Skip to comments.

Consumer Spending Climbs By Most In Almost 7 Years [GOOD NEWS ALERT]

Investors Business Daily ^

| 5/31/2016

| BLOOMBERG NEWS

Posted on 06/01/2016 4:16:13 AM PDT by expat_panama

Consumer spending climbed in April by the most in almost seven years, a sign U.S. households are ready to help jump start growth after a first-quarter slowdown. Key Points Consumer purchases climbed 1% in April (vs. 0.7% forecast) after little change in March Personal income climbed 0.4% for a second month Fed’s preferred measure of inflation (tied to consumer spending) climbed 0.3% from month before, the biggest May 2015; 1.1% from year before

Big Picture

Households will need to do the heavy lifting if a growth rebound is to materialize...

[snip]

The Details

After adjusting for inflation, which generates the figures used to calculate gross domestic product, purchases climbed 0.6% in April, the most since February 2014, after being little changed the prior month Purchases of durable goods jumped 2.2% Price measure excluding food and fuel increased 0.2% in April from month before and 1.6% in 12 months ended April Disposable income (money left over after taxes) increased 0.2% in April from prior month after adjusting for inflation; up 3.3% over past year

(Excerpt) Read more at investors.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; spending

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-45 next last

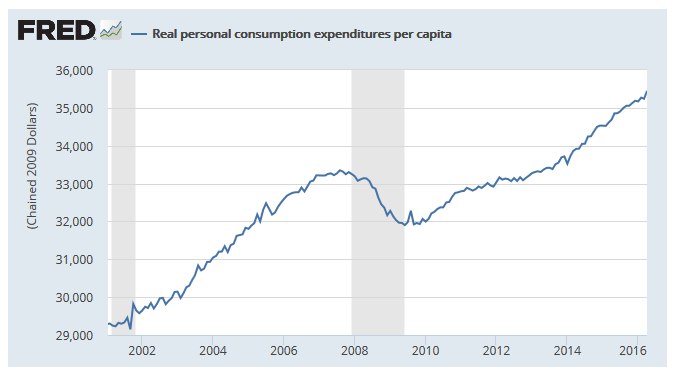

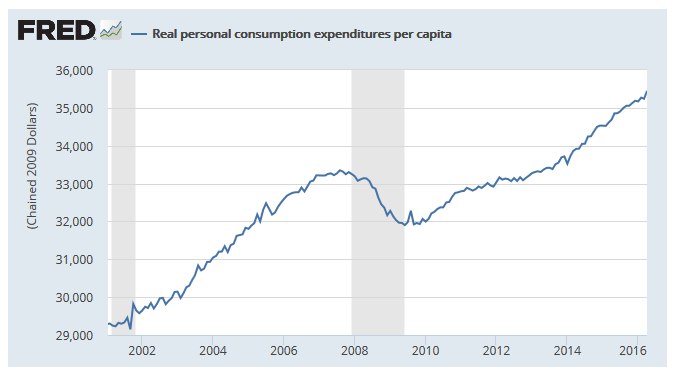

The headline's "big jump" bit made me wonder what the over all long term trend was, but appearantly even when we adjust for inflation and population---

--personal spending is at an all time high and last month's jump was downright healthy!

As usual this kind of stat will be impossible for the living w/ parents comic book set that insists everything is doom'n'gloom, but the rest of us who work for a living understand that there's a lot going on and there are times in life where we need to be ready to accept the good as well as the bad.

To: expat_panama

People are starting to see the Trump light at the end of the tunnel.

2

posted on

06/01/2016 4:17:57 AM PDT

by

ConservativeMind

("Humane" = "Don't pen up pets or eat meat, but allow infanticide, abortion, and euthanasia.")

To: expat_panama

When Trump went over the 1237 mark, I expected to see the financial figures improve. It’s optimism and hope for the future. A shot in the arm.

3

posted on

06/01/2016 4:21:43 AM PDT

by

MayflowerMadam

(Trump loves America and will protect the people who live here first, last and always. - Coulter)

To: expat_panama

4

posted on

06/01/2016 4:24:27 AM PDT

by

rsobin

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; aposiopetic; ..

Happy mid-week investors! Stock indexes ended yesterday mixed in heavier trade as the IBD distribution count falls --the NASDAQ count is too far in the past to matter any more. Things are getting a bit choppy tho and the futures heat map pegs the trend continuing at a flat +0.03%.

Precious metals hang on to their bases w/ gold above its $1,200 and silver atop $16. Still. Futures traders see that sagging now....

LOTS OF REPORTS TODAY!!!!

7:00 AM MBA Mortgage Index

8:15 AM ADP Employment Change

10:00 AM Construction Spending

10:00 AM ISM Index

10:00 AM Construction Spending

10:30 AM Crude Inventories

2:00 PM Auto Sales

2:00 PM Truck Sales

2:00 PM Fed's Beige Book

--and really guys, someone really needs to post some of these:

Socialism Sounds Great Until It Is Unwrapped - Thomas Sowell, Investor's

Guaranteed Income Is a Poor Poverty-Fighting Tool - Eduardo Porter,NYT

Tax Millionaires to Death, They Won't Leave - Jordan Weissmann, Slate

Searching For 'Why' Behind Trump's Problems w/Fed - Judy Shelton, Hill

Uber and Taylor Swift Expose a Fed Without Clothes - Ralph Benko, TAS

A Business Deal? What's Next for Cuba? - Oscar Biscet & Jordan Allot, TWS

Any Real Reform of Wall Street Is Very Doubtful - Darrell Delamaide, USA

Why Stocks Did Better Than You Think in '15 - Simon Constable, TheStreet

Who Is Bearing the Most Risk From Fracking? - Editorial, New York Times

Musk Admits All Dumb Things Tesla's Done - Katie Fehrenbacher, Fortune

To: expat_panama

Consumer spending is not an improvement in the economy. It bumps the numbers in the present moment while doing nothing for the long term. Consumer saving builds the economy for the long term while not giving the politicians the numbers they like to point at to prove how wonderful they are.

6

posted on

06/01/2016 4:30:20 AM PDT

by

arthurus

(Het is waar. Tutti i liberali soli o feccia.)

To: expat_panama

All the leaches got their EITC’s.

7

posted on

06/01/2016 4:35:18 AM PDT

by

poobear

(Socialism in the minds of the elites is a con-game for the serfs, nothing more.)

To: expat_panama

Just in time for the election. I don't remember, but did we see something similar in 2012? There's a jump in the chart for 2012, too.

-PJ

8

posted on

06/01/2016 4:40:04 AM PDT

by

Political Junkie Too

(If you are the Posterity of We the People, then you are a Natural Born Citizen.)

To: expat_panama

The real question is: Are people going into debt with this spending? If so, it's NOT a good thing.

How much of this is spending on goods that they've been putting off but now have to in order to survive? Is spending on health care included?

9

posted on

06/01/2016 4:42:20 AM PDT

by

raybbr

(That progressive bumpers sticker on your car might just as well say, "Yes, I'm THAT stupid!")

To: expat_panama

The one and only cause!

Mr. Trump!

But y’all know who/what will claim the credit, doncha?????

Not ALL Americans are yet awake!

There is still the enemy within; the AINOs!!!!!

Keep working on the truth, America...

Semper FIDELIS

Dick.Gaines: AMERICAN

*****

10

posted on

06/01/2016 4:43:09 AM PDT

by

gunnyg

("A Constitution changed from Freedom, can never be restored; Liberty, once lost, is lost forever...)

To: expat_panama

Buying guns, ammo, food and prepper supplies to avoid the next round of price increases.

11

posted on

06/01/2016 4:43:52 AM PDT

by

Iron Munro

(WAS THE)

To: expat_panama

When you say “adjusted for inflation” - be careful not to accept the phony Government figure of between 1 and 2%. After all: Venezuela has excellent consumer spending numbers right now.

Shadowstats (http://www.shadowstats.com/) uses the same official inflation-determination method that was used in 1990. They show an inflation rate of between 4 and 5%.

The Chapwood Index (http://www.chapwoodindex.com/) is an index that captures true cost-of-living increases across America. It is not used as the basis of Government index figures. When we look at their results we can guess why.

The Chapwood Index shows that annual price inflation has been running north of 9% over the last five years. They report inflation as high as 13% in some cities.

Chapwood simply track the changes in prices of 500 commonly purchased items. They publish their methodology on their website.

The official CPI figures are completely, utterly wrong. If any of you are wondering why you’re so damn poor while “inflation is less than 2%” then there’s your answer.

12

posted on

06/01/2016 4:44:29 AM PDT

by

agere_contra

(Hamas has dug miles of tunnels - but no bomb-shelters.)

To: arthurus

consumer spending is not an improvement in the economyIt could be. That would involve spending on made-in-USA goods. It would also have to be spending that isn't debt-driven.

You brought up consumer saving, which builds the economy for the long term. Near-zero interest rates are a disincentive to saving. What's the point of putting off a purchase until it can be afforded if the money in the bank isn't growing and if the seller is offering very low or no interest on loans to buy stuff for the first few months?

13

posted on

06/01/2016 4:46:51 AM PDT

by

grania

To: expat_panama

Do they adjust for inflation? Real inflation?

14

posted on

06/01/2016 4:58:11 AM PDT

by

palmer

(Net "neutrality" = Obama turning the internet over to foreign enemies)

To: expat_panama

To: grania

Saving is the only economy builder. That doesn’t mean that saving is sensible to the income earner if there are no incentives and money in the bank is actually at risk of confiscation.

16

posted on

06/01/2016 5:10:53 AM PDT

by

arthurus

(Het is waar. Tutti i liberali soli o feccia.)

To: grania

Building economy without debt requires savings.

Building economy with sensibly provided debt requires savings, no matter where the goods are made or by whom.

17

posted on

06/01/2016 5:12:40 AM PDT

by

arthurus

(Het is waar. Tutti i liberali soli o feccia.)

To: expat_panama

Tax refunds were delayed this year by 2 to 3 weeks or more. Tax refunds sent out in bulk on same day or by electronic check to bank. Those that receive EIC refund up 5% Most EIC refunds are multiple thousands of dollars. Those who work and are paying taxes usually don’t get a big refund and are paying their taxes tweeked to their W-2 and don’t get big refunds. More people receiving more in tax refunds than their taxes paid. If you are working less than 35 hrs a week and have kids, there is a good chance you will receive EIC above taxes paid.

To: arthurus

Saving is the only economy builder. That doesn't mean that saving is sensible to the income earner if there are no incentives and money in the bank is actually at risk of confiscationAgree 100%. What's happening now has just about destroyed the middle class and made it impossible for most to get a few steps ahead financially.

If I were younger I'd worry about even "safe" retirement savings. I'd worry about a future where those savings got automatically transferred into "safe" government annuities. That would mean the principle would be gone for future use and future generations. It's already happening. So many seniors have been talked into forfeiting their savings for annuities, just to compensate for low interest rates on their savings.

The more I learn about things, the more having some physical, easily-verifiable gold or silver in ones possession makes sense.

19

posted on

06/01/2016 5:17:45 AM PDT

by

grania

To: arthurus

If the goods are made in the US, that means revenue from local job growth, associated taxes and spending. Manufacturing keeps local communitities solvent. It has to be part of any recovery.

20

posted on

06/01/2016 5:20:13 AM PDT

by

grania

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson