Skip to comments.

H.R.5404 - To define the dollar as a fixed weight of gold.

congress.gov ^

Posted on 03/28/2018 11:33:11 AM PDT by MNDude

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-114 next last

To: MNDude

A 100% gold standard will reduce the risk of both inflation and deflation and create a more stable monetary system.

61

posted on

03/28/2018 12:43:37 PM PDT

by

mjp

((pro-{God, reality, reason, egoism, individualism, natural rights, limited government, capitalism}))

To: All

> Any profits of the federal reserve are turned over to the Treasury and the control is the federal appointment and Senate ratified of the Chairman and Board of Governors.

What a crock. Even if this was true, the largest share of profit comes from being repayed the principle, which was created -out-of-thin-air-.

If I am a _federal_reserve_ bank and you want to borrow $1,000. I create $1000 out-of-thin-air, and loan it to you at say 10% interest. Legally you must pay me back $1100. So I give $100 to treasury and keep $1000 which I didn’t have to begin with. I made 10 times as much money as the treasure.

62

posted on

03/28/2018 12:45:01 PM PDT

by

veracious

(UN = OIC = Islam ; Dems may change USAgov completely, just amend USConstitution)

To: MNDude

As if the price of gold can’t be manipulated. Feh.

63

posted on

03/28/2018 12:46:33 PM PDT

by

jdsteel

(Americans are Dreamers too!!!)

To: DesertRhino

It was simply created out of thin air and electronically deposited. An 18th Century economist named Richard Cantillon described the localized effects of printed money, and how the "first handlers" of newly printed money always get the benefits of it. In America's case, Wall Street and the major Federal Reserve banks that rec'd this QE money rec'd the greatest benefits.

64

posted on

03/28/2018 12:46:48 PM PDT

by

PGR88

To: DoodleDawg

That tells you that Gold is way undervalued.

To: TheTimeOfMan

Existing $$ will be recalled

New $$ valued in gold will be issued.

Existing $$ have no real value and are a state of mind

66

posted on

03/28/2018 12:49:48 PM PDT

by

Thibodeaux

(Long Live the Republic!)

To: TexasGator

You really believe you know the amount in Russia and china? It's an educated guess, but the IMF and the World Gold Council keep pretty good track of who has what.

To: veracious

Sad, to see so many hereon think _federal_reserve_ is their friend. No wonder we are so lost. Rothchild said (roughly), only one person in a million could understand how fiat currency gave all power to them.

_federal_reserve_ has and is destroying USA. It represents globalism and the transfer of USA industry to other nations. It loans money to non-USA entities and has done so from the beginning.

Return to USConstitution, or perish.

68

posted on

03/28/2018 12:57:29 PM PDT

by

veracious

(UN = OIC = Islam ; Dems may change USAgov completely, just amend USConstitution)

To: MNDude

The Fed won’t like that at all.

69

posted on

03/28/2018 12:59:15 PM PDT

by

Buckeye Battle Cry

(Progressivism is socialism. Venezuela is how it ends.)

To: Red Badger

centrifugal centripital force.

Fixed it.

70

posted on

03/28/2018 1:07:39 PM PDT

by

Ouderkirk

(Life is about ass, you're either covering, hauling, laughing, kicking, kissing, or behaving like one)

To: veracious

That would require a degree of honesty that is not possible amongst all the purchased politicians.

71

posted on

03/28/2018 1:07:43 PM PDT

by

odawg

To: Ouderkirk

That too...................

72

posted on

03/28/2018 1:08:02 PM PDT

by

Red Badger

(The people who call Trump a tyrant are the same people who want the president to confiscate weapons.)

To: DesertRhino

Rather than trying to tie the dollar to a specific amount of gold a better solution would be to change the laws to allow contracts and taxes to be paid in Gold,silver or what else the parties ageeed upon.

geshams law will take care of the rest.

To: All; MNDude

So help me with the math here:

U.S. Money Supply (dollars out there): $13858.30 Billion ($13,858,300,000,000.00)

U.S. Gold Reserves: 261,498,926.241 ounces (Govt. uses "Troy" I presume)

So each dollar bill would represent 1.88694808339406709337e−5 ounce per dollar (0.00001886948083394067 oz. per $)

So each ounce of gold would have to be currently valued at $52,995.63 to account for the current U.S. money supply?

U.S. would have to increase their gold reserves by a lot to avoid wild price swings when The Fed plays with the "M3" money supply? Or increase gold reserves to keep the current gold price? Or ? (I haven't read the Bill...does it mention "the math"?) Comments?

https://tradingeconomics.com/united-states/money-supply-m2

https://www.fiscal.treasury.gov/fsreports/rpt/goldRpt/current_report.htm

74

posted on

03/28/2018 1:14:34 PM PDT

by

Drago

To: MNDude

Does the bill get pulled from consideration if all its sponsors accidentally commit suicide?

75

posted on

03/28/2018 1:15:33 PM PDT

by

Garth Tater

(What's mine is mine.)

To: TheTimeOfMan

I agree. The chances of this ever happening are nil. That said, it would put the Fed and the federal government as we know it out of business. It would result in a market crash that would make Black Tuesday pale by comparison. In two years we would be fully recovered and experience a permanent, non-inflationary boom.

To: huckfillary

In two years we would be fully recovered and experience a permanent, non-inflationary boom. We had inflation, depressions, and boom-and-bust business cycles when we were on the gold standard. Why would those go away if we resumed it?

To: veracious

Today you can go on a personal gold standard, by simply buying gold. But the price of gold fluctuates. And it's market based fluctuation, not government controlled.

I guess what is being proposed is locking the gold - dollar ratio. But how would that work in practice? What would prevent another run on US Gold (assuming there is any) like the one that originally caused use to end the gold standard?

That ability to exchange at a fixed rate turned into a problem for us under Nixon, which is why he took us off the gold standard to start with. We had set a fixed exchange rate: $40 an oz. When our inflation was at about 6% a bunch of countries decided they would rather have the gold. We has a big outflow of gold in a short amount of time: France took $171 million in one day.

So Nixon closed the gold window, ending convertibility.

I don't see how you undo that.

I suppose the idea is to go all the way back to time before FDR confiscated American's money and replaced it all with Fedbux. But a *lot* of water has gone over the damn since then, that is to say our currency has been massively debased.

Here's what it might look like:

Gold is at $1350 an oz. So, if we set the price today a dollar would be 1/1350th of a oz.

The last time we started an official gold standard was 1900 (ending "bi-metalism").

..the dollar consisting of twenty-five and eight-tenths grains (1.67 g) of gold nine-tenths fine, as established by section thirty-five hundred and eleven of the Revised Statutes of the United States, shall be the standard unit of value, and all forms of money issued or coined by the United States shall be maintained at a parity of value with this standard...

This is pretty much what the $20 Gold Liberty Head Double Eagle coin was: it contained 33.431 grams (sorry for unit change) of 90% gold. Again, doing the math 30.8 grams of pure gold. A troy oz is 31.1 grams, so, holders were getting almost exactly (just a miniscule .3 grams less) than one oz of gold in that $20 gold piece. (And, historically the 10% non-gold in US money was silver, so you got 2.4 grams of that "for free" in each dollar.

NOW That's convertibility!

So, lets say we wanted to have honest money like that again. One dollar is 1/1350th of a troy oz, so $20 would be 20/1350ths. Or 1/67th of an oz.

The smallest fractional oz coin currently manufactured by any mint that I am aware of is 1/20th of an oz, and they are damn small. Where as the old $20 gold piece was a chunky coin of 1.3" in diameter and weighing 33 grams, or 1 troy oz. the new one would weigh only 0.015 of a troy oz, or .46 of a gram. (Don't sneeze, your going to lose that $20 gold "piece").

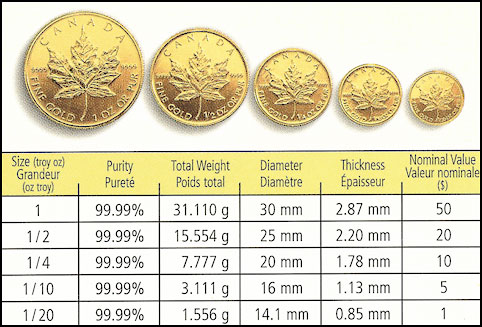

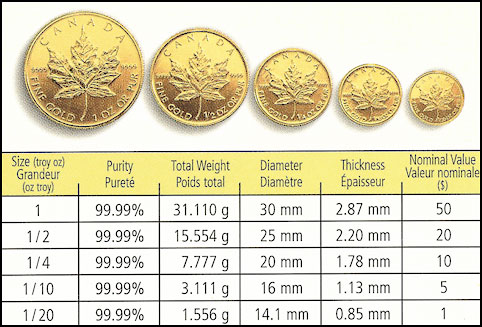

Small factional gold coins available today:

We are getting to the practical limits with the 1/20th of an oz coin (some would say, we've passed it), here are the 1/10th and 1/20th in comparison.

To: entropy12

That will limit expansion of economy by limiting volume of dollars Nonsense. It would put no limits on growth -- prices would simply decrease to create something we've never seen in our lifetimes: currency inflation and price deflation.

79

posted on

03/28/2018 1:23:08 PM PDT

by

BfloGuy

( Even the opponents of Socialism are dominated by socialist ideas.)

To: DoodleDawg

“It’s an educated guess, but the IMF and the World Gold Council keep pretty good track of who has what. “

OK. Which number is correct? China has 1.8k tonnes but mines 0.5k tons per year?

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-114 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson