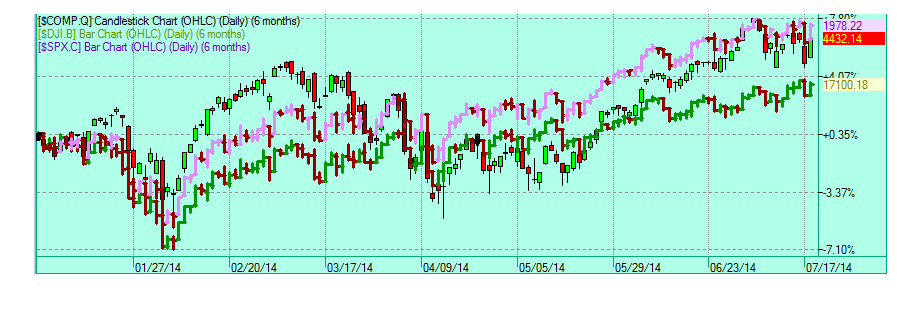

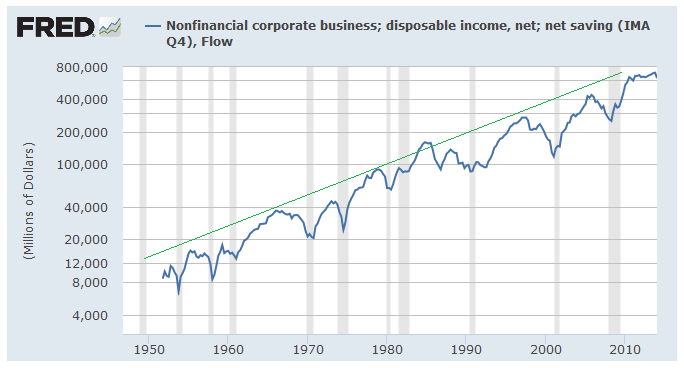

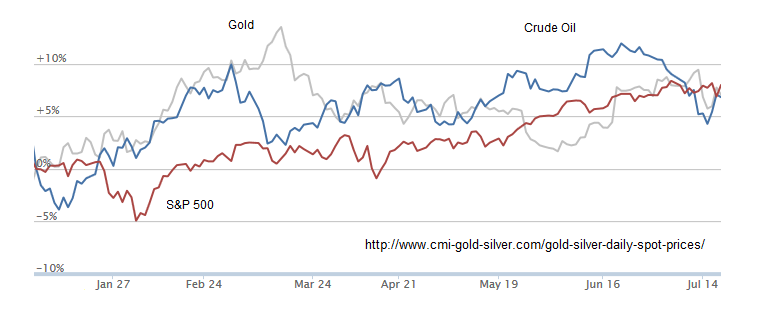

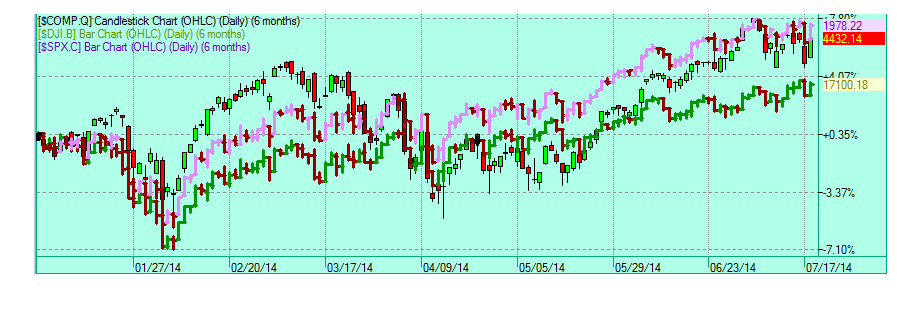

General markets varied a lot but right now they're all together at 5-10% up so far. Actually that's pretty good as it represents a 5-year doubling time. click to enlarge |

A closer look at stock indexes so far this year are showing roughly the same track but my dim eyes are somehow seeing us having a plateau for the past 3 weeks. That's usually a good sign; witness the run-up after the mid-April basing. click to enlarge |

.As Torch says, "Discuss".

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

To: 1010RD

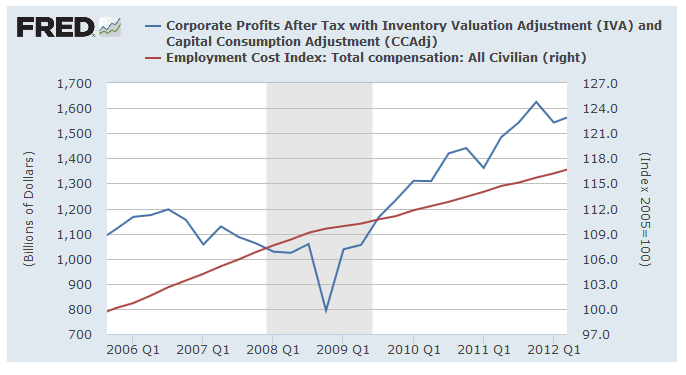

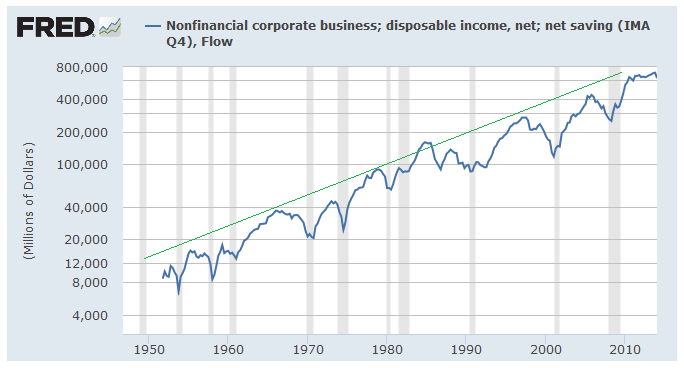

The disparity between corporate profits... ...and the rest of the countryIt's bad but not the way you mean it. Historically average yearly corp profit growth is about 7%, but for the past four years it's hit a brick wall even while employee compensation's jumped another ten percent.

Corp. profits are a good thing, we need them but they're lagging.

Corp. profits are a good thing, we need them but they're lagging.

To: 1010RD

I take that back.

Corp. profits have increased more than pay, though it's been a bit more erratic...

To: expat_panama

Wage growth is always last as slack in the labor market is worked through. Job markets are tightening (look at the JOLTS) but we aren’t at the inflection point for wages...quite yet. It’s coming though. And the Fed sees it.

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Top'o'the morning to everyone as we continue our back'n'forth markets. While this must be great for day-traders my swing-trading (2-3 week frame) just sees everything stalling flat. Note, today's futures have stocks up and metals down awaiting today's CPI and home sales.

- Premarket: Global markets rebound as Ukraine rebels hand over black boxes The Globe and Mail - 2 hours ago European markets rode a global rebound in risk appetite on Tuesday helped by the first signs of co-operation from Ukraine's pro-Russian separatists over the downed Malaysian Airlines plane.

- China food scandal spreads, drags in Starbucks, Burger King and McNuggets in ... Reuters - 6 hours ago SHANGHAI (Reuters) - The latest food scandal in China is spreading fast, dragging in U.S. coffee chain Starbucks, Burger King Worldwide Inc and others, as well as McDonald's products as far away as Japan.

- Saudi Arabia to open $530 billion bourse to foreigners in early 2015 Reuters - 4 hours ago RIYADH/DUBAI (Reuters) - Saudi Arabia plans to open its stock market, the Arab world's biggest, to direct investment by foreign financial institutions in the first half of next year, the market regulator said on Tuesday.

- Why You Should Finally Pay Attention to Earnings Jul 17 by Chad Karnes

- Fund managers unconvinced by Apple rebound

- Why millennials are missing Wall St. gains

- New Warming On the U.S.'s Gathering Debt Storm - Gene Epstein, Barron's

- 'Benedict Arnold' CEOs Are the Real Patriots - Mark Hendrickson, Forbes

- Fed Should Be Asked to Say Why It Sees Market Failure - Iain Murray, NR

- Don't Be Surprised If U.S. Stocks Start To Crack Up - Vitaliy Katsenelson, II

To: expat_panama

CPI +1.9% ex food/energy vs +2.0% consensus

To: expat_panama

To: expat_panama

Just to be clear, I love corporate profits, particularly when they’re my corporate profits. ;-]

There is a trend, and its causes are relatively broad, but generally are driven by government policy, to reduce human labor. Conservatives can address this and I think Uber/Lyft are pointing it out very well. What benefit is there to workers and consumers of a “taxi license”? It helps crony capitalists and Chicago government.

Chicago recently had a license auction and expected prices to be around $360K minimum per license. Nobody came.

There are too many of these kind of anti-labor regimes in place at the local/county and state level. Wise focus on these kinds of working class economic issues - tariffs that benefit only a few families, cab licenses that have cabbies paying $100/day before they’ve made dime one, etc. are easy sells in an urban setting.

What if the top 10 American cities were run by Rudy Giuliani clones?

Take a look here: http://www.washingtonpost.com/blogs/wonkblog/wp/2014/06/20/taxi-medallions-have-been-the-best-investment-in-america-for-years-now-uber-may-be-changing-that/

The trend is real and unless we undo the negative incentives to labor this will force us into a crisis. The result will be permanent transfer payments to what ostensibly would be America’s middle-class. Much of that is already in place.

27

posted on

07/22/2014 6:25:03 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

You have hit the nail on the head. In a fast changing world the government on all levels is clutching for their ability to control who wins and who loses. Instead of allowing entrepreneurs to succeed they seem to want to stifle it. Uber and Tesla’s direct sales are two glaring examples.

To: Lurkina.n.Learnin

They’ve been impoverishing people like that for decades in our cities. It’s only going to get more and more exacerbated as we go forward. It must change and will change by legislation or just breaking completely.

The key here, I believe, for the conservative cause is to get out in front of these issues. We’re not going to get urban centers to come to every cause. They’re just too filled with radical libs (30% normally), but we can capture 51% of voters in election after election by pushing real progress via conservative economic policies. Economic liberty is a real winner.

Who is keeping Walmart and jobs out of the cities? Democrats and their liberal masters.

I also think that arguing in favor of families and marriage will be widely accepted. 4 out of 5 poor families are headed by females who had babies in their teens and never graduated HS. Vouchers also would easily pass in black neighborhoods and among many poor/middle class as well. In Chicago getting into a good public HS is not merit, but politics based.

29

posted on

07/22/2014 8:46:15 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

..to be clear, I love corporate profits, particularly when they’re my corporate profits. ;-]You're absolutely right --what gets my pants in a wad is reading "...robust earnings growth by fattening profit margins... ...by laying off workers..." knowing that the Fed's BEA numbers say otherwise. You're also right that a stupid press is only bad while a stupid government is worse.

To: expat_panama

31

posted on

07/22/2014 1:10:32 PM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

Have you been following this Hebalife/Ackman thing? Popcorn worthy.

32

posted on

07/22/2014 1:25:43 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

HLF +25% today!

Ackman, “Oops...”

To: expat_panama

AAPL missed on sales, beat on EPS. Lowers 4Q guidance. Shares pretty much flat after market.

To: Wyatt's Torch

I wasn’t really paying attention until I saw Akman near tears on the telly.

35

posted on

07/22/2014 1:36:33 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Wyatt's Torch

AAPL generated $10.3B in cash from operations during the quarter and returned $8B to shareholder through buybacks and dividends...

P.S. I hate buybacks... worthless.

To: expat_panama

To: Wyatt's Torch

Wish I had of had some PBYI. Up 225% after hearing.

38

posted on

07/22/2014 1:52:34 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

39

posted on

07/22/2014 1:53:53 PM PDT

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Futures traders are looking at gains in both metals and stocks this morning after yesterday's flat metals and rising stocks w/ increasing volume. Looking like those that sell have sold. Reports today amount to just the Mortgage Index first thing and Crude inventories 3-1/2 hours later.

Morning 'show-prep':

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Corp. profits are a good thing, we need them but they're lagging.

Corp. profits are a good thing, we need them but they're lagging.