Skip to comments.

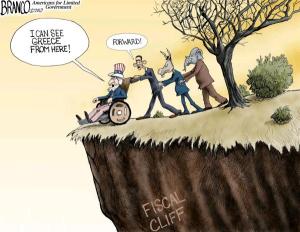

Grading the Fiscal Cliff Deal: Terrible, but Could Be Worse

Townhall.com ^

| January 1, 2013

| Daniel J. Mitchell

Posted on 01/01/2013 9:23:28 AM PST by Kaslin

There’s no official agreement, so everything you read here may turn out to be nonsense, but it appears that the misfits in Washington have reached a deal on the fiscal cliff.

It seems as though my prediction about the outcome was correct. Not that this makes me happy.

First, the good news.

…

…

…

Oh, wait, there isn’t any.

Now for the bad news.

The top tax rate will increase to 39.6 percent for entrepreneurs, investors, small business owners, and other “rich” taxpayers making more than $400,000 ($450,000 for married couples). This is Obama’s big victory. He gets his class-warfare trophy.

The double tax on dividends and capital gains will climb from 15 percent to 20 percent (23.8 percent if you include the Obamacare tax on investment income).

The death tax rate will be boosted from 35 percent to 40 percent (which doesn’t sound like a big step in the wrong direction until you remember it was 0 percent in 2010).

The alternative minimum tax will still exist, though it will be “patched” to protect as many as 30 million households from being swept into this surreal parallel tax system that requires people to use a second method of calculating their taxes – with the government getting the greatest possible amount.

Unemployment benefits will be extended, ensnaring more Americans in joblessness.

Medicare spending will be increased as part of a “doc fix” to increase reimbursement payments for providers.

This is sort of like a late Christmas present, but we must have been naughty all year long and taxpayers are getting lumps of coal.

That being said, I was expecting even worse, so this deal (assuming it happens) almost seems like a relief.

Sort of like knowing that you were going to have your arm amputated, but then finding out that at least you’ll get some anesthetic. You’re not happy about the outcome, but you’re relieved that it won’t be as bad as you thought it would be.

But let’s not delude ourselves. This deal is not good for the economy. It doesn’t do anything to cap the burden of government spending. It doesn’t reform entitlement programs.

And we may even lose the sequester, the provision that was included in the 2011 debt limit that would have slightly reduced the growth of government over the next 10 years.

What a dismal ending to 2012.

Back in mid-2010, I wrote that Portugal was going to exacerbate its fiscal problems by raising taxes.

Needless to say, I was right. Not that this required any special insight. After all, no nation has ever taxed its way to prosperity.

We’re now at the end of 2012 and Portugal is still saddled with a weak economy. And the higher taxes haven’t resulted in less red ink. Indeed, according to the Economist Intelligence Unit, government debt has jumped from 93 percent of GDP in 2010 to 124 percent of GDP this year.

Why did higher taxes backfire in Portugal? For the same reasons that higher taxes have failed in Greece, Spain, Bulgaria, France, Italy, the United Kingdom, and so many other nations.

- Higher taxes undermine incentives for productive behavior, thus reducing an economy’s potential for growth. This means less economic output, which also means a smaller tax base. This Laffer Curve effect doesn’t necessarily mean less revenue, but it certainly means that tax increases rarely raise as much money as initially projected.

- Higher taxes usually are a substitute for the real solution of spending restraint (i.e., Mitchell’s Golden Rule). Politicians oftentimes refuse to reduce the burden of government spending because of an expectation of additional tax revenue. Heck, in many cases, higher taxes trigger an increase in the size and scope of the public sector.

So did Portugal learn any lessons from this failed experiment in Obamanomics?

Hardly. Indeed, the government plans to double down on this approach – even though it’s increasingly apparent that higher tax burdens won’t translate into much – if any – additional tax revenue. Here are some excerpts from a report in the Financial Times.

Lisbon plans to lift income tax revenue by more than 30 per cent, raising the effective average rate by more than a third from 9.8 to 13.2 per cent. Anyone receiving more than the minimum wage of €485 a month, including pensioners, will also pay an extraordinary tax of 3.5 per cent on their income. …the steep tax increases facing many families have made the outlook for 2013 – the third consecutive year of austerity, recession and rising unemployment – the grimmest yet. Total tax revenue has fallen considerably below target this year, forcing the government to implement additional austerity measures… The coalition will be relying on increased state revenue to account for about 80 per cent of the fiscal adjustment required in 2013 – a reversal of the original bailout plan, in which consolidation was to be achieved mainly through spending cuts.

Amazing. The government imposes huge tax hikes, which don’t generate any positive results. Yet even though “tax revenue has fallen considerably below target,” confirming that there are significant Laffer Curve issues, the government chooses to repeat the snake-oil fiscal therapy of higher taxes.

Anybody want to guess what’s going to happen? The answer, of course, is that this will further dampen incentives to generate income and comply with the government’s fiscal demands.

The latest increases have stretched the tax system to the limit, says Carlos Loureiro, a tax partner at Deloitte. “The current model is exhausted. We need to do something different,” he says. “Any further increase in tax rates is unlikely to result in increased revenue.” Income from value added tax, the government’s biggest source of tax revenue representing about 36 per cent of the total, has been falling since 2008, despite a sharp increase in the rate – the main rate is now 23 per cent. Both the government and the European Commission have acknowledged the risks of depending on increased tax revenue, which is more growth sensitive, to meet fiscal targets and contingency spending cuts amounting to 0.5 per cent of national output have prepared in case of another tax shortfall.

I almost want to laugh at the part of the excerpt which notes that tax revenue “has been falling…despite a sharp increase in the rate.”

Maybe it’s time for these fiscal pyromaniacs to realize that revenues might be falling because rates are higher. In other words, Portugal not only isn’t at the ideal point on the Laffer Curve (collecting the amount of revenue needed to finance legitimate activities of government), it may even be past the revenue-maximizing part of the curve.

To be fair, there are lots of factors that determine economic performance, so higher tax burdens are just one possible explanation for why the tax base is shrinking or stagnant.

The one thing we can state with certainty, though, is that Portugal’s fiscal problem is too much government spending. The failure to address this problem then leads to very unpleasant symptoms, such as lots of red ink and self-destructive class-warfare tax policy.

If all that sounds familiar, that’s because it’s also a description of what President Obama is proposing for the United States.

Ummm…shouldn’t they be targeting politicians?

P.S. I don’t want to imply that Portugal is a total basket case. True, I’m not optimistic about the country’s future, but at least some lawmakers now acknowledge that Keynesian spending was a big mistake. And there are even signs that Portuguese officials are beginning to realize that lower tax rates should be part of the solution. But good policy may be impossible since so many people now have a moocher mentality.

P.P.S. At the risk of bearing bad news to close the year, research from both the Bank for International Settlements and the Organization for Economic Cooperation and Development shows the United States actually faces a bigger long-run fiscal challenge than Portugal.

TOPICS: Business/Economy; Culture/Society; Editorial

KEYWORDS: 112th; fiscalcliff

1

posted on

01/01/2013 9:23:32 AM PST

by

Kaslin

To: Kaslin

The good news part is that the debt ceiling is not raised. We will see what happens in March.

To: Kaslin

The news media came up with this “fiscal cliff” bs . And that's all we've heard about since the election even from the common idiots who have no idea what is the cliff when asked. Call Congress and tell them not to believe the media. What is the stupid cliff?There is no cliff. the country supposedly went over the cliff at midnight. pure media lies. then last night Senators were forced at 2 am on New year's day to rush vote for a bill they couldn't have read as the agreement was done by Biden and McConnell yesterday: all this avoid the great media cliff.

The U.S.A is a dictatorship and the media are the dictators.

call GOP Congressmen in the House, tell them not to vote for this nor any deal ,there is no cliff as that is media lies to force them to agree to tax increases

Congress switchboard number: (202) 224-3121.

3

posted on

01/01/2013 9:38:45 AM PST

by

Democrat_media

(media makes mass shooters household names to create more & take our guns)

To: Kaslin

Remember that Temper Tantrum that Casey Anthony had in Jail, while talking to her parents?

I think that scene expresses perfectly the feeling many of us have as we sit behind our screens and think on this Fiscal Cliff debacle and the way we are ignored.

Hate to bring that little beyitch back to mind, sorry.

4

posted on

01/01/2013 9:42:38 AM PST

by

annieokie

To: Kaslin

before this is all over, taxes will be raised on everyone earning more than $250,000.

We might as well get used to the idea, and give the Democrats this to take it off the table thus denying Obama the “Republicans held up a real deal in order to keep the richest among us from paying more in taxes” talking point.

Yes, I know it will hurt the economy. But who cares, let the economy go down and let the Democrats take the blame.

As long as we continue fighting against raising taxes, the Democrats will keep screaming that it Republicans are at fault for not letting them raise taxes.

I say give the idiots what they want and then lay blame sqaurely where it belongs when things fall apart.

5

posted on

01/01/2013 9:46:42 AM PST

by

TexasFreeper2009

(Obama lied .. the economy died.)

To: Kaslin

Only if the House votes Yes and....does a deal on NEVER RAISING THE DEBT CEILING as Senator Graham is pushing, will this travesty even look like a win win situation. Now, Obama and Biden are the winners, Mitch loses and America will look like a socialist failure in about 4 months when this all is worked out. Then we have the 2014 bi elections where Pubs will once again think big, and lose big because they will not be able to overcome the Moron vote and will not be able to get all of their BASE out as they did not in Nov.’s election. Yikes.

To: TexasFreeper2009

I almost agree with you - when Obama won the election, the decision was not between higher or lower taxes, but higher taxes on whom. But if taxes get raised as much as Obama wants and the economy tanks (not certain, but almost), the media will still blame the Republicans for not doing it sooner (or something).

What I would like to see is Boehner bring two bills to the floor. The first would embrace about 80% of Simpson-Bowles - raising revenue, but not tax rates, reforming entitlements and holding all other spending flat for the next few years. The second one would be the agreement worked out (with one minor change, to force the Senate to vote again). Then tell all the Republicans to vote “present” on the second one. Tell the press, the Demoncrats, etc. that if the second bill passes, the Demoncrats own the economy (for good or ill).

7

posted on

01/01/2013 12:28:42 PM PST

by

BruceS

To: Kaslin

“Grading the Fiscal Cliff Deal: Terrible, but Could Be Worse”

To tweak the punchline of an old joke, “Sure it could have been worse - it could have been your money!”

8

posted on

01/01/2013 5:46:03 PM PST

by

headsonpikes

(Mass murder and cannibalism are the twin sacraments of socialism - "Who-whom?"-Lenin)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson