Skip to comments.

Dow Falls 449

http://money.cnn.com/2008/09/17/markets/markets_newyork/index.htm?cnn=yes ^

Posted on 09/17/2008 2:32:54 PM PDT by wyowolf

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 121-137 next last

To: Revolting cat!

Yeah, I am holding on to a lot of cash. Wonder if it is time.

61

posted on

09/17/2008 3:33:18 PM PDT

by

MeanWestTexan

(Wish it was Palin/McCain)

To: Mr. Jeeves

1. Unfortunately, we aren’t even oversold yet!

2. I don’t think we’ll get to 7,500.

3. I think we’re in a fan formation. One more leg down.

4. LS: Smart money always moves in advance of “news events”.

62

posted on

09/17/2008 3:35:38 PM PDT

by

Cedric

To: devere

thats my big fear is that is a gift for bambi, even though he is neck deep in donations to Freddie and Fannie and Lehman...

your right that is worse then a market crash... i hope McCain figures out a way to come out of this instead of being tied to it...

63

posted on

09/17/2008 3:38:41 PM PDT

by

wyowolf

("we were the winners , cause we didn't know we could fail.")

To: wyowolf

If things steady out, some buying opportunities. If this continues...

Invest in steel, brass, lead, and seeds.

64

posted on

09/17/2008 3:40:32 PM PDT

by

redgolum

("God is dead" -- Nietzsche. "Nietzsche is dead" -- God.)

To: GOPJ

In the short run, we all will be but we are Americans, don’t despair.

65

posted on

09/17/2008 3:40:45 PM PDT

by

tiki

(True Christians will not deliberately slander or misrepresent others or their beliefs)

To: wyowolf

The DOW low in July 18, 2006 was 10683, and double bottomed there along with June 14, 2006. This is the nearest resistance. Today (coincidentally?) the DOW had a low of 10660, which slightly broke through this resistance level.

If the DOW (and other markets) continues to break down, the next appreciable resistance is from mid-October, 2005, 10213.

The step after that is around 10000 (Apr 2005).

Below that, one goes to the around 9700 (Oct 2004)

From there, it's a plunge to the 7500 level (Mar 2003).

My bet is it ends up there if this continues into next week. Panic has now hit the Markets all over the world.

There is in place an immense formation that is breaking down here and we are at a critical point. Further chaos will continue to fuel the plunge. With the systemic changes in the banking and currency which are happening, I see nothing to stop it.

Sorry to be so glum, but this seems to be a massive meltdown with little hope in sight. The government can only temporarily halt the slide or make it worse - not make it better and I don't care who gets elected. But with Obama, it will be institutionalized and made permanent.

As the Reverend Wright would say, "them chickens are comin' home to roost!".

Thanks to unwise governmental mandates and economic policies - most lately in the housing mortgage markets - unbridled greed by Big Connected Players, and rampant speculation in the derivatives and banking markets all fueled by the bright people with huge bonuses who thought their complicated computer models simply couldn't fail (they are too smart). Then, Our government's huge budget deficits, unfunded liabilities, plunging dollar, outrageous regulations, and insane energy policies have only added fuel to the raging fire which now burns bright worldwide.

In the end, our creditors will own us for our decades of hubris and mismanagement. Or maybe we'll just financially take them down with us.

The major weapon we have left is our US Dollar printing press - now working full speed ahead. In the end, that will destroy the accumulated savings and wealth of everybody in this country. It is already heating up fast. Look at all the guarantees and bailouts. Can we even count them up any more? How does anyone think this house of cards can remain standing?

I don't claim to be an expert in all this. I'm just reading the charts and listening to the news like everybody else.

Somebody, anybody, please, show me where I am wrong. I want a good night's sleep, just like anybody else.

66

posted on

09/17/2008 3:41:56 PM PDT

by

Gritty

(Politicians' top priority is to solve their own problem: getting elected and re-elected-Thomas Sowel)

To: montag813

You’re going to go long GS?

You’ve obviously got more money than you know what to do with.

There’s going to be many better bargains out there, and in companies that still have a functional business model.

67

posted on

09/17/2008 3:42:45 PM PDT

by

NVDave

To: divine_moment_of_facts

“http://beta.realtor.com/realestate/1099212203/ The heck with NJ.. I have my eye on this!”

What would taxes be on that home? Here in the South Hills of Western PA (near Pittsburgh), depending on school district, and assuming the assessed value was about $300K, you’re looking to spend $10,500 to lease that house from the government each year. In my school district, you are looking @ $12K/year to, again, lease that home from the Borough.

Nice, huh? And they wonder why we keep losing population.

I don’t know how much longer this oppression can last...governments bail out banks that should FAIL yet we have to pay all of that damn tax money to support this nonsense while you have a welfare class that is nothing more than a bunch of parasites on the entire system.

I HAVE HAD IT!

68

posted on

09/17/2008 3:43:30 PM PDT

by

edh

(I need a better tagline)

To: microgood

True, but voters will blame this on Bush, and to the extent they can tie McCain to Bush, they will take it out on him.

I could be wrong...we'll see. Anyway, Carter ran as a populist and he was a governor. Obama's got the "elitist" label stuck on him and he's only been senator for two years.

69

posted on

09/17/2008 3:43:39 PM PDT

by

macamadamia

(Life is a continuation of war by other means.)

To: Uncle Hal

Okay, tell me, do you know what they do with borrowers if they’re going broke? I’m not worried about the stock, per se, I have none and I don’t have a 401K but I have a lot of debt on land, I am current on my payments but I do know that every note I sign does say that they can demand immediate payment and that scares me. I’d have to just let them have my business.

70

posted on

09/17/2008 3:43:59 PM PDT

by

tiki

(True Christians will not deliberately slander or misrepresent others or their beliefs)

To: divine_moment_of_facts

That is the one thing the gold bugs haven't realized.

Look at the early Middle Ages. If you had a gold coin, you were rich! Except you couldn't really spend, and a lot of people will kill you to get it.

In a SHTF scenario, gold is a big liability. It makes you a target.

71

posted on

09/17/2008 3:44:21 PM PDT

by

redgolum

("God is dead" -- Nietzsche. "Nietzsche is dead" -- God.)

Boy... somebody on McCain’s staff really screwed up. First on Tuesday, McCain flat out said he was against the AIG bailout. Now he is supporting it. Some staff members have just not been doing their job.

72

posted on

09/17/2008 3:44:47 PM PDT

by

ruschpa

To: Gritty

I don’t see anything wrong in your analysis.

I see nothing that indicates capitulation yet. Just wave after wave of sell-off.

The best indicator of the end of this crap that I can think of now is that we go a whole month without there being some meeting at the offices of the NY Fed over a weekend.

Every time we have one of those meetings, the market gets more ape. There’s a lack of actual details and analysis being announced by the Fed or Treasury. All we know is that they meet, and then more banks/companies/funds blow up.

73

posted on

09/17/2008 3:45:57 PM PDT

by

NVDave

To: wyowolf

This is nothing compared to what will happen if WaMu goes under. That name keeps popping up in articles today and its making me pretty uneasy.

To put it in perspective, WaMu is worth about 10 times more than IndyMac. So if Indy was too big to fail, and WaMu goes under...more business bailout on taxpayer dime.

To: Gritty

Steve McCroskey: Looks like I picked the wrong week to quit drinking.

Steve McCroskey: Looks like I picked the wrong week to quit smoking.

Steve McCroskey: Looks like I picked the wrong week to quit sniffing glue.

Steve McCroskey: Looks like I picked the wrong week to quit amphetamines

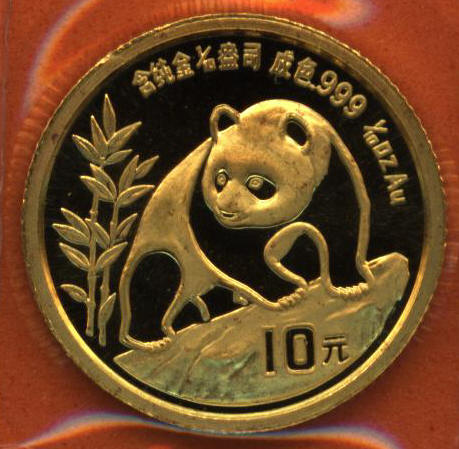

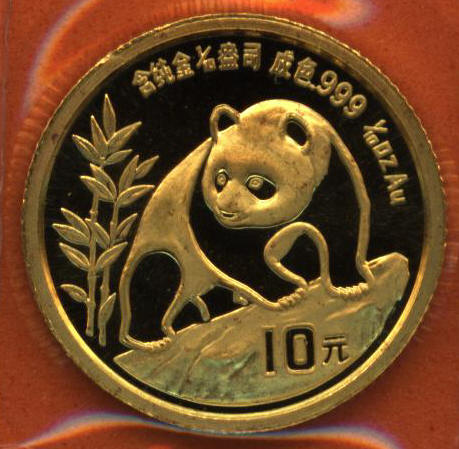

To: divine_moment_of_facts

"I’ve always wondered.. When you go to buy a loaf of bread with a $1000 gold coin.. how are they going to give you change?" Years ago, I was in a big hurry at the Dallas/Ft Worth airport and as I was getting out of the taxi, I look down where I was placing my foot and saw what I thought looked similar to a round package of Life Savers...I grabbed it off the curb and shoved it in my pocket.

After I was comfortable on the plane, I looked at the package...It was a package of Chinese Panda 1/10 ounce gold coins, 10 of'em! The point is, all gold coins aren't one ounce. There's also a 1/20th ounce too.

76

posted on

09/17/2008 3:49:00 PM PDT

by

blam

To: ruschpa

None of the candidates knows their buttocks from a warm rock about the market. That’s the worst thing about this - none of our illustrious political leaders (including Bush) know anything useful about markets any more. They’re completely out of the loop, clueless as a five-year-old.

77

posted on

09/17/2008 3:50:12 PM PDT

by

NVDave

To: LS

Same here. Gotta ride it out. I think 10,000 is bottom. Important support on the Dow has just been violated, which is why we had a huge collapse starting an hour before closing. I see the bottom as being in the 6000 - 8000 area. Change your asset allocation to T-bills and shotgun shells.

Watch the Asian markets tonight. The next few days will probably see one of those round-the-world cascading meltdowns. In a week or so, you'll be able to come out from under the bed and be able to give UN troops some help cleaning up broken glass in your neighborhood.

To: edh

Now that is a whole lotta house for the loot!

I didn't check the taxes for Round Rock, TX.. but it has to be a fraction of what I pay on a tiny, modest condo in NJ.

The only things keeping me here are my family and the weather.

To: blam

True and that is a great story! Sweet!

Guess I'll only be able to do business with people who have change for an ounce.. lol!

We're all going to need to sharpen our bartering skills real soon.

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100 ... 121-137 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson