Skip to comments.

Q3 Earnings Will Be Weak, And It's Not Just Energy

Investors Busniness Daily ^

| 10/06/2015

| CIARAN MCEVOY

Posted on 10/07/2015 4:06:06 AM PDT by expat_panama

The third quarter was a bumpy ride for investors, with violent swings in stocks, weakness in China, Federal Reserve uncertainty and a battered energy sector.

Now, earnings season will likely show how companies struggled to handle those headwinds.

S&P 500 companies are expected to report that Q3 profits fell 4.4% on a 3.5% revenue drop, according to analysts tracked by Thomson Reuters. Excluding energy, S&P 500 companies are expected to grow earnings 3.2% and sales 2.1%.

S&P 500 companies are expected to report that Q3 profits fell 4.4% on a 3.5% revenue drop, according to analysts tracked by Thomson Reuters. Excluding energy, S&P 500 companies are expected to grow earnings 3.2% and sales 2.1%.

Either way, that would be the worst since Q3 2012. Actual results are likely to be a couple of percentage points higher than official Wall Street forecasts.

"It's not materially different from what we saw in Q2," said Sheraz Mian, director of research at Zacks Investment Research. "They're the same headwinds everybody cited as reason for their bad earnings."

Big Cap, Big Exposure

Being more exposed to international markets, large-cap S&P 500 companies are more vulnerable to currency headwinds and overseas woes than U.S. businesses overall.

Analysts predict that the industrials sector will see its earnings decline 3.7% and revenue fall 5.2%. Both DuPont (NYSE:DD) and Caterpillar (NYSE:CAT) have warned...

[snip]

Manufacturers are also being hurt as the materials and energy sectors slash spending due to weak demand and prices.

Analysts predict that the materials sector will report earnings down nearly 16% and revenue off 9.3%. Alcoa (NYSE:AA), which reports Q3 results Thursday, is expected to suffer a 54% net income decline.

"Definitely China not buying as much raw materials is hurting a lot of these companies," said Gregory Harrison, senior research analyst at Thomson Reuters.

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: business; economy; investing

Not a good sign. Lowered earnings expectations hurt the capital markets which in turn hits hiring and then everyone's in a bad way.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Happy mid-week everyone! Yesterday's profit taking came out as an opening distribution #1 for NASDAQ (barely) but today's futures traders say it's +0.47% for stocks and -0.04% for metals (after yesterday's rally; gold, silver now climbing to $1,148.93, $15.95!). Lot's going on, there are reports--

7:00 AM MBA Mortgage Index

10:30 AM Crude Inventories

3:00 PM Consumer Credit

--and news--

--and FR threads:

To: expat_panama

3

posted on

10/07/2015 4:32:35 AM PDT

by

Soul of the South

(Yesterday is gone. Today will be what we make of it.)

To: Soul of the South

the federal government claims the unemployment rate is only 5.1%.Not the federal gov't, it's only the dems that push the unempl rate anymore.

Sure, the UR comes from the BLS but so does the Labor Participation Rate.

To: Soul of the South

5

posted on

10/07/2015 4:42:57 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: expat_panama

Isn't the official BLS number for unemployment 5.1%? That is the federal gov't.

6

posted on

10/07/2015 4:47:25 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: expat_panama

Oh, I didn’t see the text after the broken record graphic. Doesn’t matter, though. It’s like a poll that includes results on many things. Usually one will be the “big number” and hence, the attention getter.

If the FedGov wished to highlight the labor participation rate to a higher degree, they would. Their headline number is the UR.

I do take your point that the media does also choose which to stress.

7

posted on

10/07/2015 4:53:32 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: citizen

Look for the FED to be buying our own bonds again?Personally my thinking is that there's no more ammo left (rates @ zero already). That plus Yellen seems to care too much about how much others like her (remembering some news blurb I can't find now about her promising to really raise rates next time). Then again, if China's dumping raises rates...

To: citizen

True, and while Obama and Cruz are both federal gov’t employees what comes out of ‘em is very different.

To: expat_panama

At this point, I see as the real concern is that China, or anyone - including the US or other private sector, isn’t buying our bonds then we (the FED) has to buy them from ourselves?

Redeeming some holder’s short bonds and then buying our own long bonds...this just another form of kicking the can to delay the inevitable.

If it wasn’t government doing it, I think it would be illegal - or should be. Sort of like the analogy of borrowing on one credit card to pay what is due on other CCs. And we know how that always works out.

10

posted on

10/07/2015 5:30:36 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: citizen

This should more properly read "....isn’t buying enough of our bonds"

11

posted on

10/07/2015 5:46:18 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: citizen

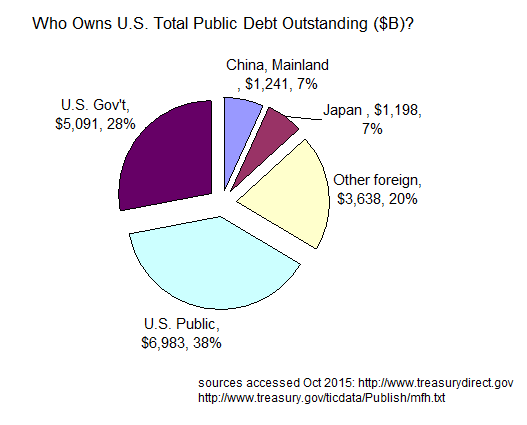

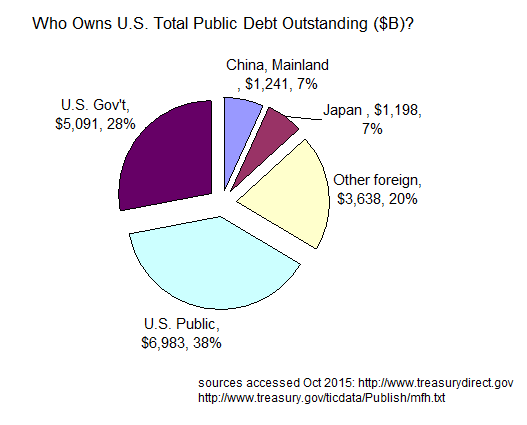

concern is that China, or anyone - including the US or other private sector, isn’t buying our bonds then we (the FED) has to buy them from ourselves? it would be illegal - or should be.China does hold 7% of the U.S. national debt--

-- but for some reason everyone wants to loan the U.S. money (from here) including (believe it or not): Russia $81.7B, Mexico $85.9B, Colombia $37B. and Kazakhstan $24.4B! As far as buying back debt, the way it works is a person (or a government) can borrow from others what ever others are willing to loan, but there's never a limit on how much folks can borrow from themselves. imho it's not really "debt", it's just pretending to have lots of money saved when you actually already spent it.

To: expat_panama

...never a limit on how much folks can borrow from themselves. imho it's not really "debt", it's just pretending to have lots of money saved when you actually already spent it.Isn't that how too many American households do it??

Now....where did I put that picture of the house of cards....?

13

posted on

10/07/2015 8:17:27 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: citizen

Noon numbers

DJIA

16,832.36 +42.17

Nasdaq

4,739.30 -9.07

S&P 500

1,979.11 -0.81

GOLD

1,143.00 -3.80

14

posted on

10/07/2015 8:58:45 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: citizen

folks can borrow from themselveshouse of cards

It's not unstable at all. Watch: I will now loan myself four trillion dollars. [...write write write write... ]. There. I'm now rich becuase I have a signed IOW for $4,000,000,000,000! Not only than but I got excellent credit because I'm able to borrow $4,000,000,000,000! On top of that, I'm perfictly solvent becuase I can pay off my entire debt --watch me: [...rip rip rip... ] and now I have not only paid $4,000,000,000 to cancel all may debts but I've also just had a $4,000,000,000,000 income from the paying back of loans! Ya know, I could do this all day long --is that stable or what?

The only problem I see is it's goofy as all hell and pure fiction. Our U.S. gov't says that there's plenty of money in the social security lock box and any talk about the gov't owing itself $5T has to involve very big words so everyone gets bored. imho they should just admit they spent the social security payments and they're expecting the next generation to support someone else's mom&pop so they'll have less money to support their own mom&pop.

Ya know, I really prefer clarity. Meanwhile I'm still trying to figure out why each and every average citizen of Kazakhstan has decided to loan out of their own pockets $1,500 (from every man, woman, and baby Kazakhy) to the U.S. just so we can be able to pay for both midnight basket ball and a Laurence Welk Museum in North Dakota.

To: expat_panama

That’s a heckofa system! Beats the heck out of buying scratch off tickets.

But the part I’m really impressed with is when I get retired and buy that travel trailer, I’m heading right for the Laurence Welk Museum in North Dakota.

LW: “A one and a two...”

16

posted on

10/07/2015 10:46:21 AM PDT

by

citizen

(America is-or wa5s-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: expat_panama

Great links. Particularly on dynastic wealth. I’d like to see a study done on political dynasties. Do those last in America?

17

posted on

10/10/2015 2:21:57 PM PDT

by

1010RD

(First, Do No Harm)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

S&P 500 companies are expected to report that Q3 profits fell 4.4% on a 3.5% revenue drop, according to analysts tracked by Thomson Reuters. Excluding energy, S&P 500 companies are expected to grow earnings 3.2% and sales 2.1%.

S&P 500 companies are expected to report that Q3 profits fell 4.4% on a 3.5% revenue drop, according to analysts tracked by Thomson Reuters. Excluding energy, S&P 500 companies are expected to grow earnings 3.2% and sales 2.1%.