Skip to comments.

Massive Downsizing In Oil Sector Brings Acute Pain For The Holidays

NPR ^

| December 17, 2015

| ANDREW SCHNEIDER

Posted on 12/17/2015 10:14:48 AM PST by thackney

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-49 next last

To: thackney

I remember all those articles in the past 8 years regarding the massive pain $4 a gallon gas and heating oil prices were having on American families...NOT.

21

posted on

12/17/2015 10:42:01 AM PST

by

riri

(Obama's Amerika--Not a fun place.)

To: ColdOne

Take a look at the coal industry. It’s being decimated right now. Look at who’s offering to pick up those companies for pennies on the dollar at bankruptcy auctions, especially companies in the Powder River region of Wyoming.

Also, keep an eye on natgas drillers and developers. They’ll be the next targets.

And then again, with oil, look at how much oil we have in storage vs. demand. The market adjusted to high fuel prices, and now supply has outstripped demand. Oil companies want to open up exports to bump the price up. So why are we still importing oil if we can’t burn through the glut that we’re currently sitting on?

And why are we still letting OPEC set the price if we don’t need their product, and we’re sitting on a glut of domestic oil?

22

posted on

12/17/2015 10:42:12 AM PST

by

factoryrat

(We are the producers, the creators. Grow it, mine it, build it.)

To: factoryrat

And why are we still letting OPEC set the price if we don’t need their product, and we're sitting on a glut of domestic oil? Letting OPEC set the price? OPEC took off their production quotas; they were not following them anyway.

The price is low do to more supply than demand at current prices. As the price stays low and drilling and investment continues to decline, the supply will drop off.

We still bring in more oil from OPEC than produced in any state except Texas.

Crude Oil Production by state

http://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

U.S. Crude Oil Imports by Country of Origin

http://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_epc0_im0_mbblpd_m.htm

23

posted on

12/17/2015 10:51:08 AM PST

by

thackney

(life is fragile, handle with prayer)

To: factoryrat

Oil companies want to open up exports to bump the price up. So why are we still importing oil if we can't burn through the glut that we're currently sitting on? All oil is not the same. The Gulf Coast Region has more expensive light sweet oil than it can use. Many of the refineries in the area are optimized to use cheaper heavy sour. This area will export a little of the expensive oil and import more of the cheaper oil.

24

posted on

12/17/2015 10:53:31 AM PST

by

thackney

(life is fragile, handle with prayer)

To: factoryrat

Yep saw who was picking those up for pennies on the dollar. Horrible. We are so screwed.

25

posted on

12/17/2015 10:59:49 AM PST

by

ColdOne

(I miss my poochie... Tasha 2000~3/14/11 HillaryForPrison2016)

To: thackney

Removing the oil export provision was in the omnibus budget bill (along with making some tax credits permanent), but in return the Republicans gave the Democrats just about everything else they wanted. See this thread:

http://www.freerepublic.com/focus/f-news/3373503/posts

26

posted on

12/17/2015 11:00:27 AM PST

by

CedarDave

(A "moderate" Muslim is one who has not yet been radicalized.)

To: CedarDave

Not permanent tax credits, but just kicking the can down the road for a few more years.

http://www.freerepublic.com/focus/f-chat/3373371/posts

In return, they agreed to the demand from Democrats for a five-year extension of credits for wind and solar energy producers and a renewal of a land and water conservation fund.

http://www.freerepublic.com/focus/bloggers/3373721/posts?page=2#2

Extensions for wind energy’s $0.023/kWh production tax credit (PTC) and solar energyâ€TMs 30% federal investment tax credit (ITC) were pushed by Congressional Democrats in exchange for lifting the ban on crude exports, a policy change long sought by Republicans and the oil and gas sector.

Under the tentative deal, the wind PTC would be extended through 2020 and would decline in value each year after December 2016 until it is phased out entirely. The solar ITC would be drawn down gradually through 2022.

27

posted on

12/17/2015 11:04:40 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

Went through this several times. Once demand catches up with supply things will improve in the patch. Managed to survive 98 we’ll survive this one also.

To: Bob434

You obviously have not been thru an oil bust.

In 1998/1999 my parents had petroleum engineers and geologists mowing their lawn. Sound crazy but when they lost their jobs they started mowing lawns. Only problem is all us ‘awl field trash’ can’t mow each other’s lawns.

29

posted on

12/17/2015 11:10:17 AM PST

by

biff

To: thackney

I can see that scenario. Wasn’t the US looking to do a swap with mexico for their oil? Trading light sweet for heavy sour?

That would actually be a fair trade.

Also, what about Alaska production? Who’s buying that oil? And is it a grade the refineries are geared up to run?

30

posted on

12/17/2015 11:12:09 AM PST

by

factoryrat

(We are the producers, the creators. Grow it, mine it, build it.)

To: Dusty Road

I’m just over here in Midstream & Nat Gas Liquids, trying to keep my head down and not draw too much attention.

In Mont Belvieu, we are probably at the top of a 50 year cycle boom.

Busy time for a little place. The drive and traffic sucks, although...

31

posted on

12/17/2015 11:12:10 AM PST

by

thackney

(life is fragile, handle with prayer)

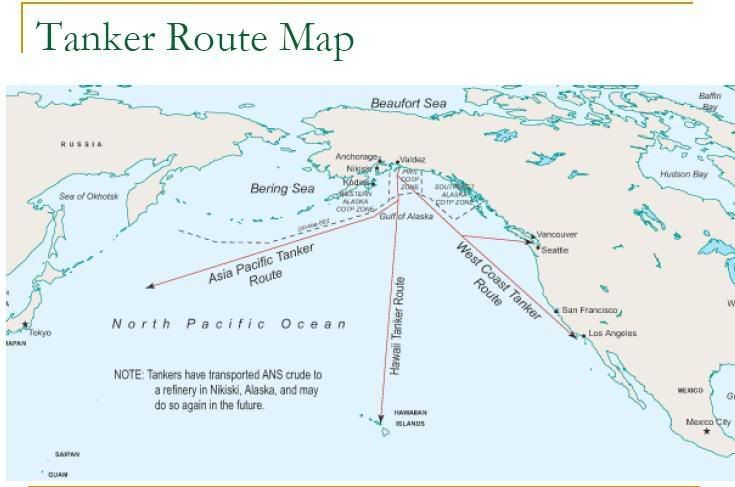

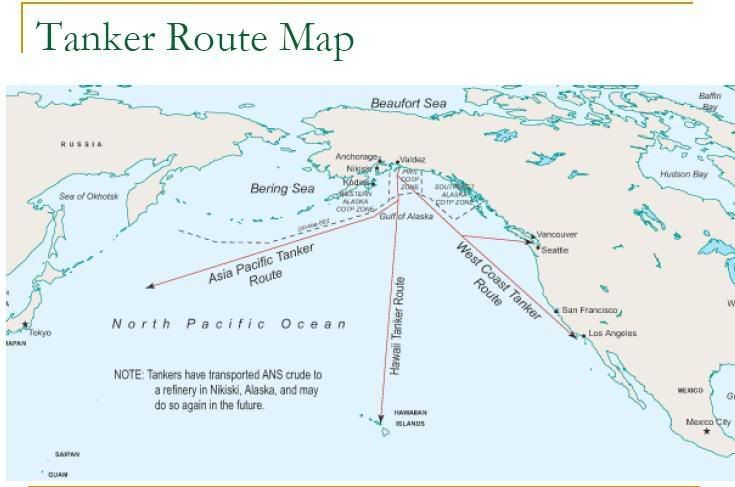

To: factoryrat

Wasn't the US looking to do a swap with mexico for their oil? Trading light sweet for heavy sour? That would actually be a fair trade. It isn't trade even money. We get a bit of cash with the heavy in trade for our light sweet.

Also, what about Alaska production? Who's buying that oil?

Mostly Washington State with the remainder going down to California. Don't believe the myths of Japan and other asia destinations:

It is 3,577 miles from Valdez, Alaska to Tokyo, Japan.

It is 1,274 miles from Valdez, Alaska to Anacortes, Washington. (largest Washington refineries)

It is 2,253 miles from Valdez, Alaska to El Segundo, California (major refinery near Los Angeles)

32

posted on

12/17/2015 11:16:39 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

The good thing about the production side is it’s much safer. While we may shut down the oil production on a few wells we never shut down the gas, it costs us nothing to produce.

To: factoryrat

34

posted on

12/17/2015 11:19:17 AM PST

by

thackney

(life is fragile, handle with prayer)

To: Dusty Road

We have over 200 million barrels in storage in the salt caverns beneath us.

35

posted on

12/17/2015 11:20:24 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

200 million barrels = 11 day supply assuming no rationing.

36

posted on

12/17/2015 11:21:36 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: thackney

The rules of supply and demand are pretty straight forward. Even a kid working at a taco stand can see the writing on the wall when he is surrounded by lots of other fast food restaurants and more being built.

37

posted on

12/17/2015 11:25:10 AM PST

by

DungeonMaster

(2John11 = shun democrats.)

To: central_va

~216 million barrels of Natural Gas Liquids, not oil.

38

posted on

12/17/2015 11:26:00 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

That’s what I thought, makes sense. So that means that the west coast refineries are set up to run Alaskan crude? The reason that I ask is that the railroad that I work for ships some crude out to the refineries up in Washington state. Most of it comes out of Alberta, some of it from the Dakotas. How similar are they?

Sorry to pepper you with questions, just curiosity. It just goes back to a 1940’s textbook I read describing the chemical makeup of crude oil from east to west of the northern hemisphere. Heavy to the east, light to the west is what the book said, more or less.

39

posted on

12/17/2015 11:35:45 AM PST

by

factoryrat

(We are the producers, the creators. Grow it, mine it, build it.)

To: Dusty Road

40

posted on

12/17/2015 11:37:59 AM PST

by

thackney

(life is fragile, handle with prayer)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-49 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson