Skip to comments.

Janet Yellen And The Weak Money Parade (Money Multiplier And Velocity At All-time Lows)

Confounded Interest ^

| 09/22/2013

| 09/22/2013

Posted on 09/22/2013 4:51:14 PM PDT by whitedog57

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

To: 1010RD

...A pro-commerce Executive could work miracles by simply opening up the market...--or just someone who's not at war with business. What people are finding out is that the law of supply and demand is like the law of gravity --they're not laws someone can disobey and evade.

...breakthrough apps that replace a medical degree for diagnosis.

A good friend of mine is a medical doctor that speaks flawless English and she's working full time as a translator. My thinking is that folks like her could make more money as online human medical doctors. Things are changing so fast; medical tourism is booming because the cost of a plane ticket plus a same-day medical appt. in Latin America is less than a U.S. appt for next month.

To: expat_panama

The benefit of the IRS scandal is that it gives more ammo for eliminating taxation of any corporation. That will really help grow the economy.

Only people pay taxes must be made clear. I don’t think, though, is that voters really get supply and demand. That’s why I think a suspension of Obamacare is the way to go. There is no excuse for Democrats. It focuses the public’s attention on the fact that government is the cause of the majority of the problems our nation faces.

22

posted on

09/23/2013 6:27:52 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

Hopefully this article and associated will help to kill the silly notion that “printing money” is, in and of itself, inflationary. Much less the just stupid comments that “hyperinflation is coming!!!” It’s just not supportable. Deflation is a far more clear and present danger. That is what killed the economy in the 1930’s and why Bernanke is so willing to be accomodative now.

To: expat_panama

On to your second point, the economy is dying because it is being choked off by regulation ,uncertainty, and the most anti-business government in American history.

To: Wyatt's Torch; 1010RD

kill the silly notion that "printing money” is, in and of itself, inflationary.--and it's necessary and it's not causing a stock market boom and it's not enabling fiscal deficits. What amazes me is how so very few people of our view are heard from these days.

...the most anti-business government in American history....

Roosevelt and Truman seemed to have that problem too, but I'm not aware of either of them having referred to the business community as "the enemy" for whom he "wasn't elected to do any favors for".

To: expat_panama; Wyatt's Torch

A lot of the most cogent posters on economics and fiscal policy were purged or quit. The issue the economy faces as regards the FED is that its accommodation isn’t getting to market. Banks are retaining the cash and a credit crunch still exists. Even the nonbank lenders and investors are extremely wary. As has been mentioned, there are too many unknowns.

The one big known is that the Cook County Communists that make up Obama’s inner circle, including his wife, hate business and the market economy and are willing to use any lever to harm it.

They’ve worked hard to create an atmosphere of continual economic despair.

26

posted on

09/23/2013 9:00:39 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

Solid post all the way around. Exactly right.

To: 1010RD; Wyatt's Torch

To: expat_panama; Wyatt's Torch

That’s classic crowding out. It’s something I don’t like about the GDP calculation - the G isn’t part of the productive sector, yet its spending raises GDP.

The credit crunch I am referring to is in the productive sector. It is literally being starved by this Administration. Ironically, it is the little guy taking it in the shorts and the Democrats always care about the little guy.

You should post those graphs. They’re the most telling as to why government is the problem. It’s hard to measure the drag on the economy of taxes and regulation, but those graphs show just how badly the productive economy is doing under Obamanomics.

29

posted on

09/23/2013 3:49:52 PM PDT

by

1010RD

(First, Do No Harm)

To: SomeCallMeTim

WHERE is all the bad stuff? It SURE AIN'T HERE??? Has it dawned on you why the FED feels the need to continue it unprecedented stimulus operations if everything appears to be fivers...?

30

posted on

09/23/2013 4:50:19 PM PDT

by

EVO X

To: expat_panama; Wyatt's Torch

31

posted on

09/23/2013 8:29:22 PM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

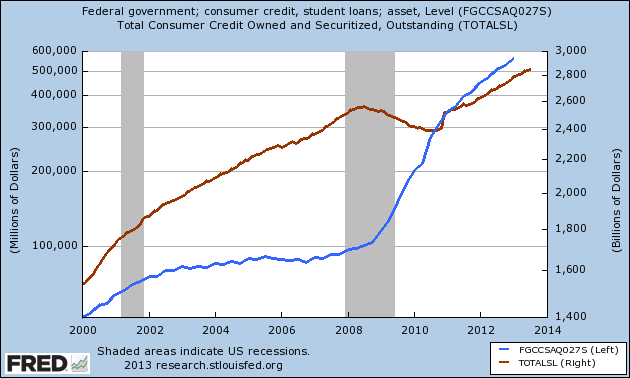

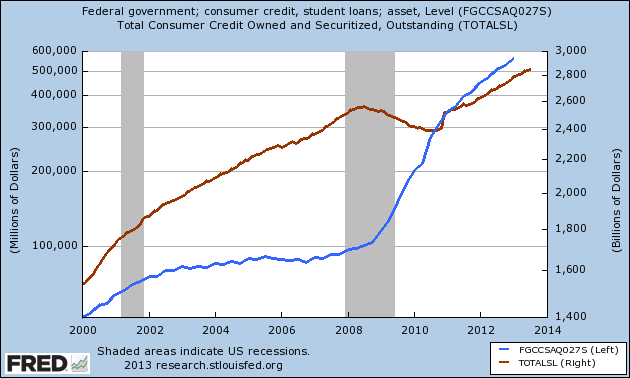

I believe that the vast majority of the increases in consumer credit come from student loans where the government is artificially creating demand. As of now banks aren’t bundling those loans and selling AAA rated CDO’s and AIG isn’t insuring the other side of the CDS’s but I could be wrong... :-)

To: Wyatt's Torch

believe that the vast majority of the increases in consumer credit come from student loansHad me wondering a minute too, but it's not even close:

It's true that student loans has surged even while total consumer credit's been leveling off but student loans still only amount only to a half $billion while total consumer credit's up in the $trillions.

Navigation: use the links below to view more comments.

first previous 1-20, 21-33 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson