Skip to comments.

Sen. Schumer: Economic Growth from Less Taxes is ‘A Rumpelstiltskin Fairy Tale’

cnsnews.com ^

Posted on 11/09/2012 11:19:58 AM PST by tsowellfan

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-57 last

To: Paladin2

Petraeus resigned today. Holder is making plans to go. Hillary as well. The rats are leaving the sinking ship.

41

posted on

11/09/2012 1:06:49 PM PST

by

Myrddin

To: tsowellfan

Schmucky... we have HISTORY TO PROVE YOU ARE LYING BUT ALL YOU HAVE IS A FOUL LYING MOUTH ATTACHED TO satan’s LAPTOP!

LLS

42

posted on

11/09/2012 1:57:32 PM PST

by

LibLieSlayer

(I AM JOHN GALT)

To: tsowellfan

Obama is the king, and Bernake is Rumpelstiltskin, spinning straw into gold to finance the king, when the miller’s daughter ( representing the people )cannot produce it. The promise of the first born represents the debt burden passed to the next generation. Rumpelstiltskin’s secret song and dance represents the mysterious machinations of the Fed.

For the happy ending to come true, the people would have to learn how the Fed works and break its hold by returning to the gold standard.

43

posted on

11/09/2012 6:20:19 PM PST

by

dr_lew

To: G Larry; Colonel_Flagg; Trapped Behind Enemy Lines; tsowellfan

G Larry wrote:

In which year were the Federal Income Tax receipts the highest ever?

2007, under the Bush Tax Cuts.

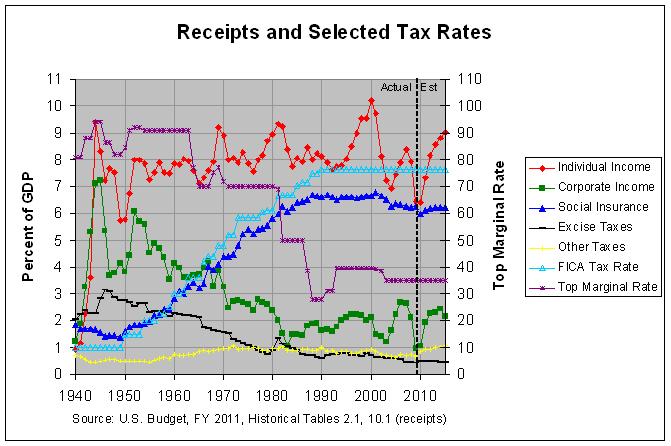

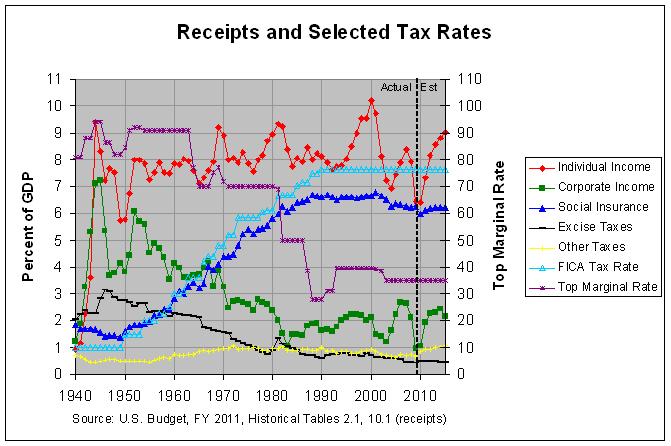

Of course, you need to correct for inflation and population growth or, better yet, look at revenues as a percentage of GDP. The following graph shows individual income tax revenue as a percentage of GDP (the red line).

As you can see, revenues dropped steeply after the Bush tax cuts and only recovered about half of that loss by 2007. You can find the numbers and sources at this link and an analysis of the effect of tax cuts on revenue at this link.

44

posted on

11/10/2012 1:26:07 AM PST

by

remember

To: remember

What I see is there is no axis for $$$DOLLARS$$$$!!!!!!!!!

Federal Income Tax receipts measured in DOLLARS were highest in 2007!

45

posted on

11/10/2012 7:11:47 AM PST

by

G Larry

(Which of Obama's policies do you think I'd support if he were white?)

To: tsowellfan

Bookmark for later comment.

46

posted on

11/10/2012 8:09:18 AM PST

by

socialism_stinX

(Boycott all shows on ABC, CBS, CNN, NBC, and MSNBC, and report your boycott in your Nielsen survey.)

To: G Larry

And the deficit was “only” $132 Billion. Pitifully small by the standards begun the following year under the Pelosi/Reid cartel.

47

posted on

11/10/2012 8:45:13 AM PST

by

csmusaret

(I will give Obama credit for one thing- he is living proof that familiarity breeds contempt.)

To: G Larry

G Larry wrote:

What I see is there is no axis for $$$DOLLARS$$$$!!!!!!!!!

And what I see is that you apparently have no clue that revenues always go up due to inflation and population growth. To quote my short analysis at this link:

At 99.6 percent, revenues did nearly double during the 80s. However, they had likewise doubled during EVERY SINGLE DECADE SINCE THE GREAT DEPRESSION! They went up 502.4% during the 40's, 134.5% during the 50's, 108.5% during the 60's, and 168.2% during the 70's. At 96.2 percent, they nearly doubled in the 90s as well. Hence, claiming that the Reagan tax cuts caused the doubling of revenues is like a rooster claiming credit for the dawn.

Federal Income Tax receipts measured in DOLLARS were highest in 2007!

Yes, and they will reach a new high due to inflation and population growth, regardless of our tax policy. If we had had this discussion in 2005, the highest receipts would still have been in 2000, before the Bush tax cuts (see the data at this link). Would you have then admitted to the total failure of the Bush tax cuts to raise revenue?

48

posted on

11/10/2012 1:40:35 PM PST

by

remember

To: remember

“and they will reach a new high due to inflation and population growth”

It’s 2012, how your inflation theory doing since 2007?

Have the Fed’s had higher receipts yet?

49

posted on

11/10/2012 8:08:54 PM PST

by

G Larry

(Which of Obama's policies do you think I'd support if he were white?)

To: G Larry

G Larry wrote:

It’s 2012, how your inflation theory doing since 2007?

Individual income tax revenues are estimated to surpass 2007 this year. In any case, you have a very interesting theory. In an earlier post, you proudly proclaimed:

In which year were the Federal Income Tax receipts the highest ever?

2007, under the Bush Tax Cuts.

So you seem to be saying that the record revenues in 2007 were due to the Bush Tax Cuts. What happened in 2008, did the magical effect of the tax cuts expire? No, we had a financial crisis led by the crash of the housing bubble. The record revenues in 2007 were very likely pumped up by this bubble, along with inflation and population growth.

If you think that tax cuts do increase revenue, accept my challenge. Tell me any specific numbers or conclusions in my analysis of the effect of tax cuts on revenues that you disagree with. Alternately, post a link to one serious economic study that purports to show evidence of any income tax cut that has ever paid for itself.

50

posted on

11/11/2012 2:58:48 PM PST

by

remember

To: remember

The simple fact is that those record receipts occurred in 2007, with those tax rates in place.

There are a number of factors that drove reduced receipts in 2008, chief among them the impact of the Dem’s mortgage scheme and the bursting housing bubble.

You can keep playing your challenge by yourself.

I’m not impressed or interested.

51

posted on

11/11/2012 3:38:42 PM PST

by

G Larry

(Which of Obama's policies do you think I'd support if he were white?)

To: G Larry

G Larry wrote:

The simple fact is that those record receipts occurred in 2007, with those tax rates in place.

There are a number of factors that drove reduced receipts in 2008, chief among them the impact of the Dem’s mortgage scheme and the bursting housing bubble.

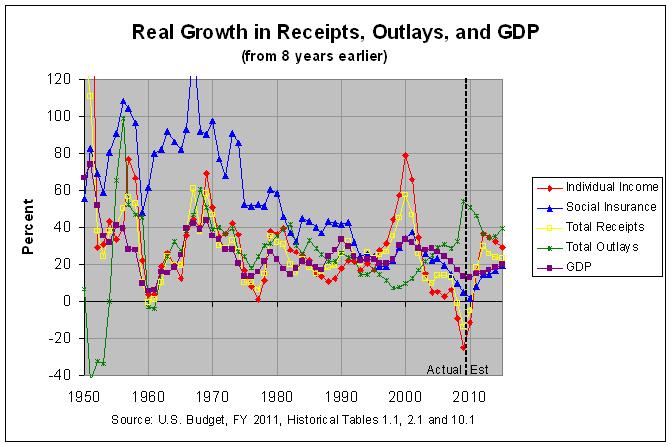

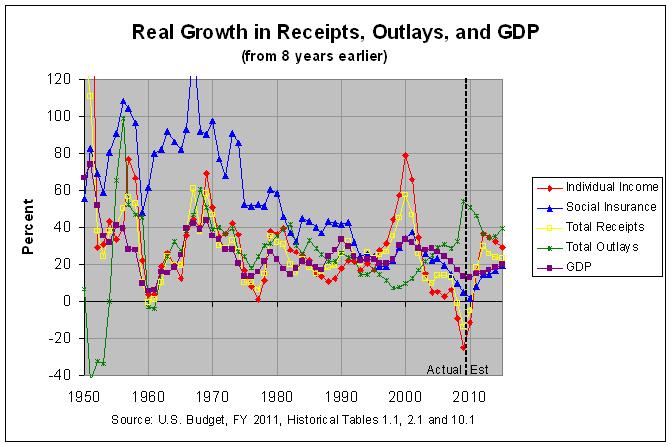

So you conclude that the Bush tax cuts effected revenues positively because they reached a high in 2007 during the housing bubble. Following is my conclusion from this link:

The actual numbers and sources can be found at recgro8y.html. As can be seen in the second table and graph, real individual income tax receipts declined 25.06% from 2001 to 2009. Even total receipts declined -13.93% over that period. Finally, real GDP grew just 13.36% from 2001 to 2009. This was the lowest real GDP growth over any 8-year span since 13.33% from 1966 to 1976. Hence, although it's been just about eight years since the 2001 tax cut and six years since the 2003 tax cut, the evidence to this point is that the Bush tax cuts decreased revenues over what they would have been, at least over the short term. This was true even in my prior analysis based on data through 2007, before the financial crisis of 2008.

We can let the readers decide (if there are any!) which conclusion makes more sense.

52

posted on

11/13/2012 12:39:16 AM PST

by

remember

To: tsowellfan

If true Schumer, how did the Bush era Tax Rate Cuts result in a 35% INCREASE in Federal Tax Revenue between 2003 and 2007?

If it wasn’t increased Economic Activity, what was it?

To: remember

>”show evidence of any income tax cut that has ever paid for itself”<

How does a Tax Cut, actually a Tax RATE Cut pay for itself? Last I checked it isn’t the Government’s money to begin with so what are you paying back?

To: remember

First we’d have to believe your distorted data.

55

posted on

11/13/2012 4:49:02 AM PST

by

G Larry

(Which of Obama's policies do you think I'd support if he were white?)

To: G Larry

G Larry wrote:

First we’d have to believe your distorted data.

They all come from the U.S. Budget, same as your one number for 2007. You can find all of the sources listed at this link and other links given in the analysis.

56

posted on

11/14/2012 8:39:55 AM PST

by

remember

To: G Larry

G Larry wrote:

First we’d have to believe your distorted data.

They all come from the U.S. Budget, same as your one number for 2007. You can find all of the sources listed at this link and other links given in the analysis.

57

posted on

11/14/2012 8:40:04 AM PST

by

remember

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-57 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson