Skip to comments.

100th Anniversary of the Income Tax

Townhall.com ^

| February 3, 2013

| Heather Ginsberg

Posted on 02/03/2013 4:05:49 PM PST by Kaslin

Today is the 100th birthday of the income tax. On February 3, 1913 the 16th amendment was ratified, which enabled the establishment of the federal income tax. This is ever in our mind as tax season is now upon us.

Look at this graphic that Americans for Tax Reform released in honor of the 100th anniversary:

| |

1913 |

2013 |

|

Top Tax Bracket |

7% |

39.6% |

|

Tax Bracket Range |

1% - 7% |

10% - 39.6% |

|

Top Tax Bracket Threshold (today's dollars) |

$11.6 million |

$450,000 |

|

Total Tax Revenues (today's dollars) |

$16.6 billion |

$2.7 trillion |

|

Family Standard Deduction (today's dollars) |

$93,000 |

$12,200 |

|

Total Number of 1040s filed |

358,000 |

140 million |

|

Total Pages in Tax Code |

400 |

73,954 |

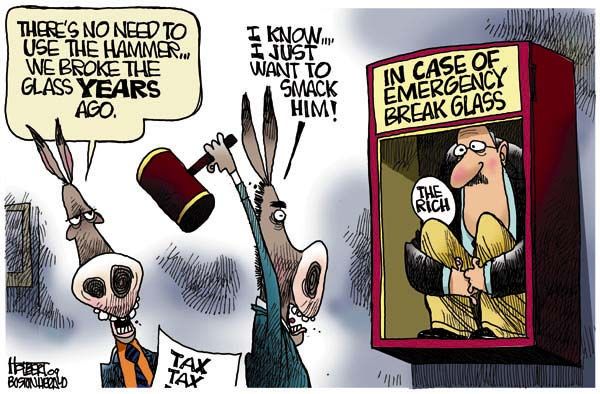

Is it just me, or does this show something is a little off? Oh yeah, remember that part where liberals think the rich need to pay their fair share! Look at our top tax bracket, who on earth would have thought one hundred years ago we would be asking almost half of Americans to pay even more in taxes?

Well, happy tax season! And the happiest of birthdays to one of the biggest pains!

TOPICS: Business/Economy; Culture/Society; Editorial; Government

KEYWORDS:

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

1

posted on

02/03/2013 4:05:56 PM PST

by

Kaslin

To: Kaslin

Yiipppeee!! 100 years of serfdom.

2

posted on

02/03/2013 4:16:28 PM PST

by

BipolarBob

(Happy Hunger Games! May the odds be ever in your favor.)

- United States the Biggest Money Printing Loser (Peter Schiff)

- The Biggest Loser

- Germany creates pile of golden opportunities (repatriated gold)

- It Will Take The Fed Seven Years To Deliver 300 Tons Of German Gold

- Germany Repatriating Gold From NY, Paris 'In Case Of A Currency Crisis'

- Bundesbank to pull gold from New York and Paris in watershed moment

- Game of Thrones: Gold, Germany, France, Taxes and the Debt Ceiling

- Oldest Swiss Bank Perishes in US Tax Case

- Angela Merkel: Eurozone crisis 'far from over'

- Business As Usual ..Louis Rukeyser .....Gold Bugs' Have Amnesia . (from 1978)

- Bacteria that poop gold? Yep, that exists, and it's in an art exhibit.

- ARE Central Banks And Wall Street Insiders Are Rapidly Preparing For Something BIG

- Soros Unloads All Investments in Major Financial Stocks; Invests $130 Million In Gold

- Central banks double last year's gold buys

- Iran Gold Imports Surge -- 1.2 Billion USD Of Precious Metals From Turkey in April Alone

- Leading Cycle Theorist Predicts "BIG Volatility Come September/October"

- CBO says US likely to fall off 'fiscal cliff' if Bush-era tax cuts allowed to expire

- BofA Technical Analyst: Gold Is Set For A Rally, Could Go As High As $3000

- Why Has Gold Fallen In Price And What Is The Outlook?

- Japan and Europe Are Killing Themselves

- Becoming An Invisible Man Could Save Your Wealth -- Trace Mayer 25.Apr.2012

- Utah Legislature goes for gold, silver as currency options

- Syria Liquidating Gold to Mitigate Sanctions

- Doomsday Preppers

- Don't blame the Depression on the gold standard ñ but don't expect it back either

- 5 Black Swans That Could Obliterate America's Future

- Mercenary Geologist Mickey Fulp -- January's Bull Stampedes into February

- All The World's Gold: How much is there? Who has the most? Where is it mined?

- Roubini: Gold Standard Fans Are ëLunatics and Hacks'

- Pure Gold USB Memory Stick from the Middle East

- South Carolina mine sparks mini-gold rush to the Southeast

- Post melt down money.....gold not all it is cracked up to be.

- What caused the recession of 1937-38?

- Follow the Money -- ... do they really know what they are talking about?

- Astronomy Picture of the Day -- On the Origin of Gold

- The Age of Permanent Crisis

- Armed robbers steal four tonnes of gold in Zimbabwe

- Gold Push Unlikely to Be Scrapped

- Opening Vaults May Anger Deity, Supreme Court Told

- Return of the Gold Standard as world order unravels(Gold has already replaced the dollar)

- No Solution To The Global Credit Crisis, Rising Gold And Silver Prices

- Zimbabwe Central Bank urges gold-backed Zim dollar, warns US Dollars days numbered

- Dealing with Our Coming Economic Disaster

- Morning Note: Gold Replacing Dollar as World's Reserve Currency?

- China's Central Bank Recommends Gold For "Value Preservation"

- The Floating Dollar as a Threat to Property Rights

- Rotten to the core (Food and energy inflation cannot be ignored)

- Oooops! Saudi oil reserves 'overstated by 40%' (Long suspected, now apparently confirmed)

- Precious Metals: 10 Things To Know Before Jumping Into Gold And Silver (The good and the bad)

- Egypt Turmoil Rattles Mideast Markets

- Virginia Considers Gold as Alternative Currency for When FED Breaks Down

- 2011 ñ The year when money starts to die

- HYPERINFLATION WILL DRIVE GOLD TO UNTHINKABLE HEIGHTS

- Gold Bears Predicting The Price Of Gold

- Top 10 Ways to Prepare for the Total Breakdown of Society Without Looking Like a (Complete) Lunatic

- Never Mind Watergate

- Gold Never Has Been (And Never Will Be) In A Bubble

- Who is Zubi Diamond?

- US Is 'Practically Owned' by China: Analyst

- Red China: Chinese think tank warns US it will emerge as loser in trade war

- 14 dead, 8 trapped in China gold mine fire

- Idaho GOP Approves Far-Right Platform: Repeal 17th Amendment, Buy Gold And Silver

- Party poopers: Most gold timers are skeptical of gold's recent strength

- Collapse of the American Empire: swift, silent, certain

- Do We Goldbugs Finally Have Your Attention?

- The Federal Reserve: Instigating Crisis Since 1913

- Dangers of a Dollar Collapse

- China warns Federal Reserve over 'printing money'

- China holds sway over US$ (she hold a US$2-trillion mortgage on the United States and is unhappy)

- John F. McManus: Dollars and Sense

- Monetary Inflation is Our Future

- Gold: the Protector and Creator of Jobs

- Citigroup Report Further Fuels Debate About the Future of Gold

- Zimbabwe: Gold Deliveries Fall 181,6 Percent (The Herald)

- Economic Collapse in September?

- Conservatism, Not in Bush White House: FY09 Budget Deficit Will Reach $482 Billion

- Confessions of a Money Manager: Gold isn't a Glittering Investment

- Long-Term Treasury Bond Market Paradox

- South Africa: Anglogold Seeks 100 Percent of Cripple Creek

- The Con That Turned the World Against America

- Oil producers shun dollar

- Dollar Falls to 14-Year Low Against Pound

- Gold Supply Likely to Swamp Demand (prediction of price drop to $550 by 2007)

- Analysts expect further commodities drop

- SLOWER GROWTH WILL NOT CONTAIN INFLATION

- Gold-Oil Ratio Spiralling Downward (630/74)

- GOVERNMENT DEBT: Termites in the House

- Back to the gold standard?

- Gold hits $700 for first time since 1980

- HONG KONG GOLD UP $8 AND SILVER UP $.50

- Gold Doesn't Fear a Fed Rate-Hike Pause (Goldbugs have new conspiracy theory = M3 + Iran)

- The Proposed Iranian Oil Bourse

- Dependence

- THE "GLOOM AND DOOMERS" FIND COMPANY

- Neo-Conservatism and the real reason we are in Iraq (ZOT!!! "The Treasure of the Bravo Sierra")

- Gold futures top $472, levels not seen since 1988

- transparent quicksand

- COMEX Gold Opens Above 7-Year High

- Gold Above 370.00 per Oz...Hits High of 373.90 [6 Year High]

- Stock Brokers Going Broke

- Sharp selloff in gold!

- Where are the gold bugs NOW?

3

posted on

02/03/2013 4:22:01 PM PST

by

SunkenCiv

(Romney would have been worse, if you're a dumb ass.)

It's worth remembering that in 1801, when Jefferson became president, the US national debt was around $100 million, about 10 times annual federal revenues. This was literally "the cost of freedom," and would correspond today to a national debt around $30 trillion. Since our actual national debt is $13+ trillion, the government is in better financial shape today than it was in Jefferson's time. And at the time, Jefferson's number one priority was paying down the national debt. So, how did he do it? How does ANY wise government ever increase its revenues? Yes, that's right! JEFFERSON REDUCED GOVERNMENT SPENDING AND CUT TAXES. -- Victor Davis Hanson: Wall Street 101 #45 by BroJoeK

4

posted on

02/03/2013 4:23:18 PM PST

by

SunkenCiv

(Romney would have been worse, if you're a dumb ass.)

