Posted on 11/06/2012 3:06:17 PM PST by blam

Recession Probability - 100%

Written by Lance Roberts

Tuesday, November 6, 2012

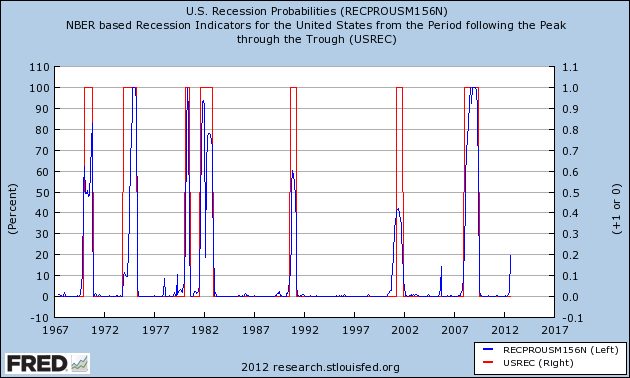

During my usual morning reading process I came across a posting on PragCap by Cullen Roche regarding a chart of U.S. recession probabilities. The chart can be found at the St. Louis Federal Reserve website and is derived from a study by J. Piger and M. Chauvet, from the University of Oregon, which was published in the Journal of Business and Economic Statistics in 2008. (For other economic geeks the full paper is attached)

Cullen points out that "What’s interesting about this index is the current reading. At 20%, the index is at a level that has ALWAYS been followed by a recession. As you can see below, the index has never approached 20% without a subsequent recession. All 6 recessions since 1967 have coincided with 20%+ readings in the US Recession Probabilities index." Currently, that index, as shown in the chart below, is approaching that 20% level as of August which is the latest reported data.

The recession probabilities, as stated in the research article, are obtained from a "dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales." Without getting to far into financial econometrics a Markov switching model involves multiple equations that can characterize the time series behaviors between different data sets. By permitting the switching between equations the model is able to capture more complex dynamic patterns. The question that we want to answer is whether the indicator is currently correct in its prediction of a U.S. recession or "is this time different."

We have written recently about the ECRI's recession call, which has been extremely early, and is probably the most widely debated recession call to date. However, there have been other calls as well from notables such as Gary Shilling and John Hussman. I also have been laying out the foundation in recent reports about the pending recession which will most likely "officially" set in in 2013 (see here, here and here) I say "officially" set in because while many of the composite and economic indicators that we follow are already signaling a recessionary economy - it is the National Bureau of Economic Research (NBER) that officially dates recessions in the U.S.

From the NBER Website: "The NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

Furthermore, the NBER awaits the final revisions to those data points before determining the peaks and troughs of economic activity. Therefore, it is usually several months after the fact before the NBER officially announces the start or end of a recession.

Why is this important? As we have discussed in the past understanding when a recession has begun is hugely important to investors. The table below, which uses monthly S&P 500 data, shows the price declines during recessionary periods going back to 1873. The average drawdown to investor's portfolios is a little more than 30%. During recent recessions the damage has been far worse.

However, the declines in the market, and subsequent damage to investors portfolios, happened WELL before the "official announcement" by the NBER. As an example the majority of the decline in the stock market in 2008 had already occurred by the time the NBER announced in December of 2008 that the recession had begun a year earlier. (As a side note I stated in the December 8, 2007 newsletter that the recession had already started)

(snip)

Today’s news was the tip of the iceberg. As in Titanic.

We may not be technically in a recession yet, but the FED sure thinks that things are bad enough to do QE infinity..

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.