Posted on 06/29/2012 5:54:35 PM PDT by Kaslin

By now you know what the Supreme Court verdict is: ObamaCare is a tax. So what does that mean in terms of actual dollar amounts for Americans and businesses who will pay this new tax? The Heritage Foundation and Americans for Tax Reform have released a series of summaries, tables and charts to help families understand what this means for their wallet.

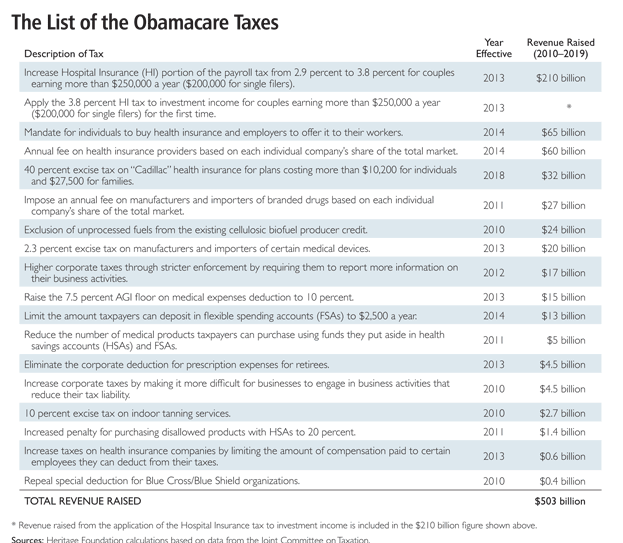

The Patient Protection and Affordable Care Act (PPACA)[1] imposes numerous tax hikes that transfer more than $500 billion over 10 years—and more in the future—from hardworking American families and businesses to Congress for spending on new entitlements and subsidies. In addition, higher tax rates on working and investing will discourage economic growth both now and in the future, further lowering the standard of living.

1. Excise Tax on Charitable Hospitals (Min$/immediate): $50,000 per hospital if they fail to meet new "community health assessment needs," "financial assistance," and "billing and collection" rules set by HHS. Bill: PPACA; Page: 1,961-1,971

2. Codification of the “economic substance doctrine” (Tax hike of $4.5 billion). This provision allows the IRS to disallow completely-legal tax deductions and other legal tax-minimizing plans just because the IRS deems that the action lacks “substance” and is merely intended to reduce taxes owed. Bill: Reconciliation Act; Page: 108-113

3. “Black liquor” tax hike (Tax hike of $23.6 billion). This is a tax increase on a type of bio-fuel. Bill: Reconciliation Act; Page: 105

4. Tax on Innovator Drug Companies ($22.2 bil/Jan 2010): $2.3 billion annual tax on the industry imposed relative to share of sales made that year. Bill: PPACA; Page: 1,971-1,980

5. Blue Cross/Blue Shield Tax Hike ($0.4 bil/Jan 2010): The special tax deduction in current law for Blue Cross/Blue Shield companies would only be allowed if 85 percent or more of premium revenues are spent on clinical services. Bill: PPACA; Page: 2,004

6. Tax on Indoor Tanning Services ($2.7 billion/July 1, 2010): New 10 percent excise tax on Americans using indoor tanning salons. Bill: PPACA; Page: 2,397-2,399

Taxes that took effect in 2011

7. Medicine Cabinet Tax ($5 bil/Jan 2011): Americans no longer able to use health savings account (HSA), flexible spending account (FSA), or health reimbursement (HRA) pre-tax dollars to purchase non-prescription, over-the-counter medicines (except insulin). Bill: PPACA; Page: 1,957-1,959

8. HSA Withdrawal Tax Hike ($1.4 bil/Jan 2011): Increases additional tax on non-medical early withdrawals from an HSA from 10 to 20 percent, disadvantaging them relative to IRAs and other tax-advantaged accounts, which remain at 10 percent. Bill: PPACA; Page: 1,959

Tax that took effect in 2012

9. Employer Reporting of Insurance on W-2 (Min$/Jan 2012): Preamble to taxing health benefits on individual tax returns. Bill: PPACA; Page: 1,957

Taxes that take effect in 2013

10. Surtax on Investment Income ($123 billion/Jan. 2013): Creation of a new, 3.8 percent surtax on investment income earned in households making at least $250,000 ($200,000 single). This would result in the following top tax rates on investment income: Bill: Reconciliation Act; Page: 87-93

*Other unearned income includes (for surtax purposes) gross income from interest, annuities, royalties, net rents, and passive income in partnerships and Subchapter-S corporations. It does not include municipal bond interest or life insurance proceeds, since those do not add to gross income. It does not include active trade or business income, fair market value sales of ownership in pass-through entities, or distributions from retirement plans. The 3.8% surtax does not apply to non-resident aliens.

11. Hike in Medicare Payroll Tax ($86.8 bil/Jan 2013): Current law and changes:

12. Tax on Medical Device Manufacturers ($20 bil/Jan 2013): Medical device manufacturers employ 360,000 people in 6000 plants across the country. This law imposes a new 2.3% excise tax. Exempts items retailing for <$100. Bill: PPACA; Page: 1,980-1,986

13. Raise "Haircut" for Medical Itemized Deduction from 7.5% to 10% of AGI ($15.2 bil/Jan 2013): Currently, those facing high medical expenses are allowed a deduction for medical expenses to the extent that those expenses exceed 7.5 percent of adjusted gross income (AGI). The new provision imposes a threshold of 10 percent of AGI. Waived for 65+ taxpayers in 2013-2016 only. Bill: PPACA; Page: 1,994-1,995

14. Flexible Spending Account Cap – aka “Special Needs Kids Tax” ($13 bil/Jan 2013): Imposes cap on FSAs of $2500 (now unlimited). Indexed to inflation after 2013. There is one group of FSA owners for whom this new cap will be particularly cruel and onerous: parents of special needs children. There are thousands of families with special needs children in the United States, and many of them use FSAs to pay for special needs education. Tuition rates at one leading school that teaches special needs children in Washington, D.C. (National Child Research Center) can easily exceed $14,000 per year. Under tax rules, FSA dollars can be used to pay for this type of special needs education. Bill: PPACA; Page: 2,388-2,389

15. Elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D ($4.5 bil/Jan 2013) Bill: PPACA; Page: 1,994

16. $500,000 Annual Executive Compensation Limit for Health Insurance Executives ($0.6 bil/Jan 2013). Bill: PPACA; Page: 1,995-2,000Taxes that take effect in 2014

17. Individual Mandate Excise Tax (Jan 2014): Starting in 2014, anyone not buying “qualifying” health insurance must pay an income surtax according to the higher of the followingExemptions for religious objectors, undocumented immigrants, prisoners, those earning less than the poverty line, members of Indian tribes, and hardship cases (determined by HHS). Bill: PPACA; Page: 317-337

18. Employer Mandate Tax (Jan 2014): If an employer does not offer health coverage, and at least one employee qualifies for a health tax credit, the employer must pay an additional non-deductible tax of $2000 for all full-time employees. Applies to all employers with 50 or more employees. If any employee actually receives coverage through the exchange, the penalty on the employer for that employee rises to $3000. If the employer requires a waiting period to enroll in coverage of 30-60 days, there is a $400 tax per employee ($600 if the period is 60 days or longer). Bill: PPACA; Page: 345-346

Combined score of individual and employer mandate tax penalty: $65 billion/10 years

19. Tax on Health Insurers ($60.1 bil/Jan 2014): Annual tax on the industry imposed relative to health insurance premiums collected that year. Phases in gradually until 2018. Fully-imposed on firms with $50 million in profits. Bill: PPACA; Page: 1,986-1,993

Taxes that take effect in 2018

20. Excise Tax on Comprehensive Health Insurance Plans ($32 bil/Jan 2018): Starting in 2018, new 40 percent excise tax on “Cadillac” health insurance plans ($10,200 single/$27,500 family). Higher threshold ($11,500 single/$29,450 family) for early retirees and high-risk professions. CPI +1 percentage point indexed. Bill: PPACA; Page: 1,941-1,956

Also, ATR is warning Americans of Taxmageddon, which will happen on January 1, 2013. This will be the largest tax hike in American history and will come in three waves.

First Wave: Expiration of 2001 and 2003 Tax Relief

In 2001 and 2003, the GOP Congress enacted several tax cuts for small business owners, families, and investors (later re-upped by President Obama and Democrat Congress in 2010). The following tax hikes will occur on January 1, 2013:

Personal income tax rates will rise on January 1, 2013. The top income tax rate will rise from 35 to 39.6 percent (this is also the rate at which the majority of small business profits are taxed). The lowest rate will rise from 10 to 15 percent. All the rates in between will also rise. Itemized deductions and personal exemptions will again phase out, which has the same mathematical effect as higher marginal tax rates. The full list of marginal rate hikes is below:

- The 10% bracket rises to a new and expanded 15%

- The 25% bracket rises to 28%

- The 28% bracket rises to 31%

- The 33% bracket rises to 36%

- The 35% bracket rises to 39.6%

Higher taxes on marriage and family coming on January 1, 2013. The “marriage penalty” (narrower tax brackets for married couples) will return from the first dollar of taxable income. The child tax credit will be cut in half from $1000 to $500 per child. The standard deduction will no longer be doubled for married couples relative to the single level.

Middle Class Death Tax returns on January 1, 2013. The death tax is currently 35% with an exemption of $5 million ($10 million for married couples). For those dying on or after January 1 2013, there is a 55 percent top death tax rate on estates over $1 million. A person leaving behind two homes and a retirement account could easily pass along a death tax bill to their loved ones.

Higher tax rates on savers and investors on January 1, 2013. The capital gains tax will rise from 15 percent this year to 23.8 percent in 2013. The top dividends tax will rise from 15 percent this year to 43.4 percent in 2013. This is because of scheduled rate hikes plus Obamacare’s investment surtax.Second Wave: Obamacare Tax Hikes

There are twenty new or higher taxes in Obamacare. Some have already gone into effect (the tanning tax, the medicine cabinet tax, the HSA withdrawal tax, W-2 health insurance reporting, and the “economic substance doctrine”). Several more will go into effect on January 1, 2013. They include:

Medicare Payroll Tax Hike takes effect on January 1, 2013. The Medicare payroll tax is currently 2.9 percent on all wages and self-employment profits. Starting in 2013, wages and profits exceeding $200,000 ($250,000 in the case of married couples) will face a 3.8 percent rate.

“Special Needs Kids Tax” comes online on January 1, 2013 Imposes a cap on FSAs of $2500 (now unlimited). Indexed to inflation after 2013. There is one group of FSA owners for whom this new cap will be particularly cruel and onerous: parents of special needs children. There are thousands of families with special needs children in the United States, and many of them use FSAs to pay for special needs education. Tuition rates at one leading school that teaches special needs children in Washington, D.C. (National Child Research Center) can easily exceed $14,000 per year. Under tax rules, FSA dollars can be used to pay for this type of special needs education. This Obamacare cap harms these families.

Medical Device Tax begins to be assessed on January 1, 2013. Medical device manufacturers employ 360,000 people in 6000 plants across the country. This law imposes a new 2.3% excise tax. Exempts items retailing for <$100.

“Haircut” for Medical Itemized Deductions goes into force on January 1, 2013. Currently, those facing high medical expenses are allowed a deduction for medical expenses to the extent that those expenses exceed 7.5 percent of adjusted gross income (AGI). The new provision imposes a threshold of 10 percent of AGI. Waived for 65+ taxpayers in 2013-2016 only.

Third Wave: The Alternative Minimum Tax and Employer Tax Hikes

When Americans prepare to file their tax returns in January of 2013, they’ll be in for a nasty surprise—the AMT won’t be held harmless, and many tax relief provisions will have expired. These tax increases will be in force for BOTH 2012 and 2013. The major items include:

The AMT will ensnare over 31 million families, up from 4 million last year. According to the left-leaning Tax Policy Center, Congress’ failure to index the AMT will lead to an explosion of AMT taxpaying families—rising from 4 million last year to 31 million. These families will have to calculate their tax burdens twice, and pay taxes at the higher level. The AMT was created in 1969 to ensnare a handful of taxpayers.

Full business expensing will disappear. In 2011, businesses can expense half of their purchases of equipment. Starting on 2013 tax returns, all of it will have to be “depreciated” (slowly deducted over many years).

Taxes will be raised on all types of businesses. There are literally scores of tax hikes on business that will take place. The biggest is the loss of the “research and experimentation tax credit,” but there are many, many others. Combining high marginal tax rates with the loss of this tax relief will cost jobs.

Tax Benefits for Education and Teaching Reduced. The deduction for tuition and fees will not be available. Tax credits for education will be limited. Teachers will no longer be able to deduct classroom expenses. Coverdell Education Savings Accounts will be cut. Employer-provided educational assistance is curtailed. The student loan interest deduction will be disallowed for hundreds of thousands of families.

Charitable Contributions from IRAs no longer allowed. Under current law, a retired person with an IRA can contribute up to $100,000 per year directly to a charity from their IRA. This contribution also counts toward an annual “required minimum distribution.” This ability will no longer be there.

Start reading Atlas Shrugged if you haven’t already, folks. The world in that book is coming very quickly.

By allowing the 2003 tax cuts to retire, President Obama will be increasing the bottom rate from 10% to 15% ...

more math here:

Raising the 10% bracket to 15% represents what percentage of increase? Hint: The correct answer is NOT 5%.

Raising the 35% bracket to 39% represents what percentage of increase? Hint: The correct answer is NOT 4%.

Extra credit question: People in which tax bracket will see the largest percentage of increase in their taxes?

Extra extra credit question: People in which tax bracket will see the smallest percentage of increase in their taxes?

To those moving from the 35% to the 39% tax bracket...that’s roughly an 11% increase in taxes.

To those moving from the 10% bracket to 15%, their taxes will be increased by a whopping 50%.

So the low-income people get their taxes raised even more when seen as a percentage. And the rich folks lose a higher magnitude of money, but the percentage compared to what they already make is lower.

A little known fact of the Obamacare Law (among many other unpleasant surprises in the fine print you can be sure) is a 3.8% tax to be imposed when you sell your home--most people's greatest or only asset. 3.8% to Uncle Sam right off the bat. So how will that tax impact those who are involved in distress sales, who are underwater on their homes?

http://online.wsj.com/article/SB10001424052748704113504575264513748386610.html

SRB

Last Tuesday President Obama got off the helicopter in front of

The White House - carrying a baby piglet under each arm.

The squared-away Marine guard snapped to attention, saluted and said:

“Nice pigs, sir.” The President replied: “These are not pigs. These are

authentic Arkansas Razorback Hogs. I got one for Secretary of State

Hillary Clinton, and I got one for Speaker of the House Nancy Pelosi.”

The squared-away Marine again snapped to attention, salutes and said,

“Excellent trade, sir.”

See you in the “Klinker”, the “Can”, “Behind Bars” - ya know (JAIL). Bring some cards and plenty of smokes (if you smoke) (if not you can always sell them and get snickers and M&Ms in the mess hall.)

http://online.wsj.com/article/SB10001424052748704113504575264513748386610.html

Your link is to a Laffer opinion piece that does not discuss the 3.8% tax that reference.

Can you please provide a link to support your claim.

“So the low-income people get their taxes raised even more when seen as a percentage. And the rich folks lose a higher magnitude of money, but the percentage compared to what they already make is lower.”

I really don’t have a problem with that. I’d like THE POOR to start paying their way, a bit, at least, now that they have free health care (along with free food, free housing, and free spending money).

Ping

In addition, couples who sell a personal residence can exclude the first $500,000 in profit from tax ($250,000 for singles). That would be profit from a home sale, not proceeds. So a couple that bought a house for $100,000 and sold it for $599,000 would owe no tax, even under the health law.

http://www.forbes.com/sites/beltway/2012/04/02/there-is-no-obamacare-tax-on-most-home-sales-really/

turns out to NOT be true. thanks for having me fact check and throw out an old , irrelevant link.

And because of these taxes already on the books, the cheaper generic meds you’ve been getting will be axed and an even cheaper generic will be substituted. It’s already happening and those cheaper ones are causing people problems. It’s only going to get worse.

Can someone please tell me if this is true. Will Congress and their staff have to get the same healthcare plan as the rest of us? I’ve been going back and forth with a flaming liberal friend of mine.

EC. 1312. CONSUMER CHOICE

(d)(3)

D) MEMBERS OF CONGRESS IN THE EXCHANGE-

(i) REQUIREMENT- Notwithstanding any other provision of law, after the effective date of this subtitle, the only health plans that the Federal Government may make available to Members of Congress and congressional staff with respect to their service as a Member of Congress or congressional staff shall be health plans that are—

(I) created under this Act (or an amendment made by this Act); or

(II) offered through an Exchange established under this Act (or an amendment made by this Act).

(ii) DEFINITIONS- In this section:

(I) MEMBER OF CONGRESS- The term ‘Member of Congress’ means any member of the House of Representatives or the Senate.

(II) CONGRESSIONAL STAFF- The term ‘congressional staff’ means all full-time and part-time employees employed by the official office of a Member of Congress, whether in Washington, DC or outside of Washington, DC.

Thanks for that! I will definitely be using that info.

I can see Starnesville from here!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.