Posted on 09/28/2014 7:00:07 PM PDT by SeekAndFind

When is the U.S. banking system going to crash? I can sum it up in three words. Watch the derivatives. It used to be only four, but now there are five "too big to fail" banks in the United States that each have more than 40 trillion dollars in exposure to derivatives. Today, the U.S. national debt is sitting at a grand total of about 17.7 trillion dollars, so when we are talking about 40 trillion dollars we are talking about an amount of money that is almost unimaginable. And unlike stocks and bonds, these derivatives do not represent "investments" in anything. They can be incredibly complex, but essentially they are just paper wagers about what will happen in the future. The truth is that derivatives trading is not too different from betting on baseball or football games. Trading in derivatives is basically just a form of legalized gambling, and the "too big to fail" banks have transformed Wall Street into the largest casino in the history of the planet. When this derivatives bubble bursts (and as surely as I am writing this it will), the pain that it will cause the global economy will be greater than words can describe.

If derivatives trading is so risky, then why do our big banks do it?

The answer to that question comes down to just one thing.

Greed.

The "too big to fail" banks run up enormous profits from their derivatives trading. According to the New York Times, U.S. banks "have nearly $280 trillion of derivatives on their books" even though the financial crisis of 2008 demonstrated how dangerous they could be...

American banks have nearly $280 trillion of derivatives on their books, and they earn some of their biggest profits from trading in them.

(Excerpt) Read more at theeconomiccollapseblog.com ...

JPMorgan Chase

Total Assets: $2,476,986,000,000 (about 2.5 trillion dollars)

Total Exposure To Derivatives: $67,951,190,000,000 (more than 67 trillion dollars)

Citibank

Total Assets: $1,894,736,000,000 (almost 1.9 trillion dollars)

Total Exposure To Derivatives: $59,944,502,000,000 (nearly 60 trillion dollars)

Goldman Sachs

Total Assets: $915,705,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $54,564,516,000,000 (more than 54 trillion dollars)

Bank Of America

Total Assets: $2,152,533,000,000 (a bit more than 2.1 trillion dollars)

Total Exposure To Derivatives: $54,457,605,000,000 (more than 54 trillion dollars)

Morgan Stanley

Total Assets: $831,381,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $44,946,153,000,000 (more than 44 trillion dollars)

Here is what I understand about derivatives. They are essentially bets on debt and only a fool would buy into them.

And the big five have made bets on the world’s debt in terms of multiples of what the world owes.

Good luck with that.

Where in the hell did you get that diagram of my vault room???

Its only money in a computer. Just move the decimal a couple places over and yer fine.

It is gambling with ‘other peoples money’. Too big to fail. No downside. We the people did it which resulted in Sept. 16, 2008, and they will do it again. I believe it is a designed destruction of this country.

This is only possible with a fiat currency and a central bank that can issue money at will.

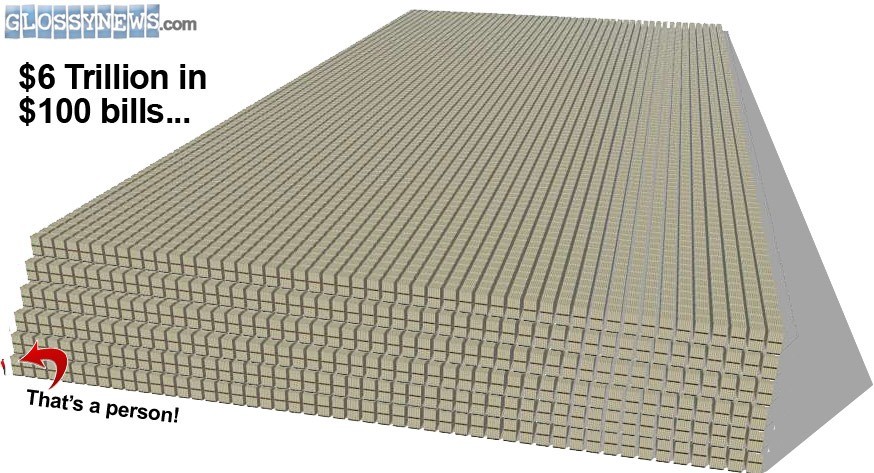

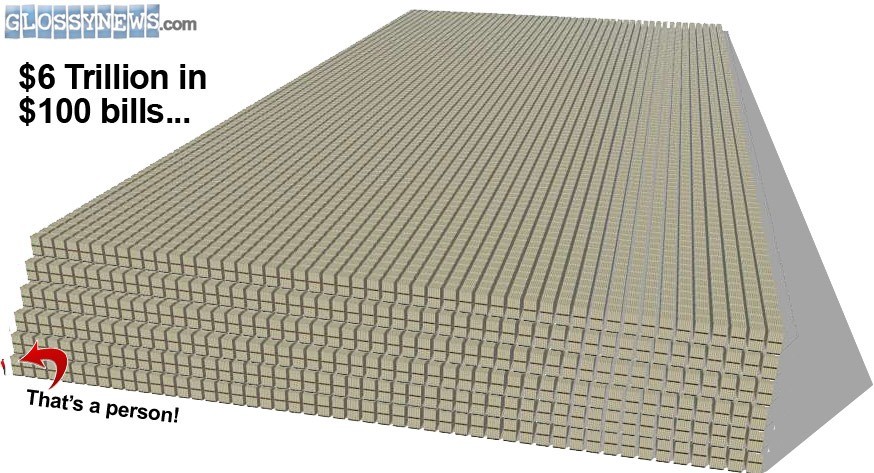

that amount of money in $100 bills is more than TWICE the width and height of the World Trade Center.

I saw a program about it, trying to give people a way to imagine it.

The Reader’s Digest version is that there is a black hole of paper debt exceeding the total appraised value of all material things ever created by mankind by several orders of magnitude floating out there in the form of binary digits waiting to implode under it’s own enormous mass, which will surely take the whole global economy with it when it does.

Derivatives are betting on a bet on a bet and so on and also trying to game (cheating) the system so the bet comes out your way. However the others involved are also gaming (cheating) the system. The taxpayers end up the loser just like the S&L and real estate scams.

Not necessarily. Suppose you have $1000 invested in Microsoft stock. You want to protect that money, yet you still want to keep it in the market.

So you buy a derivative from the Leaning Right Investment Corp. The derivative costs you $10. In return, I promise to pay you $500 if Microsoft drops by more than 20 points in the next year.

I am offering you a type of insurance, a "derivative". Its value is derived from the value of something else, in this case the value of Microsoft stock.

If you are a conservative investor, you might want to buy that derivative from me. But onl;y if you trust that I can actually pay you if Microsoft stock declines.

There are, of course, some derivatives that are insanely risky. But some do make sense.

Ut oh.

Robert Rubin - A culprit - perhaps the main culprit. Quote from link below:

“As Clinton’s two-term Secretary of the Treasury, Rubin sharply opposed any regulation of collateralized debt obligations, credit default swaps and other so-called “derivative” financial instruments which—despite having already created havoc for companies such as Procter & Gamble and Gibson Greetings, and disastrous consequences in 1994 for Orange County, California with its $1.5 billion default and subsequent bankruptcy—were nevertheless becoming the chief engine of profitability for Rubin’s former employer Goldman Sachs and other Wall Street firms.[32] When Brooksley Born, head of the Commodity Futures Trading Commission, circulated a letter urging increased regulation of derivatives in line with a 1994 General Accounting Office report, Rubin took the unusual step (for a Secretary of the Treasury) of going public in June 1998 to denounce Born and her proposal, eventually urging that the CFTC be stripped of its regulatory authority.”

http://en.wikipedia.org/wiki/Robert_Rubin

Translation: U.S. CITIZENS have more than 40 Trillion Dollars In Exposure To Derivatives

It’s only “insurance” if you have an insurable interest. With a derivative, I buy $10 “insurance” against MS stock dropping but I don’t own any MS stock and you promise to pay me $500 if it drops 20 points.

This is why derivatives were outlawed after the 1929 stock market crash (you had to have an insurable interest) but the Wall Street gamblers brought them back in the 1990s.

You're right! What started out as a somewhat reasonable "insurance" scheme has morphed into a casino-type betting system.

And when the house (the big banks) can't pay after a bad run, the taxpayers will step in to make everything whole again.

This county cannot afford a repeat of 2008.

I wonder what the national debt would look like? I wonder if there will be a nuclear war when thew whole thing comes crashing down?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.