Skip to comments.

Y'all? Please forgive my ignorance. (Questions about Romney's tax returns)

Me

| 9-22-12

| RandallFlagg

Posted on 09/22/2012 6:44:59 PM PDT by RandallFlagg

Well, FRiends....

The guys at work and I got into a heated debate about taxes and what Romney paid in a percentage.

I told them the whole thing about what one earns they should keep, and how government wastes so much of our $$$ every year.

I went through how the, "Rich," are vastly outnumbered by the middle class, and that soaking the rich does nothing toward the betterment of the nation.

Here's what I am requesting from you folks on Free Republic who are smarter than I...

What was Romney taxed on, and what was the dollar amount compared to his take-home pay?

(I'm an hourly shift-worker and have no idea about other things such as investments and all that)

In short, I want to know what the break-down of these tax returns are as compared to us regular working stiffs.

I tried to explain about his taxes, but really have no knowledge about such things. I suck at numbers.

TOPICS: Business/Economy; Politics; Reference; Society

KEYWORDS: romney

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-42 next last

To: RandallFlagg

After telling them all that you have learned from these wise Freepers, then tell them that they too can do the same.

All it takes is the Freedom to accomplish through industrious work ethic's, setting goals and learning to save.

Then tell them that they too CAN BUILD THAT, if only the Government would get out of the way.

Tell them that ALL Republicans wants everyone to succeed to the MAX of their ability, we love rich people, and hope everyone could be as well. No jealousy, just glad to have a job.

Can a poor man give you a job?

21

posted on

09/22/2012 7:33:58 PM PDT

by

annieokie

(O)

To: abercrombie_guy_38

If your family pays 25% effective rate, their income would have to be at least $500,000 and probably more like $1 million or above. The tax rate for 25% doesn’t even start until you hit $300,000 or so AFTER deductions, charity, mortgage, personal deductions, business deductions, etc. That’s only on earnings from salary or business profit for self-employed. Any stocks, investments, dividends, etc is 15%, which almost anyone one at that level of income is certainly going to be factored in.

I challenged someone I know on this a few months ago, after she said she pays 25%. I called BS on it. In reality, she had no idea.

22

posted on

09/22/2012 7:36:04 PM PDT

by

ilgipper

To: abercrombie_guy_38

My mom started saying Romney paid too low of a rate compared to the 25% my family pays Does her family really pay 25%? Or is that just the marginal rate?

Romney's tax rate was calculated by dividing taxes paid by gross income. It was low for his income bracket, but considering the source of his income and the huge charitable deduction, it's not usual.

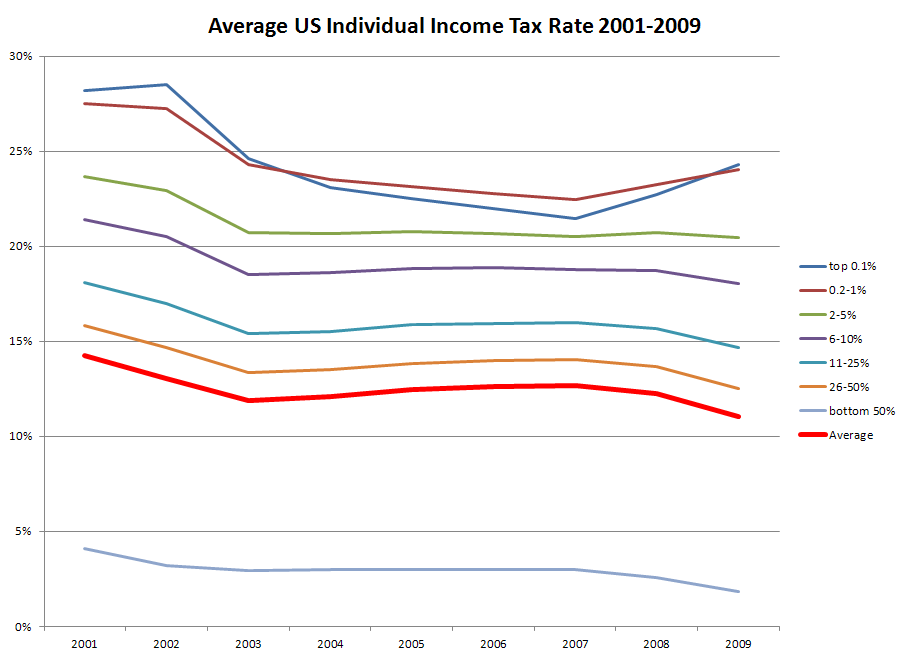

As a group, you don't pay an average rate of 25% unless you are in the top 1%. The average for EVERYONE (in 2009) was about 11%:

That is just for individual income taxes. If you are a wage earner, you pay another 7.65% for Social Security and Medicare. Actually, you pay double that, but most people don't know it.

But, you can't compare your combined Social Security + Medicare + individual income taxes to someone else's income taxes (only). There are three different taxes, and each has a different purpose.

If Romney doesn't pay Social Security taxes, he doesn't get any Social Security benefits. He will be covered by Medicare, but I suspect he won't be using it.

23

posted on

09/22/2012 7:39:08 PM PDT

by

justlurking

(The only remedy for a bad guy with a gun is a good WOMAN (Sgt. Kimberly Munley) with a gun)

To: Attention Surplus Disorder

24

posted on

09/22/2012 7:40:13 PM PDT

by

Delta 21

(Oh Crap !! Did I say that out loud ??!??)

To: RandallFlagg

Try this line of thought:

Let's say that you are single and make $50,000 / yr ($25 per hour).

For ten years you work a ton of over overtime, and make an extra $50,000 for a total of $100,000 every year.

Because you save the overtime income, you can say that you save $50,000 a year - but we know that you owe federal tax, FICA, Medicare and state taxes.

On $50,000 you pay (as a single person) a combined $15,000 each year of taxes. You learn to live on that net $35,000.

You pay about $20,000 in combined taxes on the additional $50,000 - not exact but not far off, and I like round numbers. You save that net $30,000 each year.

At the end of ten years you have $300,000 in savings, plus interest of $120,000 (less taxes on the interest of $20,000) for a total of $400,000.

You have now paid taxes on -

your weekly paycheck and all your overtime, at a rate of 35%,

your interest income on your savings account of 20% - 35%.

You have made a good living, but have paid a lot of taxes. One reason why INCOME taxes are unfair to the majority of taxpayers, and a great deal to “trust fund kiddies”.

Tired of work, and paying lots of taxes, you send your entire savings account to an INVESTMENT account - not a regular savings account - and you can get a full 10% return on it for $40,000 annually.

You no longer have a paycheck -

You pay 15% on your $40,000 of interest -

You learn to live on a net $34,000 annually ($40k - $6k)

You already paid taxes on the $400,000, so you now pay capital gains tax, which has varied from 10% to 15% to 25% and soon 35% ...

You pay no additional taxes on the $400k ... you have already paid taxes on it.

That is all that Mitt did - he earned a lot legally, paid taxes on it and saved a lot.

The only difference is that he INVESTS his money, and earns a lower tax rate, just like all the trust fund kiddies do with the money that Daddy and Grandpa left them.

25

posted on

09/22/2012 7:51:07 PM PDT

by

texas booster

(Join FreeRepublic's Folding@Home team (Team # 36120) Cure Alzheimer's!)

To: texas booster

and you can get a full 10% return on it for $40,000 annually Seriously? Where?

26

posted on

09/22/2012 8:00:52 PM PDT

by

FredZarguna

(Romney is paying 15% tax on money he's already paid taxes on at least once before.)

To: RandallFlagg

Here's the simple answer: the average American's Federal Income tax liability is about 11%. For most people, that is the effective rate for W-2 or self-employment 1099 non-investment income.

Romney has no job, so he is paying taxes on investment income. That income is taxed at a lower rate to encourage savings and future economic growth. It is also money that has already been taxed (at least once) at the higher earned income rate. And even though paying at a lower nominal rate than most American (at 15%) his effective rate (the money he actually pays) was 14.1% in 2011. That is 3.1 points and around 25% more than most Americans pay. In just one year, 2011, it was also more money in dollars than most Americans will pay in their lifetimes.

27

posted on

09/22/2012 8:09:10 PM PDT

by

FredZarguna

(Romney is paying 15% tax on money he's already paid taxes on at least once before.)

To: RandallFlagg

The taxes he paid, were on investment income, off his stocks, investments, bonds, etc. In order to pay this tax, he would have had to invest earnings, or take home pay.

Example. you put $1000 out of your take home pay (which you paid taxes on) into a savings account. It earned 10% interest. So you had $1100. You paid $14 on that earned interest, so you have $1086 after taxes. you paid taxes on the first $1000 long ago, and the $14 on what you earned off interest.

Romney payed the "$14" tax on that tax return, not the tax on the $1000.

That was a simple example, and i am not a tax expert, or do i play one on TV. And just to be clear, I did NOT stay at a Holiday Inn Express last night.

I am sure a tax expert will weigh in shorty, if anything i said was wrong, or can be clarified.

FReepgards.

28

posted on

09/22/2012 8:19:39 PM PDT

by

IllumiNaughtyByNature

($1.84 - The price of a gallon of gas on Jan. 20th, 2009.)

To: FredZarguna

More media obfuscation. A business owner pays taxes on his net revenue. All the cash after that is available to pay taxes, and his personal bills.

If that same business owner changed from a sole proprietor to a Chapter C corporation, the corporation would pay approximately 30% income tax on the net revenue and then an additional 15% for the dividends. He would have less money available for bills/taxes, under this form of business.

Publicly traded C corporations are the same. Every investor has their proportionate share of taxes paid by the corporation, plus the additional amount of tax on dividends.

In general, that would be approximately 45% tax rate. Misinformation is abundant in the news media, and the Romney campaign lets them get away with it.

29

posted on

09/22/2012 8:33:10 PM PDT

by

greeneyes

(Moderation in defense of your country is NO virtue. Let Freedom Ring.)

To: RandallFlagg

See #29 for an explanation. No one is looking at the actual income taxes paid by the corporation. Saying that Romney only pays 14 or 15% is the media’s lie.

It is a lie for the same reason that Buffet’s paying less % than his secretary is a lie. Media is ignoring all the taxes paid.

30

posted on

09/22/2012 8:38:52 PM PDT

by

greeneyes

(Moderation in defense of your country is NO virtue. Let Freedom Ring.)

To: RandallFlagg

For guidance look at one of the Left’s heroes - Warren Buffett. Both Romney and Buffett are very wealthy and both derive the majority of their income the same way, from investment income which is taxed at Cap Gains rates. If you have a problem with any of that, it’s probably envy. Too bad for you.

31

posted on

09/22/2012 9:02:39 PM PDT

by

Rembrandt

(Part of the 51% who pay Federal taxes)

To: RandallFlagg

I’ve a hunch the most challenging question your lib friends ask is “why does Romney get away with paying taxes at a lower rate than most other people - like why does Warren Buffett pay a lower rate than his secretary?” - the answer is that when Buffett’s secretary gets done with a day’s work, she knows she’s going to get paid for the time she puts in - Buffett will give her a check at the end of the week in return for her labor, as “earned income” - but Buffett and Romney pay taxes on “investment income”, return on money they invest in projects which may or may not actually pay off, and if they do pay off, may not do so for years - in fact, it’s money at risk, which they may not get back at all - thus returns on the investments are taxed at a lower rate to give people some encouragement to continue putting their money at risk in investments - Next time anybody complains about Romney’s low tax rate, ask him how much he’d like to be paid to let you flip a coin to see if he gets to keep his paycheck at the end of the week.......

To: aruanan

The deal is that you already paid taxes on that money at the full rate when you initially earned it! You then invest an (hopefully) get a return. The Governement then taxes the same money a second time at the reduced rate of 15%. Don’t blame romney - it is the (tax) law. Capital gains - in my opinion - should be taxed at zero. Interest should not be taxed.

33

posted on

09/22/2012 9:52:23 PM PDT

by

mouell

To: Andy'smom

LOL I would rather be tazed than taxed. They both hurt but the tazed pain does not last forever.

To: RandallFlagg

His income was from INVESTMENTS...that means he had already PAID the highest tax rate when he first earned the wages that bought those investments. He has paid tax on the earnings from his labor every year AFTER having already paid confiscatory taxes. MOREOVER his family will pay INHERITANCE tax on anything left over after his death which will add another 35% to the feds coffers....All in all he will have paid over 60% of his wealth to the government for the right to be rich in America

35

posted on

09/22/2012 10:59:43 PM PDT

by

Nifster

To: abercrombie_guy_38; dixiechick2000; Black Agnes; Pelham

Man...you yankees have some difficult families

God bless you for sticking it out for conservatism

down here at least amongst whites it’s rare to find lefty family members

out of my extended family of say..200 folks all the way to 3rd cousins and whatnot..of which none are blue collar anymore..all educated class

two libs...maybe 3 actually...one in San Francisco (not out of the closet gay) and another in academia (female..not totally lib) and another hybridizing the world without the benefit of marriage and also in academia (female obviously)

I actually have a lesbian very old aunt who is very conservative and very quiet about her and her old partner of 50 years...they are near 80..they detest Obama and entitlement culture..and think gay marriage is loony

but most Yankees I know come from lib families and they have struck out on their own

now folks will say “now wardaddy, all southerners used to be Democrats”

true ..as were most yankees too..but those southerners were still EXTREMELY socially conservative but drank New Deal elixir ..like most of the country

36

posted on

09/22/2012 11:17:25 PM PDT

by

wardaddy

(this is a perfect window for Netanyahu to bomb Iran..I hereby give my go ahead..thanks Muzzie idiots)

To: wardaddy

“but those southerners were still EXTREMELY socially conservative but drank New Deal elixir ..like most of the country”

Get yourself a copy of Thomas Fleming’s “The New Dealer’s War”.

You’ll find that conservative southern Democrats joined with Republicans to form ‘the conservative coalition’ and they ruled Congress from about 1937 to 1965. It was this group that brought FDR’s socialistic schemes to a halt.

37

posted on

09/22/2012 11:42:31 PM PDT

by

Pelham

(Liberate the White House)

To: RandallFlagg; wardaddy

What irks the left is that Romney adheres to the current tax code.

The same one that Warren Buffet adheres to, but Romney paid more than his fair share.

Warren Buffet wants to raise income taxes, but that’s okay for him as he doesn’t pay income taxes.

Does anyone know if he’s settled with the government over that pesky $1 Billion that he owes?

His income is from dividends, just as Romney’s is, but Romney is much more generous with his money.

38

posted on

09/23/2012 12:50:17 AM PDT

by

dixiechick2000

(~~~RAGE ~~~ I haz it.)

To: cumbo78

Yeilds on investments are income (dividends and capital gains). They are just not wages. They are taxed at a lower rate than wages. Dividends are taxed at a lower rate because it’s a double taxation. Coporations are taxed when they make a profit, then if those profits are distributed to the owners (shareholders), it’s taxed again.

39

posted on

09/23/2012 4:45:31 AM PDT

by

Hugin

("Most times a man'll tell you his bad intentions, if you listen and let yourself hear."---Open Range)

To: All

Thank all of you for replying. I just got to work and need to get busy. I’ll reply individually as the day goes on.

I did, however, find a YouTube video that was quite interesting.

Search for:

The National Debt and Federal Budget Deficit Deconstructed - Tony Robbins

(I can’t post the link from here)

Talk later, FRiends.

40

posted on

09/23/2012 5:14:05 AM PDT

by

RandallFlagg

(Obama hates Mexicans (Fast and Furious))

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-42 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson