Posted on 11/30/2014 1:24:35 PM PST by expat_panama

Once again we can say we're looking at a great time for investing! OK, so it means we wince over last Friday's metals prices, but like who does metals anyway dude, like it's soooo 2013 even. That and the general feeling we get reading stuff like Gold mining industry mostly ‘under water’ – Gold Fields CEO (h/t Chgogal).

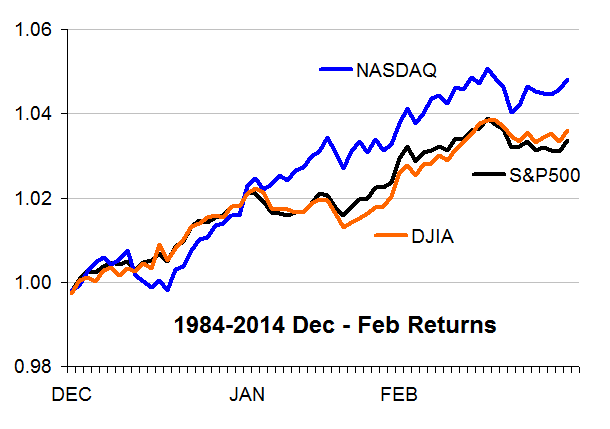

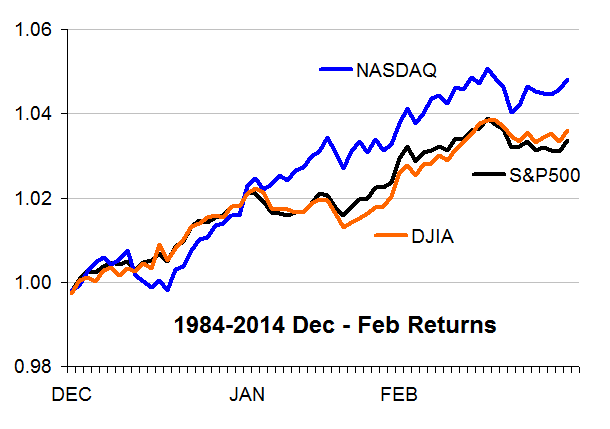

Hey, I'm talking stock market year end "window dressing"† January effect --check out the averages over the past 30 years for the Dow, S&P500, and the NASDAQ, they typically go up 3.4%, 3.6% and 4.8% respectively. On top of that these are for just 3 months and it translates to annualized returns of 15%, 14% and 21%!

Only thing we could hope for is that we're looking at an average year --problem is that the reason this time it's different is becuase it's always different. The plots on the right (click to enlarge) show how the stellar year-end trends look compared to what the 30-year extremes have been. Sure, the past 3 decades includes the 2009 Inaugaration Grand Market Crash that was in all the papers, but still we all know that we can't just buy and expect any guarantees here.

That said yours truly is cautiously moving back in w/ one hand while the other hand's holding on to the ejection seat lever. Stay calm. Remember that the new congress takes office in the latter part of Jan. and they won't be able to have any actual impact until weeks later. At the same time we know the President has already gotten middleeast-defeat, amnesty, Ferguson, and obabacare-defiance completely out of his system so that there's nothing down the pike that he might toss out that can possibly be any worse....

† "window dressing" is when institutional traders clean up their portfolios at year's end w/ pop darlings bought w/ cash from dumping the bow-wows --the idea being they want the annual report to look better.

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

Iran Wary of Oil ‘Shock Therapy’ as OPEC Vies for Market Share

UK’s key Gulf ally Oman faces catastrophe from Opec oil price war

http://www.businessinsider.com/bakken-and-permian-shale-basin-in-red-2014-11

2 Of America’s Important Shale Basins Are Now In The Red

http://www.finnewsnetwork.com.au/archives/finance_news_network98611.html

AUD under heavy pressure early on Monday

https://au.news.yahoo.com/thewest/business/national/a/25650753/australian-market-set-to-open-lower/

Australian market set to open lower

The 'even-better' ping list.

Even After Selloff, Energy Stocks Find Few Buyers

Investors Hesitate to Chase Bargains Following Oil-Price Slide

By Dan Strumpf, Matt Wirz and Nicole Friedman

Nov. 30, 2014 2:36 p.m. ET

Energy stocks are on sale following a five-month plunge in crude oil, but so far few investors are heeding the temptation to bargain-hunt.

Portfolio managers and analysts covering the sector are bracing for a wave of dividend cuts, share-repurchase delays and capital-spending reductions that will likely ripple across an industry reeling from the 38% tumble in U.S. crude futures since June. Distressed-debt investors are circling a handful of deeply indebted U.S. shale-oil producers that are deemed unlikely to survive further oil-price declines without mergers or overhauls.

Driving the tumult, traders and analysts say, is a steepening decline in the price of crude oil. Entering 2014, few analysts predicted that crude futures would move much from a range of $80 to $110 that has prevailed since the financial crisis.

But now, following an unexpected decision by the Organization of the Petroleum Exporting Countries to maintain its existing output target, prices could soon plumb new depths, analysts say, testing the finances of many energy companies large and small. Nymex crude now sits at $66.15 a barrel, a five-year low.

“There’s lower prices ahead,” said Ed Morse, global head of commodities research at Citigroup Inc.

On Friday, energy companies in the S&P 500 tumbled 6.3% in the wake of the OPEC decision. Over the past three months, they have fallen 18.3%. The broader S&P 500 is up 3.2% in the same period.

snip

tx abb. Is it just me or is the world really sort of picking up speed lately?

http://www.businessweek.com/news/2014-11-30/oil-at-40-possible-as-market-transforms-caracas-to-iran

Oil at $40 Possible as Market Transforms Caracas to Iran

Lookie here.

http://www.skynews.com.au/business/business/market/2014/12/01/gold-falls-on-opec-decision.html

Gold falls on OPEC decision

Published: 8:26 am, Monday, 1 December 2014

Gold has neared a two-week low as weaker oil prices and a firmer US dollar pressure investors’ appetites for protection from inflation.

The most actively traded contract, for February delivery, fell $US22, or 1.8 per cent, to settle at $US1,175.50 a troy ounce on the Comex division of the New York Mercantile Exchange. This was the lowest settlement level since November 13, when prices closed at $US1,161.50 an ounce.

Gold futures pulled lower as US investors had their first chance to react to Thursday’s drop in crude oil prices. The Organisation of the Petroleum Exporting Countries on Thursday said it would leave output quotas unchanged. The decision comes as plentiful global supplies of the fuel have pushed benchmark prices down by more than 35 per cent since June.

Tumbling energy costs are turning up the heat on investor demand for gold, said George Gero, a senior vice president with RBC Capital Markets Global futures. Gold is a popular hedge against inflation, as some investors believe it will hold its value better than other assets if consumer prices rocket higher.

However, with oil prices in retreat, a major contributor to production costs is shrinking, a shift that is likely to keep inflation tame for months to come.

‘Manufacturing costs are sure to go down because of low crude prices—trucking, transportation and utility costs will go down too,’ Gero said.

U.S. stocks may need a December rally to combat year-end headwinds

Huh, whenever oil's price soars we always hear the pundits say that although "oil’s jump is great for producers, it could spell trouble for the U.S. economy at large,"

Lol, it depends on where you are in the economy. Oil patch landowners who get paid royalties from production definitely get affected. As do the local governments who wax fat off the sales taxes that goes with the activity.

I see it up close every day here in North Central Louisiana. Lots of gas production coming online. Drilling, pipelines, several new gas processing plants in the area, etc.

Live trading (here) has got it now at $1,168.10.

BHP Billiton Limited’s trifecta of bad news: Is this a stock to buy in 2015?

http://www.bhpbilliton.com/home/Pages/default.aspx

Mrs. 2nddivisionvet reminds you all to look at your vision insurance and get some glasses and or contacts before the year is out.

So lower interest rates are here to stay for a while?

Aust bond futures strong on oil falls

December 1, 2014 - 9:02AM

Australian bond futures prices are remaining high on the back of falling oil prices.

Oil prices have slumped to four-year lows after OPEC decided against cutting the amount of oil it produces, despite a glut in global supplies.

“Friday’s overnight session was dominated by a sharp drop in both Brent and WTI oil prices as the market digested OPEC’s announcement,” ANZ economists said.

“Bond yields fell on the assumption of resulting lower inflation.”

Advertisement

At 0830 AEDT on Monday, the December 2014 10-year bond futures contract was trading at 96.950 (implying a yield of 3.050 per cent), unchanged from Friday.

The December 2014 three-year bond futures contract was at 97.610 (2.390 per cent), up from 97.590 (2.410 per cent).

Have an appointment with the eye doctor tomorrow morning.

http://blogs.wsj.com/moneybeat/2014/11/30/lessons-from-oils-black-friday/

Lessons From Oil’s Black Friday

By Jason Zweig

There are lessons in this latest Black Friday for all investors, not just those who lost money on commodities. Here are some of the most salient.

Beware of extreme extrapolations.

When the consensus is strong, it’s wrong.

Understand how you will make money before you risk losing it.

http://www.gurufocus.com/news/295937/opecs-early-christmas-gift-to-you—bp

OPEC’s Early Christmas Gift to You - BP!!!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.