Skip to comments.

US recession jitters stoke fears of impotent Fed and fiscal paralysis

The Telegraph ^

| September 2016 • 10:20pm

| Ambrose Evans-Pritchard

Posted on 09/08/2016 3:49:42 AM PDT by expat_panama

Debt terrifies people but the paradox of macro-economics is that sometimes borrowing even more is the best way out Credit: Jon Elswick

An ominous paper by the US Federal Reserve has become the hottest document in high finance.

It was intended to reassure us that the world's hegemonic central bank still has ample firepower to overcome the next downturn. But the author was too honest. He has instead set off an agitated debate, and rattled a lot of nerves. ...

...federal debt is already 105pc of GDP - up from 54pc...

...nagging question is what happens at the onset of the next recession. If elected, Hillary Clinton is likely to be...

...new orthodoxy is emerging in elite global circles that the only way to escape of the liquidity trap and soak up excess savings is concerted fiscal stimulus on a world scale. The International Monetary Fund has become the fiscal cheerleader, yet even the IMF cannot seem to marshal its own staff,,,

,,,still pushing the old contractionary view in aggregate, if you tot up its 'Article IV' advice to each country. Follies die hard...

...our desperate deflationary age, and can cast aside deeply-ingrained and totemic beliefs about debt...

...survivors - will be those most willing to seize on the cheapest borrowing costs in history to fight back, preferably combining fiscal and monetary in a radical fashion. Call it helicopter money if you want, or 'overt monetary financing' of deficits. The accounting terminology is irrelevant.

Since no country can risk watching its precious national stimulus leak away to free riders in the austerity camp - at least in a crisis - this may imply some degree of calibrated protectionism. The twin liberal pieties of progressive public policy and global free trade may ultimately come into conflict. That is tomorrow's battle.

(Excerpt) Read more at telegraph.co.uk ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; recession

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; alrea; ...

A lovely new morning!

Stocks are steady moving slightly up in slightly higher trade while our gold and silver hoards hang on to $1,348.91 and $19.96. Futures promise more of the same for stocks but their a bit jumpy on metals @ -0.75%.

Data today:

8:30 AM Initial Claims

8:30 AM Continuing Claims

10:30 AM Natural Gas Inventories

11:00 AM Crude Inventories

3:00 PM Consumer Credit

fwiw:

Top 10 Lessons From 10 Years In The Trenches - Jason Trennert, Strategas

Stocks Inch Closer to 2nd Correction of '16 - Michael Gayed, MarketWatch

The U.S. Jobs Rebound Isn't Helping the 'Missing Men' - Conor Sen, BBW

Will Fed Deliver Another September Surprise? - Anthony Mirhaydari, TFT

Cash Is Freedom, Which Is Why Gov't Hates Cash - J.D. Tuccille, Reason

New Century Brings Big Downshift in GDP Per Capita - Alex Pollock, RCM

Fear Not, 'Brexit' Is Coming to America Too - Thomas Del Beccaro, Forbes

Couples' Money Secrets Imperil Retirement Dreams - Paul Katzeff, IBD

Threads:

To: expat_panama

They say “be careful what you wish for”. A recession at this time might actually save the country. Hillary will loose big, and Obama will not be turned into a FDR.

To: expat_panama

new orthodoxy is emerging in elite global circles that the only way to escape of the liquidity trap and soak up excess savings is concerted fiscal stimulus on a world scaleTranslation: 'we need to steal more purchasing power from everyone who holds fiat currency'.

Peter Schiff called this years ago. To paraphrase:

"There are going to be more QEs than Rocky Movies. And - just like the Rocky Movies - each QE will be worse than the one before."

4

posted on

09/08/2016 4:32:59 AM PDT

by

agere_contra

(Hamas has dug miles of tunnels - but no bomb-shelters.)

To: expat_panama

“The only thing keeping the US out of recession is the US consumer.”

Thank goodness for credit.

5

posted on

09/08/2016 4:48:36 AM PDT

by

moovova

To: ThinkingBuddha

A recession at this time might actually save the country. Hillary will loose big, and Obama will not be turned into a FDR. I'm praying daily for our country's survival. As bad as another recession would be without a real recovery since the last one, it's a small price to pay for America. Even another civil war would be better than losing the legacy of freedom that our ancestors passed down to us in the Constitution and in the Bill of Rights, and a mere recession would be far better.

6

posted on

09/08/2016 5:24:34 AM PDT

by

Pollster1

(Somebody who agrees with me 80% of the time is a friend and ally, not a 20% traitor. - Ronald Reagan)

To: expat_panama

Indebtedness Is Freedom

7

posted on

09/08/2016 5:43:48 AM PDT

by

Iron Munro

(If Illegals voted Rebublican 50 Million Democrats Would Be Screaming "Build The Wall!")

To: expat_panama

8

posted on

09/08/2016 6:04:52 AM PDT

by

Dr.Deth

To: ThinkingBuddha

We are in a recession now.

Only you would not necessarily know that as the media is working triple-overtime to cover it up.

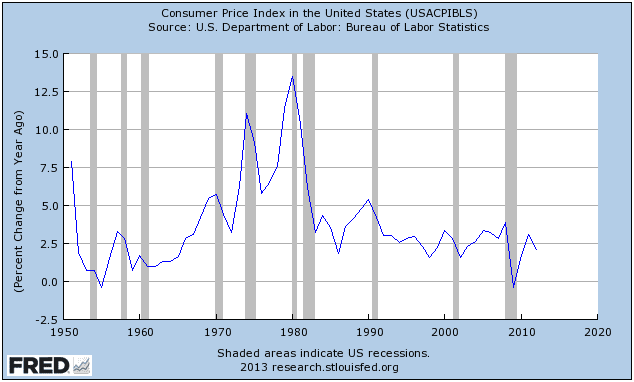

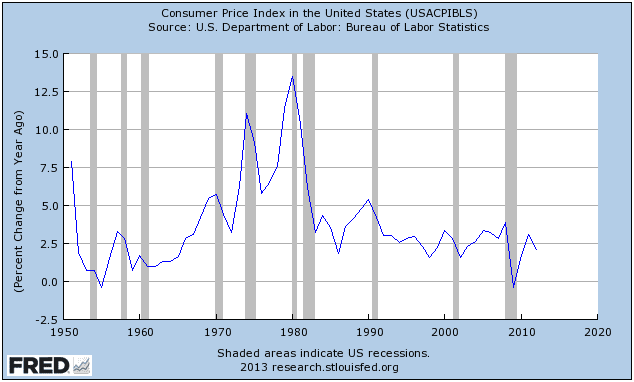

To: Buckeye McFrog; expat_panama; All

"We are in a recession now. Only you would not necessarily know that as the media is working triple-overtime to cover it up."

Don't worry. The MINUTE Trump is elected, they'll add a big, fat, gray bar to this chart...about a DECADE wide!

10

posted on

09/08/2016 8:20:03 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set!)

To: expat_panama

I’ve got analysis paralysis, with just a touch of malaise and a,’smidgen’ of ennui! ;)

11

posted on

09/08/2016 8:23:03 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set!)

To: All

12

posted on

09/08/2016 8:24:10 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set!)

To: expat_panama

Even then it might have to launch a further $4 trillion of QE and stretch its balance sheet to a once unthinkable $8.5 trillion.

Is there anyone that thinks this is not already a virtual certainty? And by doing so, giving another healthy nudge toward making my savings...not worthless but surely worth considerably less.

13

posted on

09/08/2016 10:29:52 AM PDT

by

citizen

(Sanctuary cities: Illegals move in for free stuff, residents move out b/c they can't pay the taxes.)

To: expat_panama

Gee, here is

another money quote you left out.

Larry Summers...said the implication of the Fed paper is that the rates would have to be anywhere from minus 6pc to minus 9pc to extract the US from a deep recession...

So, here we are up against it.

The only path these fiat budgeters can see is massive confiscation of wealth. (By whatever name they choose to call it)

At which time there will no doubt be handshakes and cigars all around!

14

posted on

09/08/2016 10:46:34 AM PDT

by

citizen

(Sanctuary cities: Illegals move in for free stuff, residents move out b/c they can't pay the taxes.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson