Just talking about this,

http://finance.yahoo.com/q?s=%5ETNX

If we have hit the long term support bottom in August, there is only two options, inflation, or stagflation.

No one in the history of the world knows how to unwind this unprecedented stimulus, the world is awash in digital currency, ...

Because fed pumping is helping growth in Asia not in the US, better tax laws and opportunity.

I’m commenting here mainly so that smarter people than me can tell me how I’m wrong.

In my opinion, inflation is masked over the last couple of decades by a couple of things. For one, computers, internet, telecommunications, have revolutionized all kinds of things and this has helped to keep prices low and going lower.

Offshoring our manufacturing has kept prices low.

A collapsing economy has cut the price of housing.

A weak economy also affects the demand for trucking, making it lower than it would otherwise be, which helps to keep fuel lower than it otherwise would be.

High unemployment keeps wages from rising much if at all.

Thats aside from the games that the statisticians play, where they claim that something is better, hence the higher cost isn’t really a higher cost. (Similar to the games they play with unemployment figures, where if you’re out of work long enough they stop counting you). The 2% figure, I believe, is a lie.

Still, whatever is the true figure, its lower than it would be if the economy wasn’t on the rocks and we weren’t innovating, and we weren’t letting Chinese do our work for us.

Check the inflation rate of food and ammo.

2% Inflation???

Seriously??

Anyone who has bought groceries or fuel in the past 12 months knows that the “real” inflation rate is probably around 12% per year.

Just like the unemployment rate is 7.something when 8 million fewer people are employed than four years ago.

I just can’t tell if I’m reading Pravda or Tass.

No inflation?

4 years ago I was surprised when my shopping total went over $200 or $250 dollars.

Last week my bill topped $400 for the first time ever

We have plenty of inflation, but prices are measured in such a way as to hide the real inflation rate.

Yes, with the BIG CAVEAT: "Ceteris Paribus", or "All things remaining equal"

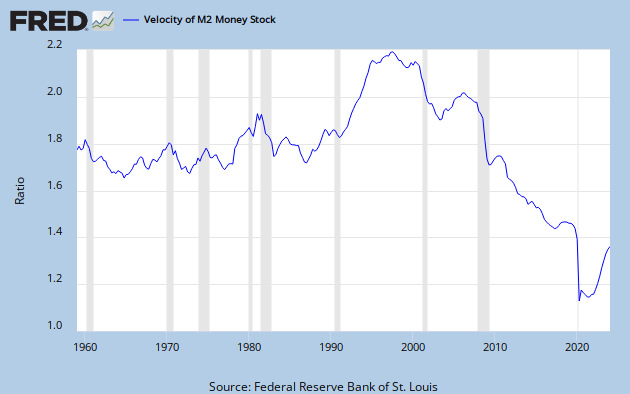

But if the Velocity of money simultaneously slows dramatically, it is entirely possible for Money Supply to expand without inflation.

So, if banks don't lend the excess cash, and corporations don't spend (invest) their excess capital, what happens inflation-wise? Nothing.

Yet.

But Monday's WSJ had three articles pointing to the beginning of asset bubbles: The price of Stocks, Houses and Bonds are all up.

All that cash is starting to chase things. Bubble-mania, here we go again!

Food prices are through the roof! I'm sure if a Repub was in the WH, the "media" would harping on how "the people" are having a hard time putting food on the table due to the rising costs.

Nope

Velocity of M1 Money Stock in the US data by YCharts

An increase in prices is just a symptom of inflation. But there are always several pressures working simultaneously to decrease the rise in prices caused by increases in the money supply such as:

1) during a recession, it is normal for prices to decrease and

2) money sent to China to buy Chinese goods lowers the American money supply which tends to decrease demand which tends to decrease prices.

The drop in velocity, the recession, and trade with China are price lowering pressures that are working against the price increasing pressures that are caused by the increase in the money supply.

Cash is piling up in Banks and Corporations

No One in their right minds will invest cash in this environment, with a negative ROI for injected capital

The GDP Velocity is dangerously close to 1

The real inflation rate is over 5%. The gubmint is cooking the on inflation estimates.

I think part of the reason might be that the Chinese haven’t re-flooded our market with their increasingly worth less dollars we’re paying them with.

If they do that, like France did with Germany in the 20s, we will get hit. Hard.

Goldbug ping.

Pumping/printing money and distributing through the banks means that with fewer people borrowing money, most of this Ca$h ends up in investments. Hence according to the Administration, everything is good (for now), yet once the this money has doubled stocks as it already has done, the real inflation will start to kill the American workers. The only folks who this does not matter for are those who get total subsidized living from government payments....

At that point, you're likely to get all the inflation you want - it's basically what happened in the German Weimar Republic in 1923.

Lots of folks have stopped buying our Treasuries - the 'solution'? We buy them. It's getting nutty...