Historical Length of Recoveries

Posted on 01/09/2016 9:43:05 PM PST by SeekAndFind

Here’s a newsflash that CNBC didn’t mention. According to the BLS, the US economy generated a miniscule 11,000 jobs in the month of December.

Yet notwithstanding the fact that almost nobody works outdoors any more, the BLS fiction writers added 281,000 to their headline number to cover the “seasonal adjustment.” This is done on the apparent truism that December is generally colder than November and that workers get holiday vacations.

Of course, this December was much warmer, not colder, than average. And that’s not the only deviation from normal seasonal trends.

The Christmas selling season this year, for example, was absolutely not comparable to the ghosts of Christmas past. Bricks and mortar retail is in turmoil and in secular decline due to Amazon and its e-commerce ilk, and this trend is accelerating by the year.

So too, energy and export based sectors have been thrown for a loop in the last few months by a surging dollar and collapsing commodity prices. Likewise, construction activity has been so weak in this cycle—-and for the good reason that both commercial and residential stock is vastly overbuilt owing to two decades of cheap credit—–that its not remotely comparable to historic patterns.

Never mind. The BLS always adds the same big dollop of jobs to the December establishment survey come hell or high water. In fact, the seasonal adjustment has averaged 320,000 for the last 12 years!

For crying out loud, folks, every December is different—–and not just because of the vagaries of the weather. Capitalism is about incessant change and reallocation of economic activity and resources. And now the globalized ebbs and flows of economic activity have only accentuated the rate and intensity of these adjustments.

Yet the statistical wizards at the BLS think they can approximate a seasonal adjustment factor for December that at +/- 300k amounts to just 0.2% of the currently reported 144.2 million establishment survey jobs, and an even smaller fraction of the potential adult work force which is at least 165 million.

But that’s a pretentious stab in the dark. The December seasonal adjustment (SA) could just as easily be 0.3% of the job base or 0.1%, depending upon the specific point in the business cycle and structural trends roiling the economy.

Indeed, these brackets alone would vary the headline SA number by 150k to 450k. The fact that the seasonal adjustment factor for December has oscillated tightly around 300,000 for the last 12 years proves only one thing—–namely, that the bureaucrats at the BLS have chosen to invent the same guesstimate year after year; its not science, its political fiction.

The fact is, the seasonal adjustment factors are about the closest thing there is to pure noise among all the dubious “incoming” data that the Fed and Wall Street obsess over.

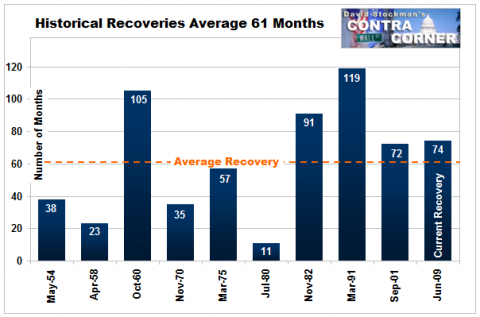

Here’s a better take on the matter. We are now in the 78th month since the June 2009 recession bottom, and are reaching the point where this so-called business cycle expansion is getting very long in the tooth by all historical standards.

So what happened to the non-seasonally adjusted (NSA) job count in December at similar points late in the course of prior cycles? Well, in December 1999 about 140,000 jobs were added and in December 2007 there was a NSA gain of 212,000. This time we got the magnificent sum of 11,000, and by the way, last year was only 6,000.

The real news flash in the December “jobs” report, therefore, is that even by the lights of the BLS’ rickety, archaic and virtually worthless establishment survey, the domestic economy is dead in the water. We are not on the verge of “escape velocity”, as our foolish monetary politburo keeps insisting; the US economy is actually knocking on the door of recession.

And that’s why the retail sheep have been led to the slaughter once again in the Wall Street casino. The cats who run it have embraced the nonfarm payroll report as the primo macroeconomic indicator because they know that it drastically lags the real drivers of main street activity and has an abysmal record of forecasting turns in the macroeconomic cycle.

Stated differently, these fictional monthly SA jobs numbers are extremely useful to the Wall Street sell side. They keep the rubes hitting the “buy” button until the fast money can slowly dump its holdings and get out of Dodge; or even pivot and reload to the short side.

That’s right. We are not talking tin foil hats here. It is plain as day that the BLS’ seasonal adjustments are a completely stupid waste of time. During the winter season especially, it might as well just use a random numbers generator.

Indeed, here’s what the Steve Liesman’s of the world never tell you—–undoubtedly because they don’t know. Fully two-thirds or 200,000 of the 300,000 December seasonal adjustment is in the construction sector!

So the whole December SA is essentially a weather proxy designed to adjust a survey taken during the middle week of the first month of winter. Could weather fluctuations impact the number of construction workers on the job by a mere 2% (150,000) around the week of December 15?

Well, yes it could. And that means we really don’t know whether 292,000 “jobs” were created in December or whether it was only 142,000.

Once again, loose the SA noise in the construction sector job count. This category alone accounted for 45,000 of the headline gain, but that was owing to the fact that the 6.538 million figure reported for the construction category was flattered by a 196,000 seasonal adjustment.

Instead, look at the non-seasonally adjusted (NSA) number compared to the same point in the cycle from prior history. Thus, at the December 2006 peak the number of construction jobs was 7.585 million, meaning we are still down by 1.1 million jobs or 15% from the prior cycle high.

And in December 2000, there were actually 6.7 million construction jobs. That is, we have not yet returned to the cyclically comparable level that prevailed at the turn of the century.

In short, the December jobs report was not evidence of a “strong” economy. It was just another emission from the government’s SA noise factory that obscures the actual state of the main street economy.

So here’s the real truth. Construction jobs are breadwinner jobs. The average annualized pay rate for the category is $57,000, but the US economy is not actually generating new construction jobs any longer.

What’s happening is that the BLS is simply reporting “born again” jobs and thereby enabling the Keynesian chorus to claim “progress” and “strength”, and for its Wall Street section to blather about “blow-out numbers”. Indeed, the latter has embraced the Keynesian model lock, stock and barrel precisely because its so useful in the stock peddling business.

The Keynesian model is about deltas, not levels. For reasons we will amplify below that’s almost always misleading in the context of monetary central planning and the bubble finance cycles that flow from it.

In fact, the only valid measure of economic strength and the main street economy’s capacity to support sustainable profit growth and higher stock prices is the change in levels over time at cyclically comparable points.

That gets us to the larger story embedded in the above observations about the construction sector jobs series. Namely, just as there have been no trend gains in the level of construction jobs since the turn of the century, the same is true of the much wider swath of what we have called “breadwinner jobs”.

These jobs in construction, energy and mining, manufacturing, FIRE, the white collar professions, business management, information technology and trade/distribution account for 50% of all nonfarm payroll slots, pay upwards of $50,000 per year on average and account for more than 66% of total wage and salary disbursements.

Yet the December 2015 number of breadwinner jobs was still 1.1 million jobs below that posted for the first month of this century!

Needless to say, that’s not “strength”. It’s actually a profound indictment of the archaic convention embedded in the monthly employment report that counts job slots, not the variable gigs and hours on which employment in the contemporary US economy is actually based.

Indeed, all the Jobs Friday hoopla is based on your grandfather’s BLS survey, which arose at a time when everyone punched the clock at the Ford factory 40-50 hours per week, including overtime. By contrast, now the greeters and cash register operators at Wal-Mart are computer-scheduled in 15 minute increments.

Since average pay for the bartenders and waiters category is less than $20,000 on an annualized basis owing to an average of 26 hours per week and $13/hour pay rates, you need 2.5 of these gigs to get the equivalent of one breadwinner job. Yet on Jobs Friday its all one job, one vote.

So what is actually happening beneath the surface is a great swap out. The very highest productivity jobs in goods production are disappearing on a trend basis; the monthly deltas reported so breathlessly on bubble vision actually embody purely “born again” employment slots that represent the partial recovery of jobs lost during each crash of the Fed’s serial financial bubbles.

But the cyclically adjusted trend is down, not up. It represents economic weakness and reduced capacity to generate productivity, income and profits, not strength.

In fact, not withstanding the “blow-out” December numbers, the US economy still has 11% fewer jobs in goods production—-mining, energy, manufacturing and construction—–than it did at the December 2007 cyclical peak, and 21% fewer than at the turn of the century.

By contrast, what is being swapped in are what we have called Part-Time Economy jobs, where there have been modest cyclically comparable gains in job levels during the past 15 years. Needless to say, however, the average annualized pay rate in this category is less than $20,000.

But even these trend level gains are heavily concentrated in the lowest quality quadrant. That is, in what we have called the “Bread and Circuses Economy”—–bartenders, waiters, bellhops, maids, parking attendants, hot dog vendors and the like.

The fact is, this category accounts for fully 70%, or 1.8 million, of the 2.59 million gain in Part Time Economy jobs since the pre-recession peak in December 2007.

Another factor obscured by the BLS’ archaic job slot counting convention is the root wealth and productivity contribution of the job count at any point in time. Generally, private sector jobs financed by consumers add to wealth and productivity at varying degrees, depending on the sector.

By contrast, taxpayer financed jobs—–directly through government outlays or indirectly through heavy tax subsidies and preferences—–do not add to wealth, and, not to put too fine a point on it, may well subtract from it. And that gets us to the HES Complex (health, education and social services).

This is the fastest growing job category since the turn of the century, yet it now depends upon more than $2 trillion per year of Medicare, Medicaid and other government health spending—–plus another $250 billion or so of tax expenditures for employer health plans and tax credits for education.

Yes, it can be argued that a some part of the current 32.6 million jobs in the HES Complex add to long-run productivity via education and health status improvement of the working age population. But that point does not get you too far if you recognize the abject and worsening failure of public education in the US and the gross inefficiency of our third-party payment dominated health care system.

Far more relevant is this fact. For the entirety of this century there has been only a 3.7% net gain in even the gross number of job slots in the US economy outside of the HES Complex, and that measurement includes the Part Time Economy and its Bread and Circuses subset.

Stated differently, on a trend level basis, the US economy has only generated 21,000 jobs per month over the last 15 years that were not funded by the public fisc, and therefore indirectly by the $10 trillion gain in public sector debts since the turn of the century.

So whatever is embedded in the BLS payroll count, don’t call it recovery, strength or progress. Instead, call it a propaganda cloud that serves the interests of Wall Street and the monetary central planners, alike.

Here’s the thing. You can not sell stock if you tell customers that a recession is coming and earnings are going to be heading sharply in a southerly direction. So Wall Street never does.

By the spring of 2008, for example, after the subprime mortgage implosion was well underway, Countrywide Financial had already failed, AIG was hitting the rocks, Bear Stearns was gone, and housing sales and starts were sliding rapidly from their towering peaks, the Wall Street consensus ex-items hockey stick still pointed to S&P earnings of $115 per share.

As it happened, the actual result was $15 per share. And the homegamers who stayed in the market on that assurance were treated, instead, to a bloodbath in which they lost trillions in their 401k and brokerage accounts.

Likewise, the monetary central planners at the Fed and their economist cheerleaders have never forecast a recession. That’s because they embrace the cardinal Keynesian Error, which holds that private capitalism is inherently unstable and prone to extreme cyclical swings—-even a tendency toward depressionary black holes.

In fact, the overwhelming share of business cycle fluctuations are caused by central bank intervention. The excesses, imbalances, malinvestments and speculative bubbles which cause recessions result from the systemic falsification of interest rates and financial asset prices that is inherent in activist monetary policy.

Nevertheless, monetary central planners assume that their policy tools and maneuvers are not only doing gods work of keeping private capitalism on the straight and narrow, but that they are actually abolishing the business cycle itself. Indeed, the arrogant and foolish professor from Princeton, Ben Bernanke, called it The Great Moderation in March 2004 just as the greatest bubble and bust in modern history was working up an explosive head of steam.

Notwithstanding the thumping repudiation of that conceit which occurred during the great financial crisis and recession, the predicate remains that this time is different. To wit, the monetary central planners finally have it right and will steer the US economy deftly to the nirvana of permanent Full Employment, world without end.

But just as the stock market narrows as the bubble reaches its apogee—-a dynamic played out again in 2015 when the four FANG stocks ( Facebook, Amazon, Netflix and Google) accounted for $500 billion of gain while the 496 remaining stocks in the S&P 500 lost more than that amount—-an inverse process happens with the “incoming” macroeconomic data.

To wit, the positive monthly and quarterly deltas become fewer and fewer as the leading edges of the GDP roll over. In that respect, CapEx orders, business sales, inventory accumulation, exports and much else have already left behind the big gains recorded early in the recovery cycle, and are now posting decidedly negative comps.

But our Keynesian chorus in the Eccles Building and in the canyons of Wall Street clings to the last positive delta standing—–the monthly jobs count.

That’s party because they embrace a closed economy, labor utilization model of the US economy that has been obsolete since the 1960s, but also because our monetary central planners and their acolytes cling to the conceit that they have abolished the business cycle.

Out of some combination of naiveté, duplicity and stupidity, these fools actually believe they are feathering the $18 trillion US GDP to a soft landing and a permanent cycle of expansion.

Needless to say, the 281,000 seasonal adjustment factor contained in the December jobs “blowout” came just in the nick of time. Practically every other indicator is pointing toward recession and their itemization would require a whole new post. But here are two.

When they stop buying big truck rigs after a strong cyclical rebound, the end is near. During the last three months, new orders for heavy trucks have declined by more than 40% Y/Y, and inventories of unsold rigs are near an all-time high.

At the end of the day, the phony December jobs number is probably the last positive delta standing. Yet it is the laggard of all lagging indicators.

As we have consistently pointed out, the C-suites of corporate America have been turned into stock trading rooms—–focused almost exclusively on financial engineering in the form of M&A deals and stock buybacks. Accordingly, they remain way too bullish as the Fed’s bubble cycle is drawing to a close and hoard labor until the very end.

Then, when the bubble collapses, they furiously heave excess labor overboard in a desperate efforts to keep their stock price afloat and their stock options from plunging deep underwater.

Here’s what happened last time the stock market crashed. This time will surely will be no different.

and Macy's just dumped 4000+ workers after the first of the year

and Macy's just dumped 4000+ workers after the first of the year

The agriculture sector is entering a third year of depressed prices and from past experience the regular economy hits recession in that third year.

What the Worst First Week of Trading In History Tells us About the Year to Come

https://www.youtube.com/watch?v=0YV3v9TDdz0

11,000 new jobs rounded up to the nearest 300,000.

I was in numerous retailers this holiday season , business sucked... my wife manages a restaurant ,, the servers normally work extra leading into Christmas but most couldn’t find extra work.. All this happy talk about “but they bought online!” is crapola ,, people buy online because it saves money ,, gas money , your time and lower prices because online retailers have lower costs.

100% and i think those that Macy's let go were mostly full time positions not seasonal

100% and i think those that Macy's let go were mostly full time positions not seasonal

Looks to me like the seven year cycle is inevitable but worse than in the past because this is mostly a fake economy. The next president inherits a bloody mess for at least two years, probably more like three or four.

This economy generates crap jobs. About the only way to have a decent income is to create a job for yourself as in create a business but the people to sell to are dwindling down. Bartenders, baristas, waiters and the like don’t buy much stuff. They can’t.

The money is going to medical and legal professions so long as the boomers have money to spend on their health and so long as more laws are made. Both seem to be booming industries.

I am amazed at Houston though. What is sustaining it? The restaurants are full out in the burbs and mid-town even on week nights. Oilfield jobs are absolutely in the dumper. There are people employed but all the jobs are on squishy ground if not just marsh grass mats.

A service economy is a very weak economy that can’t last. You have to make something that adds value to the materials you have available.

I buy online because it is convenient, less stress, I find what I want and it is available in the selections I want.

More and more a trip to the store is a waste of time. Every time, and I do mean every time, I go to Lowe’s the basked is a compromise of what I really want and need. After searching the store over and asking clueless “in store experts” about the whereabouts of products I end up just parking my partially full cart and walking away. I go home and order what I need for the most part. My wife finds the same thing, because of lack of stock in correct sizes and colors she just orders everything she buys in the way of clothing and a bunch of other products and I do mean EVERYTHING.

I also buy a lot of used stuff from Ebay and Craig’s list. Either of those places have become my go-to for all manner of industrial supplies and equipment. We have a lot of good used serviceable stuff scattered across the country that can be repurposed and there is a lot of that going on. The internet has become a boon to recirculating durable goods that once only had local outlets and just sat unused or went to the scrap yard. For example, three durable things I have bought in the last month that served someone well for a long time and are perfectly serviceable or recoverable by someone with know how are pallet racks, hydraulic hose crimper and a a 35 year-old US MADE bull dozer I can still get parts for that has no computer and is easy to work on. All three items bought for a fraction of new cost. This looks like a new and growing economy segment to me. So much stuff made now is some form of throw-away, too complex to be dependable or just made in China crap not worth buying so why bother buying it at all?

Big lies!

Stockman: Only 11,000 Jobs Last Month, Not 292,000

NewsMax ^ | 01/09/2016 | David Stockman

Posted on 1/11/2016, 4:06:12 PM by GilGil

So what happened to the non-seasonally adjusted (NSA) job count in December at similar points late in the course of prior cycles? Well, in December 1999 about 140,000 jobs were added and in December 2007 there was a NSA gain of 212,000. This time we got the magnificent sum of 11,000, and by the way, last year was only 6,000.

The real news flash in the December “jobs†report, therefore, is that even by the lights of the BLS’ rickety, archaic and virtually worthless establishment survey, the domestic economy is dead in the water. We are not on the verge of “escape velocity,†as our foolish monetary politburo keeps insisting; the US economy is actually knocking on the door of recession.

http://www.freerepublic.com/focus/f-news/3382446/posts

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.