Posted on 08/27/2015 6:37:53 PM PDT by SkyPilot

Former Dallas Federal Reserve President Richard Fisher made sound remarks when discussing the current market meltdown with CNBC on Tuesday.

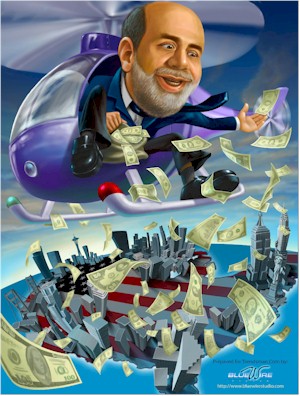

Although he is incorrect in his assertion that the United States central bank will do what’s right for the national economy and avoid monitoring daily activity reports, he was right that investors are addicted to easy money from quantitative easing, otherwise known as QE.

“I don’t think there is a single member of the FOMC that’s going to react to one day’s market activity,” Fisher told the business news outlet. “Nobody on that committee would like to see that continue, they’d like to find the right exit point and they’ll see what it is.”

With that being said, Fisher does think the stock market crisis is an illustration of the way traders and investors think and behave today.

“It does demonstrate that people are hooked on the heroin of quantitative easing,” he said.

Fisher may argue the Fed will focus on the “good that’s going on in the economy.” But David Stockman, former Reagan budget chair and bestselling author of “The Great Deformation,” believes the Fed will employ a number of manipulative tools to contain “the giant financial bubble.”

“So now comes the era of gluts, shrinking profits and a drastic deflation of the giant financial bubble that the world’s central banks have so foolishly generated. And this time they will be powerless to stop the carnage,” he wrote in an op-ed.

“Yet the beleaguered central bankers will launch desperate verbal and market manipulation ploys to brake the current sell-off and thereby preserve the bloodied remnants of their handiwork."

(Excerpt) Read more at economiccollapsenews.com ...

Until tomorrow, but that’s just some other time.

What happens when the Fed raises the interest rates on 20 trillion dollars of debt?

Dude sounds like he admits they are out of bullets

desperate verbal and market manipulation.

preserve the bloodied remnants of their handiwork.

ruh roh.

Without taxation or flat out theft, we are in deep kimchee.

I would not touch this with Bernakes ****

If interest rates were to rise significantly, our Federal government could not pay both debt interest and also pay Social Security, Medicare, Medicaid, our military, and scores of welfare programs at the same time.

What could go wrong?

Per last year's budget agreement in Congress, the US taxpayers are now on the hook to pay those held in the US should it all collapse (thanks Republican Congress!)

Also, our bank deposit are no longer ours. The banks now have the authority to seize all deposits to pay derivatives.

At 20 trillion debt it will not take much to put the squeeze on, but hey we givin ya what yall want.

And Big Ben and the boys wont lose.

Wall street wont lose, and you wont lose either will ya?

After all this is the greatest economic time the world has ever seen.

By the way, where is Ben and what is in his portfolio?

Charlatans.

Snake oil sales men..

Grifters They work in packs

Get yerself an Iphone and order a dominos pizza on your app, you’ll feel better...

/s

1% of a quadrillion is a hella lot of zeros.

Economic Collapse News? They are usually so bullish.;-)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.