To: Kaslin

The fraud continues....Guess what the standard exemption was in 1913? That will tell you who was taxed and on what.

5

posted on

02/03/2013 4:23:27 PM PST

by

wesagain

(The God #Elohim# of Abraham, Isaac and Jacob is the One True GOD.)

OPEC Has Already Turned to the Euro

GoldMoney Alert

February 18, 2004

...The source for the euro exchange rate is the Federal Reserve, and I have calculated the euro's average exchange rate to the dollar for each year based on daily data.

|

US Imports of Crude oil

|

|

(1)

|

(2)

|

(3)

|

(4)

|

(5)

|

(6)

|

|

Year

|

Quantity (thousands of barrels)

|

Value (thousands of US dollars)

|

Unit price (US dollars)

|

Average daily US$ per € exchange rate

|

Unit price (euros)

|

|

2001 |

3,471,066

|

74,292,894

|

21.40

|

0.8952

|

23.91

|

|

2002

|

3,418,021

|

77,283,329

|

22.61

|

0.9454

|

23.92

|

|

2003

|

3,673,596

|

99,094,675

|

26.97

|

1.1321

|

23.82

|

We can see from column (4) in the above table that in 2001, each barrel of imported crude oil cost $21.40 on average for that year. But by 2003 the average price of a barrel of crude oil had risen 26.0% to $26.97 per barrel. However, the important point is shown in column (6). Note that the price of crude oil in terms of euros is essentially unchanged throughout this 3-year period.

As the dollar has fallen, the dollar price of crude oil has risen. But the euro price of crude oil remains essentially unchanged throughout this 3-year period. It does not seem logical that this result is pure coincidence. It is more likely the result of purposeful design, namely, that OPEC is mindful of the dollar's decline and increases the dollar price of its crude oil by an amount that offsets the loss in purchasing power OPEC's members would otherwise incur. In short, OPEC is protecting its purchasing power as the dollar declines.

6

posted on

02/03/2013 4:23:30 PM PST

by

SunkenCiv

(Romney would have been worse, if you're a dumb ass.)

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; ColdOne; Convert from ECUSA; ...

7

posted on

02/03/2013 4:24:21 PM PST

by

SunkenCiv

(Romney would have been worse, if you're a dumb ass.)

To: Kaslin

Don’t worry. It’s just temporary.

8

posted on

02/03/2013 4:28:00 PM PST

by

clintonh8r

(Happy to be represented by Lt. Col. Allen West)

To: Kaslin

The 16th and 17th were two of the most devastating amendments to the constitution.

Perfect examples of why you don’t have constitutional conventions when Washington is full of progressives.

9

posted on

02/03/2013 4:32:24 PM PST

by

cripplecreek

(REMEMBER THE RIVER RAISIN!)

To: All

10

posted on

02/03/2013 4:37:56 PM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: clintonh8r

11

posted on

02/03/2013 4:39:03 PM PST

by

Kaslin

(He needed the ignorant to reelect him, and he got them. Now we all have to pay the consequenses)

To: All

12

posted on

02/03/2013 4:42:26 PM PST

by

Son House

(Romney Plan: Cap Spending At 20 Percent Of GDP.)

To: Kaslin

The four worst socialists presidents we ever had were Wilson, Roosevelt, Johnson, and Obama.

13

posted on

02/03/2013 4:43:43 PM PST

by

Blood of Tyrants

(There is no requirement to show need in order to exercise your rights.)

To: Kaslin

Makes on wonder how the nation survived without a tax from 1776 to 1913.

14

posted on

02/03/2013 4:44:18 PM PST

by

Ruy Dias de Bivar

(Click my name! See new paintings!)

To: Blood of Tyrants

Franklin or Teddy? Or both?

15

posted on

02/03/2013 4:45:12 PM PST

by

abb

To: Kaslin

16

posted on

02/03/2013 4:50:10 PM PST

by

abb

To: clintonh8r

17

posted on

02/03/2013 4:57:14 PM PST

by

clintonh8r

(Happy to be represented by Lt. Col. Allen West)

To: Kaslin

18

posted on

02/03/2013 4:59:58 PM PST

by

Chad N. Freud

(FR is the modern equivalent of the Committees of Correspondence. Let other analogies arise.)

To: abb; All

19

posted on

02/03/2013 5:00:29 PM PST

by

Kaslin

(He needed the ignorant to reelect him, and he got them. Now we all have to pay the consequenses)

To: Blood of Tyrants

20

posted on

02/03/2013 5:05:58 PM PST

by

Kaslin

(He needed the ignorant to reelect him, and he got them. Now we all have to pay the consequenses)

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson