Skip to comments.

Is The Takedown Of Gold A Sign That The Entire Global Financial System Is About To Crash?

TEC ^

| 4-17-2013

| Michael Snyder

Posted on 04/17/2013 7:56:19 AM PDT by blam

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-58 last

To: Labyrinthos

No, it means that all the people who are foolish enough to buy gold as an investment have already brought all of the gold that they want or can afford to buy and there are not enough "greater fools" out there to pump the demand that is needed to support the price. Those 'greater fools' are standing in line to buy ammo.

41

posted on

04/17/2013 9:59:14 AM PDT

by

Carry_Okie

(An economy is not a zero-sum game, but politics usually is.)

To: dennisw; PieterCasparzen; All

Thanks for the ping to this very good thread.

One is “possession is 9/10ths of the law”.

Possession is 10/10ths in a lawless environment...and the ability to defend it BUMP!

42

posted on

04/17/2013 10:15:39 AM PDT

by

PGalt

To: Labyrinthos

“No, it means that all the people who are foolish enough to buy gold as an investment have already brought all of the gold that they want or can afford to buy and there are not enough “greater fools” out there to pump the demand that is needed to support the price.”

I see. And what are the enlightened buying these days for an investment?

43

posted on

04/17/2013 10:20:14 AM PDT

by

MichaelCorleone

(Keep your eyes on Jesus. He is the same yesterday, today, and forever.)

To: SeekAndFind

44

posted on

04/17/2013 10:40:03 AM PDT

by

blam

To: aMorePerfectUnion

by

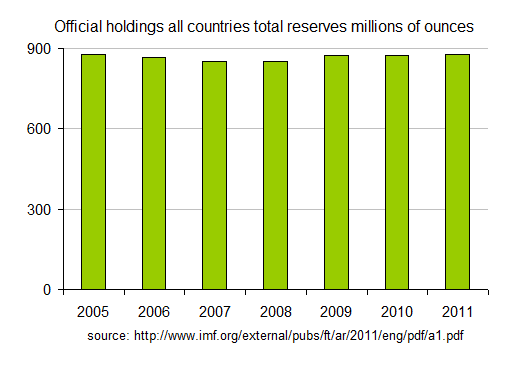

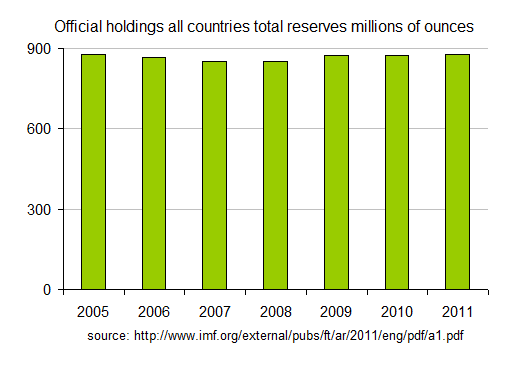

expat_panama the IMF lists total central bank holdings at 879M oz., no change from what it was in 2005.by aMorePerfectUnion IMF?? Read this. Google has much more. http://qz.com/74459/why-central-banks-have-been-hoarding-gold-since-2009/

Our numbers are the same here, qz.com cites gold.org which bases their info on imf.org. Here's the qz.com grapic--

--showing IMF stats on how from 2005 to 2009 central banks sold about a thousand tons of gold which they bought back since. Those sales and purchases (a couple percent--

--per year) have had negligible affect on gold's market price. Consider how they're buying less than a fifth of new mined gold hitting the market and how gold's price soared while central banks sold, and and how the price is tanking now while the banks are buying.

To: MichaelCorleone

The enlightened are not buying, but selling what we already brought at fire sale prices back in 2008 - 2009 when the foolish investors were bailing out of the market as it approached the cyclical bear market low.

To: blam

There’s a run on the LBMA.

Holders of Gold in the LBMA system were *extremely alarmed* by the AMRO default and the Cyprus confiscations. They drew the appropriate conclusion - which is “If you don’t hold it, you don’t own it”. They’re trying to take delivery of their Gold.

And their Gold either doesn’t exist, or it’s been hypothecated and has multiple owners.

The result was this orchestrated takedown. Five hundred tons of fake, not-real, naked-short, birdcage-liner IOU ‘Gold’ was sold on Friday - about 150 tons of it in the space of one hour.

This drop in Gold wasn’t due to a ‘confluence of factors’. That’s just MSM shill-talk.

This was a raid. It was a paper-intervention to shove the price of Gold (and Silver) way, way down.

The bullion banks in the LBMA are desperate. They need to shake metal out of weak hands, and they need to do it now.

The only sensible reaction is to do what the Indians are doing - back up the truck and buy physical precious metals. Just remember to store them outside of the banking system.

47

posted on

04/17/2013 10:48:34 AM PDT

by

agere_contra

(I once saw a movie where only the police and military had guns. It was called 'Schindler's List'.)

To: blam

The price of gold and silver in dollars swing. The value of gold and silver does not swing wildly. Maybe we should chart the price of dollars in grams of gold and silver.

48

posted on

04/17/2013 10:51:08 AM PDT

by

Jabba the Nutt

(.Are they stupid, malicious or evil?)

To: blam; dennisw

“If any of the allegations above are even remotely true, then a whole lot of people need to be criminally investigated.”

Yep. Sure. That’ll happen...

49

posted on

04/17/2013 12:10:34 PM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: E. Pluribus Unum

Cramer basically ran a boiler room operation. How does that orangatang have enough credibility to be on Bloomberg?

50

posted on

04/17/2013 12:42:27 PM PDT

by

Sam Gamgee

(May God have mercy upon my enemies, because I won't. - Patton)

To: Sam Gamgee

He has the primary qualification; the ability to shout over everybody else. The only one better at it is Christine Matthews.

51

posted on

04/17/2013 12:49:49 PM PDT

by

E. Pluribus Unum

("Deficit spending is simply a scheme for the confiscation of wealth." --Alan Greenspan)

To: mountainlion

52

posted on

04/17/2013 1:25:21 PM PDT

by

M-cubed

To: M-cubed

53

posted on

04/17/2013 1:28:17 PM PDT

by

Chickensoup

(200 million unarmed " people killed in the 20th century by Leftist Totalitarian Fascists)

To: SeekAndFind

“So where to go?”

My strategy? Hard assets. Paying off my farm ASAP. No car payment. No CC debt. Stockpiling ammo (when I can find it), canned goods and potable water.

Buy land, for cash if you can.

Lather. Rinse. Repeat. Works in Good Times and Bad. :)

54

posted on

04/17/2013 1:43:35 PM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Jabba the Nutt

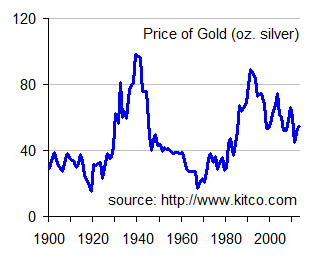

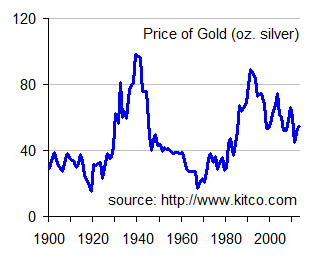

value of gold and silver does not swing wildlyThat depends on whether you're talking some kind of philosophical spiritual wealth or you're making market trades. This is the price of gold in oz. of silver--

--and it's ranged from 15 oz. to 100 oz. silver per oz. gold with far more volatility than we've seen with dollars..

To: expat_panama

Do you believe the Fed and JPM have been conspiring to jam down gold and silver for a few years? GATA was the first to go on about this

56

posted on

04/17/2013 2:05:48 PM PDT

by

dennisw

(too much of a good thing is a bad thing - Joe Pine)

To: dennisw

The gold/silver prices posted were from Kitco’s London markets, so we’d have to expect any conspiracy involving the Fed and JPM to also include the cooperation of a number of other international economic powers.

To: SeekAndFind

Welcome to the economic depression. Now we all know how it feels. It is not very comfortable, is it. We are all just guessing out our butts and trying to hang on.

Since 2008 my SINGLE question has been, does all this end in deflation or severe inflation. If you can answer that question, I can tell you where your money is safe.

For the life of me, I can’t answer it. Everything is and has been pointing to deflation. But the fundamentals of debt and Fed printing look like severe inflation wins in the end.

I guess you can position for both deflation and inflation and hope that when you get crushed by one, you will be offset by your position in the other. For my part, I’m baffled.

I know only one thing. I have ZERO appetite for risk. I am constantly concerned about return of principal, not return on principal.

I didn’t really answer your question because I can’t answer it, because I am still a confustinista regarding the only question that matters. “Does this end in deflation or severe inflation”. I would give half my net worth to know the answer to that question, then laugh all the way to the bank.

58

posted on

04/17/2013 9:50:05 PM PDT

by

Freedom_Is_Not_Free

(Free goodies for all -- Freedom for none.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-58 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson