Posted on 01/29/2013 8:43:20 AM PST by 1rudeboy

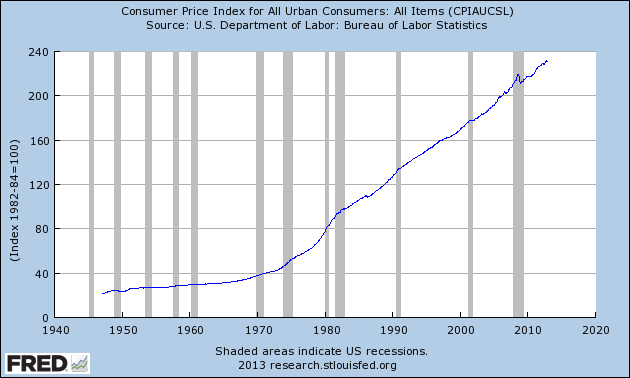

Despite the Fed’s breathtaking increase of base money since the autumn of 2008, the money stock as measured by conventional concepts such as M2 has not increased greatly, and hence, as ordinary quantity-theory-of-money thinking would lead us to expect, inflation as measured by conventional concepts such as the consumer price index (CPI) has been fairly tame during the past five years. Between December 2007 and December 2012, the CPI for all items increased only 9.3 percent. As the chart shows, this increase represented a continuation of a slow-but-steady inflation trend that extends back to the early 1980s.

This modest consumer-price inflation serves as one of the major bases for the Fed’s continued “quantitative easing” and the government’s ongoing “stimulus” spending. The idea is that because inflation seems so well contained, additional monetary ease, near-zero interest rates, and huge government deficits will affect primarily income and employment, rather than the price level.

This conventional macroeconomic thinking, however, by virtue of its highly aggregative view and its reliance on macroeconomic models with no place for capital, fails to alert policy makers to other effects—almost certainly pernicious effects—that their policies are creating.

One form of evidence of such effects appears in the asset markets, where the rate of price increase has been much greater than it has been in the markets for final consumer goods. As Austrian business cycle thinking suggests, these effects have been greatest in the markets for the goods most distant from final consumer products and services, especially in the markets for raw commodities.

As the chart shows, the producer price index (PPI) for crude materials has followed a quite different historical path from the CPI. Since World War II, it has passed through four distinct phases: I, no-growth stability from the late 1940s to the early 1970s; II, rapid increase in two bursts between 1972 and 1981; III, no growth (but with much greater variance than in phase I) between 1981 and 2001; and IV, rapid growth with even greater variance from 2002 to 2012.

Austrian thinking associates the rapid run-up of crude materials prices in phases II and IV with a flight from monetary assets, whose real values are falling or expected to fall. Investors seek the safe haven of real assets as the Fed engages in sustained easy-money policies. In addition, producers bid up disproportionately the prices of “early stage” goods required for undertaking the longer-term projects that artificially reduced interest rates encourage.

Whereas the CPI increased by 30.2 percent between December 2001 and December 2012, the PPI for crude materials increased by 166.4 percent during this period .

With the onset of the financial panic in the second half of 2008 and the economic contraction that accelerated between mid-2008 and early 2009, the PPI dropped almost by half. Since then, however, crude materials prices have increased relatively rapidly, rising by 58 percent between March 2009 and December 2012, far outpacing the increase in the CPI and maintaining a rate of increase comparable to that between 2002 and mid-2008.

Between the early 1980s and 2007, mainstream economists came to speak of a Great Moderation in business fluctuations and the rate of inflation. They spoke too soon, and they confined their view of price behavior too narrowly. Had they been alive to the importance of asset markets and to the link between monetary policy and price change in these markets, they might have noticed that all was no so well as they imagined when they heaped accolades on “the maestro” Alan Greenspan for having engineered this seeming conquest of inflation and produced this miracle of monetary micromanagement.

As anyone who ponders the movements of the PPI from the late 1940s to the present can see, things are currently far from placid on the price front. In the markets for raw materials, the past decade has been the exact opposite of a “great moderation,” and these wild swings have occasioned tremendous difficulties and required wrenching adjustments by many different kinds of producers. Yet scarcely have they made one adjustment when another one cries out for their attention. Such a violently variable, impossible-to-forecast price environment has necessarily brought about a greater volume of business mistakes and a heightened reluctance to embark on new enterprises and to make new long-term investments in existing firms. For such paralyzing uncertainty, we have policy makers at the Fed and in the federal government to thank.

After all, it's worked so well SO far...

One analogy to explain the looming inflation might be to consider a flood control dam. The water that builds up behind it during the winter and spring could be considered QE1, QE2, QE3, etc. The face of the dam would be the current moribund economic activity indicating a very low velocity of money as exampled by such questions as “Why do I want to borrow if no one wants to buy? or “Why do I want to buy when I don’t have a job?” Now stagflation happens when the reservoir gets so full with QE’s that some water just has to go over the top, even though economic activity remains anemic.

But when the economy picks up money begins to actively circulate. Water infiltrates the face of the earthen dam just as money moves through society. Now the increased velocity of money reveals the previous latent power of the QE’s, and the pressure shatters the face of the dam. Just as a wall of water scours out the stream bed and washes all before it, inflation now rages through the economy and destroys people’s financial asset values and their purchasing power.

Wow. The Dow is very near 14,000 now.

ping

Thank you for posting this, 1rudeboy. I like the way Dr. Higgs has outlined the facts.

Yet economics is not my forte - I think he is saying we’re in very deep trouble, that unemployment is

not going to improve - true?

However, when that producer "eats" the additional cost, that's a machine he didn't buy, or an employee he didn't hire. Essentially, this is what Higgs argues: policy-makers don't, or refuse, to see it.

Thanks for the explanation, 1rudeboy. The producers/businessmen must be reimbursed, or paid, whether the payment is gained by drastic budget revamping, such as in not buying a new machine, not hiring new employees. But that also negatively impacts the economy.

How can policy makers not recognize this?

We're in deep. Hope you don't mind my pinging a few people.

Thanks for the ping. More important and more overlooked is the psychology QE and other forms of government intervention and the effect it has on businesses. Every savvy RE investor I know sees a paradox in the RE market - low prices being preserved by ZIRP.

We know that once rates rise price pressures will mount because buyers don’t buy the price, they buy the payment. In the ZIRP environment you cannot make good longterm RE decisions. Right now you can buy relatively low priced RE at low interest rates and good rents if you can finance it.

Commercial mortgage rates are 5 year terms for the most part. 5 years from now you could have a refinance disaster on your hands if interest rates rise while incomes continue to stagnate. It makes long term planning difficult.

So all the QE is just amphetimine pumped into a tired body. You’re not getting the normal or natural creative destruction you should see in the market and then the new growth based on Supply/Demand reality. You’re getting sustainment by government debt and a prostituted FED. RE would be in recovery had it been allowed to seek it’s own level and the more I read about it the less I believe the “entire financial system was in meltdown”. Bush fell for it because the regulators/FED/Bankers were all one and the same.

There’s a recent article out of the Dallas Fed about the importance of small banks to economic growth. They killed the S&L market and they’ve nearly ended the small commuity banks and even regionals are under incredible pressure.

Like most liberal policies they reinforce the worst outcomes and a vicious cycle. The big guys investing in SFR is proof of this. They’re all ex-officios of the RTC and they’re getting 0% loans from the FHA with 50% down to buy the FHA’s REOs. Why not just offer those loans directly to investors and stop the mess? It’s stupid and it’s a hallmark of crony capitalism.

I know an investor who begged the bank to extend his loan or give him a principal reduction or interest rate reduction. They didn’t care and because of them he couldn’t refinance because his LTV wasn’t there. They FC’d on him and he lost 6 properties. They’re vacant and sold for 30% fo the UPB. They could have cut him a deal at 50% of the UPB and everyone would have been better off. It’s a messy situation made worse by our friends the Government.

Thanks for the ping. More important and more overlooked is the psychology QE and other forms of government intervention and the effect it has on businesses. Every savvy RE investor I know sees a paradox in the RE market - low prices being preserved by ZIRP.

We know that once rates rise price pressures will mount because buyers don’t buy the price, they buy the payment. In the ZIRP environment you cannot make good longterm RE decisions. Right now you can buy relatively low priced RE at low interest rates and good rents if you can finance it.

Commercial mortgage rates are 5 year terms for the most part. 5 years from now you could have a refinance disaster on your hands if interest rates rise while incomes continue to stagnate. It makes long term planning difficult.

So all the QE is just amphetimine pumped into a tired body. You’re not getting the normal or natural creative destruction you should see in the market and then the new growth based on Supply/Demand reality. You’re getting sustainment by government debt and a prostituted FED. RE would be in recovery had it been allowed to seek it’s own level and the more I read about it the less I believe the “entire financial system was in meltdown”. Bush fell for it because the regulators/FED/Bankers were all one and the same.

There’s a recent article out of the Dallas Fed about the importance of small banks to economic growth. They killed the S&L market and they’ve nearly ended the small commuity banks and even regionals are under incredible pressure.

Like most liberal policies they reinforce the worst outcomes and a vicious cycle. The big guys investing in SFR is proof of this. They’re all ex-officios of the RTC and they’re getting 0% loans from the FHA with 50% down to buy the FHA’s REOs. Why not just offer those loans directly to investors and stop the mess? It’s stupid and it’s a hallmark of crony capitalism.

I know an investor who begged the bank to extend his loan or give him a principal reduction or interest rate reduction. They didn’t care and because of them he couldn’t refinance because his LTV wasn’t there. They FC’d on him and he lost 6 properties. They’re vacant and sold for 30% fo the UPB. They could have cut him a deal at 50% of the UPB and everyone would have been better off. It’s a messy situation made worse by our friends the Government.

ROFLOL only a couple minutes into it and I love it! Who knew economists could have such a rich sense of humor?

Thanks for the ping! Jeepers...

Thanks for the ping. When I stopped laughing, I emailed the link. :-)

ROFLOL! Loved it! He's wickedly funny! Where did you find him? He's smart, he's funny and an economist! Wow!

You’re welcome, Alamo-Girl. Gloomy news, to be sure.

Have you read this?: http://research.stlouisfed.org/publications/review/12/11/Thornton.pdf

Only slightly less funny. ;-]

Thank you for the ping, post, and links.

Here’s a bump to go with them. [smiles]

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.